Stocks Bear Market Primary Trend Intact

Stock-Markets / Stocks Bear Market May 24, 2009 - 06:25 PM GMTBy: Richard_Shaw

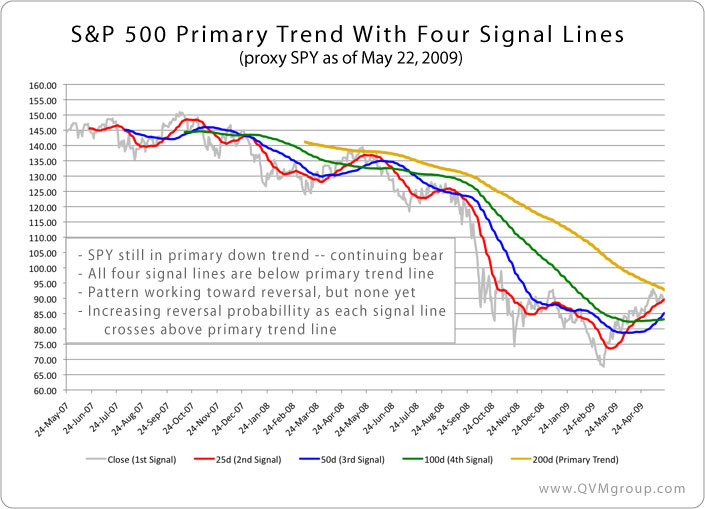

Here is the 200-day primary trend line of the S&P 500 showing its prolonged and continued downward movement (bear market condition) along with the position of four secondary trend lines that must move above the primary trend line before the primary trend changes slope from negative to positive.

Here is the 200-day primary trend line of the S&P 500 showing its prolonged and continued downward movement (bear market condition) along with the position of four secondary trend lines that must move above the primary trend line before the primary trend changes slope from negative to positive.

Those staging into risk positions in the US stock market would be well served to monitor these key visual clues about the eventual transition from the current bear to a future bull when deciding how much and when to commit cash for an intended ultimate position size:

(1) the slope of the primary trend line

(2) the location of the secondary trend lines (whether above or below the primary trend line)

(3) the direction of movement of the secondary trend lines

(4) the relative position of the secondary trend lines above or below each other.

Similar visual analysis of price behavior of other asset categories should be equally helpful.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.