Stock Markets Rising a Wall of Worry or Slope of Hope?

Stock-Markets / Financial Markets 2009 Apr 18, 2009 - 03:40 PM GMT Banks given a lot of slack to report better earnings. Citigroup Inc., the U.S. bank rescued by $45 billion in U.S. taxpayer funds, ended a five- quarter losing streak with a $1.6 billion profit on trading gains and an accounting benefit for companies in distress.

Citigroup posted a $2.5 billion gain from accounting rules that allow companies to profit when their own creditworthiness declines. The rules reflect the possibility that a company could buy back its own liabilities at a discount, which under traditional accounting methods would result in a profit.

Banks given a lot of slack to report better earnings. Citigroup Inc., the U.S. bank rescued by $45 billion in U.S. taxpayer funds, ended a five- quarter losing streak with a $1.6 billion profit on trading gains and an accounting benefit for companies in distress.

Citigroup posted a $2.5 billion gain from accounting rules that allow companies to profit when their own creditworthiness declines. The rules reflect the possibility that a company could buy back its own liabilities at a discount, which under traditional accounting methods would result in a profit.

Consumer Confidence is coming back…slowly.

Confidence among U.S. consumers improved in April for a second month amid signs the longest recession in the postwar era may be easing.

The Reuters/University of Michigan preliminary index of consumer sentiment rose to 61.9, the highest since September, from 57.3 in March. The reading on expectations for six months from now improved. The index reached a three-decade low of 55.3 in November.

Recent reports indicate housing and manufacturing, two of the hardest-hit areas, may be stabilizing, supporting Federal Reserve Chairman Ben S. Bernanke’s view that the U.S.’s “sharp decline” could be slowing. An improvement in confidence may help sustain a recovery in consumer spending, which accounts for 70 percent of the economy.

A wall of worry or a slope of hope?

-- Newsletter editors are significantly more bullish now than they were two weeks ago. From a contrarian point of view, it is not a good sign when advisers continue to become more bullish, even as the market churns sideways. Richard Russell, editor of Dow Theory Letters, comments, "The market is now about one month off its March 9 low. Yet already the mood has changed, public sentiment is turning almost rosy, and analysts are openly urging people to buy stocks. ... It seems to me that this is awfully fast for the business news to turn rosy. ... Bear market bottoms don't tend to work that way. After a true bear market bottom, it often requires many months before the crowd and the media turn bullish."

-- Newsletter editors are significantly more bullish now than they were two weeks ago. From a contrarian point of view, it is not a good sign when advisers continue to become more bullish, even as the market churns sideways. Richard Russell, editor of Dow Theory Letters, comments, "The market is now about one month off its March 9 low. Yet already the mood has changed, public sentiment is turning almost rosy, and analysts are openly urging people to buy stocks. ... It seems to me that this is awfully fast for the business news to turn rosy. ... Bear market bottoms don't tend to work that way. After a true bear market bottom, it often requires many months before the crowd and the media turn bullish."

Treasury bonds pull back again.

-- Treasuries headed for their first weekly gain in a month after the Federal Reserve increased purchases of government debt to cut borrowing costs. Interest rates will hold at low levels because the “severe” global recession will last through 2009, according to Pacific Investment Management Co., the world’s biggest bond-fund manager. Dallas Fed President Richard Fisher said the U.S. economy faces the risk of deflation, not inflation.

-- Treasuries headed for their first weekly gain in a month after the Federal Reserve increased purchases of government debt to cut borrowing costs. Interest rates will hold at low levels because the “severe” global recession will last through 2009, according to Pacific Investment Management Co., the world’s biggest bond-fund manager. Dallas Fed President Richard Fisher said the U.S. economy faces the risk of deflation, not inflation.

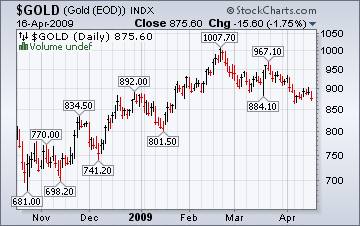

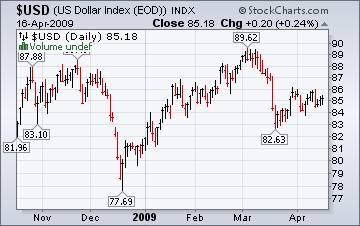

Gold takes a back seat to the stock rally.

(Bloomberg) -- Gold headed for its fourth weekly decline, the longest losing streak since August, as a global stock rally eroded demand for the metal as a store of value. An increasing appetite for risk on the part of investors seems to be the blame for the decline in gold, since it is looked upon as a safe haven in times of trouble. Let’s hope we don’t need it again soon.

(Bloomberg) -- Gold headed for its fourth weekly decline, the longest losing streak since August, as a global stock rally eroded demand for the metal as a store of value. An increasing appetite for risk on the part of investors seems to be the blame for the decline in gold, since it is looked upon as a safe haven in times of trouble. Let’s hope we don’t need it again soon.

Advisors are bullish in Japan, too?

(Bloomberg) -- “This is what I want to tell investors now: Prepare for a sharp increase in stock prices because the bottom is about to fall out from under the pessimists,” Ryoji Musha, chief investment adviser for Japanese equities at Deutsche Bank AG, wrote in a report today. “We are very likely to see a rebound that returns stock prices to the level we saw prior to the Lehman Brothers shock.”

(Bloomberg) -- “This is what I want to tell investors now: Prepare for a sharp increase in stock prices because the bottom is about to fall out from under the pessimists,” Ryoji Musha, chief investment adviser for Japanese equities at Deutsche Bank AG, wrote in a report today. “We are very likely to see a rebound that returns stock prices to the level we saw prior to the Lehman Brothers shock.”

Do you really think so?

Chinese rally may not have a solid foundation, says Chinese Premier.

-- China’s stocks fell the most in more than a week, led by commodities producers, after raw material prices tumbled and Premier Wen Jiabao said the economic recovery lacks a solid foundation. The Shanghai Composite fell after Wen yesterday told the official Xinhua News Agency the financial crisis on China is still deepening and the rebound in industrial output growth lacks momentum. Wen spoke after a meeting of the State Council.

-- China’s stocks fell the most in more than a week, led by commodities producers, after raw material prices tumbled and Premier Wen Jiabao said the economic recovery lacks a solid foundation. The Shanghai Composite fell after Wen yesterday told the official Xinhua News Agency the financial crisis on China is still deepening and the rebound in industrial output growth lacks momentum. Wen spoke after a meeting of the State Council.

Stimulus dollars are adding up.

-- The Department of Education is making a fresh $109 million available for school construction. High-speed rail advocates and states are lining up to fight for $8 billion in funds. And nearly $20 million is going to state agencies to support performing- and visual-arts jobs and productions.

-- The Department of Education is making a fresh $109 million available for school construction. High-speed rail advocates and states are lining up to fight for $8 billion in funds. And nearly $20 million is going to state agencies to support performing- and visual-arts jobs and productions.

These are just a few of the areas of the U.S. economy beginning to see dollars flow in from the $787 billion stimulus package signed by President Barack Obama on Feb. 17.

Lowering the mortgage payment for the unemployed misses the mark.

Unemployment is a bigger reason for missed mortgage payments than high interest rates, according to a study from the Boston Federal Reserve that raises questions about President Obama's plan to stem foreclosures by modifying loans.

Unemployment is a bigger reason for missed mortgage payments than high interest rates, according to a study from the Boston Federal Reserve that raises questions about President Obama's plan to stem foreclosures by modifying loans.

Borrowers are more likely to default on their payments because they have lost their jobs or because the price of their homes has plummeted than because of tough terms on their mortgages, the study found.

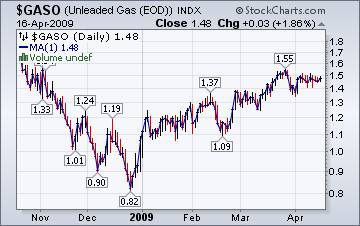

Summer driving season is here.

Energy Information Administration Weekly Report suggests that, “This summer driving season, defined as the period between April 1 and September 30, is expected to be very different from last year. Regular-grade motor gasoline retail prices are projected to average $2.23 per gallon this summer, down from $3.81 per gallon last summer. The monthly average gasoline price is expected to peak at about $2.30 per gallon late this summer. Diesel fuel prices, which averaged $4.37 per gallon last summer, are projected to average $2.27 this summer.”

Energy Information Administration Weekly Report suggests that, “This summer driving season, defined as the period between April 1 and September 30, is expected to be very different from last year. Regular-grade motor gasoline retail prices are projected to average $2.23 per gallon this summer, down from $3.81 per gallon last summer. The monthly average gasoline price is expected to peak at about $2.30 per gallon late this summer. Diesel fuel prices, which averaged $4.37 per gallon last summer, are projected to average $2.27 this summer.”

Natural gas prices remain low.

The Energy Information Agency’s Natural Gas Weekly Update reports, “Since Wednesday, April 8, natural gas spot prices increased at most market locations in the Lower 48 States, with some exceptions including those in the Northeast, Midwest, and Midcontinent. Despite this week’s upticks at most locations, natural gas spot prices remain at relatively low levels and have continued to trade within a limited range for the past 4 weeks.”

The Energy Information Agency’s Natural Gas Weekly Update reports, “Since Wednesday, April 8, natural gas spot prices increased at most market locations in the Lower 48 States, with some exceptions including those in the Northeast, Midwest, and Midcontinent. Despite this week’s upticks at most locations, natural gas spot prices remain at relatively low levels and have continued to trade within a limited range for the past 4 weeks.”

Is your home a shelter or a burden?”

Attempts to expand home ownership have contributed to the wider economic crisis without succeeding in their own terms. How does that affect the arguments for supporting home ownership? Should it still be deemed a public good?

No, say several economists and commentators. “Given the way US policy favours owning over renting,” writes Paul Krugman, 2008’s Nobel laureate in economics, “you can make a good case that America already has too many homeowners.” Edward Glaeser, an economist at Harvard University, talks about “the madness of encouraging Americans to bet everything on housing”.

Big questions for Goldman Sachs?

The question many Wall Street observers are asking is just how Goldman once again snatched victory from the jaws of defeat. Many point to Goldman’s expert manipulation of the levers of power in Washington. Since Robert Rubin, its former chairman, joined the Clinton administration in 1993, first as the director of the National Economic Council and then as Treasury secretary, the firm has come to be known, as a headline in this newspaper last October put it, as “Government Sachs.”

Our Investment Advisor Registration is on the Web .

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.