Voices About Crude Oil, The New Gold

Commodities / Crude Oil Apr 13, 2009 - 04:58 AM GMTBy: Richard_Shaw

There are conflicting voices about oil. Some say too much is available and demand is falling. Others say demand is rising and reduced exploration will contribute to a new boom. Some say oil is responding to the equities rally. Charts show oil with upward tendencies weeks before equities began to rise.

There are conflicting voices about oil. Some say too much is available and demand is falling. Others say demand is rising and reduced exploration will contribute to a new boom. Some say oil is responding to the equities rally. Charts show oil with upward tendencies weeks before equities began to rise.

Here are some important media snippets with mixed bullish and bearish messages:

(April 9 Wall Street Journal) U.S. petroleum inventories sit at about 360 million barrels, their highest level since 1993, … McKinsey [report] suggests that energy demand may snap back more quickly than many observers project, driven by strong demand growth from developing countries. …If the world economy returns to moderate growth, energy demand will increase about 2.3% a year between 2010 and 2020, nearly a full point faster than the period from 2006 to 2010 … Developing regions will account for more than 90% of the growth, led by the Middle East.

(April 9, Bloomberg) Crude oil rose more than $2 a barrel as equities gained, signaling that some investors expect economies to stabilize, bolstering energy demand.

(April 10, US Department of Energy - Energy Information Agency) The global economic contraction continues to depress energy demand. … The annual price of West Texas Intermediate (WTI) crude oil averaged $100 per barrel in 2008. The global economic slowdown is projected to cut these prices by more than half, to average $42 per barrel in 2009 and $53 in 2010—forecasts slightly lower than last month’s Outlook. … Following the sharp price decline that occurred during the second half of 2008, the global oil market has remained relatively stable since the beginning of the year. This situation is expected to continue through most of 2009, until economic recovery in the United States and elsewhere leads to a rebound in oil demand growth. … The future direction of world oil prices in the short-term will largely depend upon the timing and pace of the recovery of the global economy.

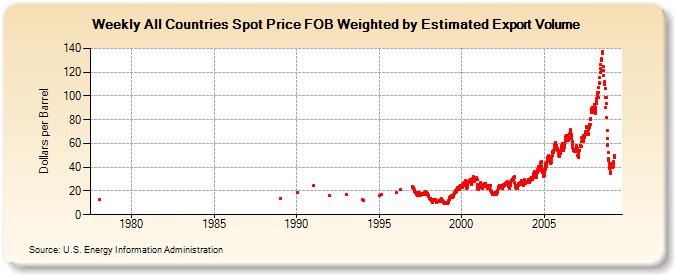

World Traded Weighted Oil Prices 1978-early 2009

(April 10, Wall Street Journal) Most of the total 1 million barrel-a-day downward demand revision came from weakness in big oil-consuming nations like the U.S., though sluggish consumption is clearly deepening in emerging markets like China, the world’s second biggest oil consumer after the U.S. … China’s oil consumption — previously expected to register small growth in 2009 — is now expected to fall by almost 1% for the first time in 19 years,

(April 11, Wall Street Journal) Chinese demand for raw materials, hard hit in past months, is showing signs of recovery, with crude-oil imports hitting a one-year high in March, the government reported Friday. Steel mills in March imported record quantities of their key raw material, iron ore, in anticipation of a pickup in demand in coming months.

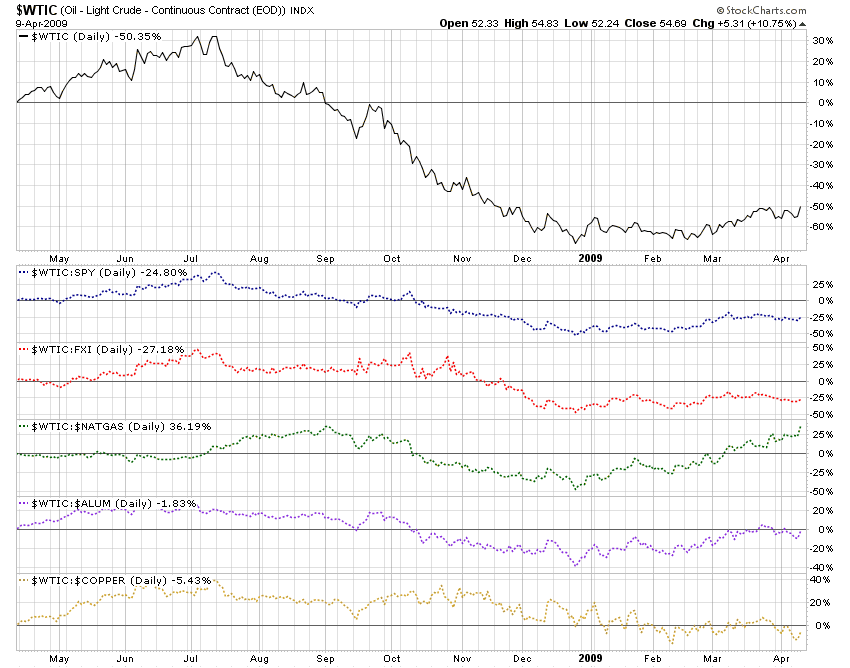

Relative Performance Charts:

The 1-year daily chart below plots price performance of crude oil and of crude oil versus the US stocks (SPY), Chinese stocks (FXI), copper, aluminum and natural gas.

Where We Stand:

We like owning physical crude oil through royalty trusts that pay cash distributions, as opposed to owning futures contracts or futures funds for crude oil. There is no expiration date on royalty rights. The cash flow is consistent with our equity income orientation. The reserves of the wells increase as the price of oil increases due to the ability to afford more expensive extraction methods. Technology improvements can increase reserves too.

It is true that oil royalty trusts are wasting assets, but so too are futures contracts. There is nothing that can extend the life or number of barrels of a futures contract, but the life and number of barrels in a well can and generally do increase when oil prices increase.

The interest earned on the collateral behind futures accounts is consumed by management fees in oil futures ETFs such as USO or USL, and the interest earned on collateral by those investing directly in futures contracts is much lower than the cash flow from the royalty trusts.

To each his own, of course, but we are comfortable with royalties.

Our favorites have been Prudhoe Bay Trust (BPT) and Canadian Oil Sands (COSWF), and we own both.

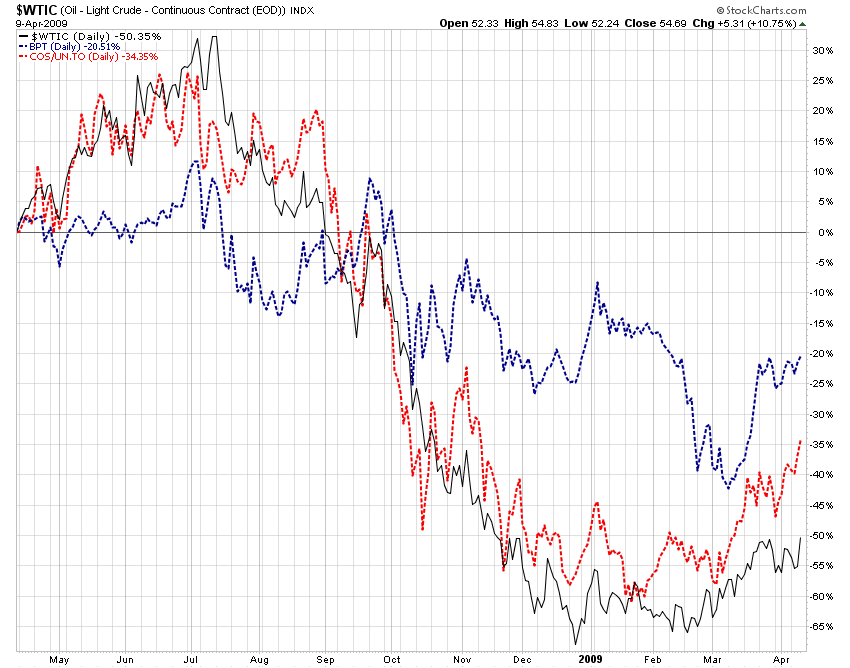

Relative Perforamance: Crude Oil, BPT and COSWF

The two trusts have different gearing to the change in the price of oil. BPT has a break-even around $14 per barrel, whereas COSWF has a break-even around $36 per barrel. That means, for example, if oil goes from $52 to $57, the margin for BPT goes from $38 to $43 per barrel, whereas the margin for COSWF goes from $16 to $21 per barrel — different rates of change.

Unfortunately, we will probably eventually move away from COSWF due to the combined issues of new Canadian tax rules that will force the trusts to convert entity form and begin paying corporate taxes in 2011; and the recently expressed position of the Obama administration on greenhouse gases that will likely further reduce the profitability of oil sands. We will wait to see how things pan out, but are concerned that Canadian oil sands will lose a good deal of their appeal, as the comments below from Petroleum Intelligence Weekly illustrate,

(April 13, Petroleum Intelligence Weekly) Oil Sands Not Part Of Obama’s Green Vision … Synthetic crude [provides] 8% of overall US crude imports, but the production of this crude involves 15%-40% higher greenhouse gas emissions per energy unit than conventional crude. This puts the oil sands on a collision course with the Obama administration, which wants a gradually tightening cap on greenhouse gases in order to cut emissions by 14% by 2020 and by 80% by 2050, using 2005 levels as a starting point. To do this, the White House is supporting legislation that could derive hundreds of billions of dollars per year from carbon trading, starting with a price on carbon at around $20 per ton … Obama has indicated that a US cap-and-trade policy would affect Canadian oil sands producers the same as the US oil business.

Summary:

Oil we believe is the new gold, and is the closest thing to a global currency. Societies will hack away at its share of world energy, as they must, but for a long, long time oil will be in short supply over full business cycles.

The current price in the low $50’s is below the cost of replacement from deep ocean wells which reportedly is in the vicinity of $70.

The carbon tax penalties on oil sands will only add to the global average cost of producing oil, which will increase the profits for those who own proven reserves of conventional liquid petroleum.

We own oil in royalty trusts and expect long-term rising cash flows from them. We are also more comfortable riding out potential new downward stock market movements in oil trusts than in corporate stocks.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.