The Fiat Currencies Death March, Got Gold?

Currencies / Fiat Currency May 21, 2009 - 04:36 AM GMTBy: Darryl_R_Schoon

The past has condemned us. Only the future can save us- We live in extraordinary times. Poised between the past and the future, never has the present been so uncertain. But, when certainty comes, it will be in the form of a scythe and ducking will be the only option.

The past has condemned us. Only the future can save us- We live in extraordinary times. Poised between the past and the future, never has the present been so uncertain. But, when certainty comes, it will be in the form of a scythe and ducking will be the only option.

In March 2007, when I presented my analysis of the US and global economy, How To Survive The Crisis And Prosper In The Process, to Marshall Thurber’s Positive Deviant Network, I predicted real estate prices would fall 40-70 %, stocks would fall 70-90 %, and another depression was coming.

At the time, the global economy was still expanding. It is no longer. Today, the opposite is true, the global economy is contracting. But the predicted crisis, decades long in the making, is now underway and has entered a new and different phase, one far more dangerous than that which preceded it.

The world economy is now on the verge of a total systemic breakdown. The mechanism underlying the present credit-based system is now broken; for its two critical underpinnings, banks and government are not just broken—far more importantly, both are now literally flat broke.

I'm broke, no bread, I mean like nothing,

from Busted, lyrics by Ray Charles

Prior to the Great Depression, the collapse of the 1920s bubble unleashed a cascade of defaulting debt that buried lenders and borrowers alike. Then, governments were not bankrupt; today, governments are as broke as those they are attempting to save.

The siren’s call of credit lured both the innocent and greedy alike to wager what instead should have put aside for a rainy day.

This is the conundrum central bankers cannot solve. Deflation, the collapse of demand that follows in the wake of defaulting debt has been loosed from its shackles and, soon, the conundrum of bankers will become the nightmare of all—a deflationary depression worse than the 1930s.

After the Great Depression, mainstream economists, monetary poseurs who graduated from Harvard, Princeton, the University of Chicago, etc. (schools where the dark arts of “I” finance are taught), convinced themselves that they had solved the problems that had plagued fiat systems in the past.

They were wrong and society is about to pay the price for their hubris. The so-called great moderation, i.e. the apparent containment of inflation, turned out to be but a monetary abnormality that led not to inflation but to enormously destructive asset bubbles that have now collapsed.

Central bankers have revealed themselves to be not masters of finance but the co-conspirators of investment bankers who looted government treasuries for the benefit of Wall Street’s parasitic plundering.

Today, the banker’s plundering of productivity is almost at an end, but not because of societal awareness, resistance and opposition but because governments today are as broke as the banks; and, their collective bankruptcy will hopefully prevent both from destroying what little savings and few freedoms are left.

No matter how respectable their appearance, the greatest enemies of society and freedom today are central banking and centralized government—the twin towers of monetary Mordor.

THE GOAT RODEO OF THE BROKE

Today, we are witness to a most absurd spectacle: Bankrupt nations with collapsing and contracting economies planning to re-spend themselves back into prosperity on borrowed money—at least, that’s the plan.

The US, England, Japan and others are trapped in a sinkhole of defaulting debt and deflating demand, the combination of which broke global economies in the 1930s and is in the process of doing so again today.

It is ironic and appropriate that England, the US, and Japan are following the same path at the same time; for the three together comprise the historical lineage of credit and power in this epoch, credit which built and whose consequent debt is now about to destroy all three.

LEAD INTO GOLD

PAPER INTO MONEY

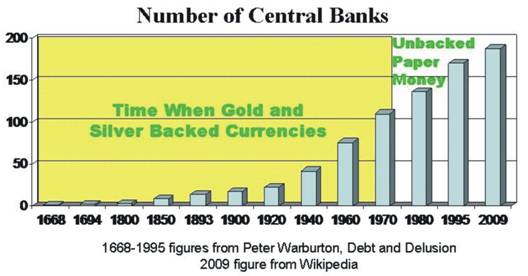

The medieval dream of alchemy turning base metals into gold was achieved in principle in England in 1694 when base motives instead accomplished almost the same, the transformation of paper coupons into money, or at least legal tender.

Issued by a central bank, the Bank of England’s credit-based paper money quickly turned into debt forever indebting the people of England and ultimately requiring the establishment of the world’s first income tax to pay for ever expanding government expenditures made possible by bankers’ now unlimited credit.

England’s credit-based money gave it an advantage over other nations resulting in global dominion called imperialism. But when the gaping maw of England’s ambition could no longer absorb more nations, England’s global thuggery came to an end.

GLOBALIZATION—IMPERIALISM IN THE 20TH CENTURY

The next iteration of global dominion was called globalization, an economic hegemony shared by England and the US, their central banks, the Bank of England and the US Federal Reserve and their progeny, investment banks headquartered on Wall Street and in The City.

The ability to print fiat currencies accepted everywhere as real money gave Western banks and corporations the same advantage in the 20th century as did England’s navy in the 18th and 19th centuries.

By the late 1900s, credit-fueled Western multi-national corporations and banks had established increasing control and power over global commerce—the one exception being Japan.

Japan had escaped the intended noose of Western domination after WWII by a combination of well-deserved insular paranoia and fate. Unexpectedly, in 1949 the Japanese adopted the revolutionary teachings of W. Edwards Deming, an American quality control expert whose humanistic philosophy of quality transformed Japan into an industrial power.

What profiteth a corporation should it increase shareholder value at the cost of market share and product quality?

Western corporations are focused not on the long term but on the short term, not on quality but on profits, a fundamentally flawed bias that allowed Japan to overtake the West and become the 2nd largest economy in the world and the predominant economic power in Asia.

MEIJI MOOLA

The Japanese not only learned to manufacture better products than the West, they also learned the secrets of the West’s extraordinary banking alchemy. When Japan invaded Hong Kong in 1941, they went directly to the English banks, put guns to the heads of the bank managers and forcibly extracted the secrets of England’s immense power, the power to create money out of thin air, credit and debt.

After WWII, knowing the extraordinary advantage that control over credit gives the West, the Japanese built a financial firewall around Japanese corporations, thus preventing foreign takeovers and disabling the built-in advantage that the “free-market” flow of currencies gave Western bankers.

The Japanese created interlocking ownership of Japanese corporations by Zaibatsu, Japanese industrial and financial conglomerates; and allowed the shares of these giant corporations to be included on bank balance sheets, enabling an even greater leverage of credit in Japanese banks than in the West.

As insular as China but far more adoptive, the Japanese addition of even more bank leverage, however, was to contribute to the destruction of the Japanese economy; for, now, in the 21st century, leverage is about to destroy what credit built in the 20th, both in Japan and in the rest of the world.

The addition of more bank leverage was a fatal mistake as the scythe of credit ultimately cuts down both its victims and those who wield it; for the handle on unlimited credit is only ephemeral and is as sharp as the blade itself; and, in the end, both the ignorant and sophisticated will suffer for succumbing to the temptation neither can control.

The pejorative view of subprime borrowers avoids the fact that sophisticated borrowers were equally guilty when feeding at the apparently free trough of credit made available by central banks (investment banks borrowed at 0 % from Japan)—and whereas poor people lost their impossible chance at homeownership, sophisticated bankers lost the savings of entire nations.

When the dust clears, lenders and borrowers alike will be buried beneath the rubble that credit created. The origins of credit resemble the present variant of swine flu, now possibly believed to be created by man, not nature, see http://www.bloomberg.com/apps/news?pid=20601087&sid=afrdATVXPEAk&refer=worldwide--the spread of credit and paper money being no less virulent or dangerous than the spread of a deadly flu is now about to take its toll on all who drank from the bankers’ diseased cup.

DEBT DESCENT & DISASTER

Leveraged bank credit temporarily catapulted Japan into the forefront of world economies by 1980; and, when combined with enormous positive trade imbalances—made possible by the free flow of US fiat money—created a large speculative bubble that culminated in the collapse of the Japanese stock market in 1990.

The collapse of the Japanese bubble was staggering. The built-in bank leverage used in its economic ascent turned into a noose on the way down and reawakened deflationary forces that central bankers believed had been vanquished after the 1930s.

The staggering amount of defaulting debt sank Japanese banks. Prior to 1990, buoyed by their built-in leverage, Japanese banks were among the world’s largest; but when the Nikkei collapsed in 1990, so, too, did Japanese banks and the Japanese economy.

What happened to Japan in the 1990s is now happening to the West, e.g. the US, the UK and other credit-based economies. The current hope is that because Japan survived deflation in the 1990s, so, too, will the US, the UK, and others.

Such hopes are futile as Japan’s survival was only temporary. This time Japan won’t survive because today it’s deflation is far more virulent; and, this time Japan will be joined by others also trapped by a collapse in demand, defaulting debt, insolvency of banks and endemic unemployment—a replay of the 1930s Great Depression but joined this time by a global monetary pandemic.

THE COMING PANDEMIC OF PAPER MONEY

This time the deflationary depression will be accompanied by an extraordinary global currency crisis. Government attempts to reflate their deflating economies will instead give rise to additional massive economic distress.

Just as low 1 % interest rates reflated economies in 2002 but also caused property prices to balloon then collapse in 2006, today’s even lower 0.25 % rates coupled with today’s unprecedented monetary creation will create an unmitigated global currency disaster that will destroy money as we know it.

To stimulate deflating economies, so much fiat money is being printed that money will eventually become worthless. Throughout history this is how all fiat currencies have ended, in the uncontrolled printing and circulation of increasing amounts of increasingly worthless paper.

Last month, M-2, the monetary aggregate in Japan increased at a rate even greater than 100 % annually. The printing presses are now being run as never before in the US, the UK and Japan in the desperate hope that it will save them from the overwhelming gravitational pull of deflation, an economic black hole of immense inertia.

The borrowing, printing and circulating of excessive amounts of fiat money has been done before and does not work. Doing so is a recipe for disaster; albeit a time-honored recipe that has been tried in the past always with the same result.

It will be no different this time. If you think otherwise, just wait and see.

QUANTITATIVE EASING INTO ECONOMIC DEATH

The term quantitative easing disguises the incredible absurdity of governments borrowing from themselves. The practice first emerged in the 1990s when deflation forced the Japanese to do so in order to keep its vulnerable economy afloat.

It is no coincidence that quantitative easing is now being adopted by the US and UK nor is it a good sign that it is being done. Quantitative easing is a sign that deflation has reached a level where governments cannot survive unless extreme measures are implemented.

…when a government resorts to quantitative easing, it shows that it has run out of other means to finance its endeavors. It has reached the end of the line.

The Meaning of Quantitative Easing, Michael S. Rozeff

We are now witness to otherwise bankrupt nations with contracting economies planning to re-spend themselves back into prosperity on borrowed money—money to be borrowed from themselves.

The US, the UK and Japan—the economic troika of the living dead—are all engaged in quantitative easing and are now in the last stages of capital destruction and economic collapse.

THE END OF THE LINE

Banks and governments—especially the US, the UK and Japan—have reached the end of the line; indeed, we have all reached the end of an era. The bankers’ game of debt-based capital masquerading as money in order to indebt and profit from the productivity of others is now in its final stage.

The bankers’ resultant debts are now so large, they can no longer be retired, serviced, sold, or even rolled over. That governments have announced they will guarantee all bank deposits and increasing amounts of public and private sector debt when they themselves are broke is a sign of the times—the end times.

Two weeks after the historic August 2007 credit contraction froze global credit markets, I spoke at Session II of Professor Fekete’s Gold Standard University Live in Hungary. The last segment of my speech was titled, “The Path To The Future Is A Cliff”.

In May 2009, it is clear that we have now fallen off that cliff. The recent rebound in global stock markets indicates only that we have not yet hit the bottom. We will. Just wait and see.

INVESTING ON THE WAY DOWN

Whether this year is the death watch of the US dollar or next year or perhaps the year after is as yet unknown; but, what is known, is that all fiat currencies eventually succumb to the ever-increasing pressures placed upon them by government.

When the only constraint on monetary creation is paper and ink or a keystroke, as is true today, the temptation to do so is greater than any bureaucrat’s limited ability to withstand, especially if that bureaucrat is Ben Bernanke, the head of the US Federal Reserve who has a known weakness for monetary excesses.

Investing in the end times is very different than investing in times precedent. What worked before will not work now, at least not in the long run. While powerful bear market rallies are common, such rallies are either an opportunity to exit the markets, a trap for the hopeful or a playing field for those adroit and knowledgeable enough to know what assets rise and fall in such times and when they will do so.

However, few can dance fast enough to outwit the scimitar’s edge, the exact time when paper assets turn into dust and the slippered fantasies of fools are revealed for what they are—and aren’t. But while few such expert advisors do exist; all such experts understand the transitive nature of the game they play.

Central banker, John Exter, clearly understood the fraudulent game of central banking. Exter called the US dollar and other fiat currencies “I-owe-you-nothing-money”. Exter’s inverted pyramid denoted the flight of paper money in such times, at the bottom of Exter’s pyramid is gold, the asset of last resort.

Gold, a barbarous relic, Lord Keynes? I think not. Gold and silver are today as they always have been, the refuge of freedom and safety in times of chaos and tyranny, times such as today.

THE LAST DAYS

You can feel it in the air

There’s a stirring everywhere

An end is coming soon

An end to this cocoon

An end to all we know

An end to what’s been so

An end to funny money

An end that’s not so funny

I wonder what will be

What tomorrow we shall see

And may the grace that brought us here

Transform our every fear

Buy gold, buy silver, have faith.

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.