Downward Pressure Building for S&P 500 Stock Market Index

Stock-Markets / Stock Index Trading May 13, 2009 - 04:17 PM GMTBy: Donald_W_Dony

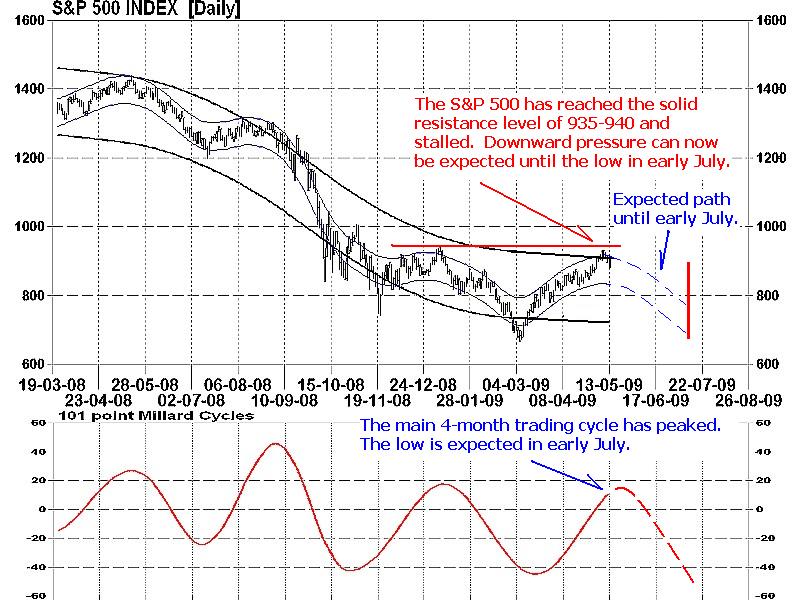

In the May newsletter, I indicated that major indexes were expected to retest their march lows by early July. Models were suggesting that the highest probability of renewed weakness could be expected in mid-May. Though the actual change in trend has not quite occurred, the bullish attitude and trading over the last 2-3 days for the benchmark S&P 500 has clearly shifted to a more bearish tone.

In the May newsletter, I indicated that major indexes were expected to retest their march lows by early July. Models were suggesting that the highest probability of renewed weakness could be expected in mid-May. Though the actual change in trend has not quite occurred, the bullish attitude and trading over the last 2-3 days for the benchmark S&P 500 has clearly shifted to a more bearish tone.

Once the index closes below 890, the bullish uptrend that began in early March has ended. As the low is anticipated in 7-8 weeks, models continue to point to 700-650 by July.

Bottom line: As there has not been a final bear market trough in March for over 70 years, probability models would suggest that this past low of 670 for the S&P 500 is unlikely the bottom. The greatest likelihood still rests with the coming October trough. Of the last 12 bear markets since 1946, six declines posted their deepest level in October.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2009 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.