The Impact of Economic Data Revisions at Stock Market Junctures

Stock-Markets / Recession 2008 - 2010 May 16, 2009 - 08:36 AM GMTBy: John_Mauldin

Can I Have Some More of that Data, Please?

Can I Have Some More of that Data, Please?

The Fault, Dear Brutus, is Not in Our Stars

Faith-Based Economics

Is Unemployment a Lagging or a Leading Indicator?

An Unsustainable Trend in Debt

Some Thoughts on the Health Care Problem

Why does government data need to be revised so often? Is it conspiracy, as some claim, or is it methodology? And if it is methodology that leads to faulty data, then why not change the methodology? Is unemployment a lagging indicator, as conventional wisdom suggests? We look again at the underlying assumptions to suggest that things are not always the same. And finally, we look at unsustainable trends, fiscal deficits, and health care -- there is a connection.

But first, a quick note about the latest "Conversations with John Mauldin" that I just did with Don Coxe and Gary Shilling. These two esteemed analysts have different views on whether commodity prices will rise or fall, and are not afraid to make their views known. I edited the final transcript today, and I can tell you that even though I was "at the table" I learned a lot reading it the second time. If you want to understand the nature of what is a very central debate, this is a must-read. This was a VERY lively debate. Most of my friends know that I am not shy, but it was hard to get a word in edgewise as these guys went at it. It was great fun to watch.

And if you have not yet subscribed, you can go back and listen to my Conversation with Chris Whalen and Rick Lashley on the banking crisis, and see if you can figure out what motivated the Manhattan district attorney's office to call me asking for clarification. Plus the quintessential piece with Lacy Hunt and Ed Easterling on the fundamentals of the current economic crisis, which many subscribers said was worth the price of an annual subscription. And then there is the Conversation I did with Nouriel Roubini. It is all there for you.

The new Conversation will be posted early next week. Subscribers will get an email notifying you when it is up. Also, George Friedman of Stratfor and I are going to start doing a regular quarterly Conversation that will be a separate product, but if you subscribe today you will get it as part of the regular service for a year.

Right now, we are offering a subscription for $109, $90 off the regular $199 price. To learn more, you can click here and subscribe, if you haven't already. Insert code JM77 for this special offer. You can enter that code on the final screen of the subscription process.

Note: When George and I record that first piece sometime in the next few weeks, the price will rise to $129 a year, so you should act now. As we add more features like the one with George, current subscribers will simply get the new services, but the price for a new subscription will rise. New subscribers will however get access to the previous Conversations, at least for now.

Can I Have Some More of that Data, Please?

One of my regular reads is the blog The Big Picture. They featured a short piece by Michael Panzner this week. He put together some rather interesting data and then asked a question, which gives me an opportunity for discussing government data. Let's see what he had to say, and then I will make my comments.

"Many market-watchers claim that U.S. economic statistics are increasingly being revised downward in subsequent periods, suggesting that the figures initially being reported by Washington are "puffed up," so to speak, most likely for political purposes.

"Well, I went back and had a look at the differences between the reported and revised data for various series, including monthly retail sales, nonfarm payrolls, industrial production, and durable goods orders, to try and figure out if the cynics are right.

"Using data from Bloomberg, I calculated whether the revised data for each month was lower than the first-cut estimate. Then I tabulated 12-month running totals for each series to see if there has been some sort of systematic bias (in other words, whether the pattern of monthly downward revisions was trending higher instead of undulating up and down).

"To make the comparisons easier, I subtracted the 12-month tally as of May 2002 (an arbitrarily chosen date) from the monthly totals for all four economic series so that the starting point for each would be the same — zero.

"Based on a quick read of a graph of the data (see below), it does seem as though the pattern of negative revisions has been trending higher lately, especially during the past year or so, suggesting that the cynics may be on to something.

"That said, I am not a statistician, and the results may be nothing more than "noise." There is also the possibility that my methodology is lacking (because, for example, the margins-of-error for each month's data are relatively large, or because of certain quirks that crop up when an economy is in transition). Still, you gotta wonder..."

Actually, Mike (can I call you Mike?) your last thought is the correct one: "or because of certain quirks that crop up when an economy is in transition."

Go back to 2003-04. Notice that the numbers of downward revisions in non-farm payrolls are negative in your graph? Remember all the talk back then about the "jobless recovery"? We can now look back and see there were a lot of jobs being created. They just did not show up in the early statistics. And look at the opposite reaction in industrial production: here they revised strongly downward for a the better part of two years, yet it turned out there was a production boom going on.

Was all this a conspiracy on the part of the Bush administration to make things look worse than they actually were? Hardly seems like rational political behavior.

The "problem" comes from the methodology. There is no exact data for any of those statistics. They have to get as much data as they can and then make estimates. Part of the process of estimation uses previous trends. It is as if we were using past performance of a mutual fund or stock to project future returns. Even though we look at the past performance, we should know that past performance is not indicative of future results. Just look at some of the top-performing value-oriented mutual funds in the recent bear market, like superstar Bill Miller's Legg Mason Value Trust fund (LMVTX), the after-fee returns of which had beaten the S&P 500 index for 15 consecutive years, from 1991 through 2005. It did rather poorly last year, even in comparison with the S&P, which was horrid. Past performance is interesting, but it can disappoint. And sometimes rather viciously.

Now, just as saying that a fund on average will produce a 10% return does not mean that it will yield 10% every year, neither do government statistics work that way. While the methodology for each series of data is different, they all are more or less trend-following. They take past relationships in the data they can gather and use them to estimate current numbers. And -- this is important -- on average and over longer periods of time, they are pretty accurate.

They will revise the data many times over the coming years, getting closer and closer to the actual numbers. For instance, I can't remember exactly when, but it was several years later that we learned that we were already in a recession in the third quarter of 2000, at the very time most economists were calling for a robust economic future! (Except for your humble analyst, who was predicting a recession, and had been for some time because of the inverted yield curve, but that's another story.)

But in the short run, at economic transitions they are going to get it wrong, because the backward-looking data is mean-reverting. But how else would you do it? One of the keys to economic transitions is to look at the direction of the revisions. Recently, the revisions have all been negative. Things are actually getting worse than the initial data suggested. And during the last recovery the data kept getting revised upward, especially six months and one year later.

The Fault, Dear Brutus, is Not in Our Stars

Look again at the very useful chart above (great work, wish I had thought of it!). Non-farm payrolls, which for some odd reason everyone pays attention to, is especially wrong at the turns. Anyone trading on non-farm payroll data deserves the losses they will get.

One of the reasons that non-farm payrolls are so often revised is that the Bureau of Labor Statistics (BLS) is forced to estimate the number of new businesses being created each month that are simply under the radar screen of government statisticians. This number is called the birth/death ratio. You could not create a useful payroll number without this estimate, yet it is simply a wild-eyed guess based on past trends, which by definition we know will change at economic turning points.

Further, almost no one pays attention to the fine print in the data, which talks about margin of error. The statisticians clearly understand the limits of their data, even if the public does not. Often, the margin of error is larger than the number being given, so that a positive number may actually turn out to be negative, and vice versa, when viewed from a few years out.

As Cassius said in Julius Caesar, "The fault, dear Brutus, is not in our stars, But in ourselves, that we are underlings."

Faith-Based Economics

Should we cast aspersions on the data creators? I rather think not. The various government statistics creators are doing their best to give us information that, over time, will be useful. Some is more useful than others in real time. Some has large time lags before it is accurate. To expect the BLS or the Commerce Department to have accurate current data is expecting them to know the future. The very people who are the most critical would never presume to be accurate about the prices of stocks six months out (or even one month), on a consistent basis. Yet that is the kind of prescience they want from government statisticians.

Do you really want data from government sources that makes assumptions about economic recoveries and recessions? That is the job of independent economists, and they generally do it pretty badly. There is no need for the government to compound the errors.

Again, repeating myself, anyone who trades on government statistics as being anywhere close to accurate in real time deserves any losses they get. They are at best a foggy window through which we peer into the future. Taken together, and with some seasoning of time, they can be rather useful; but to pin hopes of a recovery or a bull-market run on one week's data is hazardous to one's wealth.

Reading and watching all the analysts and economists who "see" recovery in one set of data or another makes me wonder what sort of faith-based economics they actually practice. Just as it requires faith to believe in God, it also requires a lot of faith to believe in forecasts made on a single month's set of data, or based on past performance.

Are you interested in finding a real green shoot? Let's look for a quarter when the economic data keeps getting revised upward, two and three months out. That will signal a real recovery. As long as the data is being revised downward, the economy is "having issues," as my kids would say.

Quick sidebar to those who keep asking: Yes, I think we have seen the worst of the economic data, as far as GDP goes. But that does not mean we don't have further negative quarters in our future. I just don't think they will be a negative 6 like they have been the last two quarters. And we may even see a quarter this year with a positive number. But take it with a grain of salt when the usual suspects declare the end of the recession. Look into the data that produces the numbers. As Gary Shilling points out, eight of the last eleven recessions have had a positive quarter, only to see more negative quarters follow. GDP numbers are quirky. But here's to hoping for a real recovery when we do see the next positive number.

Is Unemployment a Lagging or a Leading Indicator?

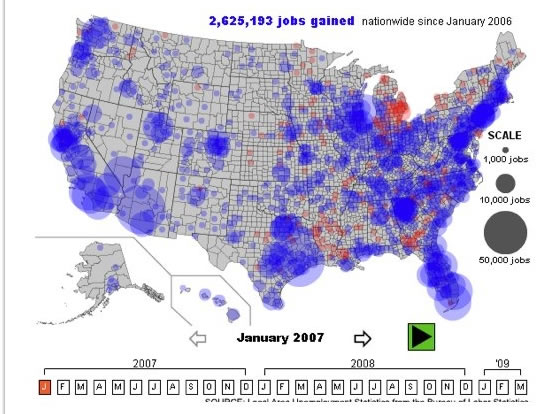

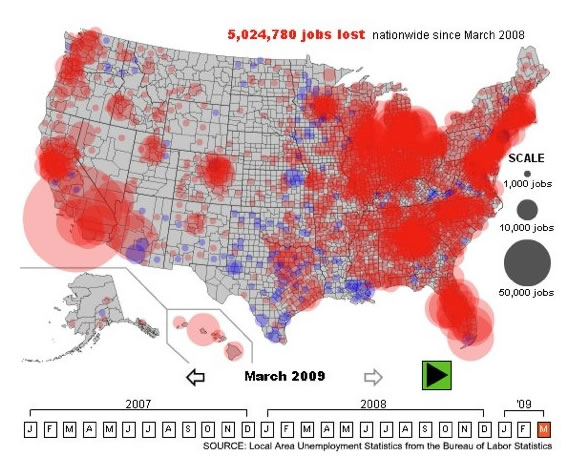

There is a very interesting animated graphic done by Chris Wilson at Slate.com (http://www.slate.com/id/2216238/). It shows the progression of unemployment by US county over the last two years. I reproduce the beginning and ending stages of the graph for you below, and apologize to those of you who are reading this in black and white, as it will not be as dramatic. But if you watch the entire series, it shows how rapid the deterioration in unemployment has been. (It takes about ten seconds.) The first graph shows that there 2.6 million jobs had been created in 2006. The last one shows that job losses were 5 million through March and, if we add in April and estimates for May, it will be close to 6 million. Again, the actual animation is dramatic, and made my daughter go "Ouch!"

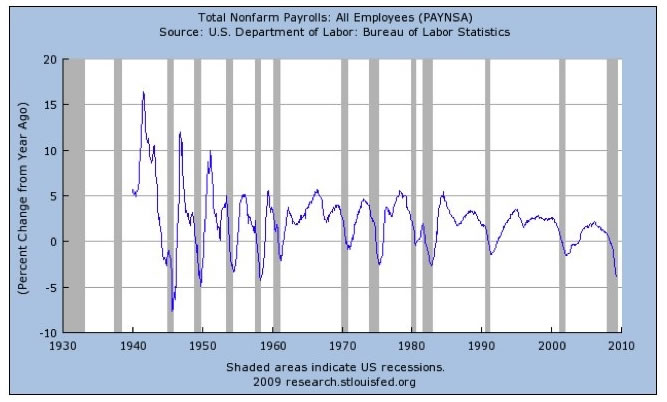

It's been 50 years since we have seen unemployment drop as rapidly as it has in the current recession. Given that we have a much smaller percentage of manufacturing jobs now, that volatility is breathtaking. Look at the data since 1930 from the St. Louis Fed:

The typical pundit keeps telling us unemployment is a lagging indicator, and that the recovery will be well under way before it shows up in the job numbers. Therefore, you should buy what they are selling, because the recovery is on its way. But that may not be the case this time. One of my favorite reads, when I get to see it, is the economic analysis from Bridgewater. They are among the best thinkers anywhere, and everyone who follows them gives them a great deal of credence. This is what they wrote about unemployment being a lagging indicator last month:

"Normally, labor markets lag the economy because incremental spending transactions are financed via debt, stimulated by interest rate cuts. But as long as credit remains frozen, spending will require income, and income comes from jobs. And debt service payments are made out of income. Therefore, in a deleveraging environment job growth becomes an important leading, causal indicator of demand and other economic conditions.

"... The bounce in the economy and the stabilization in markets reflect government actions that are big enough to impact near-term growth rates, but are not sufficiently directed at the root problem of excessive indebtedness to produce permanent healing. The deterioration in employment markets will continue because companies' profit margins are so deeply damaged that a little bounce in growth won't do much to alter their need to cut costs. This deterioration in labor markets will undermine demand and continue to pressure loan losses, which will keep the pressure on the banks and elevate the cost of capital for tentative borrowers, inhibiting credit expansion."

This again illustrates the problem of using past performance to project future results. You have to look at the underlying conditions in order to get a real comparison, and we have not seen a deleveraging recession in the US for 80 years. Using the past data in today's world is statistical masturbation: it may make you feel good, but it is not producing anything really useful, and may be harmful to your portfolio.

An Unsustainable Trend in Debt

This week, the federal government published two important reports on long-term budgetary trends. They both show that we are on an unsustainable path that will almost certainly result in massively higher taxes. By 2016 we will have to fund Social Security out of general revenues, as the surplus we now have will be gone. And there are no trust funds. They are a myth. It as if I wrote myself a check for $2 trillion and then declared I was worth $2 trillion. The money is just not there. Social Security makes Bernie Madoff look like a small-time crook.

And Medicare is in far worse shape. For those with the stomach, you can read Bruce Bartlett's analysis at http://www.forbes.com/2009/05/14/taxes-social-security-opinions-columnists-medicare.html. He estimates that taxes will have to go up by 81% if we are to pay the obligations as they now stand.

Now that is unsustainable. It won't happen. And as the saying goes, if something is unsustainable, at some point it will stop. No getting around it. Long before we get there, change you will not like will be forced on the US.

The following headline caught my eye: "Obama Says US Long-Term Debt Load is 'Unsustainable.'" Yet they announced a $1.8 trillion deficit, which is really going to be at least $2 trillion, and are getting ready to pass health-care programs that will mean at least a trillion in deficits for as long as one can project.

How will they pay for it? Even getting rid of the Bush tax cuts will only produce a few hundred billion a year, which is nowhere near enough. They project much lower medical costs in the future, because they assume they are going to figure out ways to cut costs and make medical care more efficient. As if no one has ever tried that.

Yes, there are some savings on the margin; but the only way you really cut costs is to ration health care, especially health care in the last year of life, which is about 30% of health-care expenses. That is going to be very tough in the US. But when faced with a real budget crisis, the choices are going to be stark. And that crisis is coming if we do not control spending.

You cannot propose massive increases in spending without either creating crushing debt that the markets will simply not allow, pushing interest rates much higher and really slowing growth and hurting the economy. It is a simple fact that you cannot increase the debt-to-GDP ratio without limit.

We found the limit on personal and corporate debt this past year. We pushed the limits until the system crashed. And now the US government wants to basically do the same thing. They are planning to see where the limits on government debt-to-GDP will be. Unless cooler and more rational heads in the Democratic Party prevail, this is not going to be pretty. Sometime in the middle of the next decade we will hit the wall, and it will make the current crisis pale in comparison.

The only way to solve the problem is to grow GDP more rapidly than debt, and for that to happen you have to have policies which are shaped for the growth of the economy or massive savings by consumers. And right now we have neither. Cap and trade is hugely anti-growth. So are high corporate taxes, and Obama is proposing to effectively raise corporate taxes by closing loopholes for income earned outside the US. Much better would be to lower the overall corporate level to a competitive world rate and then require the offshore income to be taxed. A lower rate would actually increase tax revenues.

Looming protectionism worldwide is a problem. (See the article at http://www.msnbc.msn.com/id/30758018.) Towns in Ontario, Canada with a population totalling 500,000 have effectively barred US contractors from doing business with them, in retaliation for job losses stemming from US protectionism in the stimulus plan. That movement is spreading. A US steel mill with 600 union jobs will have to close down because its owners are not US-based, and thus it is not technically a US supplier. They are losing jobs to US-owned mills -- but those are US jobs. The insanity goes on and on. As I have written for many years, the one thing that really gets me worried is protectionism. That can make this very significant recession into a depression quicker than you can imagine. Bad ideas have bad consequences.

All in all, we face some very difficult decisions, not just in the US but all over the developed world. Ironically, the less developed nations will have fewer problems and on a relative basis will likely grow much faster than the developed world. But, multi-trillion-dollar deficits and massive new programs are not the right answer.

Obama is right: the debt load is unsustainable. Let's hope he will do more than talk, and show some budget restraint.

Woody Brock has given me permission to pass on to you his recent notes on this very topic of what we have to do to get out of this crisis. It will soon be an Outside the Box. Read it. It is a very sobering and thought-provoking piece.

Some Thoughts on the Health Care Problem

Now, some positive news. This week I visited the Cleveland Clinic and went through their Executive Health Program (more on that below). I got to visit for several hours with my doctor, Michael Roizen, of YOU: The Owner's Manual fame (not to mention all his subsequent books). They have now sold over 20 million copies, and I highly recommend them.

I have long been a student of medical trends, and long-time readers know that I think the next really big boom will be in the biotech world. I asked Mike what three things he thought would have the biggest impact in the next five years in medicine. What he said gave me hope, because he thinks there may be some advances in medicine that could help solve some of the basic health issues we all face, and at the same time give us some relief from the high and rising costs of medical care. I was aware of most of the research, but did not know that we were as close as it appears we actually are.

Briefly, he feels there are three developments in late-stage trials that could have major impacts. The first is the development of sirtuin, which so far seems to be delaying the effects of diabetes but also seems to work for a host of diseases that are inflammatory in nature (including many heart-related issues). It essentially delays the symptoms for 30-40 years. While the current trials are for very specific diseases, he thinks sirtuin will have a wide applicability and that it could be huge, as inflammation is the cause of a number of diseases. This could prolong useful life and forestall a number of debilitating conditions.

Second, there is a late-stage-three trial due out soon that promises to increase muscle mass. I have been reading about such developments, but was not aware that something might be available within a few years. This promises to help people stay active a lot longer than currently possible, which will be a good thing if we are going to live longer.

And finally, there is a study and trial which shows that DHA may delay the onset of Alzheimer's disease, which eats up a significant portion of US medical budgets.

I recently spent time with a research doctor at the University of California Irvine who believes that muscular dystrophy and other brain/nerve-related diseases may be conquered within five years.

We may just get lucky. Instead of high and rising medical expenses that we cannot pay for without bankrupting the country, we may be able to reduce our medical bill by staying healthier and living longer.

Everybody should be like my personal hero, Richard Russell. I hope to be writing as well as he does when I am 85. With some luck, I might just make it.

Let me quickly recommend to my readers that they get serious annual physicals. At the Cleveland Clinic this week I saw seven doctors in one and a half days, and went through some serious poking and prodding. The program was tailored to my needs, as it is different for every person. You see professionals who are geared to your physical challenges. They make all the arrangements, and a staff person walks you into see the doctors, who are on very tight schedules.

The advantage of the Cleveland Clinic is that they are very oriented toward helping you not get sick in the first place. I am turning 60 this year, and Iwant to be active for a very long time. You have to be proactive.

As an aside, I had a colonoscopy. I was really dreading it, but it is one of those things you need to do. As it turns out, it was nowhere near as bad as I thought, and they basically gave me a drug which allowed me to relax and only experience a little discomfort. ("You are going to feel really relaxed in about 30 seconds.")

You can learn more at www.clevelandclinic.org/executivehealth. Whether it is there or somewhere else, get a serious physical. I want you to be reading me in 25 years as much as I want to be writing.

It is time to hit the send button. I will close by wishing you a very healthy week.

Your really an optimist at heart analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Nadeem_Walayat

17 May 09, 17:22 |

Ignore Fundementals at Market Junctures

Hi John Great to see your view is starting to come in line with my own of the past six months that Fundementals / economic statistics are irrelevant at market Junctures. Hopefully the million strong that follow your commentary will also start to eventually partake in the stealth bull market that has many more years to run Stealth Bull Market Follows Stocks Bear Market Bottom at Dow 6,470 So well, done in being ahead of 'most' of the herd, Best. |