Stock Market Bottom? What Market Bottom?

Stock-Markets / Stocks Bear Market May 22, 2009 - 12:57 PM GMTBy: Mike_Shedlock

Inquiring minds keep asking "Is The Bottom In?" Of course, no one knows for sure. However, I believe it is not, and one of the reasons is the complete collapse in S&P earnings.

Inquiring minds keep asking "Is The Bottom In?" Of course, no one knows for sure. However, I believe it is not, and one of the reasons is the complete collapse in S&P earnings.

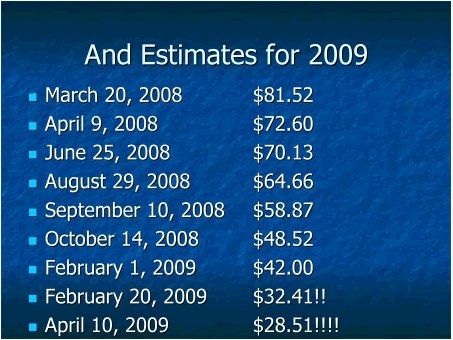

Earnings Estimates

In Is That Recovery We See? John Mauldin posted the following chart of earnings estimates.

The S&P closed Thursday at 888. That's a richly priced PE of 31. Let's assume that earnings recover to $48. That's still a richly priced PE of 18.5. A bear market bottom might sport a PE of 10-12 but let's be generous and use 15.

15*$28.51 would put the S&P 500 at 382!

Let's be more generous and use an earnings estimate of $48.

15*$48 would put the S&P 500 at 720!

Those expecting still higher earnings need to consider the Effect of Household Deleveraging on Housing, Consumption and the Stock Market.

No matter how you slice and dice things, fundamentally the stock market is very pricey.

Looking For Leaders

For the sake of argument, let's assume that for whatever reason the bottom is in. What sectors should one prefer?

To help decide, let's take a look at some historical charts of the 2000 Nasdaq bubble.

Intel (INTC) Monthly

Cisco (CSCO) Monthly

JDS Uniphase (JDSU) Monthly

Microsoft (MSFT) Monthly

Many leaders of the tech bubble had an initial rebound after the bubble popped. Those leaders then languished for years to come. Many other technology stocks did not survive at all. To be fair there are some huge success stories like Apple (AAPL). However, Apple remade itself in a new space rather than by competing in computers.

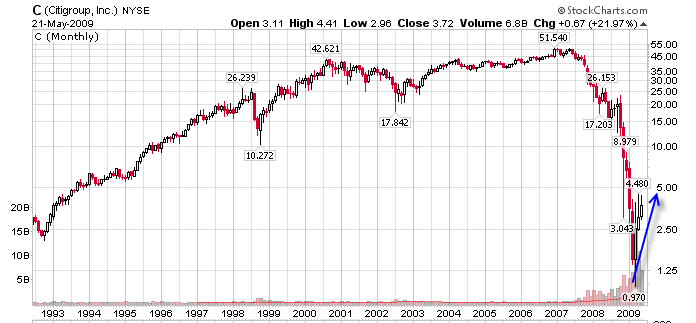

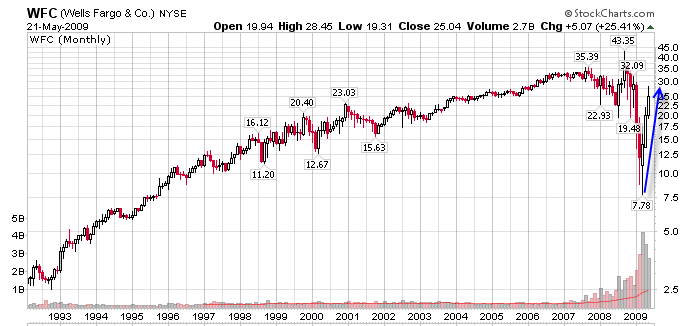

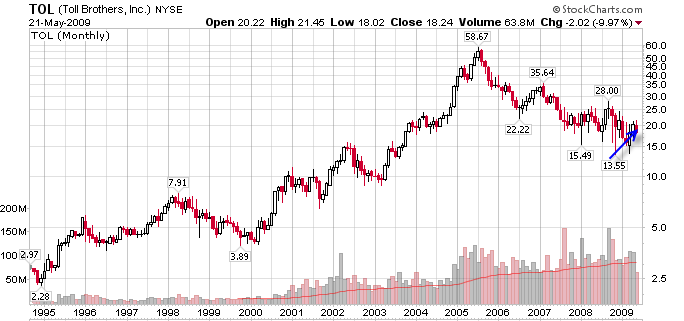

Credit Housing Bubble Aftermath

Financial stocks were the leaders in the housing and credit bubble that just popped. Here are a few of the survivors the Fed is protecting, with an additional homebuilder thrown in for good measure.

Citigroup (C) Monthly

Bank of America (BAC) Monthly

Wells Fargo (WFC) Monthly

Toll Brothers (TOL) Monthly

Search For Leadership

There was some serious money that could have been made with excellent timing in the financial sector this Spring. However, that is an opportunity gone by and not worth dwelling on. Besides, opportunities are easier to make up than losses.

Looking ahead, it's difficult to say what sectors will lead the next bull market (energy, alternative energy, gold, pharmaceuticals, etc. are all possible candidates) but whatever the leaders will be, financials and homebuilders are not good candidates.

Investors should look for new opportunities as history strongly suggests the last bubble will not be re-blown. Traders have no such concerns but do need to consider the current risk-reward scenario of the short squeeze propelling financials in light of the above historical data.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.