Retail Sales "Green Shoots" of Economic Recovery Wither On The Vine

Economics / Recession 2008 - 2010 May 13, 2009 - 04:40 PM GMTBy: Mike_Shedlock

Whatever momentum consumers had (real or imaginary) is already in question as Retail Sales Unexpectedly Fall for Second Month.

Whatever momentum consumers had (real or imaginary) is already in question as Retail Sales Unexpectedly Fall for Second Month.

Retail sales in the U.S. unexpectedly dropped in April for a second month, indicating that rising unemployment is prompting consumers to conserve cash.

The 0.4 percent decrease followed a revised 1.3 percent drop in March that was larger than previously estimated, the Commerce Department said today in Washington. Other reports showed companies continued to cut stockpiles as demand slowed, and climbing oil costs pushed up prices for imported goods.

A separate report from Commerce showed inventories at U.S. businesses fell 1 percent in March, a seventh consecutive drop as slumping sales forced companies to pull back. The streak of decreases is the longest since 2001-2002.

Economists had forecast retail sales would be unchanged, according to the median of 67 projections in a Bloomberg News survey, after a previously reported 1.2 percent drop in March. Estimates ranged from a 0.8 percent decline to an increase of 1.1 percent.

The decline in sales was led by falling demand at electronics, furniture, clothing and grocery stores.

“The second quarter is going to be tough,” Bill Cheney, chief economist at John Hancock Financial Services Inc. in Boston, said in a Bloomberg Television interview. “Consumers are losing their jobs, concerned about losing their jobs and losing wealth.”

Receipts at service stations also fell in April, even as fuel prices climbed, indicating Americans may be cutting back on driving to save money.

Autos sold at a 9.3 million annual pace in April, compared with a 9.9 million rate in March, according to industry data. Chrysler LLC, whose U.S. sales tumbled 48 percent in April from the same month last year as bankruptcy neared, said last week it will offer rebates of as much as $6,000 to boost demand. The incentives began May 6 and end June 1.

Excluding autos, retail sales also fell unexpectedly, dropping 0.5 percent in April. They were projected to rise 0.2 percent, according to a Bloomberg survey.

Some Discounters Beat Estimates

Kohl’s Corp. and BJ’s Wholesale Club Inc. were among retailers last week that said first-quarter preliminary earnings exceeded their forecasts and April sales signaled shoppers are returning to stores. Wal-Mart Stores Inc., the world’s largest retailer, said sales at U.S. stores open at least a year rose 5 percent, also beating estimates.

Shoppers are not returning to stores as the article suggests. Rather it is clear that shoppers are "shopping down", looking for bargains or necessities at the discounters. Moreover beating estimates is a poor way of looking at things in the first place. All it usually means is things are bad, just not as bad as expected.

Advance Monthly Sales for Retail Trade and Food Services

Inquiring minds are looking at the US Department of Commerce Advance Monthly Sales for Retail Trade and Food Services report.

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for April, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $337.7 billion, a decrease of 0.4 percent from the previous month and 10.1 percent below April 2008. Total sales for the February through April 2009 period were down 9.2 percent from the same period a year ago. The February to March 2009 percent change was revised from -1.2 percent to -1.3 percent.

Retail trade sales were down 0.4 percent from March 2009 and 11.4 percent below last year. Gasoline stations sales were down 36.4 percent from April 2008 and motor vehicle and parts dealers sales were down 20.7 percent from last year.

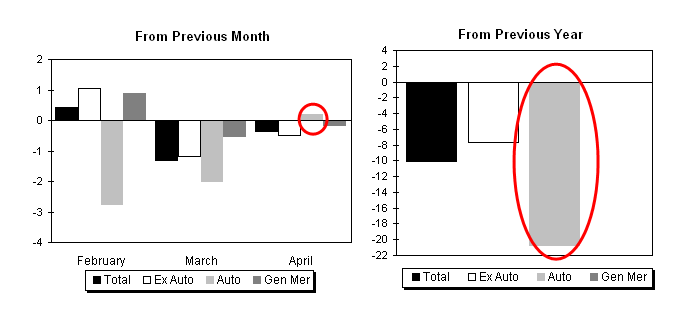

Percent Changes in Retail Sales

It's rather hard to get excited about an uptick in auto sales when it takes massive discounts to get that uptick. Moreover, the uptick is as likely as not to get revised away next month. Note too that auto sales are off over 20% from a year ago and total retail sales are down 9.2%.

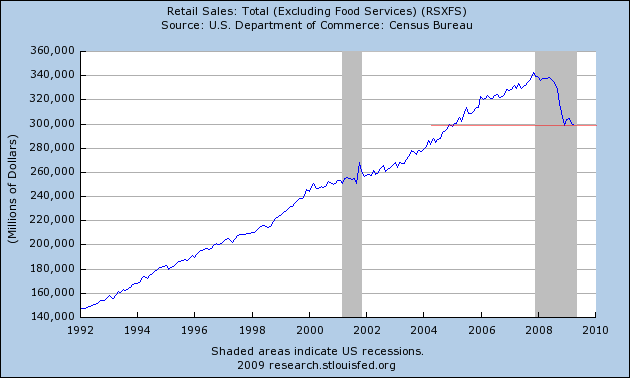

Total Retail Sales Excluding Food Services

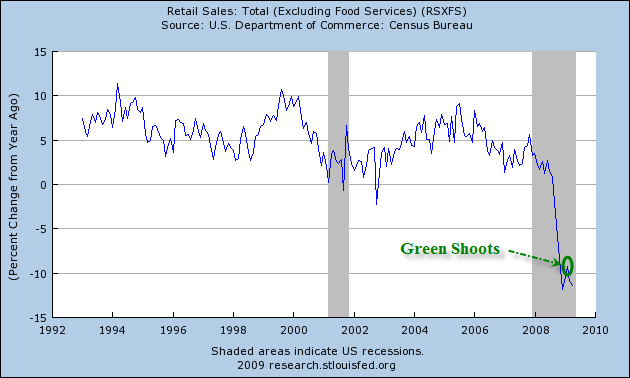

Total Retail Sales Excluding Food Services % Change From Year Ago

Total retail sales are now back at levels last seen in 2004. Retail sales green shoots are withering on the vine.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.