Balancing Crude Oil Supply and Demand

Commodities / Crude Oil May 20, 2009 - 08:47 AM GMTBy: Evan_Smith

We’ve seen huge volatility for oil prices the last nine months, but it now looks like oil is starting to bottom out after hitting lows in late 2008 and the first part of this year.

We’ve seen huge volatility for oil prices the last nine months, but it now looks like oil is starting to bottom out after hitting lows in late 2008 and the first part of this year.

While prices have improved, there hasn’t been much data in the United States to indicate we’re out of the woods just yet. But there is hope, as incremental buying from China and other Asian countries has started to pick up.

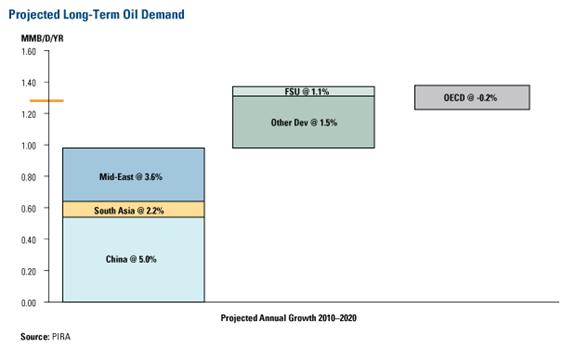

The above chart shows projected annual growth in oil demand over the next 10 years. The largest block—representing 1 million barrels a day—comes from China, Southeast Asia and the Middle East.

The next largest source of demand growth—about 400,000 barrels a day—will come from Russia and other developing markets.

Historically, as GDP per capita rises to a certain threshold between $5,000 and $10,000 per person per year on a purchasing-power-parity basis, you start to see a really accelerated demand in oil use per person. Many Southeast Asian and developing countries are at this point right now so we can expect a considerable increase in demand from those areas in the years to come.

In contrast, OECD countries are expected to see their oil demand shrink by a couple hundred thousand barrels per day. This decrease is mostly a result of aging populations and becoming more efficient in their energy use.

Oil Supply

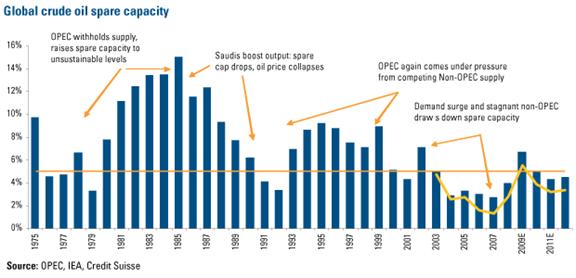

There are several factors that can disrupt supply. Spare capacity and concentrated production are two things we’re keeping an eye on.

We’re seeing a spike in spare capacity in 2009 above the historical average (marked by the horizontal yellow line) after four or five years of running well below that average. That spike is likely a result of a steep decline in demand. However, a lack of investment by OPEC producers and a recovery in demand will slip us back into the long-term trend which is supportive for oil prices.

We also see the concentration of oil supply in the Middle East as a potential threat to supply because of its susceptibility to disruptions. This has always been a big issue, but we’re starting to see more market share of the global oil industry in the hands of the Middle Eastern producers.

The Middle East is currently home to about two-thirds of the world’s crude oil reserves and about a third of global crude oil production. If there are geopolitical issues or supply problems, it’s possible we could see severe supply disruption up to a million barrels a day or more.

By Evan Smith, CFA

Evan Smith, CFA, is co-manager of U.S. Global Investors , a Texas-based investment adviser that specializes in natural resources, emerging markets and global infrastructure. The company's 13 mutual funds include the Global Resources Fund (PSPFX) , Gold and Precious Metals Fund (USERX) and Global MegaTrends Fund (MEGAX) .

More timely commentary from Frank Holmes is available in his investment blog, “Frank Talk”: www.usfunds.com/franktalk .

Please consider carefully the fund's investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. Gold funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The price of gold is subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in gold or gold stocks. The following securities mentioned in the article were held by one or more of U.S. Global Investors family of funds as of 12-31-07 : streetTRACKS Gold Trust.

Evan Smith Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.