Corporate Earnings to Test Stock Market Strength

Stock-Markets / Financial Markets 2009 Apr 20, 2009 - 06:44 AM GMTBy: PaddyPowerTrader

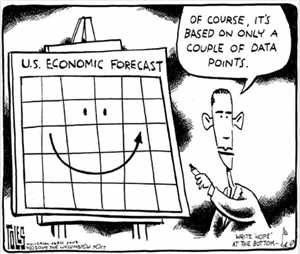

A make or break week for the six week long gravity-defying rally as a huge list of earnings reports beckon. The Dow is up 24% since March 10th, with the S&P 500 up nearly 29% and the Nasdaq up 32%.

A make or break week for the six week long gravity-defying rally as a huge list of earnings reports beckon. The Dow is up 24% since March 10th, with the S&P 500 up nearly 29% and the Nasdaq up 32%.

Note the index of US banking shares has bounced an impressive 108%, confounding the bears, tough the point remains that with the “dumbing down” of reporting standards the goal posts were moved. That said one has to respect the price action last Thursday / Friday from regional banks such as Regions Financial and BB&T Corp again confounding conventional bear market rally wisdom as the cult of the equity returns.

Today’s Market Moving Stories

- Asian bourses were led by steel producer stocks which outperformed on the view that the Chinese stimulus is working better than expected. Upgrades of the sector from brokerage houses Nomura and Nikko.

- On the DAX this morning Infineon is up strongly on an RBS upgrade while insurance giant Allianz has slipped 2.2%.

- In merger chit chat Glaxo is said to be close to a $3bn deal to buy Stiefel (think skin creams).

- ECB President J C Trichet said in an interview with Kyodo news that there was still room for more rate cuts but he continued to reject a zero rate policy. He went on to say that any additional cuts would be a measured while colleague Bini-Smaghi said that he saw no real risk of lasting deflation. In sum a 0.25% cut on May 7th has been rubber stamped.

The Fed’s Kohn said that credit easing policies are working and that loans had only been extended to sound companies. NY Fed’s Dudley remarked that he was not worried that current balance sheet expansion measures could spark inflation.

The Fed’s Kohn said that credit easing policies are working and that loans had only been extended to sound companies. NY Fed’s Dudley remarked that he was not worried that current balance sheet expansion measures could spark inflation.

- UK Rightmove house prices are up 1.8% mom in April, marking a third successive month of gains. While according to the CBI, the UK economy is set to contract 3.9% this year and predicts only a modest recovery for 2010. Separately, the Telegraph cites Insolvency Service statistics as suggesting that more than 35,000 firms will go bust in 2009.

- IMF to revise growth forecasts this week – little surprise there. “The outlook we are putting forward this week will be worse than the one we had made previously,” Strauss-Kahn said. The previous 2009 world GDP growth forecast was at 0%/-0.5%.

- Lending at the biggest US banks has fallen more sharply than previously realised, despite government efforts to pump billions of dollars into the financial sector. The biggest recipients of taxpayer aid made or refinanced 23% less in new loans in February than in October, the month the Treasury kicked off the Troubled Asset Relief Program. The total dollar amount of new loans declined in three of the four months the government has reported this data. All but three of the 19 largest TARP recipients with comparable data originated fewer loans in February than they did at the time they received federal infusions.

- Writing in the FT Mansoor Mohi-uddin says the dollar is very likely to remain the world’s leading reserve currency for the foreseeable future. He cites a number of reasons, including lethargy, the need to keep strong reserve portfolios as insurance against devaluation, and the superiority of the US treasury market relative to the eurozone bond markets. He says fears that the euro might not be sustainable would prevent large portfolio shifts from dollars into euros.

- The Trillion Dollar Bailout game.

Moody’s To Downgrade Ireland

Moody’s has placed Ireland’s Aaa government bond ratings on review for possible downgrade. Moody’s talking of a 1 or 2 notch downgrade - outcome within 3 months. S&P and Fitch have already dropped the AAA. “Today’s action reflects the severe economic adjustment taking place in Ireland, which threatens to undermine the country’s low tax, financial services-driven economic model. The government’s debt affordability metrics will probably be lastingly impaired. While Moody’s acknowledges that the authorities are being proactive to the extent possible in their effort to restore the country’s economic and financial stability, their room for manoeuvre is limited at this point.”

FT today also discussing the Irish bad bank scheme and the possible government ownership stakes in the banks depending on the discount taken on the loan books. It is looking like a majority stake no matter what.

AIB Capital Update

Ahead of its AGM on May 13th, AIB provided a capital update this morning. AIB has already agreed to take €3.5bn in government capital subject to a shareholder vote. The Department of Finance has been running some stress tests however and now reckons the bank needs another €1.5bn before the end of the year. This suggests the Department of Finance has already made some kind of decision regarding the price at which loans go the Irish bad bank. The additional capital may come from the disposals of subsidiaries M&T and Bank Zachodni. The release is short but surprisingly for a capital update, gives no details of what the tier 1 or target ratio looks like. See NAMA for updates on the scheme

Data And Earnings Ahead

A bit of a slow day on the economic data front with just the US leading indicator this afternoon.

Earnings today include IBM (expected EPS $1.66), Texas Instruments (–0.02c) and Eli Lily (0.99c).

Bank of America’s Q1 are also due today (pre-US open so around noon). Analyst’s consensus is for EPS of $0.042 on $26bn revenues. $1.6bn net income. Expect a small beat like JPM and Citibank with identical trends. Meanwhile, Ken Lewis is under pressure to keep job ahead of AGM.

The rest of the week will be very interesting with more heavyweights reporting including Apple, Microsoft, Halliburton, Schering-Plough, United Technologies, Yahoo, Merck, Boeing, Caterpillar, McDonalds and Wells Fargo.

And Finally… Something For The Kids, The Barclaycard Waterslide

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.