Misery Spread Widely, The Destruction of the Middle Class!

Economics / Social Issues May 24, 2007 - 10:37 AM GMTBy: Ty_Andros

Just as vast new middle classes are being born around the globe, some are being buried. They are being buried by the people they elected to steward their economies, these public servants are more interested in their next reelection then coming up with practical solutions that meet today's challenges while preserving the economic futures of their current constituents and future generations.

Today's middle classes in the western world have been taught a belief in two things: that you can have “something for nothing”, and that government can “protect and provide for you”. They now vote regularly for these chimeras/illusions. The growth cycle and bull markets in these ways of thinking are a self fulfilling vicious circle, which will culminate in the middle classes demise. This broad social trend is in the United States and in central Europe , and is as destructive a PRIMARY character flaw as I have ever seen, it is an investment theme for the next ten years or more as it plays out.

With the REALITY of Globalization confronting these beliefs, the developed world is faced with a difficult choice: get up out of their chairs and get to work, compete, work harder, and smarter then our economic competitors and thrive or slide into the future and slowly sink into increasing poverty as the printing press and credit creation substitutes for wealth creation. Increasingly in America and Europe the middle classes are choosing the latter option.

The printing press has subsidized for wealth generation for over twenty years now and we can see it in everyone's lives. It now takes two parents working to make ends meet: rising food, energy, housing and health care expenses are eating people and businesses alive. Three out of four of these BASIC expenses are excluded when inflation reports are calculated. Housing inflation is measured by looking at the increases in rents (not the increase in the price of the home or commercial property), food and energy are excluded from core calculations of the Consumer and Producer price indexes. Policy makers and the media focus on the Core numbers and present them as the HEADLINE numbers, virtually ignoring the actual headline numbers, which are several points higher, which are also messaged by such prestidigitation as hedonic pricing (quality improvements are used to impute lower prices).

Middle class People caught like mice on spinning wheels to nowhere, fleeced on one side by rising taxes because they aren't properly indexed for inflation, then robbed by printing press as the government prints the additional funds necessary to fund the runaway spending and government growth. NOMINALLY they take home more every year with their paychecks, but when they go to the grocery store or gas station they come away with one less bag of groceries for the same amount spent a year ago or far less gas in the tank. Yesterday, I bought some gas, what used to buy a tank 4 years ago, now buys less than half, the customer who had left the pump as I pulled up had bought 10 dollars of gas and had just left the pump with 2.5 gallons, he obviously is on a budget and it won't take him very far.

How did we get here? We elected politicians, who have spent money as if it could be created out of thin air, and they have done so with abandon, but it is only an illusion of wealth. NO wealth is actually created, IN FACT, it is actually the spreading of poverty in an ever increasing circle, and it is the destruction of the wealth these middle classes store their wealth in: Dollars, Yen, Euros, British pounds, Aussie and Kiwi Dollars, etc. The reason middle class resentment is rising is because their incomes and the purchasing power of their wages and savings accounts are falling, courtesy of the “out of control” printing press process. They look for someone to strike at and blame for this situation, not realizing it is their very own elected leaders doing it to them. These elected leaders and the media are experts at spinning and pinning the tail on the donkeys, the wrong donkeys! In this case its “foreign devils”, businessmen “big and small” and THE RICH. Just to name a few.

The reason the guys on Wall Street, private equity and in the banking industry are getting so fabulously wealthy is because they get the newly minted money and credit first, the day after it is printed and stolen out of the savings accounts of the broad citizenry's. This theft is set to continue. It is how wealth is transferred from the middle class to the ruling elites, big banks and the governments they control.

Let's look at the mechanics of the situation and the means in which it is accomplished. First let's look at CPI (consumer price index) adjusted wage growth using the official government CPI numbers in combination with the employment cost index from the labor department:

As you can plainly see since 1986 wage growth has been as reported using the “government numbers” is breaking even at best, falling dramatically at worst. In the brief period starting in 1997 through 2002, inflation adjusted wage growth exceeded 1 percent. If I recall correctly, the CPI underwent a major revision in how it was calculated immediately preceding this spurt in growth, a government inspired illusion to fool us into thinking we are actually getting ahead.

Now let's take a good look at how inflation used to be calculated before the government started accelerating the practice of lying with numbers. Thank you John Williams of www.shadowstats.com for this wonderful chart on his website;

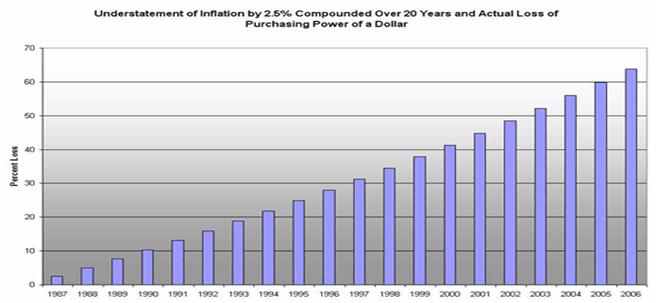

If you look closely at this chart you can see this understatement is an oscillating spread between approximately 2.5% and to over 3%, in the most recent early 2007 illustration (so the government lies are getting bigger recently). So in calculating the next chart we used the conservative side “2.5% understatement” and showed the compounded affect this understatement has had on the purchasing power has had on middle class earnings since 1987:

Even if you reduce the understatement of inflation to 2% the additional loss of purchasing power is over 49%. This number makes sense to me when I think back to how much I paid for gas, rent, a nice entrée at a restaurant, health insurance, a ticket to a ball game or the cost of a Toyota Corolla in dollars 20 years ago. If anything the 50% loss understates it and the 67% loss at 2.5% takes on additional meaning. Two percent slipping through your fingers yearly is hard for individuals to grasp, but when the effects of compounding are factored in, it is enormous over a 20 year period.

Recipients of Social security have seen similar reduction in benefits by this same technique, Real GDP growth after inflation really takes a hit when you recalculate using the actual numbers. Doug Noland reports: “ Total Money Market Fund Assets (from Invest. Co Inst) rose $18.2bn last week to a record $2.485 TN. Money Fund Assets have increased $103bn y-t-d, an 11.2% rate, and $427bn over 52 weeks, or 20.7% . If inflation is about 2.5% as the treasury claims how are these measures growing at these rates? It is money creation pure and simple. This cash hoard is a prime target for theft/loss of purchasing power via printing press, and remains under relentless attack.

This week the CBO (congressional budget office) released this table to tell the story of broad growth in incomes since 1991, here is a table illustrating their report:

T his is how the government creates the illusion of growth, by releasing this type of misinformation to the mainstream media. The journalists then take this and run with the story. Headlines that create positive impressions for public consumption. To them this is true, as these are THE OFFICIAL government numbers (one must assume that the government never lies to accept this, anyone who deals close up with government numbers whether they come from the department of treasury, commerce, labor, agriculture or whatever knows the government prints numbers as they want people to believe, not as accurate reflections). Now overlay the true inflation rate outlined by www.shadowstats.com and the understatement of loss of purchasing power graph, those REAL inflation numbers wipe out the illusions of income gains the government feeds to the public as seen in this table.

So the broad middle class has been told by the government and the media that their wages and savings are growing after inflation while they are actually plummeting. In their guts these citizens know the truth: it is a reality they are confronted with every time they pay their bills or buy groceries! Now we know why a politician promising “something for nothing”, and that: “the government can protect you” can find an ever growing constituency. As these middle classes are growing poorer and sinking into poverty at the rates outlined above. Along comes a politician saying he or she can fix it, they can absorb the added expenses, protect them from the bad guys. It is a powerful SIREN song, and the longer you hear it the more seductive the message becomes as your standard of living erodes like a beach assaulted by the waves. One day at a time this loss of income eats at you. Voters start to consider voting for any foolishness, no matter what it is as long as the going backwards in life can be halted. Little beknownst to the guy on the street, these public servants are the perpetrators.

So these middle class voters vote more and more for the thought of something for nothing, (see the “something for nothing” army on the march in the Ted bit archives at ( www.Traderview.com ) at this point no politician of any party in the United States or Europe can be elected without these promises. After elected they are confronted with the will of the voters to deliver on these promises, promises that can only be delivered upon if one actually believes in the Tooth fairy and Santa Claus. Wishful thinking in its worst incarnation.

(Authors note; looking for assistance in creating portfolio diversification that can survive and thrive in what I am outlining? In fingers of instability? If so contact me through www.TraderView.com . Subscriptions to this newsletter are also free at this address; send it to a friend, Thank you)

Taxes rise (see the next Ted bit) relentlessly, new taxes, old taxes, all rising and never been reduced or repealed, always growing faster than the economy or inflation. Spending rockets higher as government never shrinks, it actually grows faster than the real rate of inflation, which is understated by 2.5% as illustrated above.

The middle class is under relentless assault by the IRS and Regulators. If you are poor, you have no money and are on the dole, they ignore you. If you are rich or a BIG business you have accountants and lawyers to duel them and take advantage of the ins and outs of the IRS code and regulators. The IRS and regulators very rarely invade the turf of the big guys and when they do they are many times stymied by the high cost professional talent.

If you are a Middle class citizen or small to medium size businessman you are killed by the regulators and compliance costs, helpless against the IRS and unable to afford good advice or purchase good representation to deal with the government. They can deal you a death blow and don't even care that you have obeyed the laws all your life and tried to comply with every detail of the law. Unfortunately the tax code is 9 million words of mind bending complexity and the federal register of regulations makes the tax code look like child's play. Regulations are created with no concern to practicalities. Cost benefit analysis never considered. I had to join a larger firm recently myself as I was overwhelmed by compliance and legal expenses and the time spent to deal with them rather then build my small business. The middle class is easy pickings for these government bullies, so they are the primary target of them.

Below inflation growth in government spending and growth is unthinkable to these public servants, its OK for you or I to slowly sink into their quicksand, but heaven forbid that they to learn to live within a budget. Their spending priorities are ESSENTIAL. The Middle classes feeding their family or getting ahead individually is a selfish goal to these ghouls. Their spending priorities for your money is always a higher priority than the spending decisions you make for yourself. Who do you think can spend your money more responsibly? You or the government? That an easy question for them, its more problematic for you.

Politicians are constantly egged on to spend more by the far left media which controls most of the headlines, which is how most people now gather their news and opinions. Painting any politician who opposes runaway government spending as anti American or cruel hearted. Campaign ads now attack the other politicians spending plans or lack of them, if an incumbent has supported cutting a failing program, they are attacked for it. If they don't deliver on their spending promises one way or another, there is always a politician behind them that will make the same impossible promises of “something for nothing”, get put into the headlines for their vocal support of something for nothing, and take their seats from them in the next election.

So they pass Medicare prescription drug benefits, new entitlements, and fund 10's of thousands in earmarks and pork barrel spending costing 100's of billions of dollars. They print cubic amounts of money to support stock, bond and currency markets through the sophisticated open market plunge protection teams. To keep the illusion of wealth and growth in the headlines. But the canary in the coalmine is pricing those same assets in gold and commodities, which reveal the vicious loss of purchasing power of the currencies those assets or day to day expenses (food, electricity, services, education, health care, etc), are priced in. So the middle class “thinks” they are actually getting what has been promised to them by these political rascals, and their ruling elite puppet masters.

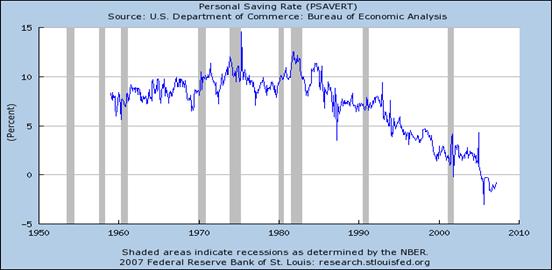

Let take a close look at really is unfolding to household finances as measured by the Federal reserve bank of St. Louis, first we will look at the savings rate and what has unfolded since 1980 as purchasing power has evaporated as outlined above;

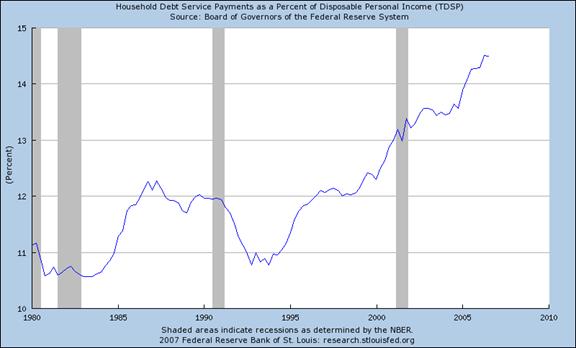

See how the level of savings declines as the stealth loss of purchasing power unfolds over a 20 plus year time frame, they are inverse pictures of one another. Now lets take a look at the amount of disposable income that is devoted to debt servicing:

Personal debt service burdens at all time highs going back to 1980! The combined picture is downright frightening. But a big investment opportunity if properly implemented ( www.TraderView.com ).

So savings decline, as more and more of everyday wages go to just keeping your standard of living on an even keel, robbing the fractional banking systems of the fuel that makes it go causing less and less to be available be invested into production, plants and equipment, business and job creation. Ludvig Von Mises' wrote about this. This is Austrian economics in reverse. Short circuiting future wealth generation activities needed by current and future generations . If spending more of current income doesn't stop the bleeding of the loss of standard of living, they then turn to Mortgage equity withdrawal or credit cards to cover the ever growing shortfalls in REAL income (income after inflation).

Unbeknownst to the guy on the street, these public servants are the perpetrators of the hoax. Since the taxes NEVER cover the cost of the goodie bags of government entitlements, plunge protection teams, outsized military expenditures and 2 wars, pork barrel, services and the ever growing, overpaid, unaccountable government departments and bureaucracies. They then have to turn to printing presses, fiat money and credit creation to supplement the available funds for their spending plans. Since the politicians don't really want to be seen as printing money (and because they want a firm grasp on future generations) they disguise it by issuing a government bond, but instead of selling it to the public they sell it to the Federal Reserve, the ECB or a foreign central bank chocking on dollar reserves and looking for a parking place.

Shackling future generations of taxpayers with the debt obligations inherent in the bond issuance which are used to fund today's political follies. These obligations are calls on future income, the future income of the citizens of the United States , or Europe whichever the case may be. It would actually be better for all of us if they just came out and said they are printing the money, as at least future generations would not have to deal with these future obligations. But then the idea of fiat money would really come under the spotlight of the immoral activity it really is, and that is unthinkable to someone whose election or reelection chances hinge on the spending promises he or she makes. It is estimated that every family in the United States has OVER $500,000 dollars of obligations which they do not know they are on the hook for. These funded and unfunded government spending obligations now total over 70 trillion dollars, equivalent to five years of GDP, which currently is approximately 13 trillion dollars a year. Obviously these bills are unpayable, these obligations will have to be printed away. Robbing the beneficiaries of these obligations of their value.

With the continuing erosion of their standard of living as outlined above, there is a constantly increasing number of people voting for this “something for nothing” activity to grow. Something is eating at their wallets, paychecks and savings, relentlessly encouraging them to vote for anything which will cause it to stop or reverse. The only roads they are offered in today's political environment lead to the same destruction in the future. They vote for public servants who will take it from them even as it sits in their pocketbooks and bank accounts, oblivious to the process of how they lift it from them.

Unfortunately, the recipe for getting this erosion to stop is: belt tightening, saving for investment and consuming less now, lower taxes, less regulation, less government spending, and working harder and smarter. Something that is unthinkable to the many people at the bottom of the income ladder, as they are already paddling as hard as they can. And more people are being moved to these bottom rungs on a daily basis, through the very same mechanism they themselves voted for the politicians to implement.

Politicians and the elites that pay to elect them pray upon this growing desperation. So they can what else? Control the MONEY, the voters and the economy. It is a vicious circle of the most insidious sort, created by the very same character flaw which has grown like a cancer in the populous, as their incomes have succumbed to the compounding of the loss of purchasing power, caused by the understatement of inflation. Then it is combined with the printing presses to cover the shortfalls. A real two edged sword, it cuts the middle classes TWICE!

Ever wonder why the GAO (government accounting office) can't really give you an accounting of the US government budget. Why there are no accounting books to speak of for the various departments of government. Why no one really sees the deficits as Social security and Medicare trust funds and new money creation are used to pay for general budget expenditures. Government growing beyond its means . This immoral behavior of our political and financial authorities would be on plain display if these numbers were reported accurately, so since the law is whatever these people in power wish it to be! So they aren't! Government accounting and accountability are an oxymoron, there is none.

The destruction of the middle class is set to accelerate in Europe and the United States, production and wealth generating activities are now victim of the broad populous belief taught by the public schools, reinforced in the headlines, and main stream media in the belief of “something for nothing”, and that government can “protect and provide for you”, through mind bending regulation of your day to day living. So more politicians are elected on an ever increasing basis to implement it. It is a requirement to be elected in the Developed world. And when taxes don't cover the bills these "Public Servants” print the money, sell it to the federal reserve for collection from your children and grand children, throw the money they created into the money supply reducing the value of your paycheck and savings accounts by the equivalent amount, then spend the money on government programs giving it away for the current and future votes of the ever growing something for nothing constituents. A Vicious circle and feedback loop.

Those same constituents are paying for the government program they perceive to be “FOR FREE”, with the stealth taxes they pay themselves through the printing needed to pay for the program. Reduction of income through inflation of the money supply and the saddling of debt on to future generations, ever increasing bills for everyday items, inflation written big, and the endless promises from the tooth fairy and public servants are set to continue, in increasing amounts forever.

The new democratic majority has just unveiled their gargantuan new spending and tax plans, they are set to be raised by the greatest amount in history (right on the heels of the republican lathering on of 30 trillion dollars of new unfunded obligations in the last 7 years), and regulation and micro management is their middle name, they are smart and you are stupid. Right into the teeth of all time low negative savings rates and the impossible debt burdens the middle class currently labors under. Over regulation and higher taxes are set to move higher like a steamroller. It is not a good recipe for success in a global economic competition, so we will lose.

So the impoverishing of the MIDDLE CLASS is set to accelerate. It's Gold and non printable assets of all varieties going to the moon as the printing presses go into high gear and wealth creation is further diminished, so taxes so each will cut deeper and deeper from both edges of the sword. Destruction of the Broad American and European Middle classes is in full swing and has 30 years or more of momentum built into it, and it is accelerating as the loss of purchasing power is accelerating. It is now pathological in nature and built into the psychology of the developed world. What we are voting for is what will do the most damage to our own futures! And because of this…

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication that comes out on Thursdays or Fridays.

By Ty Andros

TraderView

Copyright © 2007 Ty Andros

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.