Fed Monetization of Debt as U.S. Dollar Flows to Central Banks Collapses

Economics / Quantitative Easing Apr 14, 2009 - 10:25 AM GMTBy: Ned_W_Schmidt

Grand and glorious global housing bubble came to an end not because it had caused so much money to be borrowed. It came to an end because no more money could be borrowed. Debt bubbles come to traumatic conclusions not because so much credit had been created. Debt bubbles implode when no more credit is available. Lack of credit, the fuel for a mania, is what comes to be the problem.

Grand and glorious global housing bubble came to an end not because it had caused so much money to be borrowed. It came to an end because no more money could be borrowed. Debt bubbles come to traumatic conclusions not because so much credit had been created. Debt bubbles implode when no more credit is available. Lack of credit, the fuel for a mania, is what comes to be the problem.

Governments do not, perhaps regrettably, come to an end. They are, though, periodically brought to their knees by debt. The Spanish monarchy went "bankrupt" more than once from over spending and debts. Argentine governments simply decided it did not wish to repay its borrowings. U.S. government is headed in that direction.

U.S. government continues to borrow as if world were a limitless credit card. Obama Regime, with a Peronist style populism, believes spending is key to political power. No regard is given to financial foot print of that spending, or from where the money might come. Obama Regime does not apparently consider, nor care, of economic repercussions of deficit spending. With a deficit of more than two trillion dollars in the coming year, the Obama Regime has no choice, as we will see below, to resort to monetization for financing most of the forthcoming avalanche of U.S. debt.

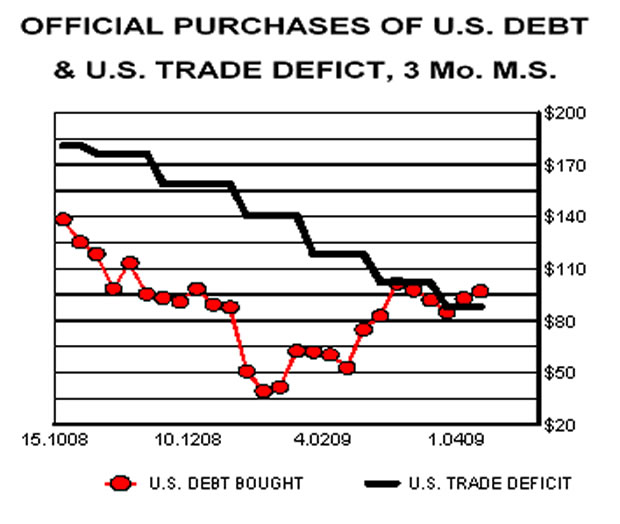

Our first chart, below, shows that Obama Regime will have little choice but to resort to debt monetization. Regrettably, the Federal Reserve will acquiesce to that necessity. This graph portrays how the "free" money from global central banks is about to be turned off. Already, the Associated Press(11 April 2007) is reporting that China, for example, has less money available to finance the Obama Regime's spending spree,

"China's central bank said Saturday that its foreign exchange reserves rose 16 percent year-on-year to $1.9537 trillion by the end of March. China's reserves, already the world's largest, increased by $7.7 billion in the first quarter - $146.2 billion less than the same period last year, the People's Bank of China said..."[Emphasis added.]

For more than a decade, the U.S. government has relied on gullible central banks to finance both economic prosperity and political power. That happened by foreign central banks recycling the foreign trade deficit of the U.S. That recycling of money may be coming to an end.

In that first graph, the black line is three month moving sum of the U.S. trade deficit. That massive spending spree has been near halted by the collapse of the housing bubble. U.S. consumers can no longer spend with abandon on foreign goods to fill their four bedroom mansions. The end of that spending spree means the flow of dollars to foreign central banks is collapsing.

But, that recycling of money was used to finance the U.S. government. The red line in that chart plots the three-month sum of purchases of U.S. debt by those gullible central banks. Early in the chart, the surplus of dollars, the U.S. trade deficit, more than covered the purchases of U.S. debt by foreign central banks. That situation no longer exists. With the U.S. trade deficit collapsing due to the Obama Depression, the supply of dollars going to foreign central banks no longer exceeds their purchases of U.S. debt by foreign central banks.

Foreign central banks can not continue to purchase U.S. debt at current rates as they do not have the flow of dollars to do so. The New York Times reports(12 April 2009) in "China Slows Purchases of U.S. and Other Bonds,"

"Reversing its role as the world's fastest-growing buyer of United States Treasuries and other foreign bonds, the Chinese government actually sold bonds heavily in January and February before resuming purchases in March, according to data released during the weekend by China's central bank."

"China's foreign reserves grew in the first quarter of this year at the slowest pace in nearly eight years, edging up $7.7 billion, compared with a record increase of $153.9 billion in the same quarter last year."

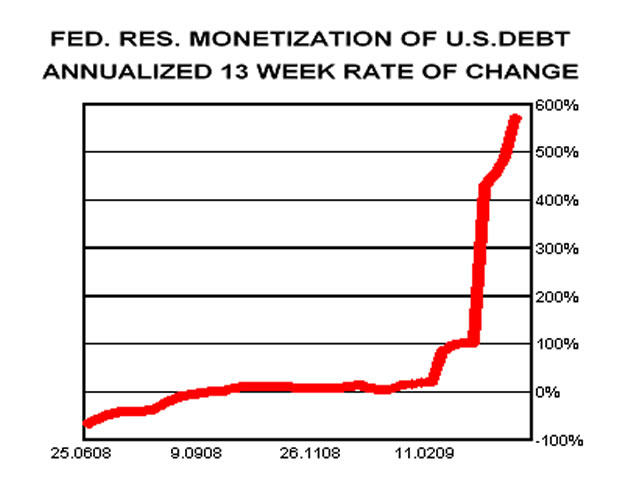

With no choice but to resort to debt monetization as a result of the inability of foreign central banks to continue financing unlimited U.S. deficit spending, the Obama Regime has forced the Federal Reserve to unleash a money tsunami. In the final chart on the previous page is portrayed the 13-week rate of change of the Federal Reserve's holdings of U.S. debt. Never, ever, has a major central bank pursued such irresponsible monetary policy. To believe that this level of debt monetization will continue without repercussions is both naive and ridiculous.

First ramification of such a rate of debt monetization is to flood the paper asset markets with money. Such is the reason the U.S. paper equity markets have rallied in recent weeks. The second round effect will be felt in the market for dollars and Gold. Near unlimited pouring forth of dollars can only ultimately send the value of the dollar lower. Next step after that can only be a higher a price for $Gold. With investor attention turned to fantasies over bank earnings, $Gold's price dipped. As a consequence, our intermediate indicator gave another buy signal on Gold on Monday. Investors, desiring to protect their wealth from Federal Reserve debt monetization and Obama Regime's wealth confiscation, should be adding to Gold holdings on current price weakness.

By Ned W Schmidt CFA, CEBS

Copyright © 2009 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to http://home.att.net/~nwschmidt/Order_Gold_GETVVGR.html

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.