Deflation Returns to the U.K.

Economics / Deflation Apr 22, 2009 - 07:26 AM GMTBy: Mike_Shedlock

Inquiring minds are reading Deflation returns to Britain for first time since 1960.

Inquiring minds are reading Deflation returns to Britain for first time since 1960.

Deflation returned to Britain for the first time in nearly five decades last month as prices measured by the retail price index (RPI) were lower than the same time a year ago.

David Kern, chief economist at the British Chambers of Commerce (BCC), said: "The RPI is in negative territory and fell by more than expected. Deflationary pressures could make the recession worse in the short-term, despite quantitative easing and the huge budget deficit posing inflationary pressures over the medium-term.

The Office for National Statistics said the RPI was 0.4% lower in March than it had been in March 2008. That was the first negative reading since March 1960, when Harold Macmillan was prime minister and John F Kennedy was running for the US presidency.

On the government's preferred consumer price index measure, which excludes housing and mortgage costs, inflation was still comfortably in positive territory, at 2.9%. CPI is much higher here than the 0.6% figure for the eurozone and economists say the falling pound has pushed up some import prices, delaying the drop in the CPI.

Figures from the Bank of England show that a third of firms have agreed pay freezes in recent months and some have cut pay. Workers at Honda's car plant in Swindon were recently told they will have to take a 10% pay cut this year, after a similar announcement by Toyota to its workers in Derby.

"The inflation data do little to dispel expectations that interest rates are set to stay at 0.5% for an extended period and that the Bank of England could eventually extend its quantitative easing programme," said Howard Archer, economist at IHS Global Insight. "The danger of an extended, deep recession still outweighs inflation risks."

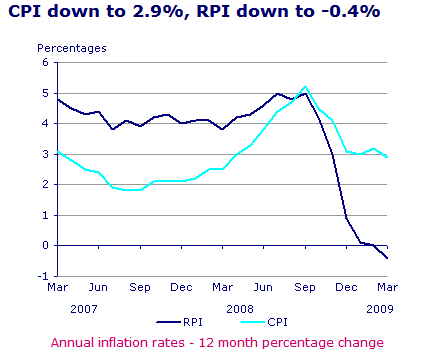

RPI vs. CPI

The Retail Price Index (RPI) includes housing while the Consumer Price Index (CPI) does not. Chart courtesy of UK National Statistics. Click here for information on the 2009 CPI RPI Basket of Goods and Services. Click here for Additional UK Government Price Statistics.

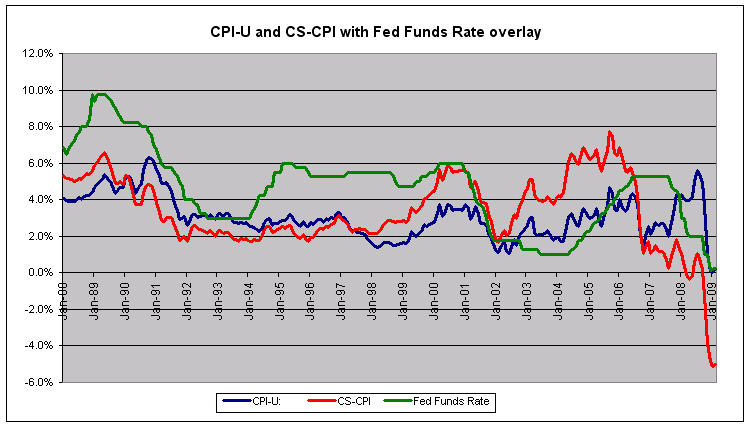

U.K. RPI vs. U.S. Case Shiller CPI

The RPI is closer to the Case-Shiller CPI and the US government reported CPI.

Case-Shiller-CPI (CS-CPI) vs. CPI-U

click on chart for sharper image.

For more on the CS-CPI please see CS-CPI Negative 5.0% Third Straight Month.

Flashback June 30, 2008

Please consider what I said about 10 months ago in Deflationary Hurricanes to Hit U.S. and U.K.

.....

Avoid A Recession?

It will be hard for the US and UK to avoid a depression.

What started as a tropical storm called "Subprime" has intensified in magnitude to engulf Alt-A, HELOCs, credit cards, commercial real estate, municipal bonds, corporate bonds, and the stock market, just as baby boomers are headed for retirement.

If you prefer, you can think of this as Many Hurricanes, Many Eyes.

Barclays Capital said in its closely-watched Global Outlook that US headline inflation would hit 5.5pc by August and the Fed will have to raise interest rates six times by the end of next year to prevent a wage-spiral. "We're in a nasty environment," said Tim Bond, the bank's chief equity strategist. "There is an inflation shock underway."

This is not Bizarro World, nor it is 1970.

If Barclays is betting on six interest rates hikes in the US with its own money it will likely get carted out in a coffin. Property values are crashing, unemployment is rising, wages are falling, global wage arbitrage is king, and most importantly Peak Credit Has Arrived.

It is impossible to get inflation out of that mix. Bernanke could cut interest rates to zero tomorrow and it would not cause inflation, at least as properly defined: a net expansion of money and credit. Banks are strapped for cash. They cannot lend. Businesses do not want to borrow. There is overcapacity everywhere. The Shopping Center Economic Model Is History.

I struggle to see how anyone can get inflation out of that mix. Last Thursday when the stock markets were in a freefall, I asked Is The Inflation Scare Over Yet? Well, I guess it's not.

And so here we are. Deflation has returned to the U.K. I need to add The U.K. to my Deflation Has Gone Global list.

In retrospect we see that Bernanke did cut rates to to zero and as predicted it did not cause inflation. And in case you missed it, please consider Bernanke's Deflation Preventing Scorecard.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.