U.S. Housing Market Crash- How Far To The Bottom?

Housing-Market / US Housing Dec 05, 2008 - 10:30 AM GMTBy: Mike_Shedlock

Inquiring minds have been asking for another housing update. My previous update was was on February 15,2008 in Housing Bottom Nowhere in Sight . I did not remember Bernanke's comments at the time but looking back now they sure seem funny.

Inquiring minds have been asking for another housing update. My previous update was was on February 15,2008 in Housing Bottom Nowhere in Sight . I did not remember Bernanke's comments at the time but looking back now they sure seem funny.

CNBC is reporting Bernanke Expects Housing Recovery by Year End .

Federal Reserve Chairman Ben Bernanke told lawmakers Tuesday he expects the downtrodden U.S. housing sector to improve by the end of the year, a senator who participated in the closed-door meeting said.

"He let us believe that the housing situation should begin to ameliorate by the end of the year," said Sen. Pete Domenici, a New Mexico Republican, told reporters.

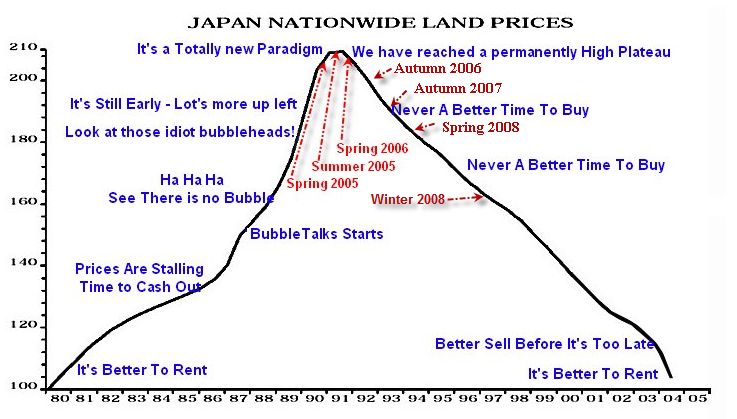

Using the Japan Nationwide Land Prices model as my guide, here is how I have called things in real time.

I just added the Winter 2008 arrow. Housing prices are now one notch closer to their final destination. The US Timeline scale is compressed. At the current pace, housing will bottom in about 7 years vs. 14 years in Japan.

Flashback March 26 2005

The initial data point was established in the post It's a Totally New Paradigm on March 26, 2005. Here are some excerpts from that post.

- Ron Shuffield, president of Esslinger-Wooten-Maxwell Realtors says that "South Florida is working off of a totally new economic model than any of us have ever experienced in the past." He predicts that a limited supply of land coupled with demand from baby boomers and foreigners will prolong the boom indefinitely.

- "I just don't think we have what it takes to prick the bubble," said Diane C. Swonk, chief economist at Mesirow Financial in Chicago, who was an optimist during the 90's. "I don't think prices are going to fall, and I don't think they're even going to be flat."

- Gregory J. Heym, the chief economist at Brown Harris Stevens, is not sold on the inevitability of a downturn. He bases his confidence in the market on things like continuing low mortgage rates, high Wall Street bonuses and the tax benefits of home ownership. " It is a new paradigm " he said.

Flashback October 27, 2005

Inquiring minds may wish to review Bernanke: There's No Housing Bubble to Go Bust .

Ben S. Bernanke does not think the national housing boom is a bubble that is about to burst, he indicated to Congress last week, just a few days before President Bush nominated him to become the next chairman of the Federal Reserve.

U.S. house prices have risen by nearly 25 percent over the past two years, noted Bernanke, currently chairman of the president's Council of Economic Advisers, in testimony to Congress's Joint Economic Committee. But these increases, he said, "largely reflect strong economic fundamentals," such as strong growth in jobs, incomes and the number of new households.

What The US Can Learn From Japan

I recently came across an interesting report called The Age of Balance Sheet Recessions: What Post-2008 U.S., Europe and China Can Learn from Japan 1990-2005 by Richard C. Koo Chief Economist, Nomura Research Institute, Tokyo, October 2008. The report contains some very interesting charts.

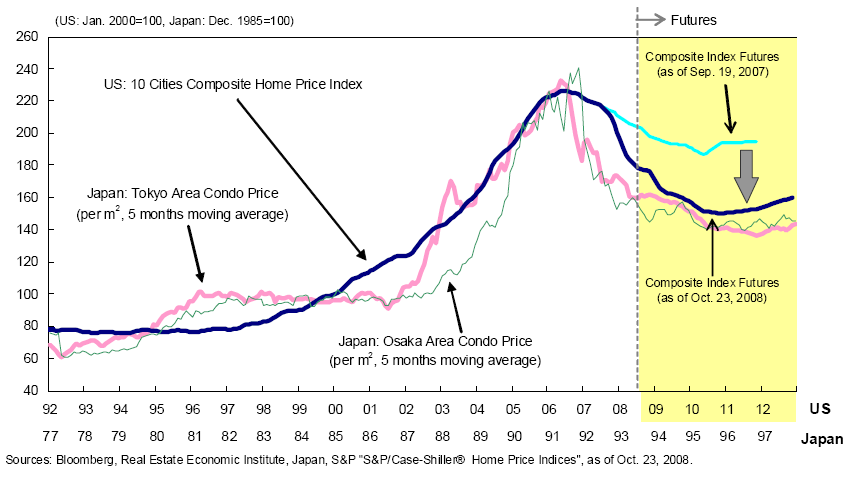

Exhibit 1. US Housing Price Futures Moving Closer to the Japanese Experience

Note: the line in pink is Tokyo Condo Prices while I am using Japan Land Prices as my model except with a US timeline that looks more like the above.

Thus I see a bottom in US housing in 4-5 years. If I can get a hold of the data that created the above charts I can probably get my friend "TC" to chart it going forward. My latest update from "TC" was Case Shiller and CAR Analysis November 2008 Release .

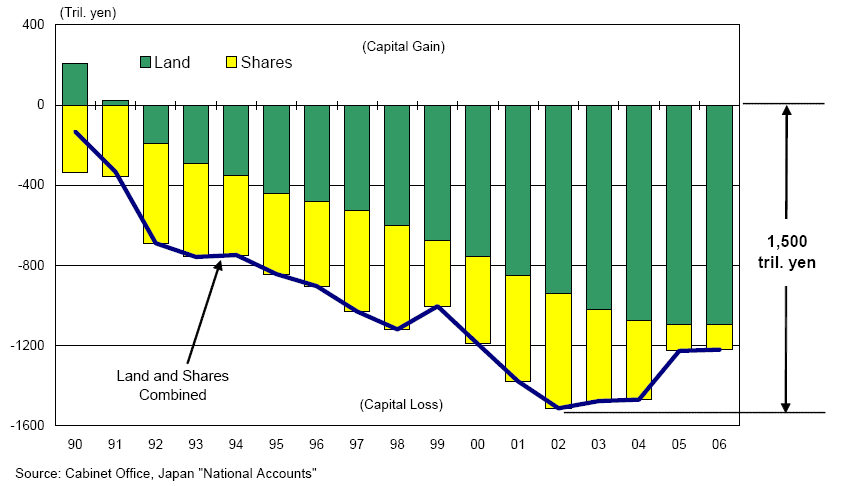

Exhibit 4. Cumulative Capital Losses on Shares and Land since 1990 Reached $15 Trillion or 3 Years Worth of Japan's GDP

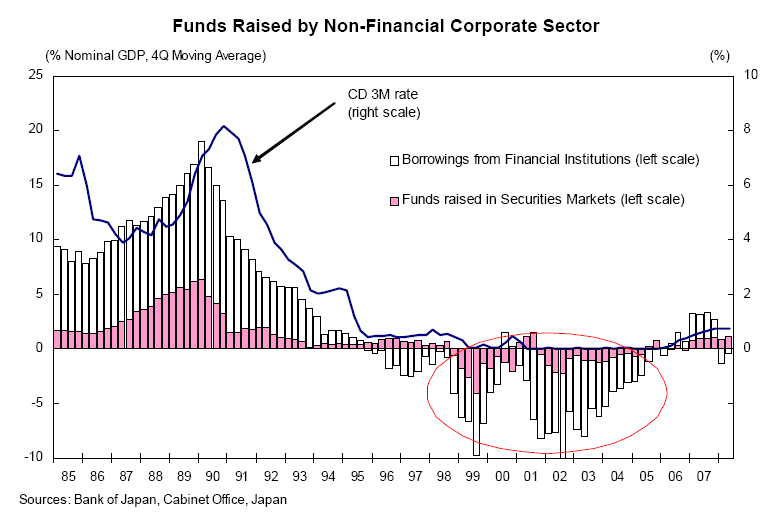

Exhibit 5. Balance Sheet Problems Forced Japanese Businesses to Pay Down Debt even with Zero Interest Rates

I have extensive comments on balance sheets and paying down debt below.

Exhibit 6. Japan's GDP Grew even after Massive Loss of Wealth and Private Sector Rushing to Pay Down Debt

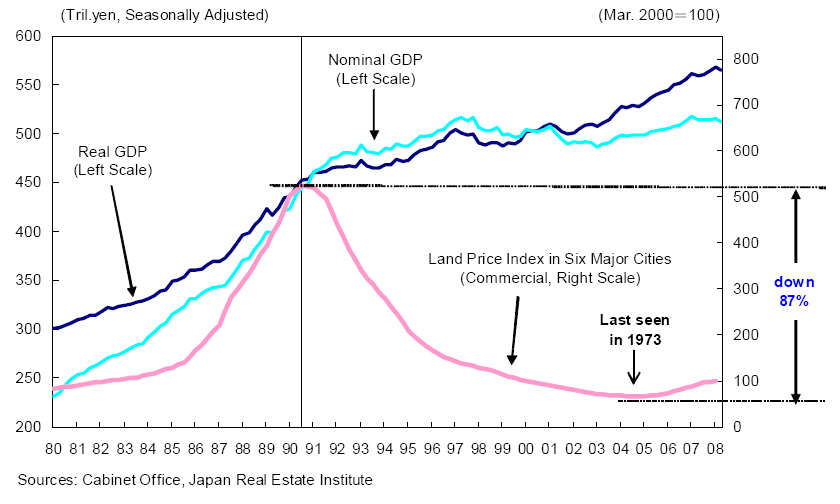

The above chart shows in pink the Japan Land Price chart that I have been using since Spring of 2005. It represents the Commercial Land Price Index in six major cities.

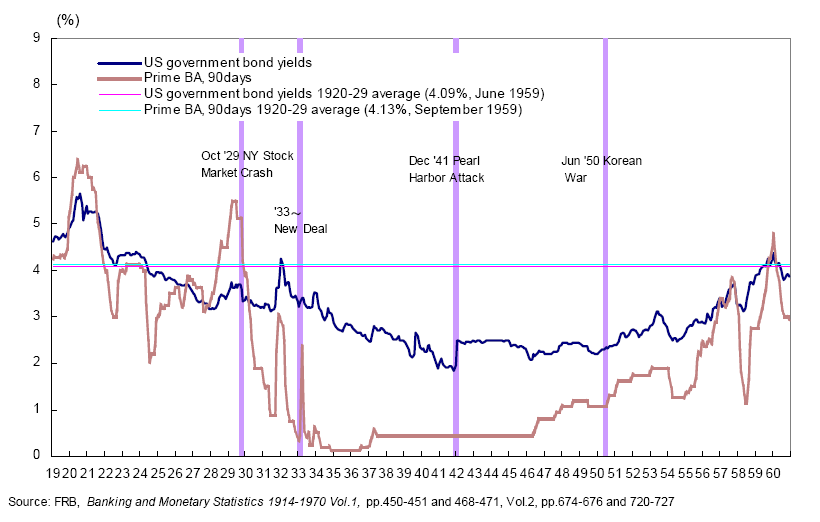

Exhibit 23. US Interest Rates Took 30 Years to Return to Their 1920s Level

The above chart should give treasury bears something to think about.

Balance Sheets and Paying Down Debt

There is every reason to believe US banks will face the same experience of paying down debts in a Zero Interest Rate world as opposed to going on a lending spree. Some will challenge this notion because of Obama's pledge to create jobs and rebuild infrastructure.

The counter is that Japan went on a wild spending spree as well, building bridges to nowhere and it did not do Japan any good. Here is an article by James Shaft quoting Richard Koo in A long, shaky bridge to recovery that discusses this very issue.

The lessons of Japan's stumbling path out of deflation and recession suggest that government spending can help stave off an extended recession, but it may take years not months and require an unlikely combination of political will and consensus.

That'll be a lot of bridges to nowhere.

Government spending can break the cycle. Not tax cuts, which will only go to pay down debt or are saved into a banking system that isn't working, but actual bricks and mortar. Think the New Deal's Works Progress Administration supersized or Japan building highways and bridges over seemingly every river, stream and rivulet.

"It was the fiscal stimulus that actually helped end the Great Depression, not the monetary policy," said Richard Koo, Tokyo-based chief economist at Nomura Research Institute and author of The Holy Grail of Macroeconomics: Lessons from Japan's Great Recession.

"I don't think it will be over quickly. I am recommending at least three to five years seamless medium-term fiscal stimulus measures to give enough time for the private sector to repair its balance sheet."

Three to five years is an eternity in political life. It is an absolute sure thing that incoming President Barack Obama will design and implement a pretty chunky fiscal stimulus package even if President Bush does not pass one in his waning days in office. But think about how difficult it will be to maintain both the will and power to maintain a huge borrow and spend programme for several years.

Koo thinks that Japan, which was facing a far more serious destruction of assets, derailed its recovery with premature fiscal reform. "If we had known in advance that this kind of recession will never be over until private balance sheets are repaired and fiscal stimulus is needed to keep the economy growing, we could have done it in seven or eight years perhaps instead of 15," he said.

Near zero interest rates were ineffective in Japan because people and business refused to borrow, continuing to pay down debt to repair balance sheets that had been hurt badly by the fall in the value of assets like stock holdings and real estate.

I disagree with the conclusions of Koo and instead suggest that building bridges to nowhere wasted capital and prolonged Japan's deflation. Simple logic dictates that one cannot spend one's way to prosperity.

In the meantime I am sticking with my model that suggests there is another 3-5 years before housing bottoms in the US. I also expect the UK, Canada, and Australia to follow similar paths, offset only by the start of their respective housing busts.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.