Financial Markets Analysis of the Week

News_Letter / Financial Markets 2009 Apr 18, 2009 - 02:23 PM GMTBy: NewsLetter

April 11th , 2009 Issue #27 Vol. 3

April 11th , 2009 Issue #27 Vol. 3

Financial Markets Analysis of the WeekFeatured analysis of the Week:

Most popular financial markets analysis of the week :

By: John_Mauldin Tonight (Saturday) some 450 people will come together in San Diego to honor Richard Russell, who has been writing the Dow Theory Letter for over 50 years. In that spirit, in today's letter we are going to look deep inside the Dow, back to its very roots. The Dow is a price-weighted index as opposed to a cap-weighted index. Does that make a difference in performance? Specifically, does it affect how the Dow has performed since it was expanded to 30 names in 1928? There are some real surprises we have found, and I think you will find this letter very interesting.

By: Hans_Wagner Analyzing monthly stock market trends uses the S&P 500 charts to indicate important trend lines. Trend following is a proven strategy to beat the market and grow your stock portfolio. Technical analysis provides the tools to analyze and identify trends in the stock market. Since the S&P 500 trend line chart is the one used by professional traders for their analysis, it is important to understand how it is performing.

By: Bill Moyers The financial industry brought the economy to its knees, but how did they get away with it? With the nation wondering how to hold the bankers accountable, Bill Moyers sits down with William K. Black, the former senior regulator who cracked down on banks during the savings and loan crisis of the 1980s. Black offers his analysis of what went wrong and his critique of the bailout

By: Nadeem_Walayat This article seeks to answer in part the approaching 150 emails in response to the recent stealth bull market trading analysis series. The stocks stealth bull market on Friday closed above 8,000 on BAD U.S. unemployment data, having rallied near 24% from the low of 6470, as expected the rally is STILL predominantly perceived as a Bear Market rally that contrary to some statements is still being AVOIDED by ALL but the Smart Money!

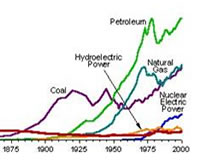

By: James_Quinn Rohm Emanuel's famous quote regarding the current financial crisis, "Never let a serious crisis go to waste...it's an opportunity to do things you couldn't do before." w as ignored last summer when oil prices reached $147 a barrel. The Obama administration has taken advantage of the financial crisis to ram through their socialist agenda which will add trillions to the National Debt.

By: Peter Morici I am changing my tune. Geithner's plan can succeed. Before anyone collapses on the floor or starts screaming that I have lost my mind, it's important to define what success means and what the plan is.

By: Andrew G. Marshall Following the 2009 G20 summit, plans were announced for implementing the creation of a new global currency to replace the US dollar's role as the world reserve currency. Point 19 of the communiqué released by the G20 at the end of the Summit stated, “We have agreed to support a general SDR allocation which will inject $250bn (£170bn) into the world economy and increase global liquidity.”

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

|

||||||||||||||||||||||||||||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.