Is The Stock Market Rally For Real?

Stock-Markets / Stocks Bear Market May 08, 2009 - 01:50 AM GMT Whether we are seeing the beginning of a new bull market or just another bear market rally, the two month upswing has been quite extraordinary. As can be expected, the perma-bears and perma-bulls are out in full force, arguing their case with the vigor of someone that has a direct line to Nostradamus. Where do I stand? While the recent move upward has been encouraging, I have not joined the longs. Why?

Whether we are seeing the beginning of a new bull market or just another bear market rally, the two month upswing has been quite extraordinary. As can be expected, the perma-bears and perma-bulls are out in full force, arguing their case with the vigor of someone that has a direct line to Nostradamus. Where do I stand? While the recent move upward has been encouraging, I have not joined the longs. Why?

Unless one is willing to cut losses quickly, playing rallies during a confirmed bear market can be a dangerous game. Sure, this rally has been more than a three day wonder, and if you played your cards correctly, you are sitting on a pile of money. Congratulations! I do not begrudge your success. However, if you played the last several bear market rallies and did not move to sell quickly enough, you could end up in what one of my former non-commissioned officers referred to as, the “hurt locker.” For every rally that sticks, there are three or four that do not.

If we are indeed on the verge of a multi-year bull market, there will be plenty of time to go long and make money. Heck, when the time comes for the market to surge forward, one can almost throw darts at a stock table and pick winners. But for position traders, buying at the March low was not a prudent time to go long; jumping in now after an extended run is even more dangerous to your wallet. The market needs to prove itself- and it has yet to make the case.

One warning flag has been the lack of leadership in this rally. No one group has bolted out of the gate to lead the way. While a lot of stocks are now sitting on sizeable gains, one needs to consider the oversold levels that needed to be worked off. Moreover, as is usually the case, the previous leaders will likely not be the leadership in the next bull market.

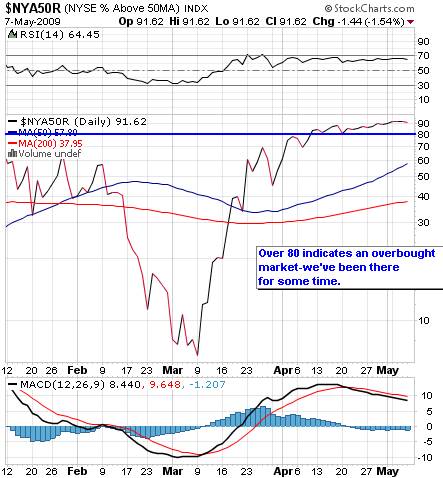

Clearly, the market is extended and in need of a break. The percentage of stock over their 50 day moving average has exceeded over 80 percent- an overbought level- since the beginning of April. Granted, the market can stay at that oversold level for some time, but to venture into an extended market now is a recipe for disaster.

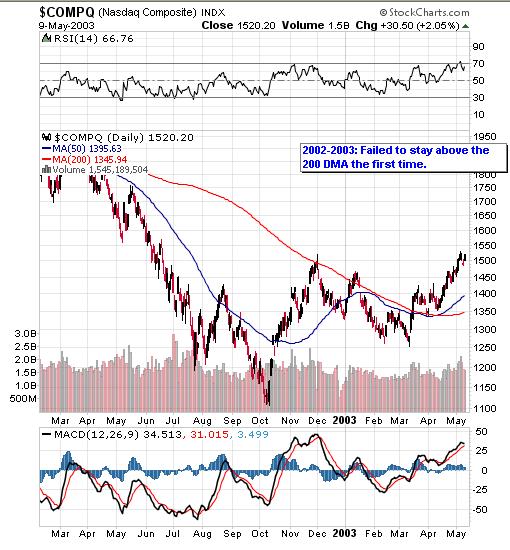

Further confirmation of an impending pullback is the fact that the Nasdaq has reached its 200 day moving average (DMA). The S&P 500 and DJIA are also not far off of testing their respective 200 DMAs. Looking back at the bottom of 2002-2003, we can see that when retesting this moving average, the Nasdaq just did not barrel through and continue upward. It took several times before it could breach the 200 DMA. Expecting the indexes to move through this area after such huge gains is asking for a lot.

So, what is a position trader to do? Relax! Let the market show its cards. How the indexes react after a pullback will be the critical test. If they can come back and break out above their recent highs, and leadership emerges, it might finally be the time to go long stocks.

Disclosure: No positions.

By Kingsley Anderson

http://tradethebreakout.blogspot.com

Kingsley Anderson (pseudonym) is a long-time individual trader. When not analyzing stocks, he is an attorney at a large law firm. Prior to entering private practice, he served as a judge advocate in the U.S. Army for five years and continues to serve in the U.S. Army Reserves. Kingsley primarily relies on technical analysis to decipher the markets.

Kingsley's website is Trade The Breakout (http://tradethebreakout.blogspot.com)

Copyright © 2009 Kingsley Anderson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Kingsley Anderson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.