Financial Markets Analysis - The Engineered Stock Market Rally?

News_Letter / Financial Markets 2009 May 09, 2009 - 02:07 PM GMTBy: NewsLetter

May 9th, 2009 Issue #34 Vol. 3

Featured Analysis of the Week

|

|

|

|

|

|

|

|

|

|

|

INO TV - Watch From Your Computer for FREE Here are the newest authors: Jack Schwager, John Murphy, Jake Bernstein, and Ron Ianieri. All experts, all well recognized, and highly trafficked by our current members. http://tv.ino.com/ |

Most Popular Financial Markets Analysis of the Week :

| 1. Stark Evidence of an Impending Global Stock Market Crash |

By: Brian_Bloom

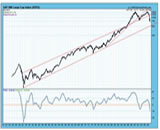

In the past few weeks the tone of this analyst’s articles has turned markedly more bearish. Regardless of the strong rally in recent weeks, the “bird’s eye” evidence seems irrefutable: Within the foreseeable future there is a high probability that the Primary Bear Market will resume in earnest. i.e. Unless there is a structural change in the behavior of the world’s political and financial authorities, a stock market crash in the USA seems to be on the cards and this will likely cascade through other markets.

| 2. Real Economy Continues to Sink Despite Economic Stimulus and Bear Market Rally |

By: Mike_Whitney

The economy continued to shrink in the first quarter of 2009 at an annual pace of 6.1 percent, making it the worst recession in more than 50 years. Gross Domestic Product slipped into negative territory from January to March for back-to-back quarters of negative 6 percent growth.

| 3. U.S. Dollar Index Analysis and Forecast |

By: David_Petch

The US Dollar Index has been experiencing weakness over the course of the past few days and is challenging present support levels, which if broken, could see a dip to 82-83. Analysis today will illustrate various trends in the USD and what to expect over the course of the next few weeks.

| 4. UK House Prices Bear Market Trend Forecast 2009 Update |

By: Nadeem_Walayat

With the stealth stocks bull market bouncing along nicely towards the mid May interim target of Dow 8,750, attention is increasingly being drawn towards green shoots of economic recovery elsewhere, specifically in the UK housing market which has endured a severe bear market that began following the August 2007 peak.

INO TV - Watch From Your Computer for FREE Here are the newest authors: Jack Schwager, John Murphy, Jake Bernstein, and Ron Ianieri. All experts, all well recognized, and highly trafficked by our current members. http://tv.ino.com/ |

| 5. Stock Market Suckers Rally Built on Insider Trading |

By: Bob Chapman

Bob Chapman writes: Suckers rally in the markets, Dow will be driven down again, market gyrations motivated by insider greed, bank acquisitions point to a greater agenda, despite what economists and institutions are attempting, the economy will remain in a spiral In the first three weeks of April this year, insiders for NYSE listed companies sold 8.32 times more stock, by dollar value, than they purchased.

| 6. Recession Ending and Stocks Sell in May and Go Away? |

By: John_Mauldin

The old adage that one should "sell in May and walk away" has been around for years. I mentioned that bromide about this time last year, urging readers to head for the sidelines if they had not already done so. I was also suggesting a strategic retreat in August of 2006 (after which the markets went up 20% before plummeting). In this week's letter we look at the actual data and offer up a fresh viewpoint. Then we turn our eyes to the recent GDP numbers, which were awful, though many took comfort in the apparent rise in consumer spending. Are Americans back to their old ways? It will make for an interesting letter.

| 7. Privatise the NHS and Save the UK Economy from Bankruptcy |

By: Nadeem_Walayat

The UK economy is on the fast track towards bankruptcy in that the level of borrowings is mushrooming out of control and those are the figures that the government is showing on its official balance sheet that has hidden the true extent of liabilities through accounting tricks that the government conjures to hide the truth of the dire state of the countries finances as the below graphs illustrate.

| Subscription |

You're receiving this Email because you've registered with our website.

How to Subscribe

Click here to register and get our FREE Newsletter

To access the Newsletter archive this link

Forward a Message to Someone [FORWARD]

To update your preferences [PREFERENCES]

How to Unsubscribe - [UNSUBSCRIBE]

| About: The Market Oracle Newsletter |

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication.

(c) 2005-2009MarketOracle.co.uk (Market Oracle Ltd) - The Market Oracle asserts copyright on all articles authored by our editorial team. Any and all information provided within this newsletter is for general information purposes only and Market Oracle do not warrant the accuracy, timeliness or suitability of any information provided in this newsletter. nor is or shall be deemed to constitute, financial or any other advice or recommendation by us. and are also not meant to be investment advice or solicitation or recommendation to establish market positions. We recommend that independent professional advice is obtained before you make any investment or trading decisions. ( Market Oracle Ltd , Registered in England and Wales, Company no 6387055.

Registered office: 226 Darnall Road, Sheffield S9 5AN , UK )

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.