Investing in Gold Exploration Companies

Commodities / Gold & Silver Stocks Feb 23, 2009 - 08:42 AM GMTBy: Frank_Holmes

An abridged excerpt from “The Goldwatcher: Demystifying Gold Investing,” co-authored by Frank Holmes, CEO and chief investment officer at U.S. Global Investors . The book, published by John Wiley & Sons, is available from amazon.com and in bookstores.

An abridged excerpt from “The Goldwatcher: Demystifying Gold Investing,” co-authored by Frank Holmes, CEO and chief investment officer at U.S. Global Investors . The book, published by John Wiley & Sons, is available from amazon.com and in bookstores.

Investors can improve their odds by learning how to assess the fundamentals of the gold exploration companies. A good tool for this job is what I call “The Five M's.”

By using the Five M's, an individual investor can build a simple but powerful model to initially sort through the many hundreds of upstart gold companies to find better opportunities.

1. MARKET CAP

If a junior gold company has 10 million shares outstanding at $1 per share, the company is valued at $10 million. The question any investor should ask is, “Is this company really worth $10 million?”

If the market pays $25 per ounce of gold in the ground, the company should be valued at $25 million. If the company's market cap is only $10 million, it may look undervalued. If the company's market cap is $50 million, it may appear to be overvalued.

For larger gold companies, an investor can measure a company's market cap against its production level, reserve assets, geographic location and other metrics to establish relative valuation.

2. MANAGEMENT

Often the heads of junior companies are geologists or engineers who have no relationships in the brokerage business. This lack of relationships impedes their ability to generate market support.

Some of the most successful company builders in the gold-mining industry are what I call the “financial engineers” – people who have the relationships and understand the capital markets and who know how to hire the best geological and engineering teams. We tend to have more confidence investing in them.

3. MONEY

A gold exploration company has to deliver reserves per share to have a chance at another round of financing. It has to convince the capital markets that it is an attractive investment on a per-share basis.

The gold-equities market is efficient at judging reserves per share, so if the exploration company doesn't come up with the results necessary to get an evaluation, investors quickly lose confidence.

There is an old rule when it comes to exploration companies: don't pay more than two times cash per share if there are no proven assets in the ground.

4. MINERALS

Gold companies have the highest industry valuations based on price to earnings, price to cash flow, price to enterprise value and price to reserves per share.

Companies operating mines that produce gold and a significant amount of another metal (typically copper) tend to have lower valuations than pure gold companies. But at the top of a gold price cycle, copper/gold deposits end up rising to the same multiples as pure gold companies.

So when it comes to picking stocks in anticipation of an upward price move for gold, the investor's margin for error is reduced by selecting companies with both gold and copper production.

5. MINE LIFECYCLE

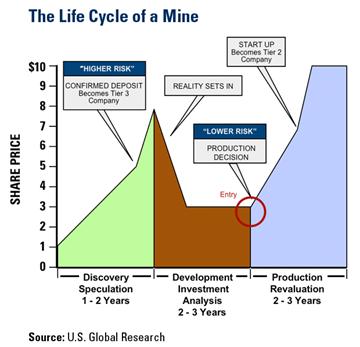

In the exploration and development phase, a price of a gold stock often follows a course that ends up looking like a double-humped camel (see graphic above).

First there's euphoria over exploration results that are better than expected. The stock price rises as investors race to buy shares. Then reality sets in – this gold discovery is still years away from being an actual producing mine. At this point, there's a huge correction in the stock price.

Assuming the company continues down the path to development, its share price drifts sideways until around six months before the first ounce of gold is expected to be produced.

At this point, the stock begins a strong new leg up when a more sophisticated set of shareholders come into the market. Eventually the price drops off and then levels as the speculative money moves on to the next hot opportunity and the company transitions from explorer to producer.

By Frank Holmes, CEO , U.S. Global Investors

Frank Holmes is CEO and chief investment officer at U.S. Global Investors , a Texas-based investment adviser that specializes in natural resources, emerging markets and global infrastructure. The company's 13 mutual funds include the Global Resources Fund (PSPFX) , Gold and Precious Metals Fund (USERX) and Global MegaTrends Fund (MEGAX) .

More timely commentary from Frank Holmes is available in his investment blog, “Frank Talk”: www.usfunds.com/franktalk .

Please consider carefully the fund's investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. Gold funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The price of gold is subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in gold or gold stocks. The following securities mentioned in the article were held by one or more of U.S. Global Investors family of funds as of 12-31-07 : streetTRACKS Gold Trust.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.