Overbought Bear Market Rally Expected to Sell off Strongly

Stock-Markets / Stocks Bear Market Apr 13, 2009 - 10:21 AM GMTBy: Guy_Lerner

After five weeks of "straight up" price action, the major indices and their ETF proxies are approaching key resistance levels.

After five weeks of "straight up" price action, the major indices and their ETF proxies are approaching key resistance levels. A weekly cart of the S&P Depository Receipts (symbol: SPY) is shown in figure 1. The weekly close over the most immediate pivot low point at 82.61 will likely propel prices to the next key pivot at 86.78. This is about 1 point away from this past Thursday's close. The pivot at 86.78 represents significant resistance formed not only by the pivot but also by the down sloping trend line and the positive divergence bar (i.e., price bars marked in red). This level served as support for over 4 weeks back in December, 2008 and it was tested as resistance for four weeks in January, 2009 before breaking down in February. The market is currently over bought and investors are becoming increasingly bullish as prices approach this key level. Therefore, I have a hard time seeing the SPY breaking through these levels very easily. Over the next couple of weeks, I am anticipating selling pressure to resume here. If I am wrong, there will be a breakout, which should propel prices to the 40 week moving average.

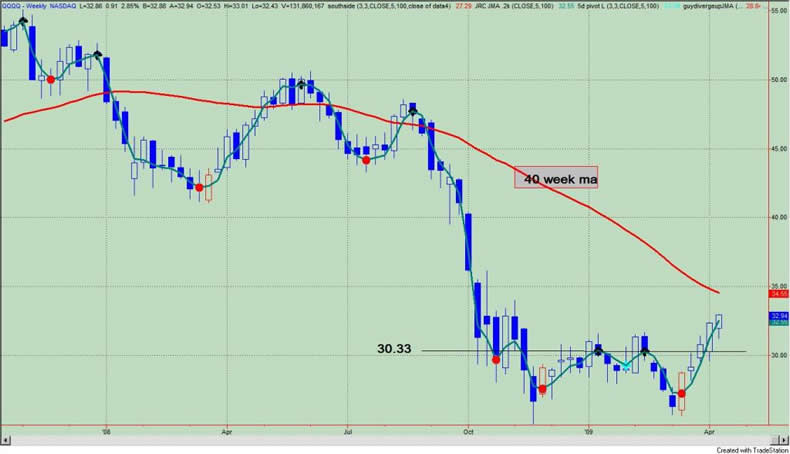

Figure 3 is a weekly chart of the Power Shares QQQ Trust (symbol: QQQQ). When I last wrote about the QQQQ on March 24 I stated: "The QQQQ is our best performer as prices have catapulted outside the upper channel line. A weekly close over the two upper pivots (at 30.33) would be considered a "breakout" in my book. The last "breakout" in early February was a fake out, but if this one "sticks", expect a melt up to $35 at the 40 week moving average."

Figure 4 is a weekly chart of the i-Shares Russell 2000 Index (symbol: IWM). The close above the pivot at 42.38 will likely propel prices to the 47.58 level, which is about 1 point away from the recent close. There is significant resistance in this region - a key pivot point and 2 positive divergence bars. Like the SPY and DIA, I would expect selling. A weekly close above these levels would be significant and likely propel prices to the 40 week moving average.

By Guy Lerner

http://thetechnicaltakedotcom.blogspot.com/

Guy M. Lerner, MD is the founder of ARL Advisers, LLC and managing partner of ARL Investment Partners, L.P. Dr. Lerner utilizes a research driven approach to determine those factors which lead to sustainable moves in the markets. He has developed many proprietary tools and trading models in his quest to outperform. Over the past four years, Lerner has shared his innovative approach with the readers of RealMoney.com and TheStreet.com as a featured columnist. He has been a regular guest on the Money Man Radio Show, DEX-TV, routinely published in the some of the most widely-read financial publications and has been a marquee speaker at financial seminars around the world.

© 2009 Copyright Guy Lerner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Guy Lerner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.