Financial Markets Analysis - Gold, Commodities and the U.S. Dollar

News_Letter / Financial Markets 2009 May 24, 2009 - 07:52 AM GMTBy: NewsLetter

Featured Analysis of the Week

Featured Analysis of the Week

|

|

|

|

|

|

|

|

|

|

|

Most Popular Financial Markets Analysis of the Week :

| 1. Gold and Silver Potential Parabolic Price Rise 2009 to 2011 |

By:Ronald_Rosen

“Surprising as it may be to most non-scientists and even to some scientists, Albert Einstein concluded in his later years that the past, present, and future all exist simultaneously. In 1952, in his book Relativity, in discussing Minkowski's Space World interpretation of his theory of relativity, Einstein writes:

| 2. The Impact of Economic Data Revisions at Stock Market Junctures |

By: John_Mauldin

Why does government data need to be revised so often? Is it conspiracy, as some claim, or is it methodology? And if it is methodology that leads to faulty data, then why not change the methodology? Is unemployment a lagging indicator, as conventional wisdom suggests? We look again at the underlying assumptions to suggest that things are not always the same. And finally, we look at unsustainable trends, fiscal deficits, and health care -- there is a connection.

| 3. Reflation and Stagnation Are Next for the Economy |

By: Justice_Litle

Mr. Market has begun to show clear signs of split personality disorder in recent weeks. Now that investors have exhaled in relief that a deflationary apocalypse has been avoided, the new reality of reflation and stagnation is sinking in…

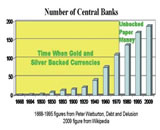

| 4. Russia Dumps the U.S. Dollar for Euro as Reserve Currency |

By: Pravda

The US dollar is not Russia’s basic reserve currency anymore. The euro-based share of reserve assets of Russia’s Central Bank increased to the level of 47.5 percent as of January 1, 2009 and exceeded the investments in dollar assets, which made up 41.5 percent, The Vedomosti newspaper wrote.

INO TV - Watch From Your Computer for FREE Here are the newest authors: Jack Schwager, John Murphy, Jake Bernstein, and Ron Ianieri. All experts, all well recognized, and highly trafficked by our current members. http://tv.ino.com/ |

| 5. Could the Weimar Hyperinflation Happen Again in America? |

By: Ellen Brown

“It was horrible. Horrible! Like lightning it struck. No one was prepared. The shelves in the grocery stores were empty. You could buy nothing with your paper money.” – Harvard University law professor Friedrich Kessler on the Weimar Republic hyperinflation (1993 interview)

| 6. UK CPI Inflation +2.4%, RPI Deflation -1.2% Hits Forecast Target |

By: Nadeem_Walayat

UK RPI Inflation data of minus 1.2% for April 09 represents severe deflation in the official data. Whilst the Governments preferred CPI inflation measure has recorded a smaller decline to 2.3% which still stubbornly puts it above the Bank of England's target rate of 2%.

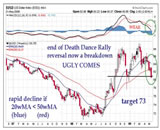

| 7. Stock Market is 50% Over Valued, Bear Market is Not Over! |

By: Sharon A. Daniels

The stock market has managed to claw its way higher since early March, despite some of the worst headlines since this financial crisis began.

Suddenly, “green shoots” are springing up everywhere, but they can just as easily turn into wilting weeds again this summer, as I’ll show you in just a moment.

| Subscription |

You're receiving this Email because you've registered with our website.

How to Subscribe

Click here to register and get our FREE Newsletter

To access the Newsletter archive this link

Forward a Message to Someone [FORWARD]

To update your preferences [PREFERENCES]

How to Unsubscribe - [UNSUBSCRIBE]

| About: The Market Oracle Newsletter |

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication.

(c) 2005-2009MarketOracle.co.uk (Market Oracle Ltd) - The Market Oracle asserts copyright on all articles authored by our editorial team. Any and all information provided within this newsletter is for general information purposes only and Market Oracle do not warrant the accuracy, timeliness or suitability of any information provided in this newsletter. nor is or shall be deemed to constitute, financial or any other advice or recommendation by us. and are also not meant to be investment advice or solicitation or recommendation to establish market positions. We recommend that independent professional advice is obtained before you make any investment or trading decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.