Goldman Sachs Bounces To Q1 Profit

Stock-Markets / Financial Markets 2009 Apr 14, 2009 - 05:34 AM GMTBy: PaddyPowerTrader

US indices yesterday managed to cut losses they had racked up during the day to finish only slightly down on a choppy session. Futures on the S&P 500 are slipping after rising to 858.73 yesterday – the highest level since February, mostly on speculation that banks’ profits for the first quarter will be better than expected. European markets rose in early trade after the Easter break, with miners benefitting from more solid metals prices and financial stocks gaining ground following strong numbers from Goldman Sachs.

US indices yesterday managed to cut losses they had racked up during the day to finish only slightly down on a choppy session. Futures on the S&P 500 are slipping after rising to 858.73 yesterday – the highest level since February, mostly on speculation that banks’ profits for the first quarter will be better than expected. European markets rose in early trade after the Easter break, with miners benefitting from more solid metals prices and financial stocks gaining ground following strong numbers from Goldman Sachs.

Today’s Market Moving News

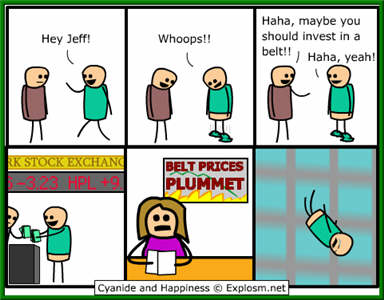

- Two more banks failed on Friday, bringing the tally for 2009 to 23. Mostly regional banks, they’re still going to cost the FDIC a lot of money. Despite less negative results from financials recently, there is still a way to go before we see the bottom.

- Expect some movement in airline stocks today after Qantas’ results. The Australian airline said full-year profits would be between 100m ($72.8m; £49m) and 200m Australian dollars, down from its previous forecast of A$500m.

- The price of oil has fallen after the International Energy Agency predicted that global demand will continue to slow today.

- The extent of the drop in Irish construction jobs is becoming clear. The Ulster Bank Construction PMI recorded 28.1 in March, down marginally from February’s 28.2 and the third lowest level on record. Any figure below 50 means activity fell. With prospective cuts in capital spending, this will no doubt drop even further.

Chinese Not Too Hot On The Dollar?

China continues to cool down its interest in the American dollar. The Chinese central bank revealed that they bought $7.7bn in foreign reserve. While this is not a small amount, compare that to the same quarter last year, when they bought up $153bn. Given that the US announced on Friday that they posted a budget deficit of $192 billion in March, is it any wonder that the Chinese are less than tempted by the dollar? The US continue to go into debt at a rate of $60k per second. The fact that there is such a dramatic slowdown in China’s interest means that the Obamalus package is going to be under pressure to perform before it’s barely off the ground. “Challenging” doesn’t seem to cover it any more when talking about the scale of task ahead.

China continues to cool down its interest in the American dollar. The Chinese central bank revealed that they bought $7.7bn in foreign reserve. While this is not a small amount, compare that to the same quarter last year, when they bought up $153bn. Given that the US announced on Friday that they posted a budget deficit of $192 billion in March, is it any wonder that the Chinese are less than tempted by the dollar? The US continue to go into debt at a rate of $60k per second. The fact that there is such a dramatic slowdown in China’s interest means that the Obamalus package is going to be under pressure to perform before it’s barely off the ground. “Challenging” doesn’t seem to cover it any more when talking about the scale of task ahead.

Stupid Question: Did Bank Of America Break The Law?

The SEC is set to review if Bank of America broke the law by not disclosing to shareholders Merrill Lynch’s plan to pay $3.62 billion in bonuses before they voted for the merger of the bank. It’s pretty obvious that even if they didn’t break the law, this omission amounts to seriously misleading your shareholders. This news comes soon after the committee overseeing federal banking-bailout programs started investigating the lending practices of institutions that received public funds, following a rash of complaints about increases in interest rates and fees. Last week, Bank of America told some customers that interest rates on their credit cards will almost double to 14%. They’re also introducing fees of $10 for a whole host of credit card transactions.

So, firstly, Bank of America receives $45 billion in capital from the US taxpayer, presumably under the pretence that it would being lending to small businesses. It fails to mention that the Merill Lynch plan included $3.6 billion in bonuses (about 8% of the bailout money) to it’s disgraced executives. Then it slap these fees on their clients. More like the Land of the Fee.

Economic Data

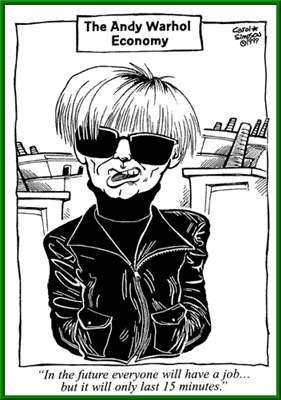

In the US, Retail Sales figures are out at lunchtime, which should again make for fairly grim reading, and later tonight, the ABC News Consumer Confidence results are released. These figures are expected to be a marginal improvement on the last time – that wouldn’t be too difficult, to be fair. With Obama and Helicopter Ben due to be speaking later today, the market will be looking to see if they speak more optimistically, or if they try to dampen expectations, given the recent slowdown in the slowdown.

In the US, Retail Sales figures are out at lunchtime, which should again make for fairly grim reading, and later tonight, the ABC News Consumer Confidence results are released. These figures are expected to be a marginal improvement on the last time – that wouldn’t be too difficult, to be fair. With Obama and Helicopter Ben due to be speaking later today, the market will be looking to see if they speak more optimistically, or if they try to dampen expectations, given the recent slowdown in the slowdown.

Equities

In Ireland, Kenmare Resources report today, but there will be more interest on the Goldman Sachs story. Hot on the heels of Wells Fargo’s unexpectedly positive results last week, the bank reported stronger-than-expected first-quarter earnings of $1.81bn. They also seem determined to be one of the first banks off it’s knees in the current crisis.

Also, the bank said that, pending government approval, it would use the $5bn raised through the sale of common stock to help pay back the $10bn allocated to it last year as part of the Troubled Asset Relief Programme. This sets the bar extremely high for their competitors. This week sees more financial institutions reporting on their first quarter results – Citigroup and JPMorgan Chase amongst them

Reporting as well today are Intel, Johnson & Johnson and Phillips.

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.