Stock Market Trends for May 2009- Buying Bear Market Rallies

Stock-Markets / Stocks Bear Market May 06, 2009 - 05:14 PM GMTBy: Hans_Wagner

Analyzing monthly stock market trends uses the S&P 500 charts to indicate important trend lines. Trend following is a proven strategy to beat the market and grow your stock portfolio. Technical analysis provides the tools to analyze and identify trends in the stock market. Since the S&P 500 trend line chart is the one used by professional traders for their analysis, it is important to understand how it is performing.

Analyzing monthly stock market trends uses the S&P 500 charts to indicate important trend lines. Trend following is a proven strategy to beat the market and grow your stock portfolio. Technical analysis provides the tools to analyze and identify trends in the stock market. Since the S&P 500 trend line chart is the one used by professional traders for their analysis, it is important to understand how it is performing.

The analysis of the S&P 500 trend line starts with the 20-year monthly view of the S&P 500 chart. Next, we examine the weekly chart of the S&P 500 trends to get a shorter-term view. Finally, we analyze the one-year daily chart of the S&P 500 trends to get an even shorter term view. On each version of the charts of the S&P 500 trend line, the view and the value of the indicators change, as we move from a monthly to a weekly and then a daily chart.

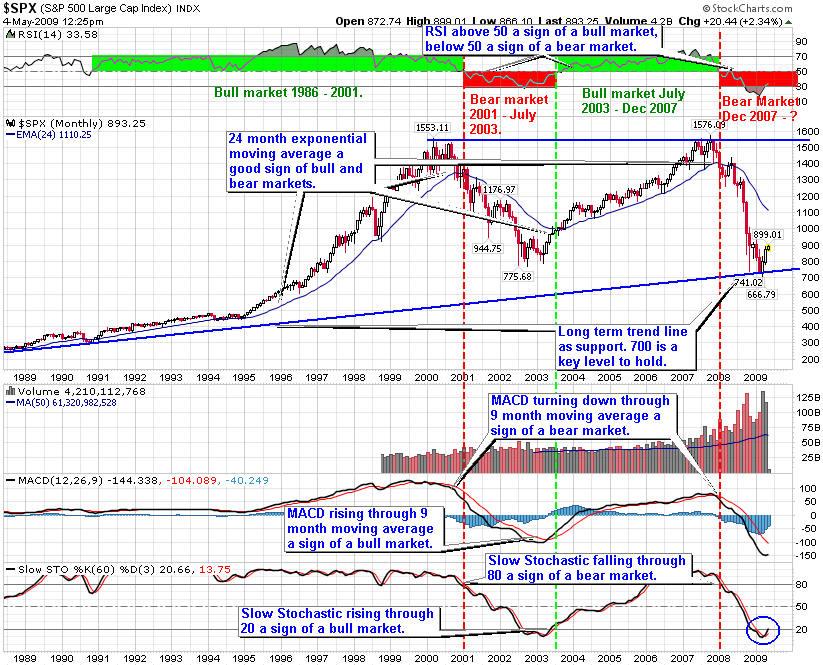

Starting with the monthly view of the S&P 500 trend chart, the bull market of the last five years turned down, as the index fell below the 24-month exponential moving average. The Relative Strength Indicator (RSI) is below 50, indicating a downtrend is in place. The Moving Average convergence Divergence (MACD) is also below zero, a sign stock market trend has reversed and we have entered a bear market. Finally, the Slow Stochastic fell through zero, another sign of a bear market.

The analysis of the monthly trends of the S&P 500 chart shows we remain in a bear market with key resistance at the 24-month exponential moving average. In addition, support at the 25 year rising S&P 500 trend line has been tested and held, so far. However, the Slow Stochastic is testing the 20 level. If it is able to stay above 20, it is an early buy sign.

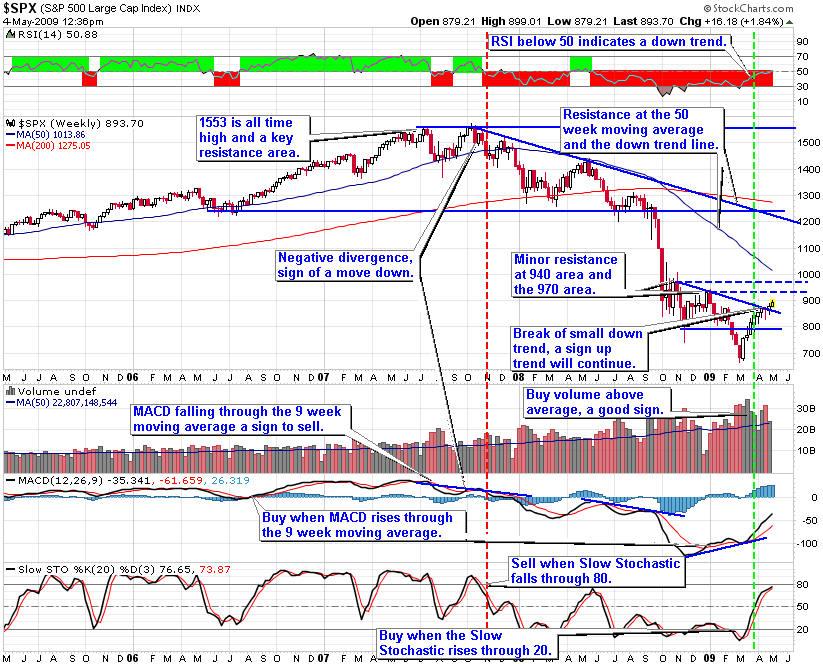

The three year weekly S&P 500 trend line chart shows more closely the transition from a bull to a bear stock market. So far, the descending trend line and the 50-week moving average are the primary resistance levels for this view of the bear market.

Earlier this year the S&P 500 fell through support at the 800 level down to the 650 area. The S&P 500 trend then reversed course, pushed through the 800 level and then the small descending trend line. There is resistance at the 940 and the 970 areas that need to be overcome.

From the chart, it looks like the S&P 500 trend line will continue to rise to test 940, possibly the 970 levels and the 50-week moving average. It will be a number of weeks before we see a test of the 50-week moving average. To accomplish this, volume needs to be above average.

RSI is testing the crossover 50 level. If it can rise above that level and stay there, then it will be a sign the up trend continues. The MACD turned up through the nine-week moving average, a buy sign and it is still trending up, which is a positive sign. In addition, the MACD showed positive divergence indicating the uptrend would begin. Slow Stochastic turned up through 20, a sign the trend on the S&P 500 chart will continue to move up.

Long term, the trend line of the S&P 500 chart is still down. The weekly pattern indicates the S&P 500 trend line will continue to rise as long as volume moves above the 50-week average. We could see a test of the 50-week moving average, as we indicated in our April Stock Market Trends report.

The daily S&P 500 is a bit complicated as many indicators say the market is overbought, yet the rally that began in early March continues. There is resistance at the 940 level and then the 200-day moving average. For this rally to climbing there needs to be more buying volume. However, volume has been trailing off, which is not a good sign for the market for this rally. Watch for above average buying volume as a sign the S&P 500 will continue this up trend. Otherwise, we should expect a pull back.

RSI is above 50 indicating an up trend. The MACD is at a high point where it normally turns down. This means we are more likely to see a pull back in the near future. The Slow Stochastic is above 80 where it will turn down giving a sell sign. These are the signs that the market is overbought, yet it can continue to rise for a while.

In bear markets, it is best to be nimble as changes in the trend can and do take place quickly. Investors are wise to use risk protection such as trailing stops, protective put options and even covered call options. On a sign the market is unable to rise through resistance, you might consider buying the short and ultra short Exchange Traded Funds (ETFs).

The S&P 500 is starting to set up a basing pattern, which is necessary before it can start a new bull market. Horizontal support at the lows and horizontal resistance at the highs form a basing pattern. This is a positive longer term and creates buying opportunities on price dips.

Given this analysis of the S&P 500 trend line charts, it is important to have your portfolio positioned for a bear market rally that might rise to the 940 area. If the S&P 500 trend line can reach this level, it will be time to add further down side protection and/or reduce your long positions. A rally to this level over the next few weeks increases the risk of a down turn as we remain in an overall bear market.

The charts of the S&P 500 trend line provide a good way for investors to align their portfolios with the overall market trends.

Bear market rallies offer investors a good time to buy stocks and ETFs in leading sectors. Look to buy on dips in the price of the S&P 500 trend charts during a bear market rally. Be sure to use proper capital management techniques including trailing stops, protective puts and covered calls. Once the rally ends take profits and reduce your long positions. Keep in mind, Warren Buffett's first rule of investing is to not loose money. Patience is key when markets are moving down.

By Hans Wagner

tradingonlinemarkets.com

My Name is Hans Wagner and as a long time investor, I was fortunate to retire at 55. I believe you can employ simple investment principles to find and evaluate companies before committing one's hard earned money. Recently, after my children and their friends graduated from college, I found my self helping them to learn about the stock market and investing in stocks. As a result I created a website that provides a growing set of information on many investing topics along with sample portfolios that consistently beat the market at http://www.tradingonlinemarkets.com/

Copyright © 2009 Hans Wagner

Hans Wagner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.