Is Copper Poised for a Sustainable Secular Bull Market?

Commodities /

Metals & Mining

Apr 14, 2009 - 09:17 AM GMT

By: Guy_Lerner

Over the last 4 months, copper has bounced about 70% from its lows. Yet it is only recently that such a significant price move is beginning to attract attention as pundits try to explain what is going on. With stocks roaring back over the past 5 weeks, the obvious (and wrong) connection is that the global recession is ending. To me, copper's price rise is more technical after a deeply oversold condition, and it appears that the pundits are only crafting a good story to explain its recent price movements.

Over the last 4 months, copper has bounced about 70% from its lows. Yet it is only recently that such a significant price move is beginning to attract attention as pundits try to explain what is going on. With stocks roaring back over the past 5 weeks, the obvious (and wrong) connection is that the global recession is ending. To me, copper's price rise is more technical after a deeply oversold condition, and it appears that the pundits are only crafting a good story to explain its recent price movements.

It is often stated that copper is more like Dr. Copper, the base metal with a PH. D. in economics. If copper, which is used in commercial and residential building, electronics and automobiles, is surging, then all must be right in the world and in the economy too. Copper knows all (sic). But there appears to be a disconnect from reality as strength in copper generally occurs late in the economic cycle, and there is little or no relationship between price rises in copper and the beginning of a new economic cycle.

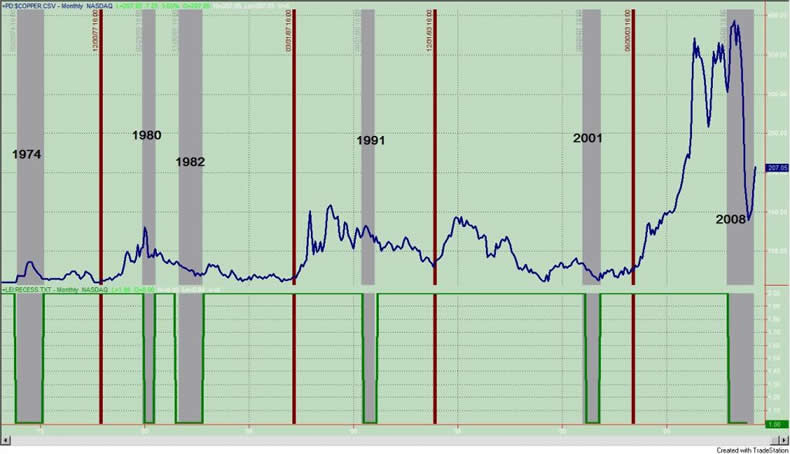

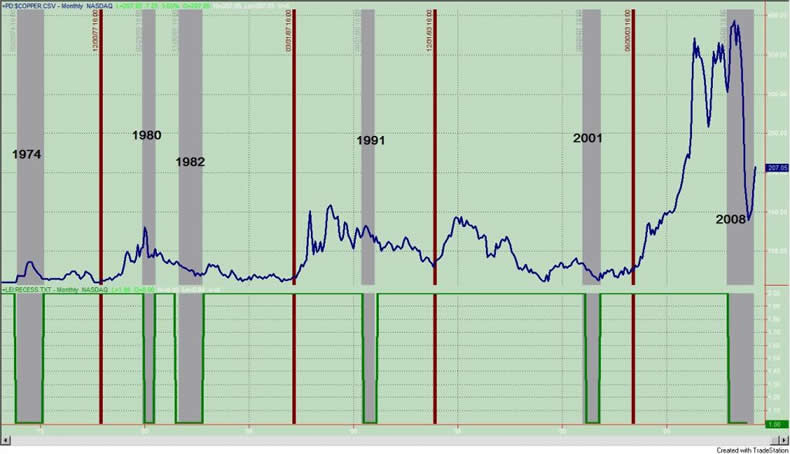

This can be seen in figure 1 a monthly chart of copper. The indicator in the lower panel is an analogue representation of economic expansions and contractions from the National Bureau of Economic Research; recessionary periods are noted with the vertical gray bars across the graph.

Figure 1. Copper v. NBER Expansions/ Contractions

Of the six recessions since 1974, the current recession would be the only one that would see copper prices acting as a leading indicator. In fact, the most bullish price moves for copper occur late in the economic cycle not at the beginning. These bull markets in copper are noted by the maroon colored vertical lines.

Another explanation tossed about to explain copper's rise is that the easy monetary policies of the Federal Reserve will lead to inflation, and copper is only anticipating these coming changes. While higher copper prices would be expected as inflation rises, the fact remains that there is a very poor correlation between higher copper prices and inflationary expectations. Of the 5 bull runs in copper since 1974, only 2 were associated with any real significant inflationary pressures, and these were in the 1970's. This can be seen in figure 2 a monthly chart of copper; in the lower panel is the inflation rate as measured by a year over year change in the CPI. As before, the vertical gray lines note recessionary periods. Recessions by definition are deflationary, and we should not expect copper prices to rise during the current de-leveraging, deflationary environment.

Figure 2. Copper v. Inflation

So why is copper rising?

"What’s behind the current price increase?

Both China and South Korea have been adding to strategic reserves and restocking at what they consider to be much better prices. Copper producers and marketers all down the supply chain are keeping some supply out of the market due to low prices or a complete lack of buyers.

The desire by Asian buyers to turn US dollars into hard assets—a phenomenon we are seeing across the entire hard asset class.

Short covering as the copper price stabilized.

A favorable arbitrage between the London Metal Exchange (LME) and Shanghai Exchange that made it cheaper to import copper cathode into China.

Scrap supplies having dwindled due to the lack of credit, low prices and slowing manufacturing activity. With the exception of Asia’s desire to convert their substantial holdings of US dollars into something of value, I believe all the factors listed above are temporary. Going forward inflation may also play a role. "

If you note, none of Mr. Cook's observations as to what is driving the price of copper have anything to do increasing copper consumption. In fact, he goes on to state that in all likelihood copper utilization will be down for 2009:

"To come to some sort of understanding of underlying fundamentals of the copper market we need to look at where copper actually goes. The retail and commercial construction markets use about 46% of all copper. Another 12% goes into vehicles. These two industries were trashed, to say the least, in 2008; they are not likely to do too well this year either. Without a global recovery in both industries to past levels I don't see how copper consumption can possibly increase significantly. "

The serial bottom callers and those pointing to the magic, predictive powers of copper can always point to China. But haven't we been down this road before? Wasn't decoupling disproved in the summer of 2008? Yes, the Chinese economy might be the world's economic engine, but they don't live in isolation. According to Cook, global demand and Chinese consumption of copper will remain weak:

"Can China save the day?

Most copper imported into China is then reprocessed and extruded as copper wire. When the copper wire is manufactured into tubing, refrigerators and batteries for export it still shows up as internal Chinese copper consumption. There is no way of knowing how much of China’s copper consumption actually stays internal and how much goes back out in other export products. If China is going to save the day for copper we have to approach usage from the perspective of China’s total economy.

China’s GPD in 2007 and 2008 was approximately 6% of global GDP—Europe and USA account for nearly half of global GDP. Based on the most recent World Bank statistics, China’s 2007 total GDP was $3.3 trillion, a full 55% of which was attributable to exports. In 2008 China’s exports were down 28%. This year is not getting off to a roaring start as the Shanghai Daily reports that industrial output is down 12.7% for the first two months of 2009.

China’s building boom is not fairing very well either. Post Beijing Olympics, China’s real estate market has collapsed. According to Jack Rodman, a China real estate expert, in Beijing alone approximately 500 million square feet of commercial real estate was developed over the past few years; this is more than all the office space in Manhattan. Rodman estimates 20% of that now stands vacant.

Similar stories are being reported across Asia as documented by the Asia Property Report which estimates that real estate transactions were down 70% in Q-4, 2008. With Asia and the world’s building boom gone bust or at least slowed significantly, and China’s export markets in a severe and prolonged recession, demand for their products and the copper within is unlikely to recover soon. In the near term at least, increased copper consumption would require a global recovery approaching the levels of a few years ago.

Confirming the obvious: true internal Chinese consumption is much less than many analysts believe and is unlikely to take up the slack in global copper consumption. "

My Take

From a technical perspective I do not believe copper is in a bull market or even poised to enter into a new bull market. In addition and as explained above, I attach no significance to the price movements of copper as they relate to economic growth.

What we do know is this: 1) over 7 months copper dropped 70% from high to low; 2) over the last 4 months, copper has bounced 70%; 3) copper still stands 50% below its all time highs.

Figure 3 is a monthly chart of a continuous copper futures contract. The indicator in the lower channel is our "next big thing" indicator, and the purpose of this indicator is to identify those assets that have the potential for secular trend change.

Figure 3. Copper/ monthly

The first thing we notice is that copper bounced at support or the breakout point (labeled with a "1") of the previous bull run. In other words, copper made a round tripper over the past 4 years. The bounce has carried 70% higher but right into the down sloping 10 month moving average. In other words, copper prices are behaving as they should. There was a breakout of historic proportions. Why did this breakout lead to such monstrous gains in 2005 and 2006? Because the breakout of historic proportions was 12 years in the making. In other words, the breakout was from a 12 year trading range. The current 70% move has the makings of a snapback or countertrend rally.

So the question I want to answer is this: Is copper poised for a new sustainable, secular bull market run?

Based upon the "next big thing" indicator, the answer is no. Based upon the technical setup, the answer is no. Going back to the 1970's, every major move in copper was heralded by the "next big thing" indicator signaling the possibility of a secular trend change. Even though copper has moved 70% off its low, I attach no significance to such a move. From my technical perspective, this is a bounce off of support and into resistance. Copper will need more sideways action and time before another new bull market is launched.

By Guy Lerner

http://thetechnicaltakedotcom.blogspot.com/

Guy M. Lerner, MD is the founder of ARL Advisers, LLC and managing partner of ARL Investment Partners, L.P. Dr. Lerner utilizes a research driven approach to determine those factors which lead to sustainable moves in the markets. He has developed many proprietary tools and trading models in his quest to outperform. Over the past four years, Lerner has shared his innovative approach with the readers of RealMoney.com and TheStreet.com as a featured columnist. He has been a regular guest on the Money Man Radio Show, DEX-TV, routinely published in the some of the most widely-read financial publications and has been a marquee speaker at financial seminars around the world.

© 2009 Copyright Guy Lerner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Over the last 4 months, copper has bounced about 70% from its lows. Yet it is only recently that such a significant price move is beginning to attract attention as pundits try to explain what is going on. With stocks roaring back over the past 5 weeks, the obvious (and wrong) connection is that the global recession is ending. To me, copper's price rise is more technical after a deeply oversold condition, and it appears that the pundits are only crafting a good story to explain its recent price movements.

Over the last 4 months, copper has bounced about 70% from its lows. Yet it is only recently that such a significant price move is beginning to attract attention as pundits try to explain what is going on. With stocks roaring back over the past 5 weeks, the obvious (and wrong) connection is that the global recession is ending. To me, copper's price rise is more technical after a deeply oversold condition, and it appears that the pundits are only crafting a good story to explain its recent price movements.