Stocks Bear Market, Russo Vs Prechter an Elliott Wave Count Comparison

Stock-Markets / Economic Theory May 23, 2009 - 05:10 PM GMTBy: Joseph_Russo

First, we wish to state for the record that there is no meaningful difference in the intermediate and long-term market opinions held by the astute Mr. Prechter and those held by this analyst. Secondly, we would like to note that we hold the utmost respect for Mr. Prechter’s talents, skills, contributions, and achievements in both his publishing empire, and in his eloquent and brilliant sharing of Elliott Wave Theory. Without Mr. Prechter, this analyst would not exist in this venue.

First, we wish to state for the record that there is no meaningful difference in the intermediate and long-term market opinions held by the astute Mr. Prechter and those held by this analyst. Secondly, we would like to note that we hold the utmost respect for Mr. Prechter’s talents, skills, contributions, and achievements in both his publishing empire, and in his eloquent and brilliant sharing of Elliott Wave Theory. Without Mr. Prechter, this analyst would not exist in this venue.

Providing market analysis and forecasting guidance is a tough and unforgiving business at times. In our best efforts to assist clients, we are at times misunderstood, and sometimes nowhere near perfect in our future views and opinions of financial markets. Duly criticized when blatantly wrong, we are after all “the experts” held accountable to foresee major directional changes in market values.

Trust us; we are no strangers to tongue lashings by former subscribers and critics alike. We take each criticism seriously, as we assume Mr. Prechter does. In our view, it is the harshest and most astute of criticisms that challenge us to hone our crafts ever finer in our quest to serve clients with the best possible guidance.

In this context, we wish to share an inquiry sent by a potential subscriber. The purpose in sharing the following exchange is not to discredit Mr. Prechter but rather to share our responses in order to distinguish subtle differences that may exist between our longer-term views on the unfolding Elliott wave pattern reflected in the Dow Jones Industrial Average.

Our prospective client writes…

Dear Mr. Russo,

I was a subscriber of Bob Prechter in the past, so I think I know what I am talking about when it comes to the magical view of Elliott waves and the costly effects of poor timing and insistence upon maintaining outright wrong interpretations for inordinately long periods of time.

COULD PLEASE EXPLAIN YOUR OWN LOGIC?

I do not care too much if you are wrong, (I would care however if, as Bob, you are too wrong) but I do care A LOT about understanding how you think. With such logic explained, you can become a different view, with its own limits, and thus better enable my understanding and grasp of the so-called "market" (or Voodoo Casino as it so often appears).

Best Regards,

A Potential Subscriber

Our response:

Dear potential subscriber,

We suspect the most brief and direct response to your inquiry surrounding the logic and “why” behind our longer term wave count differentials from those held by Mr. Prechter is the following:

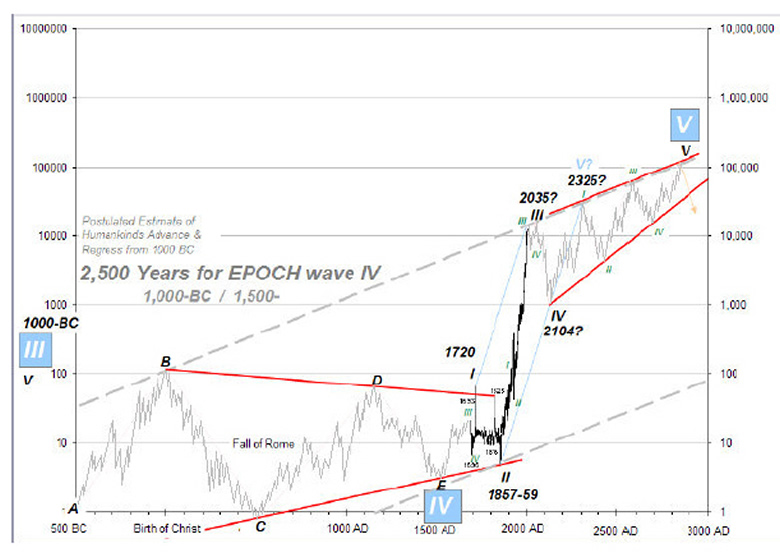

1. We have taken a radically different perspective on the postulated Grand Supercycle wave labeling at the price lows occurring in the 1857-1859 timeframe. Our view that this bottom was that of a Grand Supercycle II wave is based on the simple logic inherent in Elliott Wave sequencing, which suggests the parabolic run-up to our present day 2007 high must undoubtedly be a “third wave”.

2. Though it is plausible, we remain hesitant to interpret our recent 2007 peak as all-of the Grand Supercycle III wave, but are quite comfortable with labeling it as that of a Supercycle III wave crest.

In sum, we avoid ALL fundamental and social types of arguments to justify our wave counts. Instead, we maintain an extremely open and imaginative mindset as to the near-infinite variation of impulsive and corrective paths price may traverse across both an immense course of time, and amid the nine distinct degrees of trend possible within the theory as outlined by Mr. Elliott himself.

In our view, (and we suspect you may agree) this approach is by far the purest and least susceptible to any sort of voodoo magic.

Cordially,

Joe Russo

Publisher and Chief Market Analyst

Elliott Wave Technology

TRADE BETTER / INVEST SMARTER...

Potential subscribers follow up questions to our above response:

Then a practical question: How can I understand your logic more precisely at a reasonable low cost within the next months? Could I receive one of your old reports, perhaps the one you issued at around the low of March 2009 or at the 2003 low?

The dynamic of your thoughts (what makes you change your mind?) is very important for me.

Finally, taking out any analysis of the so-called "fundamental" is a good idea with which I agree for medium term analysis.

However, taking out all social view - isn’t that a little bit too much? Graphical analysis is not enough in my view, there should be some kind of "confirmation" somewhere, don’t you think?

Our four-point response to the follow-up questions below:

- What makes us change our mind is the price action relative to reasonably plausible wave structures along with complimentary technical analytics such as moving averages, cycles, and rate of change indicators.

- We are all too aware that markets can behave irrationally for long periods of time. Such diabolical market behavior has historically flown directly against the most astute fundamental and social arguments. Fundamental and social elements are continually present. Each can be argued both bullish and bearish in virtual perpetuity, no matter the era. At the end of the day, the price action itself determines the ultimate historical record

- Before jumping in headlong, you may wish to try our (IMF) Interim Monthly Forecast subscription for $19.00.

- We are in process of composing an article that archives realtime (NTO) Near Term Outlook subscriber content from February 2, through the March 2009 low.

We hope that our initial and follow up responses have answered all of your questions satisfactorily.

Trade the Supercycle IV -Wave

Trade the Supercycle IV -Wave

The express focus of Elliott Wave Technology's Near Term Outlook is to help active traders anticipate price direction and amplitude of broad market indices over the short, intermediate, and long-term.

Communications ‘09: To more effectively convey dynamic trading conditions relevant to our technical publications; we have recently launched complimentary E-briefings for anyone interested in following our work. E-brief dispatches will summarize current market conditions and tactical trading postures across various time horizons and trading strategies. Those interested can obtain free-inclusion from the sign-up block on our homepage.

Trade Better / Invest Smarter...

By Joseph Russo

Chief Editor and Technical Analyst

Elliott Wave Technology

Email Author

Copyright © 2009 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.