Stock Markets Don't Like Mondays

Stock-Markets / Financial Markets 2009 May 12, 2009 - 04:36 AM GMTBy: PaddyPowerTrader

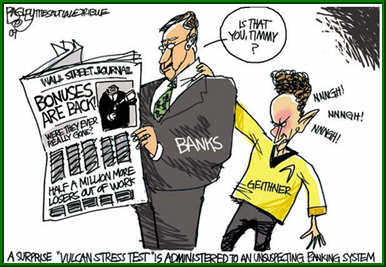

So too far, too fast, was the verdict, or was it simply the proximity to key chart levels, like this year’s high at 944 on the S&P 500 that did the damage? Either way, the optimists will still see this as base building and the pessimists will view it as a sign of a stalling rally. A chunky give back day as investors frowned on the prospect of rights issues by four banks (Capital One, KeyCorp, US Bancorp & BB&T) to repay the TARP and worries that like Paulsen before Treasury Secretary Geithner his more a slave to Wall St than a servant of Main St America with news of a last minute shady deal to dilute the stress tests (reducing the amount of capital the banks have to raise) making then less credible.

So too far, too fast, was the verdict, or was it simply the proximity to key chart levels, like this year’s high at 944 on the S&P 500 that did the damage? Either way, the optimists will still see this as base building and the pessimists will view it as a sign of a stalling rally. A chunky give back day as investors frowned on the prospect of rights issues by four banks (Capital One, KeyCorp, US Bancorp & BB&T) to repay the TARP and worries that like Paulsen before Treasury Secretary Geithner his more a slave to Wall St than a servant of Main St America with news of a last minute shady deal to dilute the stress tests (reducing the amount of capital the banks have to raise) making then less credible.

Today’s Market Moving Stories

- According to Reuters, Bank of America Corp. raised about $7.3 billion selling a stake in China Construction Bank Corp., said two people with knowledge of the matter. The shares were sold at HK$4.20 apiece, 14 percent below yesterday’s closing price, one of the people said. Bank of America spokesman Robert Stickler declined to comment. Bank of America Chief Executive Officer Kenneth Lewis is under pressure to raise money after U.S. regulators said the company needs $33.9 billion in new capital.

- Fed Chairman Bernanke sees the risk of deflation “receding” and said the Fed has been working “intensively” on exit strategies in order to achieve an “appropriate medium-term inflation rate”, which Fed members see “somewhere between 1.5-2%. He called US banks’ capital raising efforts “encouraging” and said banks should keep monitoring “operational, liquidity and reputational risks”, which weren’t addressed by US stress tests.

- Former uber Oppenheimer & Co. bnaking analyst, the much followed Meredith Whitney said in an interview with CNBC yesterday that profits at U.S. banks will trail consensus estimates in 2010 and 2011 and shares of lenders.

- RBS is down 5% this morning after Credit Suisse downgraded the stock to “underperform”

- China’s trade balance for April disappointed with a 22.6% fall in exports, with the level of sales largely unchanged. The better performance from imports, which were down 23%, reflected restocking of base metals and , to a lesser degree, stronger domestic demand. Another reminder, if we need one that global demand remains in the doldrums China FAI, Apr: Fixed investment rose by a surprisingly strong 30.5% (if you think the numbers are credible) in the first four months of the year largely on fiscal spending. The figures exaggerate the improvement in demand given likely weakness in private business invest

UK House Prices Are We At The Bottom

House prices in England and Wales fell at their slowest pace in 15 months in the three months to April while new buyer enquiries rose at their fastest pace in a decade, a survey showed on Tuesday. The Royal Institution of Chartered Surveyors’ monthly house price balance picked up to -59.9 last month, its best showing since January last year, from -72.1 in March. Analysts had forecast a reading of -70. New buyer enquiries rose for a sixth consecutive month and at their fastest pace since August 1999, RICS said. The findings tally with recent surveys from mortgage lenders suggesting that housing market activity has picked up from last year’s record low and prices are falling more slowly.

However, RICS cautioned that this was an improvement, not a turnaround. “There are tentative signs that the market is starting to pick up but transactions remain at very low levels and we are unlikely to see significant improvement while money remains in short supply and the employment picture is uncertain,” said RICS spokesperson Jeremy Leaf. The survey noted that record low interest rates meant few households were being forced to sell their properties despite rising unemployment. The sales to stock ratio — a key gauge of market slack — rose for a fourth consecutive month, to 15.3 percent from 14.5 percent, but remained low by historical standards.

How Bad Are Things In Ireland

A grim trading statement from AIB yesterday evening, ahead of Wednesday’s AGM/EGM. What leaps out on a first read is the sizable increase in bad debt expectations since the March results. In a relatively short period, the bank has seen its “stressed” bad debt assumptions become central for 2009, significantly exceeding the “base case” illustrated previously. The €4.3 billion estimate bad debt charge (325 bps) is significantly ahead of the €2.5-€2.9 billion base case presented at the full year stage in March.

It is also outside the €4 billion stress test scenario shown at the time of the results, implying that AIB is at worse case scenario, or the worse case they felt comfortable in presenting. The trouble coming down the track is also increasing at pace, with Group criticised loans ec(watch, vulnerable and impaired) increasing to c. €24.3 bn, up €9 bn. It implies that criticised loans at group level have increased from 11.7% of total loans (€15.5 billion) to 18.4% of the book at €24.3 billion.This is a nasty wake up call for AIB for what had previously been a glass half full bank

C&C reported full-year results to end-February that were in line with management’s extensive statement on March 3rd. C&C is at the beginning of a major restructuring which will re-energise its cider division alongside an overall streamlining and greater focus on cash generation. These numbers are a reasonable start to that process, and offer the prospect of a declining debt burden and improved underlying performance. Good weather for summer 2009 would augment new product launches (Pear) and a more aggressive stance towards both on and off trade business development.

EU Elections

A very useful new webservice has been launched, www.votewatch.eu, an independent website that tracks voting records of MEPs and ministers to introduce some transparency into Europe’s opaque political system. For each MEP, for example, it lists the number of speeches, attendance rates, how often they voted with their group.

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.