This is Not a Stocks Bull Market, Fresh Bear Market Lows Expected

Stock-Markets / Stocks Bear Market May 22, 2009 - 12:23 PM GMTBy: Graham_Summers

How do you measure wealth generation?

How do you measure wealth generation?

- Average annual gains?

- Gains relative to an underlying index (the S&P 500)?

- Gains relative to inflation?

Of these three, the last is the only real means of gauging wealth creation or destruction. Commentators have been going bananas over the fact stocks are up 20%+ since their bottom of 666. No one mentions that this rally may actually be induced by the Federal Reserve pumping trillions of dollars into the financial system.

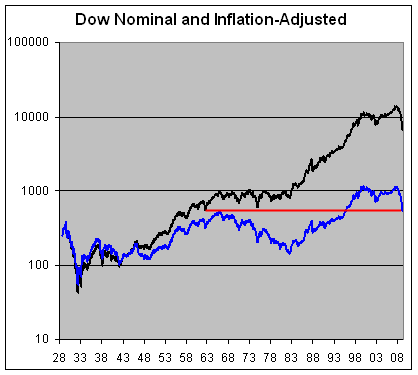

Similarly, no one mentions that adjusted for inflation, stocks are still WAY down from their peak during the Tech bubble.

Source: Crossing Wall Street

As you can see, stocks entered a bear market in earnest in the following the Tech Crash. Yes, in number or nominal terms, the Dow has risen. But you have to remember the dollar lost roughly a third of its value from 2001 to today. Measuring stocks or anything in dollars between now and then was like measuring with a ruler that was continually shrinking.

Also, bear in mind that the above chart is using the Government’s phony measure of inflation: the Consumer Price Index (CPI) which DOESN’T include food or energy prices. Using a accurate inflationary data, stocks are down even more in real terms.

My main point is this: inflation is an ever-present reality in the post WWII era. Investors need to be protecting themselves from this beast at all costs. You can do this by:

- Buying gold

- Buying commodities or real assets

- Buying companies that can offset inflationary costs by raising the price of their products

I suggest having some money in all three. It’s the only certain way to protect your wealth from inflation. The Feds are cooking up an inflationary storm of epic proportions, pumping TRILLIONS of dollars into the financial system. Stocks may rally like a rocket-ship from here. But in real terms they’re still tanking.

After all, if the Dow hits 30,000, but you’re celebrating by drinking a $150.00 coke… are you really any richer?

Good investing!

Graham Summers

PS. We’ve put together a FREE special report detailing three specific investments that will soar during the coming inflationary storm at www.gainspainscapital.com. Visit us today to pick up your FREE copy!

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2009 Copyright Paul Learton - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.