Stark Evidence of an Impending Global Stock Market Crash

Stock-Markets / Financial Crash May 03, 2009 - 08:25 AM GMTBy: Brian_Bloom

In the past few weeks the tone of this analyst’s articles has turned markedly more bearish. Regardless of the strong rally in recent weeks, the “bird’s eye” evidence seems irrefutable: Within the foreseeable future there is a high probability that the Primary Bear Market will resume in earnest. i.e. Unless there is a structural change in the behavior of the world’s political and financial authorities, a stock market crash in the USA seems to be on the cards and this will likely cascade through other markets.

In the past few weeks the tone of this analyst’s articles has turned markedly more bearish. Regardless of the strong rally in recent weeks, the “bird’s eye” evidence seems irrefutable: Within the foreseeable future there is a high probability that the Primary Bear Market will resume in earnest. i.e. Unless there is a structural change in the behavior of the world’s political and financial authorities, a stock market crash in the USA seems to be on the cards and this will likely cascade through other markets.

By contrast, a redirection of the buckshot approach of our political and financial leaders towards a rifle approach might be able to prevent such an outcome. There is an immediately available (and practical) alternative route that will be economically stimulative in a way that will almost certainly lead to compounding growth in employment opportunities.

*************

The chart below – courtesy DecisionPoint.com – contains a message which cannot be ignored by any reasonably minded person.

Using 1933 as a base starting point, if we look at any of the long term rising trend lines drawn on any of the Red (Overvalue) Blue (Fair Value) or Green (Undervalue) lines, we see that all three “theoretical” levels currently sit far below these trend lines. True, the absolute price of the S&P has not yet adjusted but, based on underlying values, the markets are anticipating the possibility of a “Super” Primary sell signal.

There will be some who will argue that the rationale behind this theoretically overvalued situation is that earnings are expected to bounce back. They will argue that if this happens, then the black line need never penetrate below its 75 year trend line.

Well, let’s examine that argument.

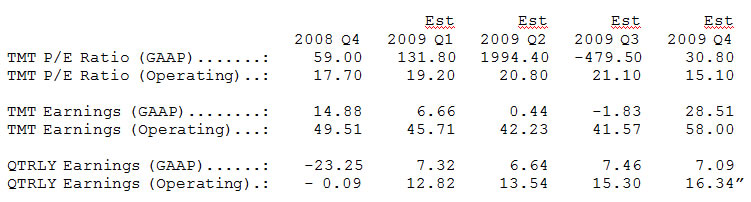

The table below is reproduced from DecisionPoint.com. It reflects the most recently reported and projected twelve-month trailing (TMT) earnings, quarterly earnings, and price/earnings ratios (P/Es) according to Standard and Poors.

Now, we can paint any rose colored picture we like; and we can argue any brilliantly convoluted logic we can conceive, but no picture and no argument will negate this stark evidence. If Standard and Poor’s forecast of GAAP profits over the next 3 quarters turns out to be correct, then P/E ratios at the end of calendar 2009 will be around 30X. i.e. By implication, in nine months time, if the P/E ratio falls to reflect historically overpriced levels of 20X, then the $SPX will fall to around 20 X 28.51 = 570.2.

OK. Let’s look at where 570.2 will be on the $SPX. The following is the long term line chart dating back to 1924 – also courtesy Decisionpoint.com

Hmm? 570.2 looks like it will be smack on the rising trend line.

OK. But why should the historically overvalued P/E ratio of 20X be the target? Why not 15X – which represents the 75 year “fair” value level?

Well, supposedly at that time (end December 2009), the markets will be looking a full year into the future. So, in order for a future P/E ratio of 15X to be justified, the underlying GAAP earnings for calendar 2010 will need to rise by a minimum 33% to 570.2/15 = $38, which is roughly back to where they were in third quarter 2008. (Note: $23.25 loss for the quarter ended December 2008 added back to the 12 months trailing earnings of $14.88 to December 2008 equals implied $38.03 for the trailing 12 months earnings to September 2008). It is emphasized that September 2008 was before the market crashed – see Dow Jones Industrial Index chart below, courtesy Bigcharts.com.

With all the above in mind, a maximum of $38 per share average, GAAP adjusted, 12 month trailing earnings for the S&P 500 to December 2010 is a tall order, but is conceivably possible – provided the economy bottoms at around this level and revenues start to rise again.

Unfortunately, the days of “real” compound growth in excess of population growth seem to be numbered – given that unemployment is still rising and that 70% of the US economy is driven by consumer spending; and given, also, that most consumers are saddled with debt in the face of house prices which have fallen significantly. For example, median house prices in Phoenix (the largest fall in the country) have fallen by 51% from their peak (see: http://www.bizjournals.com/.. )

It follows that by no stretch of the imagination can any future P/E ratio in excess of 15X be objectively justified based on currently known facts.

Interim Conclusion #1

Inflation aside, and given the highly unlikely outcome that the targeted 12 months trailing GAAP earnings which underlie the S&P 500 index will rise to a level – by the end of 2010 – that is higher than they were in September 2008 (before the crash), there is no reasonable argument that can defend a rise in the level of the $SPX from here. This level of earnings is already being fully discounted almost two years into the future. Therefore:

A “best case” scenario seems to be: A sideways movement in the $SPX for some years until the price hits the rising trend line.

A “base case” scenario is: Another substantial fall in the equity indices, until the price bounces off the rising trend line at around 570. (36% fall from current level)

A “worst case” scenario is: There is a risk that the indices will fall below the 75 year rising trend line if the politicians stubbornly continue to focus on the symptoms rather than on addressing the core problem. The continuation of such an unwise course of action will very likely cause a market collapse of such dimensions that it would presage a destruction of the momentum of world economic growth.

Where to now?

Cold and unemotional reasoning leads to the conclusion that the old thought paradigms relating to industry, finance and commerce are no longer appropriate. The chart below – courtesy DecisionPoint.com – shows that interest rates are under upward pressure.

It should be remembered that wages lag inflation. If the yields are rising because of imminent inflation, then the US consumer will find himself between a rock and a hard place:

- The rock: Saddled with debt and facing the reality of a contraction in home equity, the upward pressure on interest rates will place downward pressure on the ability of those consumers who remain employed to service their mortgages. Additionally, upside pressure on prices (price inflation) will place further downward pressure on the average consumer’s ability to make ends meet.

- The hard place: Because wages lag inflation, consumer income across the board will not keep pace with inflation

Interim Conclusion #2

The most logical conclusions – if the politicians continue down the path of throwing money indiscriminately at the economic symptoms – are:

- Velocity of money will continue to spiral downwards as volumes of transactions contract.

- Bank balance sheets will be further impaired as fewer consumers are able to honor their debt obligations.

Overall Conclusion

If the politicians and financial authorities continue along the path of “buckshot” attempts to stimulate the economy without focusing on the concept that investment needs to be in industries which can create a compounding growth in employment opportunities, the end result will be a credit crunch as banks find it increasingly difficult to find credit worthy borrowers. A credit crunch, should it manifest, will inevitably lead to a further collapse of equity prices. On the day when the market finally focuses on the likely consequences of rising interest rates, that day is when the equity market prices will recommence their Primary Bear Trend in earnest.

Author’s note

In several earlier articles by the author hereof it has been argued that the core problem facing the world economy has been the historical (since the late 1970s) flattening, and now decrease, in world-wide production (availability) of energy per capita.

As night follows day, because energy drives the world economy, it follows that unless this particular issue is addressed, the authorities are just postponing the inevitable. It also follows that the most significant target at which stimulatory activity by governments should be aimed would be those energy technologies which have the capacity to replace (as opposed to augment) traditional fossil fuels. For example, encouraging the development of “niche” energy industries such as solar power and wind – which are not supported by powerful electricity storage technologies – although constructive, is unlikely to have a major impact on the core problem.

Beyond Neanderthal is a factional novel (fictional storyline, fact based themes) which was published by this author in June 2008 – before the current financial implosion. In it, a vision is painted of the world as it might be if our political leaders move to encourage the investigation and subsequent embracement of environmental (electromagnetic) energy as a source of energy to fully replace all fossil fuels; and also the possibility that we may have overlooked a dramatically more powerful energy storage technology than the most powerful currently known.

But this is only a vision. Clearly, as a matter of pragmatic fact, there needs to be an actionable plan to get us from where we are today to the point where the vision painted in Beyond Neanderthal will be realizable.

There are two transitional energy technologies which have come to the attention of this author and which offer an immediately actionable (and practical) opportunity to drive employment creation. Embracing them will require trillions of dollars of (economically stimulatory and compounding employment generating) investment and will facilitate the immediate commencement of a move towards the holistic solution as envisaged in Beyond Neanderthal.

These two technologies will be reported on in a future article. As a bonus, embracing both of these technologies simultaneously could lead to a plummeting of CO2 in the environment within five years – thereby leapfrogging the foolish notion of carbon emissions trading. One will lead to a 40% reduction in CO2 emissions from legacy coal fired powers stations, and the other will lead to a 33% reduction in carbon emissions from legacy motor cars. Embracing the two together will address the issue of Peak Oil in one fell swoop. Both were originally validated in the late 1970s and were subsequently mothballed.

By Brian Bloom

Beyond Neanderthal is a novel with a light hearted and entertaining fictional storyline; and with carefully researched, fact based themes. In Chapter 1 (written over a year ago) the current financial turmoil is anticipated. The rest of the 430 page novel focuses on the probable causes of this turmoil and what we might do to dig ourselves out of the quagmire we now find ourselves in. The core issue is “energy”, and the story leads the reader step-by-step on one possible path which might point a way forward. Gold plays a pivotal role in our future – not as a currency, but as a commodity with unique physical characteristics that can be harnessed to humanity's benefit. Until the current market collapse, there would have been many who questioned the validity of the arguments in Beyond Neanderthal. Now the evidence is too stark to ignore. This is a book that needs to be read by large numbers of people to make a difference. It can be ordered over the internet via www.beyondneanderthal.com

Copyright © 2009 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.