Derivatives Disaster: Deriving The Truth

Companies / Corporate Earnings May 19, 2007 - 11:10 AM GMTBy: Rob_Kirby

In an article I penned two weeks ago, I discussed the misfortunes of the Bank of Montreal [BMO] and their costly foray into Natural Gas derivatives trading. In that piece I wrote what are now some rather prophetic words in my assessment of BMO and their 450 million “charge” against 2 nd quarter earnings, when I opined;

“This means that the BMO's ‘long natural gas position' was almost certainly a MUCH BIGGER LOSS – at one point in time – than they are admitting to us now.

BMO's year end is Oct. 31. I'm left wondering why they did not report a bigger loss last quarter.”

Then, this week, BMO announced they REALLY lost 680 million and they are now going to “restate” 1 st quarter earnings.

Amazing, eh?

But I suspect something is still not quite right.

You see folks, what has befallen BMO is not dissimilar to that which befell Amaranth. They made a rather large bet on the direction in price of a vital commodity – no doubt based on their fundamental views of its value – and lost.

The BMO was Amaranth's prime Canadian broker. Could they have been trading on the coat tails of Amaranth? Who knows?

But what we do know is that ‘the other side' of Amaranth's ‘losing long natural gas derivatives bets' was none other than J.P. Morgan Chase. In fact, it was J.P. Morgan Chase – and their ‘short position' that ultimately ‘ absorbed ' Amaranth's long position in the wake of their demise.

Getting back to the BMO, in an April 30 Bloomberg article dealing with this fiasco, it was revealed that,

“Bank of Montreal managed its trades according to a value- at-risk, or VaR, a model that gauged how much the bank could lose in a day if markets moved against it. The company increased its commodities VaR to C$5.9 million in 2006 from C$1.3 million in 2004, according to Dominion Bond Rating Service.”

So, it now appears that BMO, SOMEHOW, managed to lose 680 million bucks with a VaR of C$5.9.

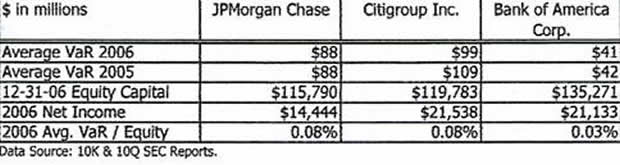

Now, let's stop to consider that the other side of those trades, namely, J.P. Morgan Chase has a derivatives book in the neighborhood of 68 TRILLION in notional and VaR of U.S.$88:

Read about VaR here . [pg. 5 of pdf. doc.]

So, now ask yourself this question: Using an ‘apples to apples' comparison - if the BMO lost 680 million with a VaR of 5.9 $CAD – what kind of loss could we expect to see from good ole J.P. Morgan if they ever “got-it-wrong” with a VaR of U.S.$88? Doing some quick ‘back of the envelope' math [not even accounting for exchange, which increases the number]:

88 / 5.9 = 14.92 x 680 million = 10.1 BILLION

Isn't math fun?

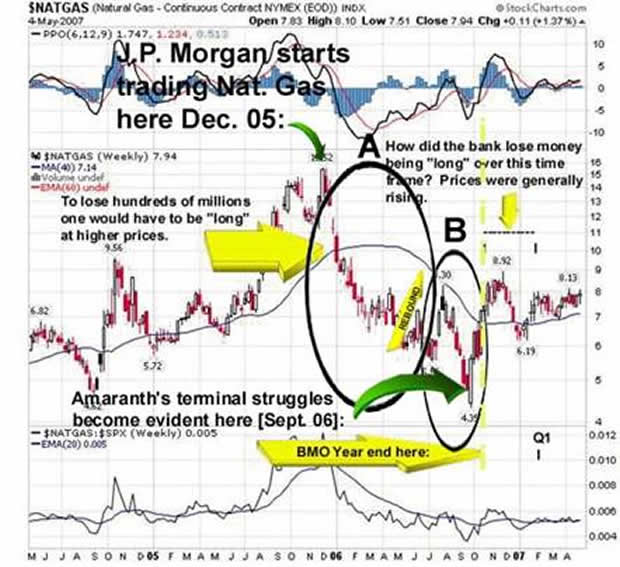

Amaranth's well publicized failure – resulting from a ‘long natural gas position' – became public knowledge in the Sept. 06 time frame. Sept. 06 falls within decline “B” on the chart above. Conventional mainstream financial media accounts at the time were rife with claims that Amaranth's difficulties were “one off” in nature – and the steep declines in natural gas prices would/should not meaningfully affect ‘ANYONE' other than this rouge trading entity.

September 23, 2006

Amaranth : Lessons on Hedge Fund Failures“The difficulty of Amaranth has three notable features. First, there was no market panic. It caused barely a ripple. Those who believe a hedge fund failure could take down our financial system are... well... silly.”

The Pundits Were At Least Partially Wrong – Maybe Very Wrong

For anyone who adheres to logic or reason - the chart above clearly shows that to incur losses trading Nat. Gas from the ‘long side' of the magnitude that BMO is now reporting [680 million at last count] – one would NECESSARILY have been “LONG NATURAL GAS” through one or both of the circled steep price declines depicted on the chart above [A and/or B].

What this means is that the BMO incurred their losses BEFORE their year end. So now, shouldn't we really be asking the question, Why weren't these losses reported in Q4 when they were incurred – and in all likelihood – were still much greater than they are being admitted to now?

Because derivatives are classified as “off-balance sheet items”, institutions like the BMO, Amaranth, Enron et al have the ability to play “shell games” with their unrealized profits/losses and effectively prolong [or time, perhaps?] the exact time when they assimilate/admit [mark-to-market] their impact back into the balance sheet.

The fundamental difference between a banking institution and a non banking institution being that latter is usually more levered - unless of course we're talking about J.P. Morgan Chase - than the former and therefore ‘more beholding' to the banking entity.

In the case of J.P. Morgan Chase, one can only wonder if this applies and is perhaps the real reason we've never heard of a J.P. Morgan “oops”,

“President George W. Bush has bestowed on his intelligence czar, John Negroponte, broad authority, in the name of national security, to excuse publicly traded companies from their usual accounting and securities-disclosure obligations. Notice of the development came in a brief entry in the Federal Register, dated May 5, 2006, that was opaque to the untrained eye.”

Perhaps some people never catch colds.

The notion that trading losses inflicted on “hedge funds” could not bring down the financial system is beyond silly – it fact, it's MORONIC. The BMO [a publicly traded bank] has CATEGORICALLY incurred substantial losses trading Natural Gas derivatives and they've kept this all a private matter – seemingly – for AT LEAST two quarters!

Yeah be they who create the money out of thin air!

Why BMO Waited to Acknowledge Losses

This is a question that only BMO management can truthfully answer. It would appear that – under the circumstances – likely contributing factors might have been:

-

not wanting to report such sudden “steep losses” so close to YEAR END – in an ‘otherwise' profitable year and negatively impacting generous year end bonuses.

-

not wanting to acknowledge “steep losses” in Natural Gas trading at the same time as Amaranth was collapsing to avoid being ‘painted with the same brush' and possibly having their share price beaten up in equity markets.

-

BMO's new chairman, Bill Downe, was “announced” to succeed former chairman, Tony Comper, on November 29, 2006 – effective March 1, 2007. Down is the former head of Capital Markets – the same division of the bank where the now 680 million losses have occurred. Would admission of these or steeper losses back in November 06 have interfered with planned succession of the chairmanship?

The really BIG and most important question – in my mind - is how and why did regulators ever allow J.P. Morgan Chase to inflict such damage on these players?

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is the editor of the Kirby Analytics Bi-weekly Online Newsletter, which provides proprietry Macroeconomic Research.

Many of Rob's published articles are archived at http://www.financialsense.com/fsu/editorials/kirby/archive.html , and edited by Mary Puplava of http://www.financialsense.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.