The Stock Market Trend is Your Friend Until It Ends

Stock-Markets / Stocks Bear Market Apr 18, 2009 - 02:21 AM GMTBy: John_Mauldin

In this issue:

In this issue:

Thoughts on the Continuing Crisis

Dressing Like an Economist

The Trend Is Your Friend Until the End of the Trend

What Is Money?

MV=PQ

Two weeks ago I presented my thoughts on the current economic situation at my 6th Annual Strategic Investment Conference in La Jolla (co-hosted with Altegris Investments). The speech was well-received, at least to judge from the comment forms. So this week and next, we are going to revisit that talk (with a few edits). Let's start with a little set-up to explain the first few paragraphs.

My speech was Saturday morning. On Friday, I wore a nice grey suit with a Leonardo tie. For those who know about Leonardo's, they are "statement" ties. I should note that Tiffani picked the tie out for me about ten years ago and persuaded me to wear it. It took some getting used to. It is 16 silk-screened colors, bright blues and pinks and grays, the central feature of which is a very vivid parrot. It is not subdued.

When my good friend George Friedman of Stratfor gave his speech on Friday, he commented rather derisively about my taste in ties, which got him a few laughs. This did not bother me too much since, while George is a brilliant geopolitical analyst, his sense of sartorial style is not exactly top-drawer. So now, let's jump into the speech.

Dressing Like an Economist

Three years ago I was here at our third conference, and my daughter Tiffani came to me in the middle of the conference and said with a very serious face, "Dad, we've got to have a talk." Oops, we have to have a talk? This was her "You've done something wrong" face. But I didn't know what I had done. Had I been speaking with my zipper down? Was something I said wrong? So I said, "Well, let's go talk right now." And she says. "No, we can do this when you get home." And I said "No, now."

So we go to another room, and I ask, "What's wrong?" And she says, "Dad, the partners wanted me to come and talk with you." Oh God, I think, what is it?

Now, Art Laffer (he of the napkin and Laffer Curve fame) had spoken earlier at that conference. If any of you have ever seen Art speak, Art dresses to the nines. He gave a speech with which I did not agree. It was brilliantly delivered, but he was just wrong. But he looked really good being wrong.

So Tiffani says, "Dad, the partners want me to talk with you. You dress like an economist. You are supposed to be a guru. We've got to get you some new clothes." And it was true, I had not bought many new clothes for years.

So this is my guru suit. Somebody at least has some sartorial taste -- Tiffani and others picked it out. You can see the evidence of true style and taste by the way she dresses, can't you? And she picked out the tie, too. (And I should point out that the one person in George's family with outstanding taste, his wife and partner Meredith, liked the tie as well.)

Thoughts on the Continuing Crisis

Ok, with that out of the way, let's talk about some of my thoughts on the continuing crisis.

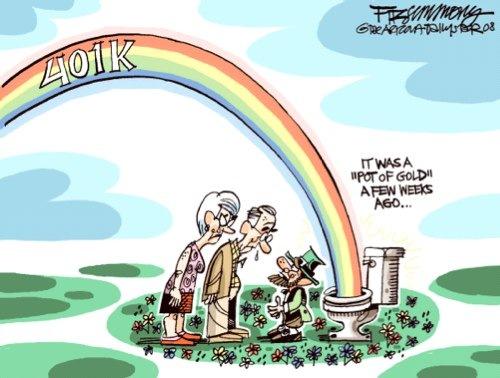

This cartoon is pretty much where we are right now. The consumer is shell-shocked. That pot of gold has now become just a pot. The 401k's are now 201k's. People are trying to figure out how to go forward. Let's go back and get some sense on how we got here and what the landscape looks like and what I think the future will look like.

By the way, I started writing this speech at 1 o'clock yesterday because everyone else was saying what I was going to say, so my friend Kerri helped me create this PowerPoint yesterday. I'm making two classic mistakes that every speaker should never make, and they are: number one, if you are not a morning person, you should never speak first thing in the morning, but I had to trade places with Dennis Gartman; and number two, you should never make a speech to your most important audience that you haven't made somewhere already. So we'll see how it goes, but you guys are all my closest friends, okay? So cut me some slack.

In the beginning there were banks, and the banks were without form or regulation. That lack of regulation begat panics. You had the panic of 1807, then the 1827 panic and Andrew Jackson got rid of the Bank of the US. Then you had the panic of 1873 and the panic of 1907 And over time, the powers that be, not wanting to have any more panics, created first the Federal Reserve and then the FDIC. After World War II, there were basically no more worries about bank deposits. The FDIC covered them, and we entered a new era of "stability." This did not repeal the business cycle and prevent recessions, but it did stop major bank runs and banking panics. We can clearly have financial crises, but they will be different than those of the Depression.

The Trend Is Your Friend Until the End of the Trend

Stability, though, as we were taught by Hyman Minsky, leads to instability. The more stable things become and the longer things are stable, the more unstable they will be when the crisis hits, because we human beings learned to trade and invest by dodging lions and chasing antelopes on the African savannah. We now chase momentum and dodge bear markets . We are hard-wired to look around at our circumstances and predict trends far into the future.

. We are hard-wired to look around at our circumstances and predict trends far into the future.

We take the current trend and we project it forever. But the one thing we know about trends is that they are eventually going to end. The trend is only your friend until it ends. Trends are notoriously fickle. That stability breeds instability. Calvin Coolidge said in early 1929 that "In the domestic field, there is tranquility and contentment and the highest record of prosperity in years." The trend ended. "Apres moi, le deluge."

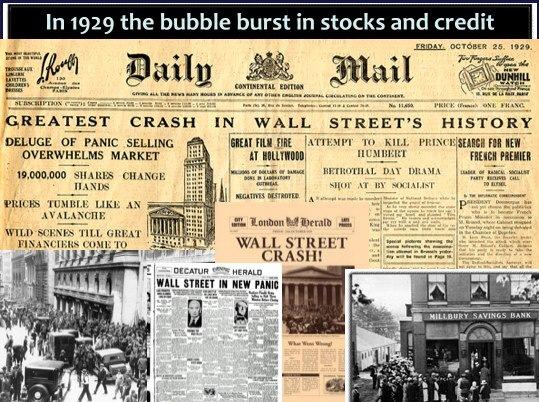

Now, so what happened in 1929, after this era of stability? The bubble burst and the stock market crashed.

crashed.

By the way, I thought one of the great headlines in the papers from those days was, "The deluge of panic selling overwhelms the market. 19 million shares changed hands." 19 million shares changing hands caused the crash in 1929! That's about a minute today. Okay, before the Great Depression, Coolidge was telling us, at the end of his presidency, that everything was cool, and then we got Hoovered. They tried to balance the budget, and they didn't really provide any stimulus. We got Smoot-Hawley. Given the massive implosion of capital and the closing of banks, there clearly was not enough growth in the money supply. Government and the Fed just did a lot of wrong things.

So at the height of the Depression, in 1933, as Roosevelt was coming into his first term, we had 25% total unemployment; 37% (!) of non-farm workers were unemployed; 4004 banks had failed; $3.6 billion in deposits was lost. That's like trillions in dog years, okay? At least in 2009 dog years. You end up with bread lines, and the stock market just keeps going down, down, down (with a few marvelous bear-market rallies – maybe like what we are seeing today?).

Roosevelt comes along and we get the New Deal. He applied massive stimulus. By the way, his stimulus hired people. He put them to work building parks and the Tennessee Valley Authority. They were building a lot of infrastructure. He didn't put it into Democratic wish lists and permanent wealth transfers and welfare and special-interest agendas to increase the overall budget beyond what we could ever hope to actually pay for (without even more radical tax increases), which the Obama Administration is clearly doing. We'll get to the effectiveness of current policies in a moment.

Then let's look at what he did in 1937. With the economy somewhat on the mend, he tried to balance the budget, raise taxes, reduce deficit spending. And what happened? We had another deep recession and unemployment jumped back up to 20%. It was hard to pull that stimulus back out. And it's particularly dangerous to raise taxes in a weak economy.

Most of the people in this room are old enough to remember the Blue Screen of Death. Remember, you would be typing along on your computer and all of a sudden you would get this screen, saying, "You have an impossible error." (Okay, what's an "impossible" error? Clearly something happened that was possible.)

And the only thing you could do was just unplug the thing. You couldn't even turn it off -- you just had to unplug the computer. It was the Blue Screen of Death. Well, that is kind of what World War II was for the world. We unplugged the world economy, and then we started from a new base. We hit the reset button. We were at lows everywhere in the world; places were in a mess. So we began to grow from there. The bebt supercycle started. For all the recessions and bear markets, a new stability ensued, and debt and leverage began to grow.

We'll revisit that point in a moment. We are doing just what I do in my regular e-letter: I'm going to take three or four ideas, and at the end I'm going to try and tie them all together. Let's see how successful I am.

What Is Money?

Let's talk about what money is. For some people it's M-1 or M-2, and they worry that the money supply is growing too much. For some people it's gold; gold is the only real currency. I think those ideas each have their place, and there's some truths to them, but they focus us on the wrong thing.

It's a bit misleading to talk about money supply, because what money really is is roughly $2 trillion of cash and then $50 trillion in credit. Because what do the banks do? They take deposits in and then they borrow money to leverage them up. I take my credit card and I spend with it. I borrow against a house. I have an asset that rises, and I borrow against it.

We have two trillion dollars of actual cash propping up $50 trillion in credit. If we all decided to settle and pay off everything, we couldn't do it because there is not enough cash. There would be massive asset deflation. We, as a nation, are levered 25 to 1, or we were. Now, that $50 trillion is in a real sense the money supply because that is what we are all pretending is real money. I lend you money and you pretend you are going to pay me back. Then you pretend he [pointing at another attendee] is not going to call your debt for cash, and we are all going to keep the system going. Because if we all try to pay each other back at once, we are all collectively -- and this is a technical economic term -- screwed.

So we keep the system going. Now, where are we today? We are at the Great Deleveraging. We are seeing massive losses and destruction of assets, on a scale that is unprecedented. There was massive destruction of assets during the Great Depression, which caused a lot of problems, and we are seeing the same thing today. We are watching trillions simply being poofed (another technical economics term – which will drive my poor Chinese translator crazy!). We are watching people pay down their credit lines, which is one way of saying the supply of money and credit is shrinking.

This is not just in the US, but all over the world. Because when you start adding European cash-to-credit, and Japanese cash-to-credit, and Indonesian and Chinese cash-to-credit, it becomes multiple tens of trillions, and we are watching a goodly portion of that credit be vaporized. So we -- individuals and businesses -- are trying to find that $2 trillion in real cash and get some of it to pay down our debts. We are reducing that massive leveraged money supply down to some smaller number. We are hitting the Blue Screen of Death. We don't know what it is going to reset to, but we have permanently seared the psyche of the American consumer, and it is going to get reset to some lower number, about which I will speculate in a minute.

Now to give you some idea of how important credit was in our recent period of economic growth – and I keep using this slide, but it is an important slide because it shows you what would have happened in the economy without mortgage equity withdrawals. The red lines are what GDP would have been without MEWs. Notice that in 2001 and 2002 we would have had negative GDP for two years, that's 24 months. It would have been as long as or longer than the current recession. Not quite as deep, because we had the Bush stimulus and Bush tax cuts at the time. The Bush tax cuts were very important in keeping the economy rolling over in 2001 and 2002.

But notice that the recovery for the next four years would have been under 1%. We would have had under 1% GDP for four years running, without mortgage equity withdrawals, without people being able to spend more. That doesn't even count the leverage we increased on our auto loans, on credit cards -- you saw the two charts that Louie [Gave] and Martin [Barnes] used yesterday about the growth of credit, and we are now seeing it in reverse. Do you think George Bush would have stood even a small chance of being reelected without mortgage equity withdrawals?

Quarter 1-2006 we had $223 billion in mortgage equity withdrawals. Quarter 2-2008 it was $9.5 billion. Is it any wonder we were in recession by 2008? By the third and fourth quarters there was no money to keep the treadmill going That $50 trillion in credit was shrinking fast. We were imploding it. Further -- just as a little throwaway slide -- if you look at 2010 and 2011, we are getting ready for another huge wave of mortgage resets.

Now, we've gone through the last wave and we saw what happened; it created a lot of foreclosures. We are not out of the woods yet. It is going to be 2012 before we sell enough houses to really get back to reasonable levels, because we had 3.5 million excess homes at the top. We absorb about a million a year, it takes 3 years, that's kind of the math.

[Skipping some attempts at humor that you had to be there to get] ... By the way, this AIG thing and the bonuses, that's so bogus. I mean, the 40 people that created the problem were gone, they go to 40 other people and say, stick around because we've got to have somebody who actually knows what these things are to try and unwind it, and we'll give you a bonus. Some of them worked for a dollar against getting that bonus, and now we've told the world that a contract isn't a contract in the US of A, for a lousy 160 million dollars. No bank is going to want to play with the US again, because you don't want to be hauled up in front of Barney Frank.

MV=PQ

Okay, when you become a central banker, you are taken into a back room and they do a DNA change on you. You are henceforth and forever physically incapable of allowing deflation on your watch. It becomes the first and foremost thought on your mind: "Deflation, we can't have it." So let's move along to the next point, and then I'm going to tie them all together.

MV=PQ. This is an important equation; this is right up there with E=MC2. M (money or the supply of money) times V (velocity, which is how fast the money goes through the system -- if you have seven kids it goes faster than if you have one) is equal to P (the price of money in terms of inflation or deflation) times Q (which roughly stands for the quantity of production, or GDP)

So what happens is, if we increase the supply of money and velocity stays the same, if GDP does not grow, it means we'll have inflation, because this equation must balance. But if you reduce velocity (which is happening today), and if you don't increase the supply of money, you are going to see deflation. Now, we are watching, for reasons we'll get into in a minute, the velocity of money slow. People are getting nervous, they are not borrowing as much, either because they can't or because the "animal spirits" that Keynes talked about are not quite there.

To fight that deflation (which we saw in this week's Producer and Consumer Price Indexes) the Fed is going to print money. A few thoughts. The Fed has announced they intend to print $300 billion. That is different from buying mortgages and securitized credit card debt -- that money (credit) already exists.

When they just print the money and buy Treasuries, like the $300 billion announced, they can sop that up pretty easily if they find themselves facing inflation down the road. But that problem is a long way off.

But sports fans, $300 billion is just a down payment on the "quantitative easing" they will eventually need to do. They can't announce what they are really going to do or the market would throw up. But we are going to get quarterly or semi-annual announcements, saying, we are going to do another $300 billion, another $500 billion.

When we first started out with TALF and everything, it was a couple hundred billion here and there, and now we throw the word trillions around and it just drips off of our tongues and we don't even think about it. A trillion is a lot. It's a big number. And the total guarantees and back-ups and all this stuff we are into -- I saw an estimate of $10-12 trillion. That's a lot of money.

Understand, the Fed is going to keep pumping money until we get inflation. You can count on it. I don't know what that number is, I'm guessing $2 trillion. I've seen some studies. Ray Dalio of Bridgewater thinks it's about $1.5 trillion. It's some big number, some number way beyond $300 billion, and they are going to keep at it until we get inflation.

Side point: what happens if the $300 billion they put in the system comes back to the Fed's books because banks don't put it into the LIBOR market because they are worried about credit risks? If that happens, it does absolutely nothing for the money supply. Okay? It's like, goes here, goes back there -- it doesn't help us. If the Fed creates money which is simply deposited back with the Fed, then there is effectively no money creation. We are still faced with deflation. The Fed has got to somehow get it into the financial system. They've got to figure out how to create some movement.

Will it create an asset bubble in stocks again? I don't know, it could. Dennis [Gartman] talked about being nervous yesterday. I would be nervous about stock markets, both on the long side, as I think we are in a bear market rally, but also there is real risk in being short. Bill Fleckenstein will be here tonight. He is a very famous short trader. He closed a short fund a couple of months ago. He says he doesn't have as many good opportunities, and basically he's scared of being short with so much stimulus coming in. So it's going to work, at least in terms of reflation, but the question is when. A year? Two years?

(This is about as good a break point as I can find in the speech, so we will end here and take it up again next week.)

One note from today's data on deflation. The headline in the Wall Street Journal says China grew at 6.1% last quarter. That doesn't sound bad. But what was not in the story is that nominal growth was just 3.7%. The other 2.4% was because of deflation. To get real (after-inflation) growth you subtract inflation and/or add deflation. Growth in China is slowing down more than the headlines suggest.

Newport Beach, Orlando, and Home

I am writing this somewhere over Canada as I fly back from London. I always try and stay up on the way back so I can get on local time quickly, although I did not get enough sleep this trip. I will need to catch up this weekend. It will be good to be home.

This Thursday Tiffani and I leave for Newport Beach to attend Rob Arnott's annual conference. Each spring Research Affiliates brings together a rather special group of analysts and money managers to work through current economic issues. Harry Markowitz, Burton Malkiel, Mohammed El-Erian, Paul McCulley, and Peter Bernstein are just a few of the luminaries who will be there. I think Rob invites me for comic relief. And just like Jeremiah, he always serves some mighty fine wine (a few of you will get that).

Sunday I get back and then leave Monday to go Orlando to speak at the national Chartered Financial Analysts conference. My assigned topic will be the "state of the union" for alternative investments. If you are attending, you might want to drop into the session, as it will be at the very least provocative and for a few people rather controversial. I think the whole industry is at a crossroads, and we are going to see some real changes in the coming years.

And then? I am home for awhile. I told my London partner Niels Jensen that I would show up for his 50th birthday party in mid-July, and maybe try to take a vacation then. And Amanda gets married in Tulsa in August. And of course the annual Maine fishing trip in early August. Oh, and Freedom Fest is penciled in for July 11, in Vegas. But not much travel in May and June, at least not yet.

Copenhagen and London were a whirlwind this week. I ended up getting asked to do CNBC Europe for about 30 minutes on a wide range of topics. I really like their Squawkbox crew. And it was good to spend time with the team at Absolute Return Partners. We had some very thought-provoking client meetings.

There is a lot of change getting ready to happen in my business, and I am grateful that it all seems to be for the good. I will be making a few announcements over the next few months that I am quite excited about. There are a lot of people in the finance world (and the world in general) that are really struggling, and I appreciate the support of my clients, my partners, and you, gentle reader. You are why I write this letter. Well, maybe you and my one million other closest friends -- but we both know it is really for you.

It's time to hit the send button, get my bags, drive home, get a good meal, and find my own bed. Have a great week!

Your happy to be home analyst,

John Mauldin

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.