Investors Celebrate Bank Stress Test Results By Buying Risky Assets

Stock-Markets / Financial Markets 2009 May 10, 2009 - 05:28 PM GMT One of the definitions of “stress” offered by the Merriam-Webster dictionary is “bodily or mental tension resulting from factors that tend to alter an existent equilibrium”. Well, any bodily or mental tension investors might have been suffering from as a result of financial factors were shrugged off on Thursday with the announcement by US regulators that ten of the nation’s largest banks had to add a total of “only” $74.6 billion in equity following the completion of stress tests. However, whether this will indeed restore the equilibrium remains to be seen.

One of the definitions of “stress” offered by the Merriam-Webster dictionary is “bodily or mental tension resulting from factors that tend to alter an existent equilibrium”. Well, any bodily or mental tension investors might have been suffering from as a result of financial factors were shrugged off on Thursday with the announcement by US regulators that ten of the nation’s largest banks had to add a total of “only” $74.6 billion in equity following the completion of stress tests. However, whether this will indeed restore the equilibrium remains to be seen.

Source: Walt Handelsman

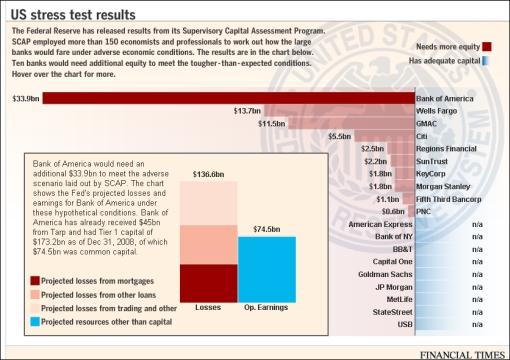

The diagram below, courtesy of the Financial Times, summarizes the stress test results in a nutshell. Click here or on the image below for a larger graphic.

Source: Financial Times

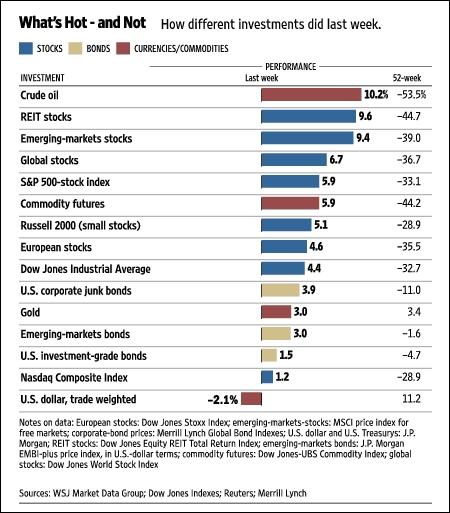

As investors welcomed the less-than-feared stress-test results and their hopes for an early economic recovery mounted, they drove up the prices of risky assets such as equities, oil and commodities, precious metals, emerging-market bonds and currencies, and high-yielding corporate bonds. On the other hand, traditional safe havens like developed-market government bonds and the US dollar experienced selling pressure.

With investors’ confidence being buoyed up, the CBOE Volatility Index (VIX) declined by 9.2% during the week to 32.1 - a far cry from more than 80 in October and a sign that markets are returning to more normal behavior.

The performance of the major asset classes is summarized by the chart below.

Source: StockCharts.com

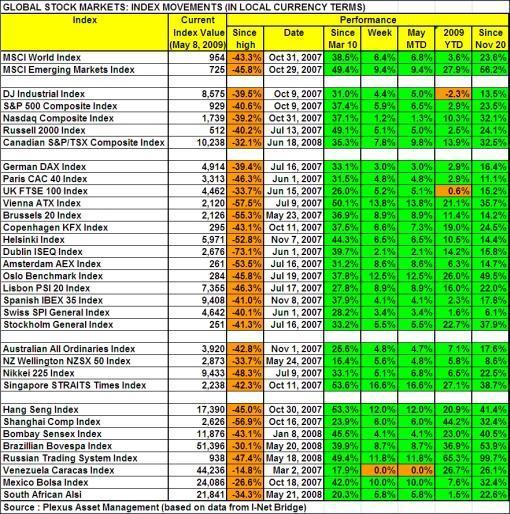

Marking nine straight weeks of gains, the MSCI World Index surged by 6.4% (YTD +3.6%) on the week, the MSCI Emerging Markets Index by 9.4% (YTD +27.9%) and the S&P 500 Index by 5.9% (YTD +2.9%). Serving as a reminder of the severity of the bear market, these indices are still down by 43.3%, 45.8% and 40.6% respectively since the October 2007 bull market highs.

With the exception of the Dow Jones Industrial Average and the UK FTSE 100 Index, most major global stock markets have now moved into positive territory for the year to date.

Click here or on the table below for a larger image.

Returns around the world ranged from top performers Ukraine (+20.5%), Serbia (+20.0%), Kazakhstan (+19.4%), Peru (+17.9%) and Singapore (+16.6%) to Barbados (-4.1%), Slovakia (-2.3%), Bangladesh (-2.0%), Pakistan (-1.0%) and Tunisia (-0.9%) which experienced headwinds. (Click here to access a complete list of global stock market movements, as supplied by Emerginvest.)

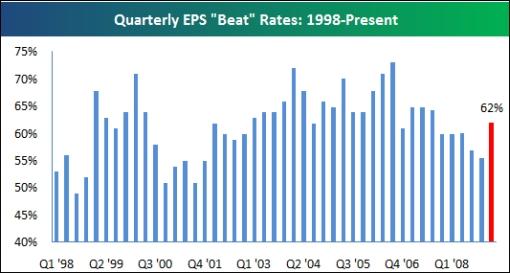

With only a handful of US companies still to report first-quarter earnings, 62% of the companies that have reported have beaten analysts’ earnings expectations. According to Bespoke, this earnings season will be the first quarter-over-quarter increase in the “beat rate” since the third quarter of 2006. “When the ‘beat rate’ started to decline in 2007, it was definitely a warning signal for the market, and this quarter’s increase is hopefully the start of a new positive trend. As long as analysts remain behind the curve, and companies exceed expectations, stocks will have a solid foundation to build on,” said Bespoke.

Source: Bespoke

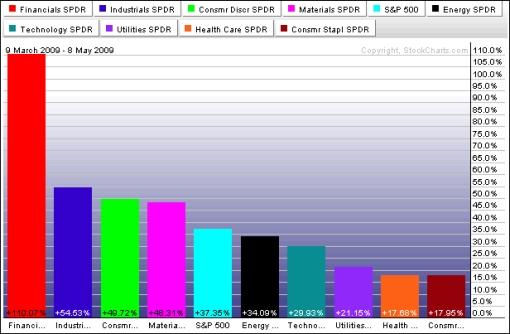

As far as leadership since the start of the nine-week-old rally is concerned, the surging Financial SPDR (XLF) is by far the top performer among the economic sector exchange-traded funds (ETFs). Interestingly, cyclical sectors such as the Industrial SPDR (XLI), Consumer Discretionary SPDR (XLY) and Materials SPDR (XLB) all outperformed the S&P 500, whereas the traditional defensive sectors like Consumer Staples SPDR (XLP), Health Care SPDR (XLV) and Utilities SPDR (XLU) all lagged the broader market. This is the type of pattern one would expect typically to emerge during a market base formation development.

Source: StockCharts.com

John Nyaradi (Wall Street Sector Selector) reports that the strongest ETFs on the week were KBW Bank (KBE) (+34.8%), PowerShares FTSE RAFI Financial (PRFF) (+30.6%) and Rydex S&P Equal Weight Financial (RYF) (+26.5%). On the other end of the performance scale ProShares Short Financial (SEF) (-15.9%), iShares Goldman Sachs Semiconductor (IGW) (‑4.0%) and Vanguard Extended Duration Treasury (EDV) (-3.3%) were underwater.

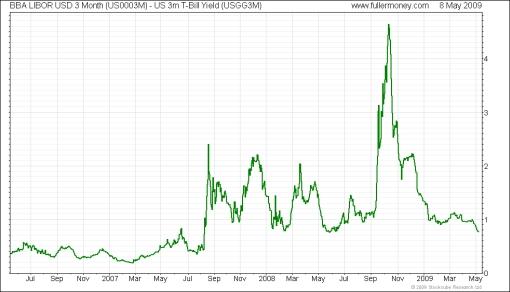

On the credit front, the TED spread (i.e. three-month dollar LIBOR less three-month Treasury Bills - a measure of perceived credit risk in the economy) narrowed by 10 basis points during the past week. Since the TED spread’s peak of 4.65% on October 10 the measure has eased to an 11-month low of 0.76% - still well above the 38-point spread it averaged in the 12 months prior to the start of the crisis, but nevertheless a strong move in the right direction.

Source: Fullermoney

Also, the cost of buying credit insurance for US and European companies eased sharply during last week’s trading, as shown by the narrower spreads for both the CDX (North American, investment-grade) Index (down from 163 to 143) and the Markit iTraxx Europe Index (down from 139 to 124).

CDX (North America, investment-grade) Index

Source: Markit

Two important trend reversals deserve mention, namely US 10-year Treasury Notes having breached their key 200-day moving average, and likewise the US dollar. Treasuries fell out of favor as a result of a poorly received $14 billion auction of 30-year bonds on Thursday, with 10-year Notes and 30-year Bonds rising to 3.29% (+17 bps) and 4.27% (+23 bps) respectively on the week. As massive issuance overhangs the sovereign bond market, investors speculated about the Fed’s pain threshold for long-term rates. According to Reuters, PIMCO’s Bill Gross said: “In order to maintain a 4% agency mortgage rate, the Fed will likely have to step up its daily purchases of Treasuries and focus on the longer end of the curve.”

Source: StockCharts.com

As far as the greenback is concerned, Richard Russell (Dow Theory Letters) said: “I don’t think most people understand the importance of the whole dollar, bond, interest rate syndrome. First, the US is creating and spending fiat dollars in the trillions. This wild creation of dollars is putting pressure on the dollar - after all, too much of anything will dilute its value. Dollar down = bonds down.”

Source: StockCharts.com

The quote du jour relates to whether the stress tests were “stressful” enough and belongs to Barry Ritholtz (The Big Picture), who remarked: “… the 25-to-1 leverage [Tier 1 capital equal to 4% of risk-weighted assets] is absurd, as is the worst case scenario of 9.5% unemployment. Odd, in my opinion, to show such largesse to those very same reckless banks that caused the entire financial mess.”

“Far be it for me to call the stress tests a charade, a dupe, a con game or an exercise in manipulation - I’ll leave that to others, like the Wall Street Journal, which noted this morning that the banks managed to browbeat the Fed into accepting much lower capital needs than the tests should have required. [For example, a decrease in required capital of 48.3% was negotiated by Bank of America, Wells Fargo, Fifth Third Bancorp and Citigroup when added together.] The entire exercise is turning out to be one giant joke - and the laugh is on the taxpayers.”

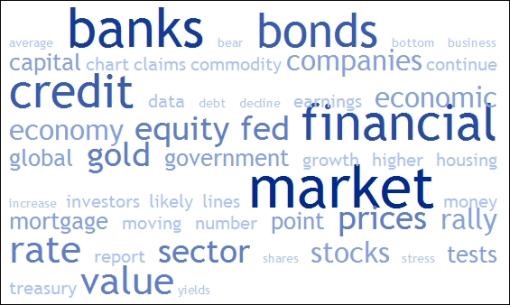

Next, a quick textual analysis of my week’s reading. No surprises here, with the word “banks” dominating the media. Strikingly, “bonds” is increasingly prominent as investors are becoming more concerned about the rise in government bond yields. (And after only one week, notice how “swine flu” shines in its absence.)

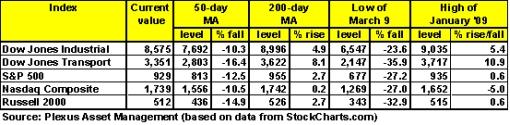

Back to the stock market. As shown in the table below, the major US indices have moved to within spitting distance of the important 200-day moving averages and the early January highs. On the downside, the levels from where the nascent rally commenced on March 9 should hold in order for the upward trend to remain intact.

The Bullish Percent Index, showing the percentage of S&P 500 constituents that are currently in bullish mode as a result of point-and-figure buy signals, has increased from 1.6% in October to 12.8% in March to the current figure of 74.8% - a positive, albeit short-term overbought, figure.

The number of S&P 500 stocks trading above their respective 200-day moving averages has increased to 47.8% from almost zero in October. This is a lagging indicator, but for a primary uptrend to be confirmed the bulk of the index constituents need to trade above their 200-day averages. (The 50-day reading is now 91.0% - the highest since October 2006 and calling for at least some consolidation of the recent gains.)

Adam Hewison of INO.com prepared a short technical analysis of the S&P 500’s most likely direction and important chart levels. Click here to access the video presentation.

On the question of whether this is a suckers’ rally or the real deal, Société Générale’s co-chief strategist James Montier weighed in on the subject in his latest investment newsletter (as discussed by FT Alphaville). He said he didn’t have a clue and was therefore buying insurance to protect on the downside. “Two methods of insurance stand out. Either I could buy index puts (relatively cheap at the moment) or I could construct individual short positions,” added Montier.

“Be careful about jumping into the stock market with both feet after this monumental rally. Consider whether or not it would be more appropriate to take advantage of the run-up to reduce equity exposure,” Merrill Lynch’s chief North American economist, David Rosenberg, wrote in his final missive (as reported by Barron’s) ahead of his previously announced departure from the firm.

Jeremy Grantham’s (GMO) take on the stock market outlook is summarized in his recent quarterly newsletter, in which he says: “The current stimulus is so extensive globally that surely it will kick up the economies of at least some of the larger countries, including the US and China, by late this year or early next year. (This seems about 80% probable to me, anyway.) Anticipating this, we should expect a stock market recovery - which normally leads economic recovery by six months, plus or minus two - sometime between two months ago and, say, August, which the astute reader will realize implies that this rally may already be it.”

In my assessment, and as written in a post last week, the thawing of credit markets and the return of confidence augur well for the outlook for equities and provide further evidence that US stock markets are mapping out a base development formation. The early-January highs and 200-day moving averages are the next important targets and a break above these levels would signal the completion of the base formation and a secular bottom (as has already been seen in leading markets such as China and Brazil). Only then will the corpse of the bear be put to rest.

Meanwhile, the speed and sheer magnitude of the rally argue for markets to either consolidate or retrace some of the past nine weeks’ gains prior to moving higher.

For more discussion about the direction of stock markets, also see my recent posts “Video-o-rama: Stress tests ad nauseum“, “Gold bullion: Regaining its shine?“, “Jeremy Grantham: The last hurrah and seven lean years“, “Parting thoughts from David Rosenberg“, “Technical talk: Stellar market internals” and “Picture du Jour: Stock markets - it’s all about confidence“. (And also make a point of listening to Donald Coxe’s webcast of May 8, which can be accessed from the sidebar of the Investment Postcards site.)

Economy

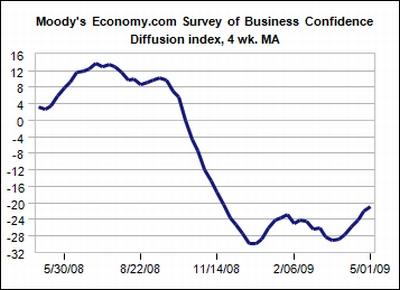

“Global business confidence has taken on a brighter hue in recent weeks. Sentiment notably improved in the US last week to its best level since early November. Expectations regarding the outlook six months from now - a good leading indicator - have risen meaningfully since hitting a record low at the very end of last year,” said the latest Survey of Business Confidence of the World conducted by Moody’s Economy.com.

Source: Moody’s Economy.com

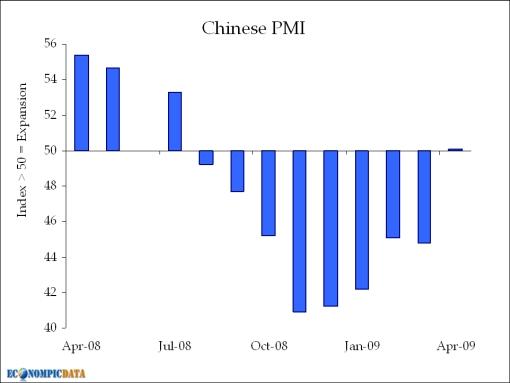

Further to the official Chinese Purchasing Managers Index (PMI) reported on last week, the CLSA China Manufacturing PMI also increased strongly to 50.1 in April from 44.8 in March - any reading over 50 indicates that the manufacturing sector is growing. “China’s government has been extremely successful in stimulating investment and, combined with a sharp improvement in export orders, this has pushed the PMI back into positive territory,” wrote CLSA’s head of economic research, Eric Fishwick.

Source: EconomPic Data

Rebecca Wilder (News N Economics) summarized the global economic picture as follows: “The signs of hope remain mostly in the soft data - US and China Purchasing Managers surveys posting consecutive monthly growth - while the hard data - export growth, inflation, and unemployment - continue to deteriorate. Going forward, the story that ‘economies are declining less quickly’ is gaining some momentum. And for some, a turning point may be on the horizon.”

In an article entitled “Green shots or dandelion weeds”, John Mauldin (Thoughts from the Frontline) said: “So many bullish analysts talk about the second derivative of growth, by which they mean that we are slowing our descent into recession. But it is not the second derivative that is important. What is important is that the first derivative, actual growth, return. Until that time, unemployment will continue to rise, which is going to put pressure on incomes and consumer spending, and thus corporate profits.”

Testimony that the coast is not yet clear came from the European Central Bank (ECB), cutting its main interest rate by 25 basis points to a record low of 1%, and announcing plans to buy €60 billion of covered bonds (backed by mortgage or public sector loans.) Across the Channel, the Bank of England (BoE) kept rates at 0.5% and said it would pump a further £50 billion into the UK economy by means of “quantitative easing”.

Turning to the US, a snapshot of the week’s economic data is provided below. (Click on the dates to see Northern Trust’s assessment of the various data releases.)

May 08, 2009 • April employment report - details point to positive developments

May 07, 2009 • Initial Jobless Claims - leading indicator! • Productivity - gains in Q1

May 06, 2009 • Challenger Report and ISM Employment Index - more encouraging news about employment conditions

May 05, 2009 • Bernanke mentions positive factors with caveats • ISM Non-Manufacturing Survey sends an upbeat signal

May 04, 2009 • Senior Loan Officer Opinion Survey - credit conditions have improved • Pending Home Sales Index posts second consecutive monthly advance • Public Sector and Non-residential Construction Outlays lift overall construction spending

Also, almost 21.8% of US homeowners owed more than their properties were worth as of March 31, Zillow.com said in a report (via Bloomberg). At the end of the fourth quarter 17.6% of homeowners were underwater, while 14.3% had negative equity three months earlier.

In his testimony before the Joint Economic Committee in Washington on Tuesday, Fed Chairman Ben Bernanke noted that “the pace of contraction may be slowing … some tentative signs that final demand, especially demand by households, may be stabilizing”. Although he expected the economic cycle to bottom out later in 2009, he also added that “a number of factors are likely to continue to weigh on consumer spending, among them weak a labor market and the declines in equity and housing wealth that households have experienced over the past two years”.

Jeremy Grantham is not assured of an enduring recovery and reasoned as follows: “Although the economy is likely to kick up in the next 12 months (although far from a near certainty), I believe it is likely that the longer-term health of the economy will be exaggerated. In time - perhaps a year into the recovery - the economy will slow once again and stay disappointingly below the standards to which we have become accustomed over the last several decades.

“… what I’m proposing could be known as a VL recovery (or very long), in which the stimulus causes a fairly quick but superficial recovery, followed by a second decline, followed in turn by a long, drawn-out period of sub-normal growth as the basic underlying economic and financial problems are corrected.”

Week’s economic reports

Click here for the week’s economy in pictures, courtesy of Jake of EconomPic Data.

Source: Yahoo Finance, May 8, 2009.

In addition to a speech on the financial crisis by Fed Chairman Bernanke (Tuesday, 12 May), the US economic highlights for the week include the following: Retail Sales (Wednesday, 13 May), PPI (Thursday, 14 May) and CPI, Industrial Production and Michigan Consumer Confidence (Friday, 15 May).

Click here for a summary of Wachovia’s weekly economic and financial commentary.

Markets

The performance chart obtained from the Wall Street Journal Online shows how different global financial markets performed during the past week.

Source: Wall Street Journal Online, May 8, 2009.

“The best investors are like socialites. They always know where the next party is going to be held. They arrive early and make sure that they depart well before the end, leaving the mob to swill the last tasteless dregs. Good money managers understand that. Investment is all about change and anticipating it,” said The Economist in 1986 (hat tip: Charles Kirk). Hopefully the “Words from the Wise” reviews will assist Investment Postcards readers in staying abreast of change in the investment markets.

That’s the way it looks from Cape Town (where we are enjoying balmy autumn days).

Source: Tom Toles

Financial Times: Stress tests show $75 billion buffer needed “US regulators on Thursday ordered 10 of the nation’s largest banks to add a total of $74.6 billion in equity following the completion of stress tests, triggering a frenzy of activity as banks lined up to announce capital-raising plans.

“‘These tests will help ensure that banks have a sufficient capital cushion to continue lending in a more adverse economic scenario,’ Tim Geithner, US Treasury secretary, said.

“The US authorities said that the tests projected that losses at the top 19 banks over 2009 and 2010 would reach $599 billion if the adverse scenario set out in the stress test materialised.

“They said that bank operating earnings would absorb $363 billion of these losses under the stress scenario. They estimated that 10 of the 19 top banks would need a further $74.6 billion in equity to be sufficiently well capitalised at the end of 2010 to cope with potential losses beyond that period.

“The regulators put the additional equity need at a much higher $185 billion at the end of 2008, but said that actions taken by the banks subsequently had reduced that amount by $110 billion.

“The long-awaited publication of the test results, which came after days of tense discussions between regulators and the banks, prompted a flurry of activity among lenders with Bank of America, which was found to have the biggest capital shortfall at $33.9 billion, announcing plans to raise $17 billion in equity. BofA said that it would add equity through a share sale and the conversion of preferred shares held by non-government investors. It also plans to raise the money through earnings and the possible sale of assets, including asset manager Columbia Management and First Republic Bank.

“Wells Fargo, which needs to plug a gap of $13.7 billion, launched a $6 billion equity issuance, while Morgan Stanley said that it would sell $2 billion in shares and $3 billion in non-government-backed debt to fill its $1.8 billion capital requirement. Citigroup, which needs $5.5 billion in additional equity, said that it would expand an existing offer to convert preferred shares.

“The stress tests could force the government to gain a large stake in a number of regional banks such as SunTrust, KeyCorp and Regions which might have to ask the government to convert its preferred shares into common stock unless they manage to sell enough shares to investors to meet the tests’ requirements.”

Click here or on the image below for a larger graphic.

Source: Krishna Guha, Francesco Guerrera and Alan Rappeport, Financial Times, May 8, 2009.

CNBC: Ken Lewis speaks about stress tests “The government’s assessment is aggressive but Bank of America will raise the equity needed, says Kenneth Lewis, Bank of America CEO.”

Source: CNBC, May 8, 2009.

CNBC: Is the US doing the right thing with banks? “A decade ago, Asia was told to tighten their belts and not to bailout their banks. Nouriel Roubini, co-founder and chairman at RGE Monitor, also known as Dr. Doom, tells CNBC’s Martin Soong, that now, the US is doing the complete opposite.”

Source: CNBC, May 7, 2009.

MarketWatch: “Goldman Conspiracy” - Bogle’s “pathological mutation?” “No, it’ll be a blockbuster because we get a chance to cheer for a new dark antihero, the infamous Depression era gangster, machine-gun-toting John Dillinger: Cheer because this new Dillinger is doing what we all secretly want to do - rip off our corrupt banking system, turn the tables on the guys who have been ripping us off for too long.

“Dillinger must be the guy former SEC Chairman Arthur Levitt had in mind when he told Fortune: ‘America’s investors have been ripped off as massively as a bank being held up by a guy with a gun and a mask.’ That was the last recession. Today, it’s a heck of a lot worse in the ‘Great Recession’: Bad banks, financial weapons of mass destruction, AK-47 derivatives.

“Yes, this time the banks are the gangsters. They’re robbing Main Street’s Treasury. And it’s an inside job. Hank Paulson, the ‘Goldman Conspiracy’s’ Trojan Horse, plays a ‘Dillinger’, leading a much bigger conspiracy, the ‘Happy Conspiracy’, that robbed America’s 300 million citizens and taxpayers. They made off with trillions, while our ‘guards’, a clueless Congress, laid down their guns and surrendered the keys to the vault.

“The ‘Happy Conspiracy?’ Yes, that’s what Vanguard founder Jack Bogle calls Wall Street in his bestseller, ‘The Battle for the Soul of Capitalism’. He sees Wall Street as a ‘pathological mutation’ of capitalism. Adam Smith’s ‘invisible hand’ no longer drives ‘capitalism in a healthy, positive direction’. Instead, Bogle sees the invisible hands of this elite ‘Happy Conspiracy’ running capitalism to serve its own selfish, greedy agenda.

“‘Over the past century, a gradual move from owners’ capitalism - providing the lion’s share of the rewards of investment to those who put up the money and risk their own capital - has culminated in an extreme version of managers’ capitalism - providing vastly disproportionate rewards to those whom we have trusted to manage our enterprises in the interest of their owners.’

“Today, the ‘Goldman Conspiracy’ is the visible hand of Bogle’s invisible ‘Happy Conspiracy’ that’s ‘ripping us off as massively as a bank being held up by a guy with a gun and a mask’. Except today: No masks, no guns. Congress just writes blank checks.

“The plot’s so hot we read all 1,243 comments, emails and links to related Web sites, such as goldman666.com, that were posted on our earlier discussion of this topic.

“What emerged has the makings of what may be the next mega-successful long-running television series.”

Click here for the full article.

Source: Paul Farrell, MarketWatch, May 4, 2009.

Charlie Rose: A conversation with Robert Zoellick, President of the World Bank

Source: Charlie Rose, May 5, 2009.

Dominic Konstam (Credit Suisse): Is inflation inevitable? “There is a growing belief in financial markets that uncontrollable inflation is inevitable, but that view is wrong, argues Dominic Konstam, interest rate strategist at Credit Suisse.

“Nor are we heading towards a prolonged depression and deflation, he believes.

“‘A more plausible scenario is a mildly deflationary middle way with positive nominal growth. We can think of this as Grandma Goldilocks,’ he says.

“This is a reference to the late 1990s, when market conditions were deemed just right - not too hot and not too cold - because real growth was high, but inflation low. ‘A decade later, Goldilocks may not be quite dead but just a lot older,’ he says.

“Mr Konstam believes growth is likely to be relatively subdued in the next few years, driven by fiscal stimulus, while real interest rates will remain high. He believes consumers will be spending less and saving more, exerting significant downside pressure on inflation. There will be plenty of excess capacity in the economy. ‘The output gap is very large and forewarns of downward pressure on prices to come,’ he says.

“What does this mean for financial markets? ‘If we’re right, [10-year Treasury] bond yields aren’t going to zero, but they’re going to stay low for a while. We’re not going to 4% anytime soon. Stocks may not make new lows and they will surely be capped to the upside.’”

Source: Dominic Konstam, Credit Suisse (via Financial Times), April 2009.

Business Week: A conversation with Nouriel Roubini “One of the most prominent voices of the financial crisis has been Nouriel Roubini, the New York University economist and chairman of economic consulting firm RGE Monitor. Credited with predicting the housing and financial crisis that crescendoed last fall, his outlook has remained consistently bleaker than those of many other economists, but so far he has often been borne out. As he is fond of pointing out lately, the International Monetary Fund recently revised its estimate of global and US bank losses upward to figures similar to his own.

“I sat down with him (and the Washington Post’s national economy correspondent, Neil Irwin) on Sunday afternoon, to talk about securitization, the Federal Reserve and the big banks.

“The economy:

“Roubini says he doesn’t see much in the way of ‘glimmers of hope’ other economists have noted. Unemployment, capital investment, and exports are all worsening, and while there are a few signs of stability in housing, it’s not much. Overall, he figures, the odds of a prolonged ‘L-shaped’ depression have fallen to less than 20%, from about 30%, thanks largely to the efforts of this administration … He expects global contraction of 2% this year, and expansion of about 0.5% next year, ‘so small it’s going to feel like a recession still’.

“Still, he adds: ‘I don’t worry as much as six months ago about a near depression.’ From the man who has been called Dr. Doom - or, as he prefers, Dr. Realistic - that’s practically cheery.

“On securitization and the TALF:

“While lending has improved somewhat, Roubini doesn’t credit the Federal Reserve’s Term Asset-Backed Loan Facility. A ‘reasonable idea’ in principle, he says, the funds it has lent to subsidize the purchase of securitized consumer credit ‘is too small to make a difference’. Moreover, demand from securitizers has proven lower than some expected, either because of the fear of complications from after-the-fact congressional meddling, or because there’s simply too little demand for new lending.

“He does see securitization returning in time, likening the metastasized securitization state of the pre-crisis market to the junk-bond market’s go-go days. ‘I don’t think we’ll go back to what it was,’ he says. But ‘now we’ve gone from too much to zero’.

“On Ben Bernanke’s Federal Reserve:

“After underestimating the depth and impact of the housing slump, mistaking the subprime crisis as a niche problem, and failing to seek legislation to dismantle failing banks after Bear Stearns’ collapse last spring, the Fed ‘has done a lot right,’ Roubini says. ‘Now that the stuff has hit the fan, they have become much more aggressive about doing the right thing.’

“Still, he’s not pleased with the Fed’s role as a back-door financier for the rescue effort. It’s understandable that the government has turned to the Fed, since early missteps led the public to see the effort as a bail-out of Wall Street bankers, which in turn has left Congress unwilling to open the purse strings. Still, using the Fed is ‘a way of bypassing Congress’, Roubini says. ‘I don’t think it’s a proper process. In a democracy, if you have a fiscal cost, you should do it the right way.’”

Click here for the full article.

Source: Business Week, April 27, 2009.

Financial Times: Bernanke expects gradual recovery “Fed chairman says economy is on track for a recovery later this year, but the pickup is likely to be sluggish and the jobless rate is likely to rise further.”

Source: Financial Times, May 6, 2009.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.