Economic Deflation Goes Global

Economics / Deflation Apr 16, 2009 - 01:30 PM GMTBy: Mike_Shedlock

Deflation properly defined is a net decrease in the money supply and credit, with credit being marked to market. Deflation by that measure went global long ago.

Deflation properly defined is a net decrease in the money supply and credit, with credit being marked to market. Deflation by that measure went global long ago.

This post however, is in reference to sustained price drops widely (and incorrectly) referred to as deflation.

Japan wholesale prices log fastest drop since 2002

In Japan wholesale prices log fastest drop since 2002.

Japanese wholesale prices fell at their fastest annual pace in nearly seven years last month, official data showed Monday, adding to worries about the renewed threat of deflation.

Corporate goods prices fell by 2.2 percent in March from a year earlier, down for a third straight month, the Bank of Japan reported. It was the steepest year-on-year drop since May 2002 and followed declines of 1.6 percent in February and 0.7 percent in January.

"Companies are in tough competition to cut prices due to weak consumer sentiment," said Hideyuki Araki, economist at the Resona Research Institute. "Consumers are now worried about their jobs or pay cuts. It's natural that they want cheaper goods," he said.German wholesale prices see record decline in 22 years

In Germany wholesale prices see record decline in 22 years.

Wholesale prices in Germany dropped 8.0 percent in March compared with the same month last year, the biggest year-on-year decline since January 1987, the German Federal Statistical Office said Wednesday.

Compared to February, however, wholesale prices declined 0.9 percent, said the Wiesbaden-based statistics office.

Crude oil prices have retreated 66 percent from a record 147 U.S. dollars per barrel in July 2008. As a result, solid fuels and petroleum products were 21.4 percent cheaper in March than a year earlier, the statistical office said.

Prices of grain, seeds and feed declined 42.6 percent in the past 12 months.

Statistics show that Germany's inflation has fallen to its lowest level in almost 10 years, as the global financial crisis has dragged the European Union's biggest economy into its worst recession since World War II.

European Central Bank (ECB) council member Athanasios Orphanides told local media a day earlier that the risk of deflation may push further monetary easing.Chinese CPI, PPI Negative

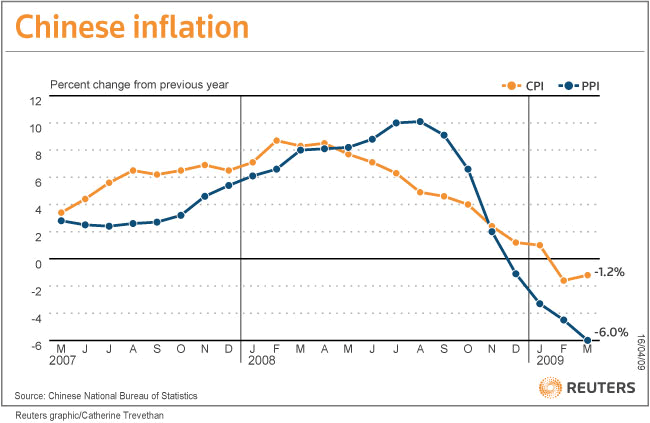

Please consider the following chart of Chinese Inflation.

US CPI In First Year-Over-Year Decline Since 1955

In the US the CPI is in First 12-Month Decline Since 1955.

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in March, before seasonal adjustment, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The index has decreased 0.4 percent over the last year, the first 12 month decline since August 1955.

On a seasonally adjusted basis, the CPI-U decreased 0.1 percent in March after rising 0.4 percent in February. The decrease was due to a downturn in the energy index, which declined 3.0 percent in March after rising 3.3 percent the previous month. All the energy indexes decreased, particularly the indexes for fuel oil, natural gas, and motor fuel. The food index declined 0.1 percent for the second straight month to virtually the same level as October 2008. The food at home index declined 0.4 percent, the second straight such decrease, as the index for dairy and related products continued to decline.US Produce Price Index (PPI) Biggest Drop In 59 Years

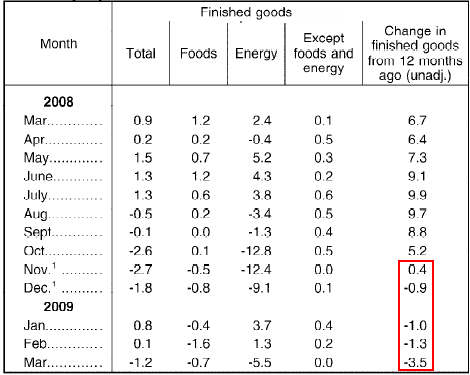

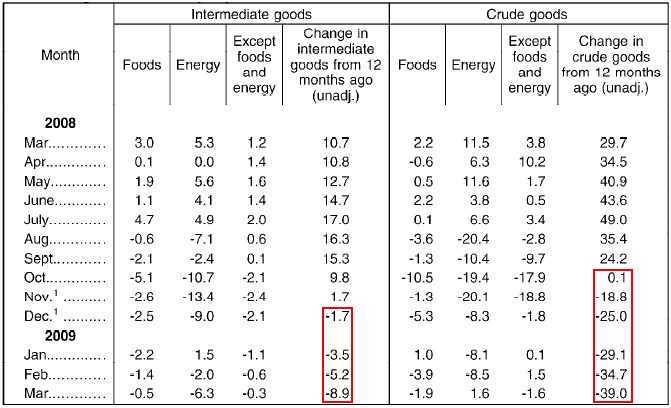

Inquiring minds are looking at Producer Price Indexes March 2009.

Finished Goods PPI

Intermediate and Crude Goods PPI

Notes from David Rosenberg at Merrill Lynch

Spare Capacity

"There seems to be a lot of market chatter today about how the dramatic fiscal and monetary stimulus is going to reignite inflation. Let's get a grip. We have a real unemployment rate of nearly 16% and a capacity utilization rate that looks about to decline to 65%. There is simply too much spare capacity to absorb to be concerned about what the government is going to do except prevent an outright deflationary environment from taking hold."

Deflation in headline to intensify going forward

"Relative to year-ago levels, overall [Consumer] prices fell by 0.4%, for the first dip into deflationary territory since August 1955. Looking ahead, easy energy comparisons versus a year-ago will be a key factor in leading the overall CPI lower in the months ahead. Food prices, eased to 4.4% Y/Y versus a peak of 6.1% Y/Y in October 2008, will also be a factor. By 3Q, we anticipate annual declines of 2.5%. Core prices were unchanged at 1.8% Y/Y in March, though down from the nearby peak of 2.5% in August 2008. By 3Q, the core CPI is also expected to ease toward 1.0%, with depressed demand and more competitive pricing for a broad array of consumer categories as tailwinds.

Underlying weakness in core CPI

"Owners’ equivalent rent – a category that accounts for 31% of the core CPI) – rose 0.2% M/M, in part due to falling natural gas prices, which have an inverse relationship to rent prices."OER Grossly Distorts The CPI

"Owners' Equivalent Rent" (OER) is the largest component in the government measure of the Consumer Price Index (CPI).

OER is a process in which the BEA estimates what it would cost if owners were to rent the homes they own from themselves. OER is not a valid pricing barometer.

By ignoring housing prices, CPI massively understated inflation for years. The CPI is massively overstating inflation now.

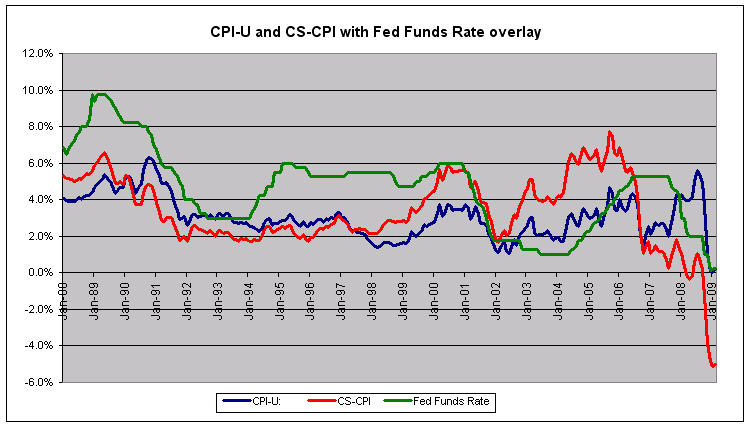

The following chart shows the effect if one substitutes the Case-Shiller housing index for Owners' Equivalent Rent in the CPI.

Case-Shiller-CPI (CS-CPI) vs. CPI-U

Please see CS-CPI Negative 5.0% Third Straight Month for details about CS-CPI, a more realistic measure of consumer prices than the widely reported CPI.

Deflation has set in. It is now unmistakable by many measures, not just in the US but globally.

Bernanke's Deflation Preventing Scorecard

In case you missed it, here is Bernanke's Deflation Preventing Scorecard.

Bernanke is under the misguided notion that Fed policies in the 30's caused the Great Depression. Bernanke is wrong. Yes, the Fed (and government) policies in the 30's made the situation worse, but that was not the cause as Bernanke thinks.

Lessons From History

Students of the Great Depression are investigation lessons from history such as the Smoot Hawley Tariff Act.

The Smoot-Hawley Tariff Act was signed into law on June 17, 1930, and raised U.S. tariffs on over 20,000 imported goods to record levels, and, in the opinion of most economists, worsened the Great Depression. Many countries retaliated, and American exports and imports plunged by more than half. The tariff was replaced by lower bilateral agreements in the mid 1930s.

The cause of the great depression is simple: There was a massive runup in credit, margin, leverage and speculation in the late 1920's. Does that sound familiar? It should. The Smoot Hawley Tariff Act made the great depression worse but it did not cause it as some believe.

Nor did the Fed's so-called tight-money policies in the 30's cause the Great Depression although Fed actions certainly made the situation worse. So did many Roosevelt New Deal policies such as the Illegal Agricultural Adjustment Act, and the illegal confiscation of gold.

Six million piglets and 220,000 pregnant cows were slaughtered in the AAA's effort to raise livestock prices. Many cotton farmers plowed under a quarter of their crop in accordance with the AAA's plans.

The tax underwriting the AAA was declared unconstitutional by the Supreme Court in the case United States v. Butler, because, among other stated reasons, it taxed one farmer in order to pay another. Farm leaders supported the Butler decision.Numerous policy decisions made the Great Depression worse and sadly those policy decisions are frequently cited as the cause.

Close analysis by any careful student of history would conclude the cause of the Great Depression was the massive runup in credit that preceded it, and that horrible policy decisions only made matters worse. And it is axiomatic that the cause of a problem and the solution to the problem cannot be the same. Thus, Bernanke's and Geithner's attempts to get banks to lend and consumers to spend cannot possibly be the cure to anything.

The Geithner-Obama-Bernanke policy track trifecta the US is on takes scarce resources (taxpayer dollars) and wastes them on the very banks and lending institutions that exacerbated the problem with foolish lending practices. This extremely poor policy decision is the modern day equivalent of Roosevelt's illegal Agricultural Adjustment Act. The big difference is the massive size and scale of the plan.

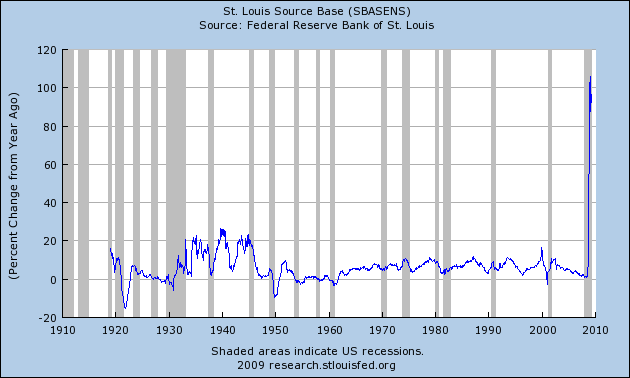

Base Money Supply % Change From A Year Ago

chart courtesy of St. Louis Fed

This expansion of money to bailout banks is not going to cause hyperinflation or even strong inflation for reasons outlined in Fiat World Mathematical Model. However, these foolish actions cannot possibly do anything good for the majority of taxpayers. All it can do is prolong the recession (depression) and increase national debt just as happened with Japan's deflation fighting efforts.

Nonetheless, in a sense, Geithner's Plan Can Succeed as long as one understand how success is defined. Success in this case being the bailout of banks, Goldman Sachs, PIMCO, and other financial institutions at the expense of everyone else.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.