Stocks Bull Market or Bear Trap? It’s Easy to See

Stock-Markets / Stocks Bear Market May 23, 2009 - 02:25 AM GMTBy: John_Handbury

There has been a large volume of press regarding the latest run-up in stock prices and whether this is a legitimate beginning of a trend, or a bear market trap. The answer is pretty simple and easy to see from the plot below:

There has been a large volume of press regarding the latest run-up in stock prices and whether this is a legitimate beginning of a trend, or a bear market trap. The answer is pretty simple and easy to see from the plot below:

A pre-bull market doesn’t simply start climbing with a gentle gradient and let the longs load up. The fact that the VIX (volatility index) has decreased suddenly to reassure new investors is very suspicious indeed.

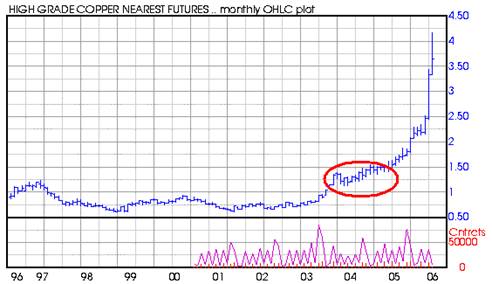

A market that is beginning a large upwards trend should be whipsawing back and forth in an attempt to get the nervous investors out, leaving only the more determined and persistent traders to reap the benefits. In my 25-odd years of trading, this has been the case almost without exception. For example, the figure below shows the whipsawing that occurred before the famous run-up in copper prices in 2005/2006. Only the most committed and disciplined traders survived this volatile period with their long copper positions intact to enjoy the unprecedented run-up that followed.

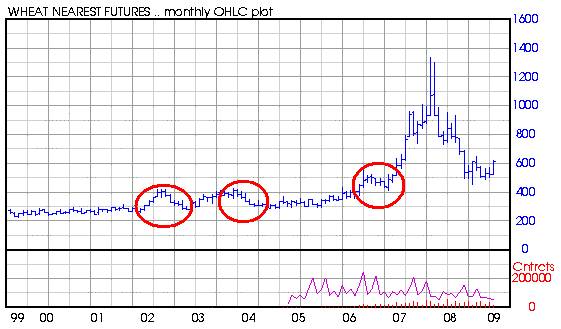

The same is true for the volatile swings before the bull market in wheat. These periods removed many of the fair-weather traders.

A bear market trap, however, would look exactly like the current SPX chart. It is very enticing and seductive in its gentleness, practically calling investors to climb back in, and then will abruptly change course to relieve them of their money (which markets like to do to nervous traders).

I take one look at the current SPX chart and say head for the hills.

By: John Handbury

Independent Trader

© 2009 Copyright John Handbury - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

John Handbury Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.