Stock Market Rally Fades In Final Minutes

Stock-Markets / Financial Markets 2009 Apr 23, 2009 - 07:33 AM GMTBy: PaddyPowerTrader

Yesterday’s tentative rally was brought to an abrupt end by some broad based late selling in financials and notable weakness in tech bellwether Intel on a report that the European Union was close to sanctioning the chip giant for anti-competitive practices. On the bright side, Apple beat street estimates thanks to healthy iPhone sales, as did eBay. Other stocks that reported yesterday, such as Wells Fargo (who had the “best” quarter ever), Scandisk and Boeing all chalked up hefty gains on the day. Caterpillar faired well on an upgrade from JP Morgan, while to the downside, Morgan Stanley had a big miss versus analysts estimates and cut their dividend by 81%.

Yesterday’s tentative rally was brought to an abrupt end by some broad based late selling in financials and notable weakness in tech bellwether Intel on a report that the European Union was close to sanctioning the chip giant for anti-competitive practices. On the bright side, Apple beat street estimates thanks to healthy iPhone sales, as did eBay. Other stocks that reported yesterday, such as Wells Fargo (who had the “best” quarter ever), Scandisk and Boeing all chalked up hefty gains on the day. Caterpillar faired well on an upgrade from JP Morgan, while to the downside, Morgan Stanley had a big miss versus analysts estimates and cut their dividend by 81%.

Today’s Market Moving Stories

In a case of “Oh dear Darling”, the UK press has taken a uniformly negative view of yesterday’s budget, focusing on both the hefty borrowing needs and the apparent optimism ingrained in the economic forecasts. It was really an unimaginative holding exercise which put off the hard decisions. A budget for politics, not for economics. The UK’s fiscal position now looks horrible and debt levels are going to soar. Note that the UK’s budget position is now worse than Ireland’s, though I doubt it will prompt the Telegragh to stop the Paddy bashing.

In a case of “Oh dear Darling”, the UK press has taken a uniformly negative view of yesterday’s budget, focusing on both the hefty borrowing needs and the apparent optimism ingrained in the economic forecasts. It was really an unimaginative holding exercise which put off the hard decisions. A budget for politics, not for economics. The UK’s fiscal position now looks horrible and debt levels are going to soar. Note that the UK’s budget position is now worse than Ireland’s, though I doubt it will prompt the Telegragh to stop the Paddy bashing.

- The Ricardian equivalence theory is about to face its biggest test ever at the global level. The consumer knows all too well that fiscal trends are unsustainable, and, facing higher taxes and lower social spending in the future, will tend to save more, even more so in countries like the UK and the US where household debt has exploded over the past decade. That will offset the positive impact of aggressive stimuli. Again, I fear that the slowdown in the pace of economic deterioration will not be followed by the usual positive turnaround. As growth stays well below potential, the global output gap will widen further, making the deflation threat ever more serious.

- The Chinese economy has bottomed out and could grow as much as 8% this year according to an independent member of the PBOC board. Another member said that the current interest rate setting was appropriate, but that there was room to cut further if warranted.

- Reuters reports that Germany’s leading economic research institutes recommend that the ECB should cut rates further to 0.5% given the Eurozone’s low inflation and the depth of the economic collapse. “Even a rate of zero would not be an adequate reaction to the crisis.”

- “From crisis to catastrophe” is the headline of this morning’s lead in Financial Times Deutschland, after it emerged that Germany’s economics institutes are forecasting a fall in economic growth of 6% for this year. The mood in Berlin has changed markedly over the last few days, reinforced by a deeply depressing “summit” of business leaders with Angela Merkel, who at least now acknowledges that there is a crisis out there.

- An Associated Press story said the US bank stress tests are designed to favour the larger Wall Street banks, while potentially threatening regional banks (some tests are due to be released by the Treasury from Friday onwards). That failed to impact risk sentiment.

Further Downgrades From The IMF

Further Downgrades From The IMF

More glum tidings from the IMF’s World Economic Outlook. It pulls no punches. A day after the release of the excellent Global Financial Stability Report, the IMF produced its economic projections, which make equally grim reading. The world economy has entered a fully synchronised recession, and is forecast to contract by 1.3% this year, another downward revision, to be followed by a sluggish resumption of growth in 2010. The reason for the latest downward revision is the greater than expected persistence of financial problems, which are not going to disappear soon even if policy makers did all the right things (which they are not). The risks of the forecast are once more on the downside, which makes further downward revision likely. Again, it is best to read the report itself, rather than rely on sketchy news reports. The report is predictably very critical of the haphazard and uncoordinated policy response in Europe.

Equities

- In sunrise European equity news, banks are unsurprisingly under a bit of selling pressure following the late sell-off in financials Stateside. Credit Suisse is bucking the trend after posting better than expected numbers.

- Japanese heavyweight Nomura was sold off overnight on a rumour that they will post a $7bn loss on Friday.

- The worlds largest paint maker Akzo Nobel posted an unexpected Q1 loss on a big slide in demand from Asia.

- GM said it was likely to miss a debt payment deadline, raising the brinkmanship one more level. But the news made barely a ripple.

- AIB’s Polish sub Bank Zachondi saw its share price close up 7% yesterday. Local commentators appear to be suggesting that a sale could provide a significant boost to the share price as a result of its attraction to potentially interested parties. “Some people seem to be betting that a new, stronger owner may appear in the bank, which is pushing the stock price higher.” That local analyst works for Deutsche Bank, one of the most likely banks to be interested in the Bank Zachondi stake.

- A number of commentators are beginning to focus on the challenges facing Irish agri-food companies in the wake of the big news from Tesco this week. First, they now account for 30.4% of the UK grocery trade and, along with three others (Asda, Sainsbury and Morrisons), takes almost three of every four pounds spent on food in British supermarkets. Second, Tesco announced plans to centralise purchasing for Ireland and the UK instead of having separate structures. Forthwith, food suppliers will have to face off with Tesco’s might across both economies. For Irish producers the lesson is clear: without scale, the ability for future sustainable profits will be seriously compromised.

Data And Earnings Today

Economic indicators are light on the ground today. In the morning, we get PMIs from the Eurozone members and in the afternoon we have initial jobless claims and homes sales data from the US.

Earnings highlights today come from Conoco-Phillips (expected EPS $0.43), Marriott ($0.14), Union Pacific ($0.66), US Air ($-2.38), Microsoft ($0.30), Amazon ($0.31), American Express ($0.12), UPS ($0.66), Philip Morris ($0.69) and Burlington Northern ($0.96).

Probably Not What The Government Had In Mind With Its Bike-To-Work Scheme

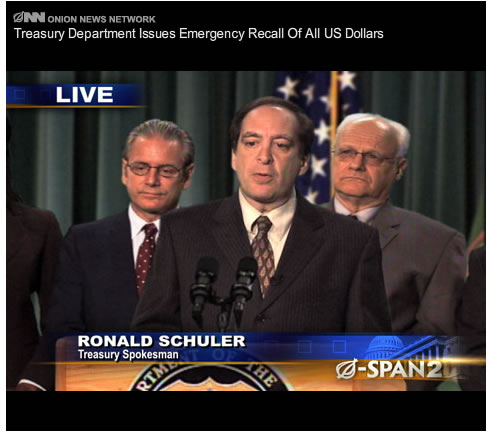

And Finally… US Treasury Department Issues Emergency Recall Of All US Dollars

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.