Consumer Spending Shifts to Discretionaries. A Sign of a Healing Economy

Stock-Markets / Investing 2009 Apr 14, 2009 - 01:04 AM GMTBy: Donald_W_Dony

As the consumer represents the largest single component of the economy, their spending habits and shifts in purchasing asset groups, which represent attitudes of either safety or optimism, is of prime importance to investors and to the decisions regarding which sectors and securities should be overweighted or underweighted in their portfolios.

As the consumer represents the largest single component of the economy, their spending habits and shifts in purchasing asset groups, which represent attitudes of either safety or optimism, is of prime importance to investors and to the decisions regarding which sectors and securities should be overweighted or underweighted in their portfolios.

Chart 1 illustrates the relative strength comparison between the Consumer Discretionary ETF (XLY)and the Consumer Staples ETF (XLP) over the course of nine years. It also demonstrates the standard pattern of consumer spending from staples to consumer cyclicals (2001-2004) and back again to the safety of non-cyclicals (2005-early 2009) all within the framework of two business cycles.

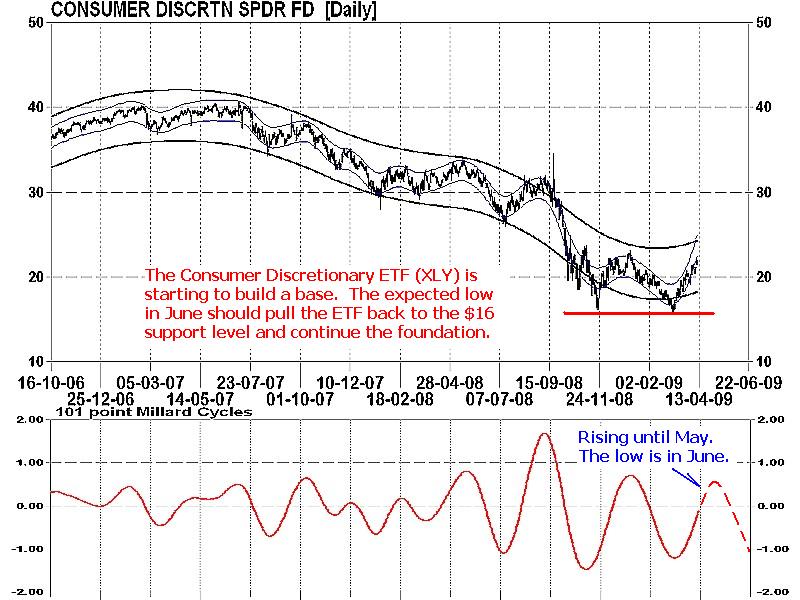

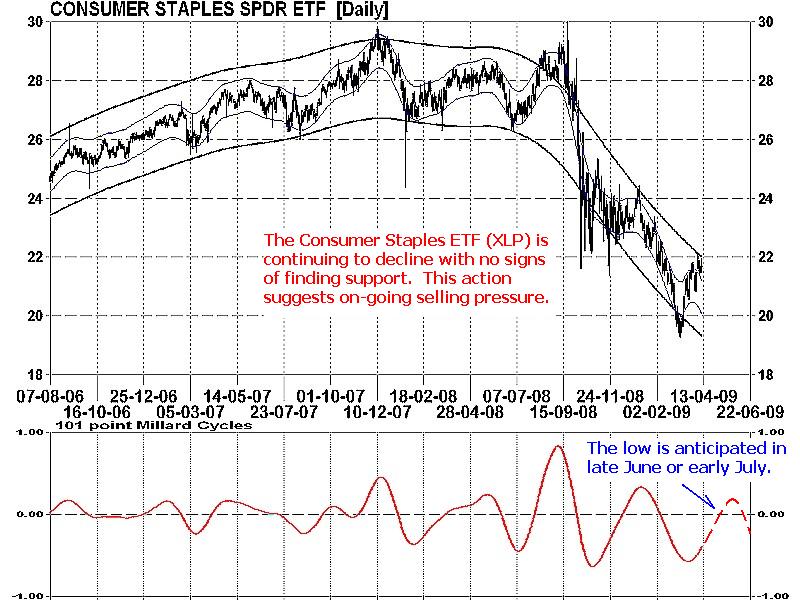

Recent market development in the 1st quarter of 2009 has suggested that the consumer discretionary sector is now beginning to out perform the staples for the first time since late 2007. Charts 2 and 3 provides an individual review of the two industry groups.

After a steady decline since mid-2007, the growth-oriented Consumer Discretionaries ETF (XLY) has finally found a base at the $16 level. This price line has held firm since November 2008 and indicates that buying support is increasing for this sector. Models (lower portion of the chart) are indicating, nevertheless, that another low is expected in June. This trough should retrace the price back near the $16 support level (Chart 2) but continue the base-building foundation. In contrast, the Consumer Staples ETF (XLP) is being driven downward by on-going selling pressure (Chart 3) with limited price support. Models point to some short-term upward movement in April and May followed by another deeper low in late June or July with a downside target of $18-$19.

Bottom line: Although the gradual shift in consumer spending habits from defensive staples to growth-oriented consumer cyclicals is often a one to two year process, it is a movement that always occurs and signals a positive first step in the healing of a contracting economy. This return of capital to discretionaries should be viewed however as a broad measure of an economic recovery verses a pin-point indicator of a stock market bottom. Equity markets routinely drift lower during these lengthy transition periods.

Investment approach: Investors may wish to start underweighting consumer staples in their portfolios as this sector is showing no signs of support. They may also wish to remain on the sidelines until the June low before starting to add some consumer discretionary securities to their portfolios.

More research can be found in the April newsletter. Go to www.technicalspeculator.com and click on member login.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2009 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.