Global Systemic Financial Crisis Surrealism at the Heart of Stock Market Trends

Stock-Markets / Market Manipulation May 16, 2009 - 07:27 PM GMTBy: Global_Research

GEAB writes: The financial surrealism which has been at the heart of stock market trends, financial indicators and political commentaries in the past two months, is in fact the swan song of the referential framework within which the world has lived since 1945.

GEAB writes: The financial surrealism which has been at the heart of stock market trends, financial indicators and political commentaries in the past two months, is in fact the swan song of the referential framework within which the world has lived since 1945.

Just as in January 2007, the 11th edition of the GEAB described that the turn of the year 2006/07 was wrapped in a « statistical fog » typical of an entry into recession and designed to raise doubts among passengers that the Titanic was really sinking (1), our team today believes that the end of Spring 2009is characterized by the world’s final stepping out of the referential framework used for sixty years by global economic, financial and political players in making their decisions, in particular of its “simplified” version massively used since the fall of the communist bloc in 1989 (when the referential framework became exclusively US-centric). In practical terms, this means that the indicators that everyone is accustomed to use for investment decisions, profitability, location, partnership, etc ... have become obsolete and that it is now necessary to find new relevant indicators to avoid making disastrous decisions.

This process of obsolescence has increased dramatically over the past few months under pressure from two trends:

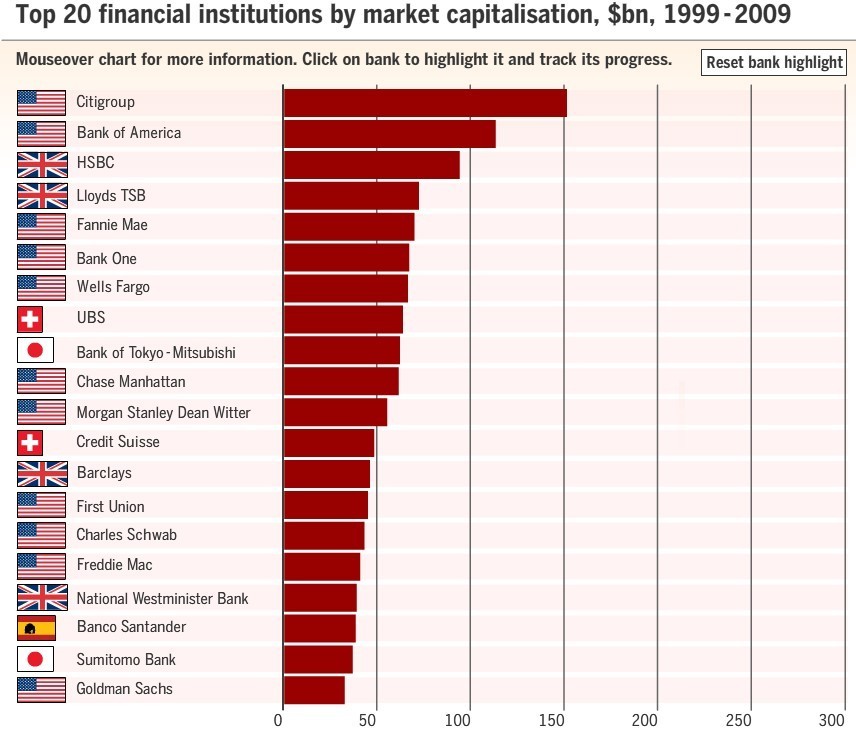

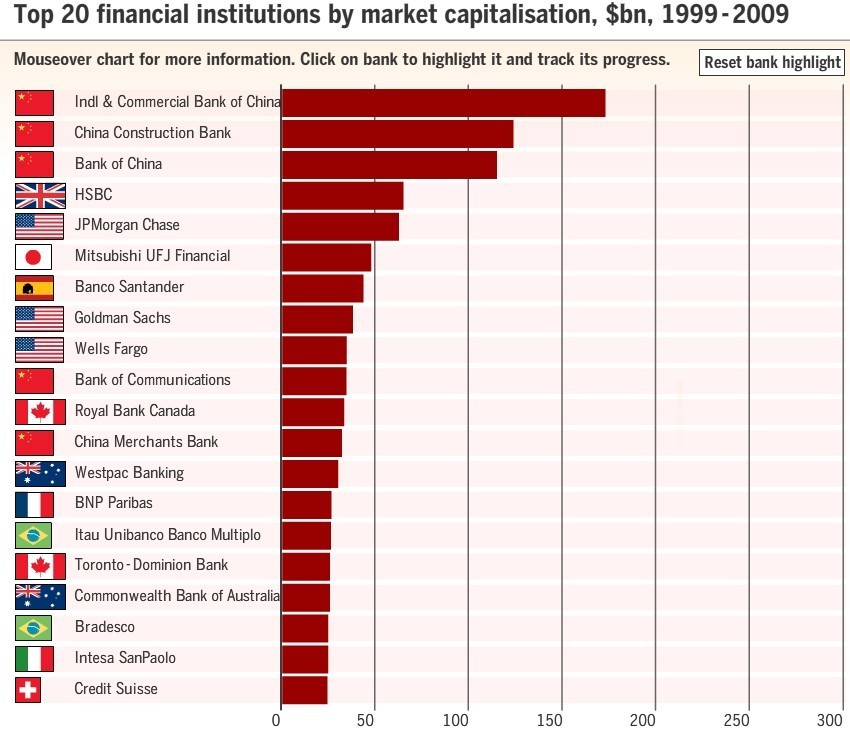

. first, the desperate attempts to rescue the global financial system, particularly the American and British systems, have de facto "broken navigational instruments" as a result of all the manipulation exerted by financial institutions themselves and by concerned governments and central banks. Among those panic-stricken and panic-striking indicators, stock markets are a perfect case as we shall see in further detail in this issue of the GEAB. Meanwhile, the two charts below brilliantly illustrate how these desperate efforts failed to prevent the world’s bank ranking from experiencing a major seism (it is mostly in 2007 that the end of the American-British domination in this ranking was triggered).

. secondly, astronomical amounts of liquidity injected in one year into the global financial system, particularly in the U.S. financial system, led all financial and political players to a total loss of touch with reality. Indeed, at this stage, they all seem to suffer from a syndrome of diver’s nitrogen narcosis – impairing those affected and leading them to dive deeper instead of surfacing. Financial nitrogen narcosis has the same effects than its aquatic counterpart.

Destroyed or perverted sensors, loss of orientation among political and financial leaders, these are the two key factors that accelerate the international system’s stepping out of the referential framework of the past few decades.

Top 20 financial institutions by market capitalization in 1999 (USD billions) - Source: Financial Times, 05/2009

Of course, it is a feature of any systemic crisis and easy to establish that, in the international system we are used to, a growing number of events or trends have started popping out of this century-old framework, demonstrating how this crisis is of a kind unique in modern history. The only way to measure the magnitude of the changes under way is to step back several centuries. Examining statistical data gathered over the last few decades only enables one to see the details of this global systemic crisis; not the overall view.

Here are three examples showing that we live in a time of change that occurs only once every two or three centuries:

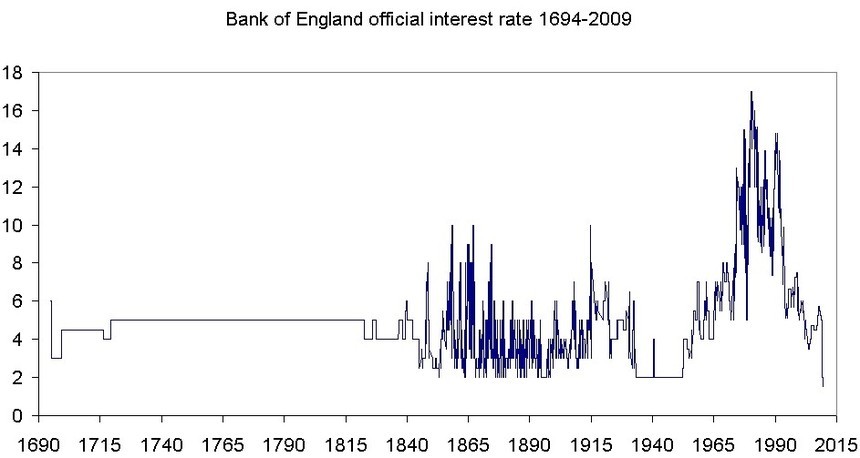

1. In 2009, the Bank of England official interest rate has reached its lowest level (0.5 percent) since the creation of this venerable institution, i.e. since 1694 (in 315 years).

3. In April 2009, China became Brazil’s leading trade partner, an event which has always announced major changes in global leadership. This is only the second time that this has happened since the UK put an end to three centuries of Portuguese hegemony two hundred years ago. The US then supplanted UK as Brazil’s leading trade partner at the beginning of the 1930s (3).

It is not worth reviewing the many specifically US trends popping out of the national referential framework compared to the past century (there is no relevant referential framework older than that in the US): loss in value of the Dollar, public deficits, cumulated public debt, cumulated trade deficits, real estate market collapse, losses of financial institutions… (4)

But of course, in the country at the heart of the global systemic crisis, examples of this kind are numerous and they have already been widely discussed in the various issues of the GEAB since 2006. In fact, it is the number of countries and areas concerned, which is symptomatic of the world’s stepping out of the current referential framework. If there was only one country or one sector affected, it would simply indicate that this country/sector is going through an unusual time; but today, many countries, at the heart of the international system, and a multitude of economic and financial sectors are being simultaneously affected by this move away from a “century-old road”.

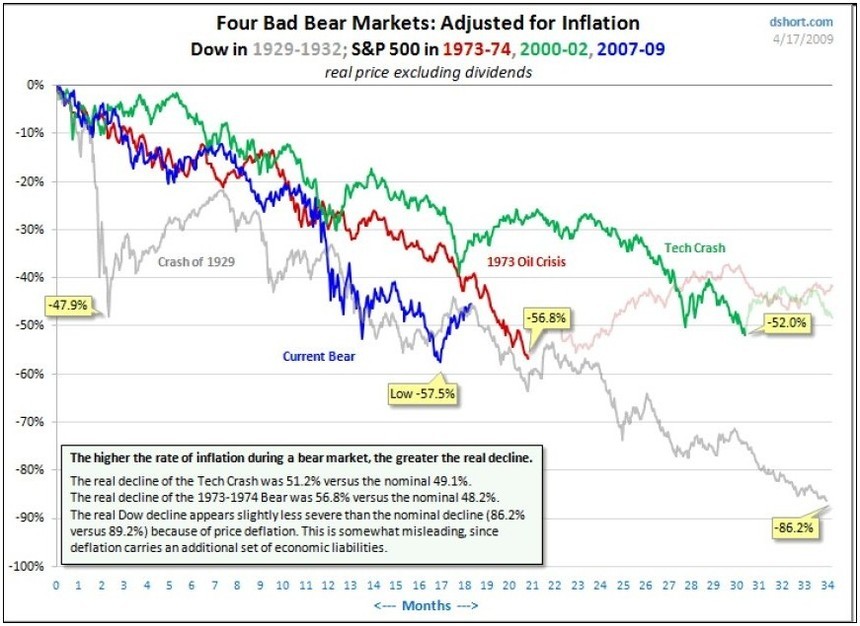

Stock market trends – adjusted for inflation – during the last four major economic crises (grey: 1929, red: 1973, green: 2000, and blue: current crisis) - Source: Dshort/Commerzbank, 17/04/2009

Of course, everyone is free to think that a few points’ monthly variation of a particular economic or financial indicator, itself largely affected by the multiple interventions of public authorities and banks, carries much more value on the evolution of the current crisis than those stepping out of century-old referential frameworks. Everyone is also free to believe that those who anticipated neither the crisis nor its intensity are now in a position to know the precise date when it will end.

Our team advises them to go see (or see again) the movie Matrix (5) and to think about the consequences of manipulating the sensors and indicators of one’s perception of given environment. Indeed, as we will examine in detail in our special summer 2009 GEAB (N°36), the coming months could be entitled « Crisis Reloaded » (6).

In this 35th issue of the GEAB, we also express our advice on which indicators, in this period of transition between two referential frameworks, are able to provide dependable information on the evolution of the crisis and the economic and financial environment.

The two other major themes addressed in this May 2009 issue of the GEAB are, first, the programmed failure of the two major economic stimulus plans: namely the Chinese and American plans, and, secondly, the United Kingdom’s appeal to the IMF for financial assistance by the end of summer 2009.

In terms of recommendations, in this issue, our team anticipates the evolution of the worlds’ largest real estate and treasuries markets.

Notes:

(1) At that time, our team added «Just like always when change occurs, the passage by zero is characterized by a «fog of statistics» where indicators point in opposite directions and measurements provide contradictory results, with margins of error sometimes wider than the measurement itself. Regarding our planet in 2007, the on-going wreck is that of the US, that LEAP/E2020 has decided to call the « Very Great Depression », firstly because the « Great Depression » already refers to the 1929 crisis and the years after; and secondly because, according to our researchers, the nature and scope of the upcoming events are very different ». Source: GEAB N°11, 01/15/2007

(2) Source: France24, 04/16/2009

(3) Source: TheLatinAmericanist, 05/06/2009

(4) Political leaders and experts insist on comparing the current crisis to the 1929 crisis, as if the latter were a binding reference. However, in the US in particular, current trends in many fields have moved beyond the events which characterized the « Great Depression ». LEAP/E2020 already reminded in GEAB N°31 that relevant references were to be found in the 1873-1896 global crisis, i.e. more than a century back.

(5) In the Matrix series of movies, reality perceived by humans is created by computers. They think they live a comfortable life when in fact they live in squalor, but all their senses (sight, hearing, taste, touch, smell) are manipulated.

(6)The title of the second in this series of movies: « Matrix reloaded ».

GEAB is a frequent contributor to Global Research. Global Research Articles by GEAB

© Copyright GEAB , Global Research, 2009

Disclaimer: The views expressed in this article are the sole responsibility of the author and do not necessarily reflect those of the Centre for Research on Globalization. The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible or liable for any inaccurate or incorrect statements contained in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.