Bargain Investments to Buy on the Next Market Correction

Stock-Markets / Investing 2009 May 11, 2009 - 01:17 AM GMTBy: Uncommon_Wisdom

Sean Broderick writes: The market rally has gone on a lot longer than I thought it would. In fact, there are some signs of real strength — signs that this rally has further to run. Does that mean the big, bad bear is dead? Don’t pin your hopes on it. There are fundamental problems that our economy will be working out for years to come.

Sean Broderick writes: The market rally has gone on a lot longer than I thought it would. In fact, there are some signs of real strength — signs that this rally has further to run. Does that mean the big, bad bear is dead? Don’t pin your hopes on it. There are fundamental problems that our economy will be working out for years to come.

But if past recessions and depressions teach us anything, you can have long rallies in the context of a bigger bear market.

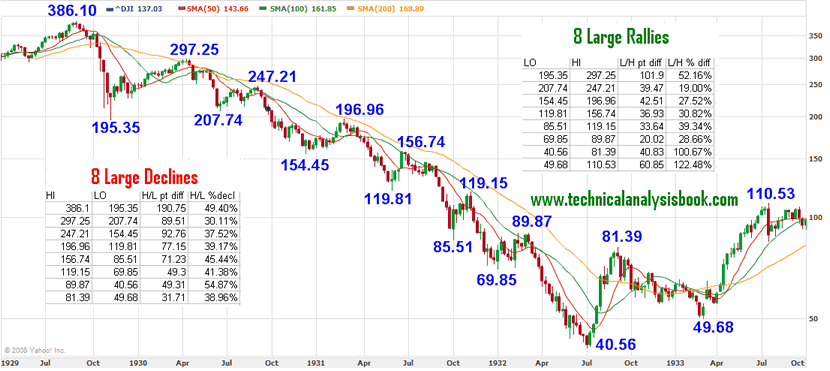

From 1929 to 1933, we saw a massive cram-down in the Dow Jones Industrial Average, with declines of 45.4 percent … 49.4 percent … and 54.9 percent. But in the same market, we also saw big rallies of 39.3 percent … 52.2 percent … even 100.7 percent!

One of those rallies — from October 1929 to April 1930 — lasted FIVE months and racked up a 52.2 percent gain. And that was before the Depression really got rolling.

My point is, nothing travels in a straight line, and we’ll see big zigs and zags up and down.

Three Investments To Consider When The Market Pulls Back

Here are my ideas for three things to buy on the next zag down — because they should do very well on the next zig up!

So why not add these bargains now? Because the market is overbought right now and I wouldn’t be surprised to see a pullback. Take a look at this daily chart of the S&P 500 Depository Receipts (SPY), which tracks the leading U.S. stock index.

You can see that the S&P 500 is channeling higher. It is testing the top of its channel. While we could see a breakout, a pullback is likely. You can see this chart updated every day by pointing your web browser here: http://tinyurl.com/cn6non.

If and when the S&P 500 pulls back to the bottom of its channel, here’s what I want to buy …

Pick #1 — Copper

As you can see, copper has been running rings around both gold and the S&P 500, and is up 55 percent since the beginning of the year.

What is driving copper? Copper inventories held in the London Metal Exchange are falling — down for three weeks in a row at the end of last week, the longest slide in inventories since February 2008.

Stockpiles held in Singapore and South Korea, the closest locations to China, were the lowest since 2005. With inventories down, the trend in prices is definitely up.

Good ways to play copper include copper producers such as Freeport McMoRan Copper & Gold (FCX) and Southern Copper (PCU). Also, the PowerShares DB Base Metals (DBB) fund, which tracks a basket of aluminum, zinc and copper should also ride this wave.

Pick #2 — China

While the S&P 500 recently scraped its way back to breakeven for the year, the iShares FTSE/Xinhua 25 (FXI) is up 20 percent. Nice!

China seems to be experiencing a V-shaped recovery. China’s official purchasing managers’ index (PMI) for March rose from 49.0 in February to 52.4. The Index compared with a record low of 38.8 plumbed in November and is the strongest since May 2008. A reading over 50 indicates expansion in the manufacturing sector. The FXI is a good way to play this move.

Pick #3 — Agriculture Stocks

Looking at this chart of the Market Vectors Agribusiness ETF (MOO). While the pattern is imperfect — many patterns are — it sure looks like MOO formed an inverse head-and-shoulders pattern and then broke through the “neckline” to the upside.

The breakout came on high volume — another bullish sign. This breakout gives us a minimum target of 38.5. I expect we’ll see a pullback in MOO before it really takes off — an opportunity that we can use to get long.

Why is agriculture doing better? People have to eat, and worldwide demand continues for grain despite the swine flu pandemic.

After suffering big losses last year, the agriculture sector looks ready for a comeback. And MOO is loaded with stocks such as Potash (POT), Syngenta (SYT), Monsanto (MON), Mosaic (MOS), and more.

These funds helped lead the market in its recent rally, and after a pullback, they will likely do so again. That makes them good additions to your portfolio. Just make sure you get that pullback price for the biggest profit potential

And in this wild and crazy market, there are two important things you MUST do …

- Use a protective stop in case this rally gives up the ghost and the bear rears its ugly head again.

- Use a profit target and don’t be greedy — bag those gains and get out.

Yours for trading profits,

Sean

P.S. If the funds mentioned in this article interest you, you’ll be interested in Red-Hot Commodity ETFs. Sign up now — CLICK HERE.

Also, remember to check out my daily updates at http://blogs.uncommonwisdomdaily.com/red-hot-energy-and-gold/.

This investment news is brought to you by Uncommon Wisdom. Uncommon Wisdom is a free daily investment newsletter from Weiss Research analysts offering the latest investing news and financial insights for the stock market, precious metals, natural resources, Asian and South American markets. From time to time, the authors of Uncommon Wisdom also cover other topics they feel can contribute to making you healthy, wealthy and wise. To view archives or subscribe, visit http://www.uncommonwisdomdaily.com.

Uncommon Wisdom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.