Government Debt Downgrades vs. Gold

Interest-Rates / Global Financial System May 21, 2009 - 03:26 PM GMTBy: Mike_Shedlock

The word for today is "downgrade". Inquiring minds may wish to count the instances of downgrade in the following paragraphs.

The word for today is "downgrade". Inquiring minds may wish to count the instances of downgrade in the following paragraphs.

UK and US Debt Face Downgrades

MarketWatch is reporting Standard & Poor's cuts U.K. outlook to negative from stable

May 21, 2009

Standard & Poor's on Thursday lowered its credit outlook on the U.K. to negative from stable for the first time ever in view of the country's swelling debt, which may expand even as the economy recovers.

The move by Standard & Poor's raises the prospect not only of a credit-rating downgrade in Britain but a lowering of the outlook in the U.S., which has taken a similar path of big spending and quantitative easing to escape the credit-led recession.

"I think there will be a downgrade on the U.K. and I think there will be a downgrade on the U.S. outlook from one of the Big Three" credit-rating firms, said Stephen Gallo, head of market analysis at Schneider Foreign Exchange.Downgrades For Spanish Banks

The Financial Times is reporting Downgrades loom for Spanish banks

May 20, 2009

Bad debt problems at Spanish banks and cajas, the regional savings and loans institutions, have triggered at least one skipped interest payment on a mortgage-backed bond this week and prompted new warnings of imminent downgrades by credit rating agencies.

Caja Madrid, Spain’s fourth biggest financial institution, on Wednesday confirmed that a deterioration of the underlying mortgages had caused the automatic cancellation of more than €1m ($1.4m) in interest owed to junior holders of mortgage-backed securities issued in 2006 and 2007 by special purpose vehicles.

Moody’s, the credit rating agency, meanwhile put half of Spain’s banks and unlisted cajas, the regional savings and loans institutions, on notice of possible credit downgrades because it expects asset quality to deteriorate further during the country’s deep recession.

Moody’s said it had placed 36 banks and cajas on review for possible downgrades of their bank financial strength ratings – including all the listed banks. Of the banks reviewed, 34 were likely to face downgrades for their deposit and senior debt ratings and 22 for their subordinated or hybrid securities.

The agency also warned it might downgrade the triple A ratings of seven Spanish programmes of mortgage covered bonds, four public sector covered bond programmes and 57 series of multi-issuer covered bonds.Hungary Debt Downgraded

RealDeal is reporting Moody's cuts credit ratings on eight Hungarian banks following gov't downgrade.

April 01, 2009

The Moody's ratings agency announced on Tuesday evening that it cut the long-term foreign-currency ratings of eight Hungarian banks-OTB Bank, OTP Mortgage Bank, CIB Bank, K and H Bank, MKB, Erste Bank Hungary, Budapest Bank and the MFB Hungarian Development Bank.

Moody's announced the ratings action on the Hungarian banks after reporting earlier on Tuesday that it had downgraded Hungary's government-bond rating to Baa1 from A3 with a negative outlook.

Moody's downgraded the long-term foreign-currency deposit ratings of the eight Hungarian banks to Baa1 from A3 as well.

The ratings agency said it had also downgraded MFB Hungarian Development Bank's long-term foreign-currency debt rating to Aa2 from Aa1 and placed the rating on review for possible further downgrade.Portgual Debt Downgraded

EU Business is reporting Portugal debt downgrade spotlights rising eurozone bond dilemma

22 January 2009

Portugal is now the third debt-degraded country in the eurozone amid concern over anti-recession borrowing by governments, amid assurances that strains on bond debt markets will not break up the bloc.

The rating agency Standard and Poor's said it had lowered its notation for Portugal's long-term sovereign debt to A-plus from AA-minus, having earlier downgraded Spain and Greece, warning that Ireland is in the danger zone.

A downgrade puts up the cost of borrowing for a government needing to fund a deficit budget.Irish Banking System Downgraded Again

The Irish Times is reporting S&P downgrades Irish banking system again

March 17, 2009

THE ANGLO Irish Bank directors’ loans affair has prompted credit ratings agency Standard&Poor’s (S&P) to downgrade the Irish banking system for the second time in four months.

SP yesterday dropped Irish banks from its second-ranked group of countries to its third, citing in particular the “reputational fallout from the events at Anglo Irish Bank” and “weakened investor confidence in the framework of bank regulation”. It said the risks to the Irish banking system had increased in recent months as a result.

Yesterday it decided to downgrade Ireland to group three following the Anglo scandal, in which former chairman Seán FitzPatrick concealed loans of up to €122 million by transferring them temporarily off the books.Gold Not Downgraded

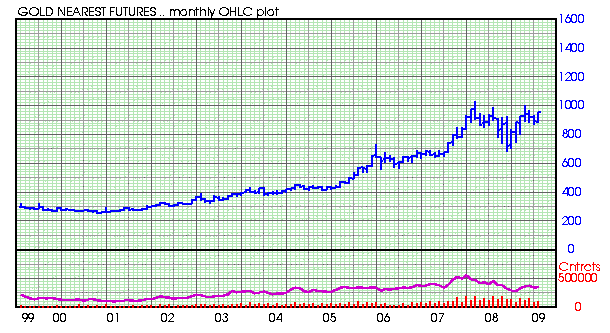

I could not find a single instance of "S&P Downgrades Gold" other than in reference to some obscure miners.

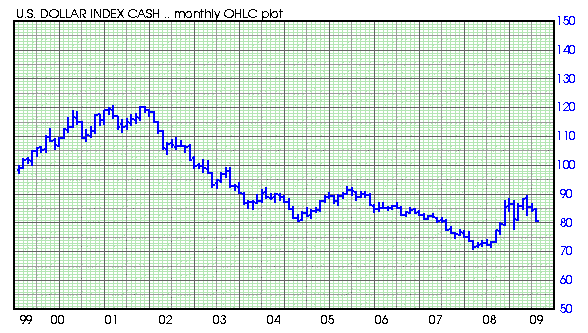

US Dollar Monthly Chart

Currencies Don't Float

The US dollar is getting pounded again today but is well within the trading range scenario I suggested at the peak. Nonetheless, I would like to pass on a saying of my friend Clyde Harrison at Brookshire Raw Materials ...

"Fiat currencies don't float. They sink at varying rates".

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.