Six Month Correlation Among iShares ETFs

Stock-Markets / Exchange Traded Funds Apr 22, 2009 - 07:00 AM GMTBy: Richard_Shaw

Owning multiple funds with close correlations is mostly wasted effort and potentially self-deception. Owning multiple funds with a significant correlation spread can be helpful in reducing overall portfolio volatility.

Owning multiple funds with close correlations is mostly wasted effort and potentially self-deception. Owning multiple funds with a significant correlation spread can be helpful in reducing overall portfolio volatility.

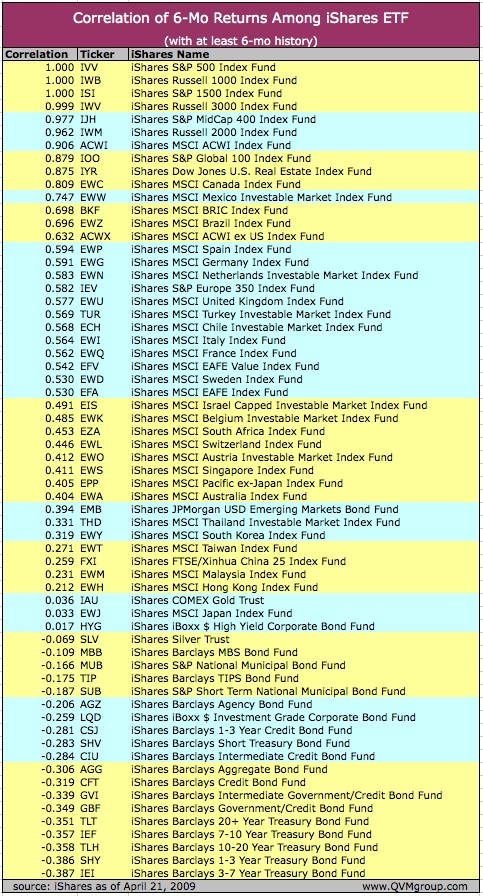

Here is a table with the 6-month correlation of daily returns of selected iShares ETFs with at least 6 months of history (as of April 21, 2009), as rendered by the iShares website.

It reveals how the various funds have behaved during the past two quarters which saw so much portfolio value destruction. Longer periods of time for correlation should generally be considered, but it is interesting to see how funds behaved during these violently turbulent times.

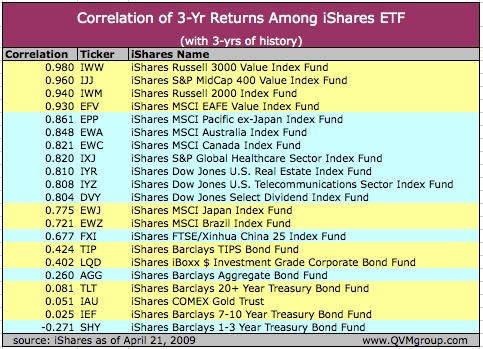

Here is a shorter list of iShares ETFs showing their 3-year correlation:

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.