Casino Royale, China and the ghosts of 1929 and POP Goes the Bubble?

Stock-Markets / Chinese Stock Market May 17, 2007 - 03:29 PM GMTBy: Ty_Andros

No matter where you turn for your financial news, one item regularly makes it way to the front page. It is the amazing bull markets in Shanghai , and Shenzhen , China . These phenomenal bull runs reflect a number of situations emerging from China . But make no mistake, to glean important economic signals from the price action and say it reflects the economy of China is not one of them.

They are casinos, pure and simple. Up until recently they could have crashed and the Chinese economy would not have sneezed, two years ago stock brokers in China, were viewed as they were in America in 1982, their names were mud as anything you gave them quickly turned into mud. My wife is currently visiting China , as she should as she is CHINESE. She just left Shenzhen and is now in Chang Chun, with family visits in Beijing and Shanghai still on the schedule.

The stories I am getting are hair curling to say the least. This is a story of endless liquidity forming a bubble that if it happened six months ago would have had very little global significance as the amount of money involved was puny, but the domestic liquidity in the Chinese economy has pushed this to far, far outstripping the fundamentals and huge money is now out upon statistically unbelievable wings. This is a story about madness of crowds and financial speculation, and reckless confidence in the future after 15 years of ever increasing wealth.

The Chinese are tremendously hard working, increasingly smart and very studious, but first and foremost they love to take risks and gamble. But gambling in China is illegal. To a Chinese citizen “to get rich is glorious”, they love to make money and are willing to work hard for it. Of course this is also the definition of “Entrepreneurs”, those dynamic personalities which also allows capitalism and wealth creation to thrive through creative destruction, wealth builders of the first order creating new and exciting new businesses and services that improve everybody's life they touch, through the improved means of doing things whatever they may be. This is why they are going to be an unstoppable economic force, now and into the future.

Anyone who closely follows financial markets knows these same domestic Chinese stock markets were flat on their backs less than two short years ago, having experienced grinding brutal bear markets for years before the bottoms that emerged at that time. Conversely China 's economy has grown at a compounded annual rate of almost 10 % for over a decade. So obviously, these stock markets didn't reflect the fundamentals economy of China up to that point. They understated what the economic situation was then, and it massively overstates it now.

Half the Companies listed are SOE's (STATE OWNED ENTERPRISES), their business models and products are for the most part very inferior to their competitors, but improving as they are forced to compete against cutting edge factories springing up right next to them. Most are bankrupt and survive based on government subsidies: their books are opaque or non existent testaments to the failings of the workers paradises that is called socialism and communism. The Chinese government is constantly on the prowl for partners to come and remake these dinosaurs into effective businesses. The pressure of the market is quickly issuing a wake up call to the ineffective managers now in charge of these enterprises. They are not closed as the unemployment and unrest it would cause would shatter the delicate social peace that is emerging China .

The Chinese are undergoing an industrialization process no different then America did at the turn of the last century, when we went from an agricultural society to an industrialized one. People moved from the farms to the cities, quit farming and learned to do other things then farm for a subsistence type of living. Huge productivity and wealth creation in the best tradition of Austrian economics, huge savings added to creation of plant and equipment equals a virtuous cycle of wealth creation, middle classes are born in this fertile recipe for growth. This history for the United States is repeating now in China . But the size and dimensions of the problem is far different, in that the US was sparsely populated and China is overflowing with population. There are hundreds of millions of people leaving the fields and moving to places with more prospects for personal improvement.

Just as the Wild Wild west was dying in the United States at that time, it is dying now in China . It takes generations and decades of time for this to transpire. But if you must characterize it at this time, It would be the “WILD, WILD EAST”, there are very few laws or government officials which can be relied on. Just as in America during industrialization. The rule of law emerged over a period of decades then and it is doing so now in China . The Robber barons of that time are plainly seen in today's Chinese society, at every level, municipal, provincial and nationally. Politically connected insiders and business men were almost above the law then and they are above it in many ways in today's China . The two way street of powerful business interests supporting politicians for favors is one written over thousands of years, it takes many forms.

In China to get ahead is as much a function of good business practices and products as it is who you know and pay. To operate in China you must know the proper government officials related to what you wish to accomplish, and you must wine and dine them properly and offer “GIFTS” of appreciation to get your objectives accomplished. These people have rooms full of gifts they have never opened, they have everything they could possibly want, when their cars go down the street you get out of the way and let them pass or risk “HAVING PROBLEMS”. After this kabuki dance they snap their fingers, and you are immediately more successful, as you have been blessed. Regulatory burdens are reduced. At that point you are almost ABOVE THE LAW, unless you cross the path of another minor mandarin you may have forgotten to acknowledge. The only time you really can get in trouble is when you cross the path of someone who has paid off a higher placed benefactor. Business people in China are in a constant game of cat and mouse, with the government as cat and the businessman as mouse. Trying to hide some of the cheese from the government.

It is this way all across China , and extends all the way to Beijing . Recently there was a pension fund scandal and convulsion in the Communist party leadership in Shanghai : this was nothing more than Beijing bringing a wayward group of lower level Mandarins back to the reality of who's really in charge, demonstrating to others who were contemplating it something to think about. Di scipline in action.

So in China there are two ways to get rich, be an entrepreneur, pay the proper tolls to “RENT SEEKING” officials or to gamble as in a casino. And as much as the Chinese growth miracle is set to continue, a minor obstacle is emerging in this growth story.

A mania is in full swing in the Shanghai and Shenzhen stock markets and the public is diving headfirst into these skyrocketing markets. Up until about 6 to 12 months ago these markets could have collapsed they would not have represented a problem for the Chinese economy. The public in China was barely involved, a total loss could have been sustained and it would have only represented “2 WEEKS” of Chinas trade Surplus. But now it has morphed into something much, much bigger!

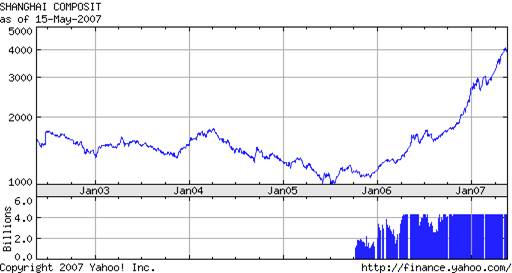

The ordinary Chinese citizen is seeking wealth in the seemingly sure thing that these markets appear to be. The market is up over 300% in less than two years. Take a look at this chart:

I still remember visiting Hong Kong in December 2005 to be with my future wife and discussing with her the buy signals I was seeing emerge in domestic Chinese bourses. The pervasive bearishness and divergences emerging in technical studies were unmistakable. Just as in the United States in 1982, the death of equities talk in China was widespread, at the same time their economy was roaring along at 10% annual growth and the US trade deficit was exploding as China was the becoming the supplier to middle America, ala WAL-MART.

The “dumbest among us”, are always late to the party and are always the greatest losers in any bubble, they are emerging in this market as well. The weakest and least prepared hands arrive last setting the table for the crash to destroy the most amount of wealth possible. A “Finger of Instability” (see Tedbits archives for the series at www.TraderView.com ) caused as asset classes get ahead of the fundamentals as fire hoses of hot money push them to impossible bubble heights. These investors do not understand risk, liquidity, or the lack of it, or risk control. Just as in NASDAQ 2000, Housing 2005-2006, the lumpen investors are coming out of the woodwork in China and the numbers are astonishing.

My wife was at the bank in Shenzhen last week, in the “VIP room” at the bank lines of people were lined up to withdraw their savings to rush headlong into these speculative frenzies in Shenzhen and Shanghai. A woman next to her was withdrawing 2 million Yuan (about $250,000 dollars, a fortune in China ), and taking it in a shopping bag to her new brokerage account. Every one there had their own story, but they all had one common theme, BUY STOCKS! The regular bank lobbies were mob scenes of people rushing to withdraw their savings. Every bank had long lines. They are selling their homes, hocking the jewelry, anything to get liquid. Rich and poor alike are withdrawing their money and throwing it at the market. And throwing it is the right metaphor to use: Taxi cab drivers, shoeshine boys, restaurant employees, public employees, you name it, they WANT IN. They are selling their homes, jewelry, or whatever to invest.

(Authors note; looking for assistance in creating portfolio diversification that can survive and thrive in what I am outlining? In fingers of instability? If so contact me through www.TraderView.com . Subscriptions to this newsletter are also free at this address; send it to a friend, Thank you)

The Chinese are prodigious savers (typically 50% of their incomes are saved), knowing from close personal experience that the government is good for nothing, and if they fail to provide for themselves there will be no one who will. But outside the stock brokerages bicycles are piled up, (my wife commented on the poor condition of them, a sure tip off they are poor) these poor, unqualified persons are all trying to get rich quick, and just like what happened in the NASDAQ and housing frenzies in the US. People bemoan the slow emergence of the Chinese consumer, well this emergence has undergone a detour, as instead of consumers they are emerging as the Chinese investor instead. Rushing like lemmings headed over a cliff, a waterfall of investors hurling themselves over the edge. Mass investors hysteria is a worldwide phenomenon seen many times in history, whether it be the original tulip mania, south seas bubbles right up to today's economies. It is front and center in China today.

Chinese investors have been opening accounts at the rate of 1 million a week since the beginning of the year: it is multiplying on a weekly basis. Bank accounts offer negative returns after inflation, wages have gone up fourfold in the last 15 years. The Chinese love to gamble, always have and always will. Go to Macau or any region where it is legal, it makes Las Vegas look like a picnic. With the Mandarins of the party in charge as outlined above it is very tough to really get ahead through private enterprise as the officials just bully you until you pay the “RENT”. Robbing the businessman of the wealth created.

For the man on the street the stock markets represent the one place the can go an escape the long arm of the communist party officials. It is why foreign investment in china will always be at risk until these corrupt officials are reigned in, as the inability to plan for the future is impossible as the law becomes whatever the local, regional or national mandarin says it is. It is why only the strongest investors in the world can venture into China (Citigroup, Goldman Sachs, IBM, Dell, Morgan Stanley, INTEL, etc.) at this time, small and intermediate sized investors really need to avoid it at this time as they don't have laws to protect them or the money to pay the tolls necessary to be secure.

Capitalism and markets really work, China is a great example of the dynamism of entrepreneurs and creative destruction, but when the inevitable crack ups occur as markets sometimes get over exuberant, politicians pin the tail on the donkey to enhance their power, claiming that the public needs to be “PROTECTED”, and this is shaping up to be a prime example of this historically reoccurring theme. The Chinese government has issued warning after warning, increased reserve requirements, and jawboned the public repeatedly, but the siren song of getting rich “QUICK” is too compelling. The Chinese public can't hear anything at this point but hurry up and get in before you miss the opportunity, and of course when you hear this it is actually time to “WATCH OUT”!

The herds of investors are stampeding into the market, and stampeding is the right word for what is unfolding. Two weeks ago I would not have written this missive, believing that while the overvaluations were severe, the sums involved were puny, six to twelve months ago a good day on the Chinese stock markets was 1 billion dollars worth of stock changed hands. This week a report was released illustrating that now the amount of domestic Chinese stock business eclipses all the volume in all the stock markets in the Asian region COMBINED . Yes, the amount of business is now more than the developed markets of Japan , Hong Kong , Australia , South Korea , Singapore , Thailand and Taiwan . Well here is a frightening statistic for you, these usually conservative savers have WITHDRAWN 1.674 TRILLION Yuan in April alone, and translated into dollars that is 219 BILLION DOLLARS. Yesterdays volume was over 46 billion dollars. This is BIG money even in the US .

This illustrates how this was an anecdote six months ago as a days worth of business was 15 minutes volume on the New York Stock Exchange, now the amount of money is equal to it. Not a problem if this occurred then with puny amounts of money at stake, the importance is directly linked to the size of the money involved, now its big big money with its you know what in the wind. The owners of this big money are the little guys, inexperienced investors with varying sizes of accounts, ranging from a few hundred dollars all the way to millions of dollars, multiplied by hundreds of millions of Chinese citizens. It cumulatively is a great deal of money.

Think of the exponential growth of volume it takes to go from the place we were 6 to 12 months ago to where we are today. It is a staggering mental exercise. Another statistical example of the probabilities of a bad thing happening to this NOW BIG MONEY, can be garnered from previous examples of markets overextensions: lets take an excerpt from a recent update of Peter Eliade's ( www.stockmarketcycles.com ) ,

“But we should point out that the Shanghai market is currently approximately 95% above its 200 day moving average. To put that in perspective, in the history of the Dow Jones Industrial Average, including wild speculative binges such as 1929, we are unable to find a market high that was more than approximately 55% above its 200 day moving average. Perhaps the amazing upward explosion in the Nasdaq leading to the Marc h 2000 peak comes to mind as a similar market bubble to be compared with Shanghai . That market also stopped its runaway phase right around the 55% mark above its 200 day moving average.

In our experience, these types of bubbly blow off market phases are more conducive to subsequent crashes than they are to subsequent economic booms. It is difficult to conceive that a market almost 100% above its 200 day moving average will end up in any way but a negative fashion. Only time will tell.” Thanks Peter…

WOW, It is 100's of millions of ordinary Chinese citizens turning en masse to this very small market (in terms of market capitalization), it is like population of New York City trying to squeeze into a Volkswagen . It is what we will see in the gold market someday, when people want in at any cost, when the dollar really does break down and people really want out at any cost. They have stretched the overextension to almost TWICE what were previous bubble crashes as detailed by Peter. They want this market in at any cost….

(Authors note; looking for assistance in creating portfolio diversification that can survive and thrive in what I am outlining? In fingers of instability? If so contact me through www.TraderView.com . Subscriptions to this newsletter are also free at this address; send it to a friend, Thank you)

Another big cause of this overextension in Stock market prices is the lack of modern trading rules in China , populous politicians globally wish to outlaw short selling, well we can see here what could be expected if this practice were abolished, short selling is not really allowed in China . This is part of the modernizing of markets and financial systems Treasury secretary Hank Paulson speaks of frequently. Limitless liquidity, good fundamentals, no negative sentiment allowed to enter the market through short selling, very small market floats, equals the types of statistics peter outlines. Rocket shots. The cost will be enormous as these inexperienced INVESTORS have pushed the window TOO FAR and the BIG money is out on the statistical wings, no mans land. The farther away from the mean and moving average the bigger the money is. OUCH. The only redeeming aspect of this big money is that the Chinese do not allow leverage or margin trading, so these stock purchases are fully funded and are not subject to forced liquidation by margin clerks during sharp pullbacks.

Even though these companies that are listed are enjoying excellent fundamentals and increasing success, their prices are not reflective of current conditions, they reflect unbounded optimism and greed ala NASDAQ 2000 and the current housing debacle, but much more so. Bubbles are created when fundamentals are excellent, but liquidity is too abundant. So liquidity is doing what it always does, getting way ahead of itself. But most of this liquidity is coming out of the savings of domestic Chinese citizens.

Who are flush with cash after the prodigious wage gains they have garnered over the last 15 years and the savings they have accumulated. For the most part Chinese stocks cannot be bought by foreigners (except in Hong Kong ), and Chinese investors cannot buy stocks outside their own country. The most vulnerable and unqualified investors are buying the inflated stocks at the highs, buying stock prices that can't be supported by even the most robust business fundamentals. It is a recipe for a crash, which will suck in the least prepared and weakest hands who will take the full brunt of the losses. MAXIMUM wealth destruction, by the people who can least afford it.

To compound the problem the Chinese financial and banking system make the federal reserve and treasury department of 1929 look like a Ferrari, it is fragmented and dysfunctional, if the Chinese government wished to provide liquidity they really don't have a transmission mechanism. When I first showed my wife my check book and how it worked she was incredulous, people in china do not have modern banking. NO one would take a check even if they did, the chance of bouncing would be almost assured. The reason Chinese citizens are at the banks withdrawing the cash is to tote it down the street to the brokerage. It is the only way to get it there, wires and checks are not a regular means of facilitating commerce.

The banks are not enmeshed in a seamless electronic interconnected network or a network of any kind as we know it. Remember back in the old days of the United States when you waited weeks for a check to clear, because it took weeks for it to travel through the system to the bank it was drawn on then back to your bank. China doesn't even have this is place. The authorities are not prepared to conduct rescue operations, as I mentioned above this is what US Treasury Secretary Hank Paulson is talking about when he talks of modernizing the financial and banking systems.

We are about to see the birth of the Chinese Plunge protection team, otherwise it will turn into an utter and complete disaster, the oceans of shares that the Chinese government owns in the SOE's must be carefully released to satiate the demand that is this tsunami of cash and investors. And what a balancing act the authorities are faced with, curb the rocket shot and stabilize it at current levels. Or the poorest people in China will be the victims of their own stupidity, and the social unrest caused by the loss of “EVERTHING” by these investors will cause a political upheaval of epic proportions. Hundreds of billions of dollars of domestic savings disappearing in the inevitable crash that must occur.

This mornings Financial Times is reporting that the Chinese financial authorities are thinking about pricking the bubble. Think of the lives this official holds in his hands, and the ones which will be destroyed, including his own as he will be the donkey they pin the tail on in the aftermath. The Chinese public is in a full blown mania, enormous amounts of their money in at the top, at unbelievably stretched valuations and a rickety banking system with the authorities trying to reign in the mania. Make no mistake in viewing this: this is the recipe that caused the great depression in the United States . A condition the Chinese government will wish to avoid at all costs, just as Bernanke and the US treasury must now avoid a collapse in US asset markets at any cost.

It is now “inflate or die”, and the club has just admitted a new member, and it resides in a place called “ BEIJING , CHINA ”. The Chinese government's ability to manage markets and capitalism is going to get a severe test RIGHT NOW, and based on today's report in the FT they are totally unprepared to understand the enormity of the unintended consequences that can occur if the choose the wrong path to dealing with this. US dollar based Fiat money and credit creation is now moving into the arteries of the Chinese economy and has trickled down to the citizens. What do you think might unfold if the emerging Chinese consumer and the US consumer are knocked out at the same time? It is not a pretty thought. If this happens the Chinese consumer will never emerge as everyone in Beijing and the world hopes for. The great depression of the US repeated in China , exacerbated by an antique banking system that is unable to properly transmit and provide liquidity. You can expect them to handle it the same way Greenspan did, the Hu Jintao put is about to be born. Moral hazards pasted one on top of another….

POP, Goes the Bubble?

This week Steven Roach wrote a missive about Trade Relations with China , that politically they are past the “point of no return” outlining dangerous protectionist plans, rhetoric and actions coming out of Washington DC . And that this rhetoric no longer was limited to China , as Japan has emerged as an additional poster child of irresponsible Trade and currency behavior. America 's two biggest creditors are having spitballs lobbed directly in their eyes (try spitting in your bankers face sometime, see where it gets you), US politicians behaving locally in a global world. It appears that if the Chinese don't prick the bubble themselves the US congress will! It is a disaster, and a pop that will be heard around the world. It threatens to make the problem in Chinas stock markets much more unmanageable as if fundamental expectations for future business are punctured by these “Public Servants”, the mis-pricing that the big money is currently resting at, in the US and in China will become even wider to the fair value of the holdings. Since business prospects will be severely diminished.

Do you realize what could materialize if these idiots light a fuse while the broad Chinese public is out on the limb of the previous Tedbit? It will be like sawing it off, do you think the Chinese government will see this as anything but an act of brutal aggression? The US consumer will be also be hit hard as the price they pay for everything Chinese will skyrocket.

Nothing fails to amaze me more than the economic ignorance that is Washington DC , they are oblivious to history, fundamentally sound accounting and fiscal policies, and fiduciary responsible behavior. They encourage the American people to spend beyond their means, save nothing and punish personal initiative and wealth creation with high taxes and mind bending micro management through overregulation. Then they pick a fight with the someone's ( China , Russia , Japan , etc.), that can in a heartbeat pull the rug out from underneath the economy and their spending plans. Daring them to do so, a giant game of chicken with our financial livelihoods and futures as the wager they are placing. Our asset based economy where systemic deflationary problems await any appreciable pullback in asset prices, as billions of dollars of loans inch towards diminished expectations. Asset prices that are dependant on 3 billion dollars a day being imported from abroad and foreign lenders. I hope Washington has recently added a number of new printing presses for all the money they will be forced to print as they are forced to become the lender of last resort.

In Conclusion, We are seeing a Rotating bubble syndrome as outlined in “Fingers of Instability” (see www.TraderView.com ,archives) as global Ce ntral Banks and Financial authorities continue the experiment with fiat money and credit creation begun decades ago. As they pile dollar on top of dollar, yen on top of yen, Euro on top of Euro, British pound upon British pound, Yuan upon Yuan, Ruble upon ruble, etc. Every increasing sand piles of stimulus. Now the man on the street Chinese citizen has joined the fray. Global fire hoses of hot money created now and in years past bounding around the world seeking “ALPHA”, creating bubble after bubble which when they burst are met with? What Else? More money printing. This money can no longer sit in the bank as that is guaranteed confiscation via printing press.

The source of this money in this case is of course the Chinese merchandise trade surplus, and the wages the Chinese public has received as it has emerged as manufacturer to the world on a scale that has dwarfed previous industrializations in history, and is joined by the rest of the BRIC's.

The management of the blow-ups is predictable. No matter how bad the crash the financial authorities will be forced to “make good” on the money that was lost by the most important players, and in this case it will have to include a big part of the public. See what's emerging in the Sub prime space in the US ? Legislation is being brought forth to bail these people out. They may have raised credit requirements as responsible lending would require, but liquidity is still very abundant in the United States . I am still being bombarded with offers to borrow money. The psychology of deflation must be nipped in the bud before it can become self fulfilling. It is going to be interesting to see the coordinated reflation and fire containment that will be required to meet this potential threat to the Global economy.

Next week we will be talking about a huge Chinese financial and trade delegation that is coming for an unbelievably important Pow Wow later this month. We will also cover why the middle class is disappearing, the mechanics of it, and how an illusion of growth covers the fingerprints of its perpetrators. It will be interesting I promise you.

I have recently composed an Overview of Tedbits to help current and potential subscribers understand our mission in serving you. It also gives a broad description of what's unfolding globally, as we see it, and what you can expect from Tedbits as a regular reader.

Subscribe to Tedbits - Click Here Tell a Friend About TedBits - Click Here

By Ty Andros

TraderView

Copyright © 2007 Ty Andros

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.