European Economic Meltdown Triggers Infighting at European Central Bank

Economics / Euro-Zone Apr 17, 2009 - 02:31 AM GMTBy: Mike_Shedlock

The European economy is in a shambles and the European Central Bank is clearly worried. Although there is a bit of infighting among the central bank governing board, Trichet Says ECB Must Do Everything to Restore Confidence.

The European economy is in a shambles and the European Central Bank is clearly worried. Although there is a bit of infighting among the central bank governing board, Trichet Says ECB Must Do Everything to Restore Confidence.

European Central Bank President Jean-Claude Trichet said the central bank would do everything possible to restore confidence and prosperity.

“Public authorities, executive branches, and central banks must do all they can to restore, preserve and foster confidence among households and corporations in order to pave the way for sustainable prosperity,” Trichet said in a speech in Tokyo today. “This calls for a measured response to changing conditions.”

The ECB’s 22-member Governing Council is divided over not only how low to cut borrowing costs but also whether to adopt unconventional monetary policy tools such as the purchase of debt assets to help revive its ailing 16-nation economy. The bank this month cut its benchmark less than economists had forecast, by a quarter point to 1.25 percent, and delayed a decision on new policy tools until its next meeting in May.

“As regards the possible further additional non-standard measures, I have been very clear,” Trichet said. “We will decide” at the next policy meeting, he said.

“It is important not to create or encourage expectations” about what will be decided at that meeting, Trichet said. “Be sure that what we will decide will fully take into account the financing structure of the euro area economy and will be fully in line with our medium-term strategy.”

While Trichet has signaled a quarter-point cut is likely, Germany’s Axel Weber said on April 15 he’s against taking the benchmark rate below 1 percent and would prefer not to buy corporate debt.

By contrast, council members George Provopoulos from Greece and Athanasios Orphanides of Cyprus have both indicated they may support cutting the key rate below 1 percent and purchasing debt securities to fight the risk of deflation.

Trichet said it was difficult to describe the euro as weak after its 6.2 percent drop against the dollar this year. When the euro was introduced, it was 1.17 to the dollar, now it’s about 1.31 so “to speak of a euro that is weak doesn’t reflect the present situation,” Trichet said.

Trichet said he agreed with the strong-dollar policy of the U.S. government.

Trichet Agrees With US Strong Dollar Policy

Excuse me but exactly what strong dollar policy is that? The US strong dollar policy consisted entirely of Paulson yapping about it. Perhaps Trichet did not notice, but Paulson is gone and Geithner is in.

Geithner does not seem to be worried about the dollar. Instead, Geithner has his hands full carrying the torch for the "Strong Goldman Policy" started under Paulson.

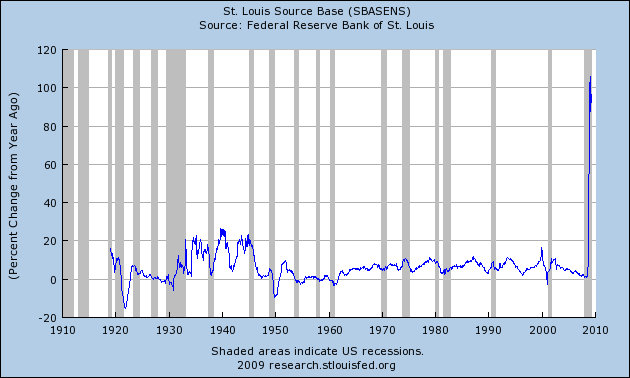

Please consider the following chart.

Base Money Supply % Change From A Year Ago

chart courtesy of St. Louis Fed

That certainly is not a strong dollar policy.

Trichet To Duplicate Paulson's "Strong Dollar Policy"

Does Trichet's dollar yapping signal he is about to institute a similar Strong Euro Policy?

I think so. Here's the clue: “To speak of a euro that is weak doesn’t reflect the present situation” Trichet said.

Trichet Worried About Deflation

Trichet is clearly worried about deflation. There is no other logical interpretation to his statement about fostering confidence: “Public authorities, executive branches, and central banks must do all they can to restore, preserve and foster confidence..."

Competitive currency debasement and beggar-thy-neighbour policies are spreading fast. Trichet has just signaled the ECB is a willing partner.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.