Inter-Market Analysis Between Stocks and Bonds for Trend Changes

InvestorEducation / Technical Analysis May 03, 2009 - 01:44 PM GMTBy: Richard_Shaw

In a post yesterday, we showed how long-term movements of yield spreads between US high quality and low quality debt tends to move coincident with, and in the same direction as, US stocks over multi-year periods. The pattern worked well for the last three stock trend changes in 2000, 2003 and 2007.

In a post yesterday, we showed how long-term movements of yield spreads between US high quality and low quality debt tends to move coincident with, and in the same direction as, US stocks over multi-year periods. The pattern worked well for the last three stock trend changes in 2000, 2003 and 2007.

It seems that inter-market analysis between stocks and bonds can be useful when seeking confirmation of stock trend changes. Parallel movement would generally be seen as confirming stock moves (reduced business risk and improved investor sentiment), while divergent movement would generally be seen a non-confirming.

Right now the longer-term indicators show both yield spreads and stock prices in a downtrend. However, looking short-term, both yield spreads and stock prices are moving up together during the current rally. That is a positive sign, although less reliable that a long-term pattern.

The yield spread has been improving since December 2008, and stocks began their rally about 3 months later in March. Since March, the two have moved in close parallel. Improvements in the debt portion of the capital structure was widely expected to precede improvements in stock prices as a result of the Q4 2008 debacle.

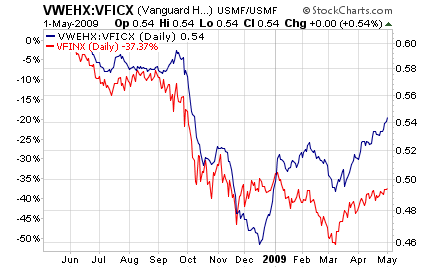

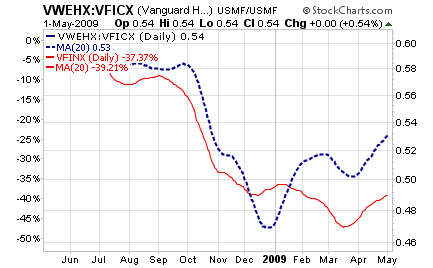

The chart shows the ratio of the price of below investment grade corporate bonds to investment grade corporate bonds versus the percentage price change of the S&P 500 index, using the three Vanguard mutual funds we used in our 15-year analysis shown later. The price ratio of the bonds is used as a proxy for the yield spread, since prices are readily available in most charting databases, while the yields are not.

1-Year Daily Data

1-Year Daily Data Smoothed With 20-day SMA

Bloomberg took special note of the yield spread changes in April.

May 1 (Bloomberg) — Junk Bonds Rally the Most in 22 Years as Buyers Play ‘Catch Up’ … Junk bonds returned 11 percent in April, the best performance since at least 1987… High-yield gains last month beat the S&P’s 9.4 percent climb and Treasuries, which fell 1.9 percent. … Speculative-grade spreads narrowed 358 basis points in April, the biggest monthly decline on record, to an almost seven-month low of 1,345 basis points… Junk-bond prices have increased even as S&P and Moody’s Investors Service predict rising corporate defaults.

While such a short period is not highly reliable as an indicator, it does deserves noting, at least as an alert of possible changes coming in the longer period indications.

Similar to the Bloomberg comments, one of our clients who is in high yield debt, pointed out that he has achieved gains about the same as stocks in April, but with high yield too.

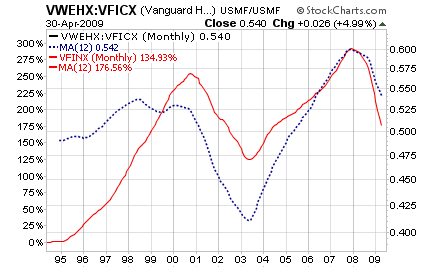

The 15-year, monthly data shown via 12-month simple moving averages (using Vanguard funds as for the short-term chart) looks like this:

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.