Republican vs Democrat Presidents and the Stock Market

Stock-Markets / Stock Markets 2024 Dec 13, 2024 - 08:43 AM GMTBy: Nadeem_Walayat

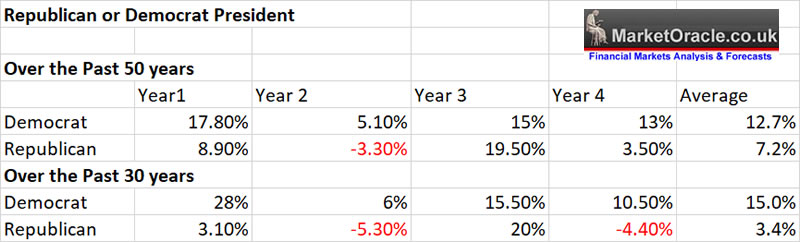

Stock market performance based on whether the President is Democrat or Republican.

The AVERAGES data suggests a Democrat president will deliver a stronger stock market performance than Republican for the first year of their new term, likely near twice that of a Republican president, with the mid-terms particularly bad for Republicans.

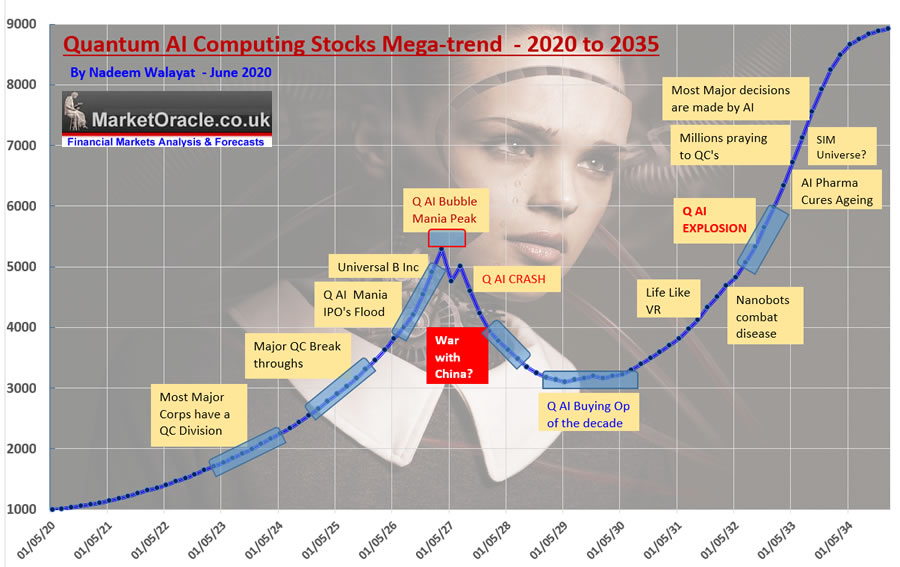

A Republican or Democrat is not going to make much difference to stocks for 2025 that looks set to be another very bullish year, likely to see a gain of between +20% and +30%, which if the S&P ends 2024 at 6000 implies a target of 7200 to 7800 by the end of 2025.

Whilst 2026 (mid-term) and 2027 look set to be when the stock market hits a brick wall, but you've already known this from my big picture narrative as of Mid 2020 of the coming Quantum AI bubble mania blow off top that rolls over into a bear market that I suspect will be well under underway by early 2027.

However, here is where most analysts tend to go wrong, AVERAGES, this is an average which tend to be misleading when conducting such analysis as the following illustrates of what actually happened following the past 8 elections.

Which is why in my last article I looked at the individual charts of the past 3 election cycles individually rather than the AVERAGE.

Now don't get carried away with the presidential cycle as it is just ONE metric, presidential cycle, global liquidity cycle, debt cycle, inflation cycle, business cycle, margin debt cycle, US wars cycle and so on.... one can do similar exercises with each and I do so keep things in context, yes presidential election cycles are very useful tools but only as part of a whole landscape of analysis as what happened during both of Bush's Presidency illustrated when one would need to understand that things are NOT going to play out as the Presidential cycle suggested it should, so useful as part of ones tool kit.

This article is an excerpt from my recent extensive analysis that was first made available to patrons who support my work - Stock Market October Correction Window Into Post US Election Rip the Face Off the Bears Rally

CONTENTS

Presidential Election Year Seasonal Trend

What Does a Strong September Mean for the Stock Market?

Stock Market Up 8 Out of First 9 months

Republican vs Democrat Presidents and the Stock Market

2025 Mid Decade Year

The Risks are to the Upside!

Presidential Cycle - Best time to buy stocks

AI Tech Stocks Portfolio

LRCX Stock Split

META $596

Nvidia 5X to 30X

CEREBUS IPO NVIDIA KILLER?

Never Buy an IPO

STOP LOSSES

CHINA Stocks Short Squeeze

Bubble Drivers

Fourth Reich Carving out an Empire Out of the Corpse of the US Empire

Why the US Empire Would Lose In a War Against Iran

Bitcoin Counting Down To Pump to New All Time Highs!

MSTR No Brainer

CRYPTO EXIT STRATEGY REVISITED

STOCKS BEAR MARKET STRATEGIES

CAPTALISNG ON THE NEXT BEAR MARKET

For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-ups in the New Year. https://www.patreon.com/Nadeem_Walayat.

Most Recent Analysis - Trump Stocks and Crypto Mania 2025 Incoming as Bitcoin Breaks $100k Barrier

CONTENTS

Global Liquidity Prepares to Fire Bull Market Booster Rockets

Fed December Rate Cut

Stocks Bubble 2025

S&P Big Picture Road Map

Moores Law is NOT Dead, it is ACCELERATING!

AI Stocks Investing Perception

Stocks Portfolio

DOCU - What it Means to Never Sell At a Loss

Riding the AMD Gravy Train

Learn to Be the Man In the Middle

BTC $100k Milestone Achieved

Bitcoin Forgives You!

Bitcoin Seasonal Trend

Bitcoin - How the Bull Market Could End

Bitcoin Dominance Drop Triggers Alt Season

CRYPTO MARKET CAPS

CRYPTO EXIT STRATEGY

COINBASE

MSTR Blow Off Top

MSTR Spectrum

Micro Strategy Ponzi

Trump Ukraine Victory Incoming

Canada Living on Borrowed Time

Hacking Ageing With Supplements

Next Analysis VOTE

Recent analysis includes -

Stocks, Bitcoin and Crypto Markets Get High on Donald Trump Pump

Bitcoin Break Out, MSTR Rocket to the Moon! AI Tech Stocks Earnings Season

Stocks, Bitcoin, Crypto's Counting Down to President Donald Pump!

Stock Market October Correction Window Into Post US Election Rip the Face Off the Bears Rally

And access to my exclusive to patron's only content such as the How to Really Get Rich series.

Change the Way You THINK! How to Really Get RICH Guide 2023

Learn to Use the FORCE! How to Really Get Rich Part 2 of 3

The Investing Assets Spectrum - How to Really Get RICH

Here's what you get access to for just $7 per month -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on this page and I will also send a short message in case the extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and net get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles, clear concise steps that I will seek to update annually and may also eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive at least 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of my analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before next rises to $10 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst.

By Nadeem Walayat

Copyright © 2005-2024 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.