Sector Rotation Investing Strategy for Beating the Recession

Stock-Markets / Sector Analysis Apr 16, 2009 - 03:51 PM GMTBy: Hans_Wagner

Sector rotation is a proven strategy to beat the market. When the current economic recession ends marking the beginning of a new bull market, it will be time to enjoy benefits of a properly positioned portfolio. An analysis of the affect of the recession on each industry in the sector rotation model will create opportunities for investors.

Sector rotation is a proven strategy to beat the market. When the current economic recession ends marking the beginning of a new bull market, it will be time to enjoy benefits of a properly positioned portfolio. An analysis of the affect of the recession on each industry in the sector rotation model will create opportunities for investors.

Stovall Sector Rotation Model

Sam Stovall of Standard & Poor’s describes a sector rotation model that assumes the economy follows a well-defined economic cycle as defined by the National Bureau of Economic Research (NBER). His theory asserts that different industry sectors perform better at various stages of the business cycle. The nine Standard & Poor’s industry sectors are matched to each stage of the economic cycle. Each industry sector follows their cycle as dictated by the stage of the economy. Investors should buy into the next sector that is about to experience a move up. When an industry sector reaches the peak of their move as defined the business cycle, they should start to sell the sector. Using the sector rotation model, an investor may be invested in several different sectors at the same time as they rotate from one sector to another as dictated by the stage of the business cycle.

Sam Stovall's Sector Investing, 1996 states that different sectors are stronger at different points along the business cycle. Be forewarned, this is a very expensive book, however it is worthwhile, as it is the best explanation of sector rotation strategy and model. The table below describes this theoretical sector rotation model throughout the business cycle.

| Stage: Consumer Expectations: Industrial Production: Interest Rates: Yield Curve: |

Full Recession |

Early Recovery |

Full Recovery |

Early Recession |

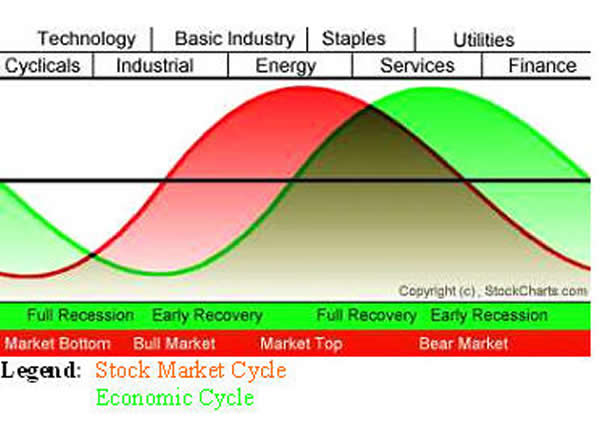

The graph below, courtesy of StockCharts.com, shows these relationships and the order the key sectors respond to the business cycle. The Stock Market Cycle precedes the Economic Cycle as investors try to anticipate how the market will react to the changes to the economy.

Sector Rotation Model

Investors beat the market when they are in the right sector at the right time. The problem is deciding when to make the transition to a sector that has greater potential. Moving one's capital to a new sector too early will result in weak performance at best with losses more likely. On the other hand, if one is late getting into the sector you miss much of the uptrend and miss most of the profit opportunity.

One of the key elements of the sector rotation strategy is to hold shares in more than one sector. The idea is to buy into the sector that is rising toward the top and then hold it until it turns down. As a sector turns down an investor rotates their money to the next sector that is rising toward the top and is expected to outperform. This strategy often means an investor will be holding a minimum of three sectors in their portfolio; one sector on the rise, one at the top and one that is starting to decline.

A sector rotation strategy can produce excellent opportunities, if you follow a sector rotation model that reflects the current economic and industry situation. Each business cycle tends to have different affects on specific industry groups. Each recession and bear market tends to have a more significant affect on one or two industries. The impact on these industries can be enough to cause them to lag behind during the following economic recovery. Moreover, a new economic quandary causes industry sectors to react in new and different ways. As a result, the rotation of the sectors in the model may not play out as depicted.

Current Sector Rotation Analysis

In anticipation of a recovery in the economy, it is appropriate to perform an analysis of the sector rotation model in light of the current recession. According to the sector rotation model, the technology sector is one of the first sectors to recover from a recession and bear market. However, following the dot.com bust of 2000, many companies in the technology sector failed to rebound as quickly as indicated by the model. The impact of the bear market on the technology sector was extensive. Many companies disappeared completely. Others struggled to survive. Eventually a number of the technology companies began to thrive, however it took several years before doing so. Those investors that followed the standard sector rotation model were disappointed when they realized that the sector did not perform, as the sector rotation model would indicate.

This raises the question – What sectors will be the best performers when the bear market that began in December 2007 finally ends? The place to begin to answer this question is to analyze the affect of the current recession on the sector rotation model.

The table below is a high-level analysis of the nine S&P 500 sectors as the might perform once the current bear market is over. A recession affects the business model of a company, some positively, some negatively. In addition, recessions can harm the financial strength of companies as they struggle to survive. Finally, government actions can cause changes in the way companies operate within the sector. Some of these government actions are attempts to help the economy recover. Other government actions are the result of new policies by the current administration. These policies may not be directly from the recession, yet they can have a significant influence on the industry.

Sector |

Changed Business Model due to Recession |

Financial Strength |

Government Influence |

Summary Affect |

| Consumer Discretionary | Partial due to affect of de-leveraging of households. Companies catering to the wealthiest individuals may also see an impact as compensation returns to more natural levels. | Curtailed in the near future. Cannot count on expanding credit to fund spending. | Attempts to stimulate spending may not have the desired affect as consumers shore up their savings and reduce debt. | Slightly negative. Likely to hinder response of the sector to recovery of the economy. |

| Technology | Minor change due to lower spending by consumers. | Many companies are financially strong with significant amounts of cash on their balance sheets. | Might see some positive influence from higher investment in energy efficiency and other government-funded programs. | Positive. Sector is well positioned to take advantage of the economic recovery. |

| Industrial | Could be significant depending on the sub-sector and company. Some companies are likely to recover stronger, while others will be weaker and some will not survive. | Varies by sub-sector and company. Some firms have the significant financial strength, while others are very weak (autos). | Not significant, unless the company received government bailout money. Longer term, some firms could be affected by the move to greener energy. Some of the stimulus money will have positive affect on the engineering and construction firms. | Mostly neutral, though some sub-sectors and companies are and will feel dramatic positive and negative affects. |

| Materials | Minor affect. While the sector is experiencing losses, this is normal during a recession. | The large firms are well positioned and are likely to benefit, as new sources of minerals are not coming online, limiting supply. | Not likely to see much change. Longer term the issues with carbon emission could be more of a problem. | Neutral to positive. Lack of investment in new sources of minerals and materials is likely to result in higher prices and profits. |

| Energy | Recession is having minimal affect on the sector. Move to new energy could be more significant eventually. | Strong. Cash flows remain very positive and a recovery of the economy will drive up prices and profits. | None from the recession. However, could be significant as the movement to green energy heats up. Should prices rise to high, we could see new government initiatives. | Positive from the recession. Sector is likely to do well though the green initiatives could become a problem. If prices climb to high, we could see negative consequences as well. |

| Consumer Staples | No significant change. | Companies remain financially strong. | Minor changes. | Neutral. |

| Health Care | New investment and new regulations will have a dramatic long term affect. Insurance will see the biggest impact. Big pharmaceuticals will also see some negative impact. Bio-technology is likely to see a positive impact from investment in new ways to fight disease. | Neutral. Most firms have the financial strength to recover. Moreover, if everyone can receive coverage for healthcare there should be a large increase in the overall revenues to many firms. | Significant. Government will be much more involved in paying for healthcare and changes to regulations. | Some positive and some negative. |

| Utilities | Movement to lower carbon emissions model will negatively affect many companies, while raising costs. | Relatively strong as many are regulated firms. | Expect carbon emission standards to become reality. | Negative. |

| Finance | Significant affect on ability to lend with a return to the more strict lending rules. | Weakened significantly, as governments have had to step in to prop up many of the larger institutions. Paying back these “loans’ will take time and cost the companies for years. | Expect more government oversight and rules | Strongly negative. Some banks that have been able to avoid the affect of the toxic assets will do well. |

Overall, we should expect to see important differences in the way sectors and companies respond to a recovery from the recession and the bear market. The massive de-leveraging process will influence any expansion in consumer spending. Those sectors and companies that depend on the consumer will struggle, as they save more and lower their debt. The technology sector should do well in the recovery. The consumer discretionary, a cyclical industry, should recover, though the affects of restrained consumer spending is likely to restrain their resurgence. The materials and energy sectors should also do well. The industrial sector will have a mixed recovery, depending on the sub-sector and individual companies.

The financial sector will experience long-term difficulties as it recovers from the affects of the massive losses and new government regulation. Healthcare will see significant changes that will have positive and negative affects, depending on the sub-sector. Utilities will continue to feel the affects of the reduction in carbon emissions and the investments necessary to create a new energy environment. Consumer staples will continue to operate as before.

The Bottom Line

Your sector rotation strategy depends on your analysis of the affects of the current recession on each sector. This analysis of each sector’s rotation provides you a more informed investing strategy. Adjusting your sector rotation strategy to reflect the current analysis of the affects of the most recent recession will help to position your portfolio to benefit the most from the new bull market.

By Hans Wagner

tradingonlinemarkets.com

My Name is Hans Wagner and as a long time investor, I was fortunate to retire at 55. I believe you can employ simple investment principles to find and evaluate companies before committing one's hard earned money. Recently, after my children and their friends graduated from college, I found my self helping them to learn about the stock market and investing in stocks. As a result I created a website that provides a growing set of information on many investing topics along with sample portfolios that consistently beat the market at http://www.tradingonlinemarkets.com/

Copyright © 2009 Hans Wagner

Hans Wagner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.