Panic in the Air As Stock Market Correction Delivers Deep Opps in AI Tech Stocks

Stock-Markets / Stock Markets 2024 Oct 27, 2024 - 10:01 PM GMTBy: Nadeem_Walayat

Dear Reader

This analysis Panic in the Air As Stock Market Correction Delivers Deep Opps in AI Tech Stocks. was first made available to patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before next rises to $10 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

But first an excerpt from my latest analysis that includes my take on who will win the US Presidential Election.

Stocks, Bitcoin, Crypto's Counting Down to President Donald Pump!

The brainwashed masses think that Donald Pump or Karamal Parris will win and save America! Despite every President in history never delivering on what they promised, all that they will do is PRINT MORE MONEY and leave office a lot richer than they were before taking office.

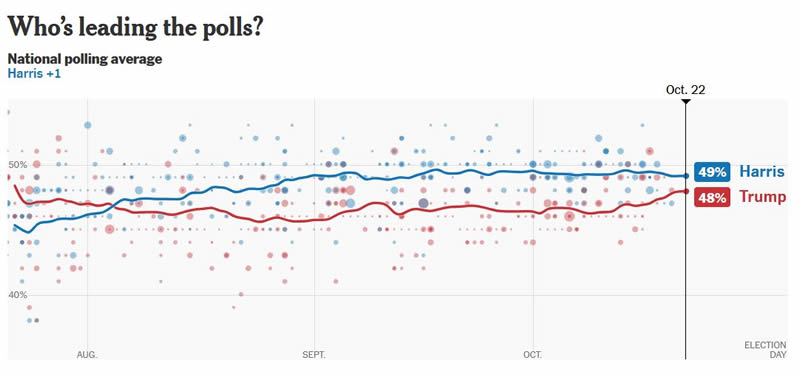

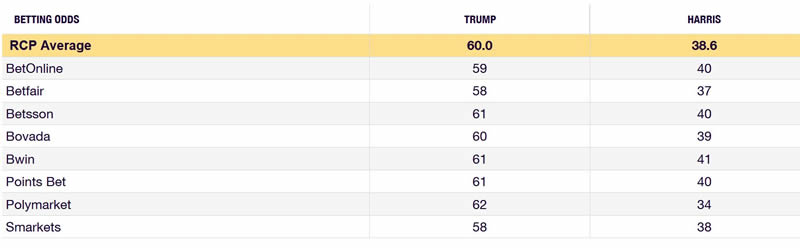

My view that President Pump will win has stayed constant all year regardless of what the opinion polls have stated as they whipsawed between giving Parris a Lead over Pump. Latest polls continue to give Harris a coin flip lead over Trump after taking over from lost all of his marbles Biden.

So probability continues to favour a President Donald Pump election victory in under 2 weeks time. and who knows it could turn out to be a match made in heaven.

Test for Allen Litchman and his 13 keys that gives this election to Kamala Harris.

Watch this space for Litchman to come out with excuses of why his so called 100% correct Keys system got 2024 WRONG!

It's earnings season again already!

Two Ai giants reported last week - ASML Dumped (as expected) and TSMC pumped to a New all time high (also as expected) as I commented ahead of the event -

TSMC - $187 - EGFs 15% / 32%, Dir 11%, PE range 122% / 79%

Earnings beat, we are in a correction window but I suspect TSMC will be strong, could see a new all time high, though a dump like ASML would be nice.

Stocks, Bitcoin, Crypto's Counting Down to President Donald Pump!

CONTENTS

Stock Market Correction Window

Stocks Bull Market Smoking Gun

Stock Market Intra Year Cycle

The Risks are to the Upside!

DOCU LIVES!

Nvidia Numero Uno

TRIMMING VS REBUYS

S&P ETF Passive Investing Bubble Mania

AI Stocks Portfolio Q3 Earnings Season

23rd - TSLA - $218 - EGF -7%, +13%, Dir +16%, P/E 93, PE Range 208% / 161%

23rd - IBM $232 - EGF -8, +1%, Dir +14%, PE 22.8, PE range 102% / 69%

23rd - Lam Research - $73.1, EGF +6%, +27%, Dir -3%. PE 24.1, PE Range 102% / 69%

24th - WDC $67, PE -177

29th - Google $166 - EGF +7%, +17%, Dir -8%, PE 23.9, PE Range 60% / 24%.

29th - AMD $154 - EGF's +15%, +54%, Dir +19%, PE 55, PE Range 95% / 51%

30th - META $582 - EGF +5%, +16%, Dir -1%. PE 29.7, PE Range 124% / 95%

Bitcoin Blood Bath Revisited.- PAIN IS GOOD!

Bitcoin Gift Bull Market Targets

BItcoin on the Launch Pad Awaiting President Donald Pump!

Crypto Market Caps

SCALING OUT OF THE BULL MARKET

UK Budget 2024

Panic in the Air As Stock Market Correction Delivers Deep Opps in AI Tech Stocks

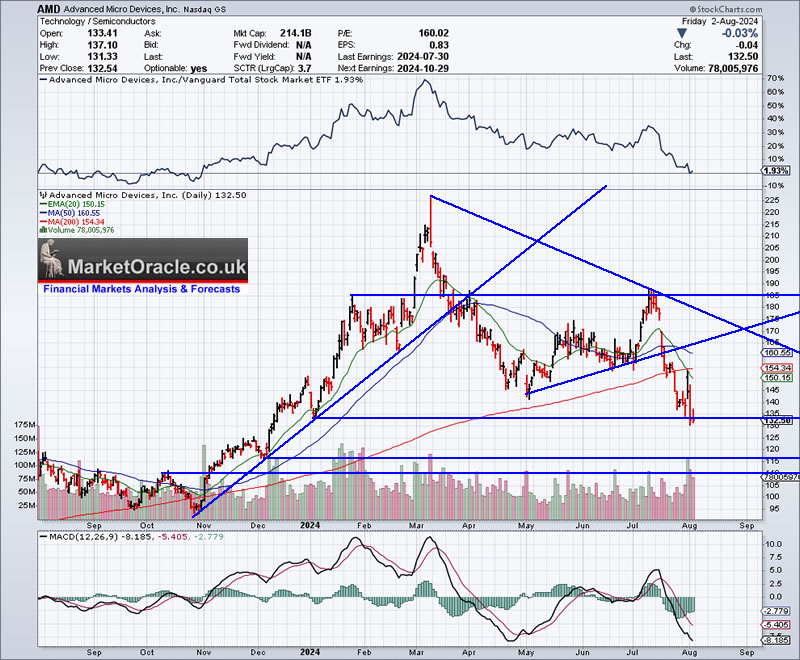

I often get asked for stock tips, which stock should one invest in for x number of years, 3 or 5 because they will be needing the money in x number of years time, so I tend to read off my list of AI tickers from but I then say it's not going to work, not unless you a. understand what you are investing i.e. what the companies do, and b. unless you actively monitor your portfolio which takes time and effort because there is no easy money as with everything in life you have to work for it, investing in the stock market is not like putting money in a short-term bond or savings account, all this crap you hear about making easy money from passive investing is not going to work, as those who invested in one of the best tech stocks on the planet AMD are experiencing right now as it went from $90 to $225 and now down to $132, targeting $120, possibly as low as $110 with the volume suggesting most bought north of $150, and recently volume surging on the break below $140 suggests some panic selling underway.

If folks recall I considered the move from $180 all the way to $225 as insane, hence why I sold down to about 30% invested, good luck with doing that for those who don't understand what they are investing nor actively monitor their portfolios, I can imagine many fomo'd in on break above $200 which is going to hold the stock down i.e. there are a lot of investors who over paid and now are waiting for a rally to sell into. And lucky us we got a second opp to trim into on the rally into mid July where at the time I was asked if I am going to raise my AMD buying range, I replied nope it was good with where it was at the time at $145 to $132, as was the case for virtually all of the AI tech stocks that had FOMO'd to ridiculous valuations, there is no point over paying for stocks just for the sake of FOMO!

Micron another stock that went nuts to the upside on AI Mania, now fast unraveling as those who FOMOd are now panic selling out of a stock that lost touch with reality that will likely soon trade to sub $80. I can't see how this stock can get anywhere near it's $156 high anytime soon. I sold down to about 15% invested and now buying the deep dip has me stand at 25% invested vs about 90% invested a year ago.

You have to work for it, there is no easy money as you can not buy and sell with the benefit of hindsight.

Stock Market Current Trend

Stock market trend continues to follow the expected trajectory for a summer correction into at least mid September that targets between S&P 5060 and 5000, current pre-market price is at 5283, so now significantly below target which on the basis of the sell off in crypto's during the weekend suggests there is panic in the air surrounding Iran's response to the latest aggression (assassination) by the Fourth Reich. So to all who may already feel like puking on the deep draw downs in the likes of AMD we are only just past the half way mark in the indices and well you did have advance warning of what was coming so plenty of time to prepare by trimming hard into the FOMO tops.

The great irony is that the market is falling on the GOOD NEWS that a Fed rate cut is now near 100% certain in September where the speculation has shifted to the chances of a 1/2 point cut. So the market reaction has once more caught most off guard as most had been looking to the certainty of a rate cut as being a bullish signal for higher stock prices hence I often get asked when will the Fed cut rates so stocks can go to the Moon, well now you get your answer in that the opposite tends to happen to what most investors expectat which sends them into a panic hence why we are seeing a strong sell off in stocks as I write and I have repeatedly stated in the comments scale in because you will feel like puking towards the end of this correction given how low tech stocks could go, i.e. I don't have a time machine but it's a lot better to accumulate the likes of AMD at sub $150 then over $200!

AI Stocks Portfolio

The AI tech stocks portfolio reported earnings EGF's have been updated that show the direction of travel for EGF's (for explanation see the investing guide in the spread sheet).

Primary AI Tech stocks EGF's collectively are +77% / 12month +227%, Dir of travel +37% so the primary stocks are very strong thus suggests the current sell off is temporary. though that does not mean the likes of AMD will get to $225 anytime soon since that run was pure FOMO mania.

Secondaries are +30% +161%, Dir +53%, again showing collective strength though most secondaries are still expensive in terms of their PE % range.

Spreadsheet Link NEW LINK - https://docs.google.com/spreadsheets/d/1FICHeQvTU1pSYalH0fS1e4VYMD6Ra0T8IwVu_LCnZNQ/edit?usp=sharing

(Link changes approx once every 2 months)

Primary and Secondary Opportunities

Format (EGF, Dir, 12M EGF, PE % Range) - For a quick read of the spreadsheet you want to see positive EGF's and direction of travel coupled with a sub 100% PE range i.e. such as Nvidia's 42%, 4%, 69%, 59% - excellent metrics as usual.

Google $168 6%, -9%, 17%, 62%

Weakening but still positive EGF, so likely will see new all time highs later this year. Price bounced off of support at $165, unlikely to hold, thus targets $155. MACD is very oversold so not much downside left in terms of time so I'd expect $155 to hold for a 20% deviation from it's high, however a break of $155 would target a deeper correction to $140. Buying range is $166 to $150, I'll seek to accumulate some sub $160.

(Charts courtesy of stockcharts.com)

Nvidia $107 42%, 4%, 69%, 59%,

Nvidias metrics remain as if its from another planet so don't blow rare opps such as this to accumulate! Price chart and MACD similar to Google, Downside looks very limited, there is a hell of a lot of support between $90 and $100. Even trading down to $95 would be getting lucky, I would be surprised if we see sub $90, in fact I suspect it will hold above $100 as that is where a lot of buy orders will be, still at $100 would be giving a 29% deviation from it's high. I'm seeking to add from $103 down to as low as it goes, seeking to get to about 20% invested from current 12%.

AMD $132.5 15%, 19%, 54%, 77%

The mania has evaporated! So much for the buy and holders and tip seekers i.e. "Nadeem give me a tip of a good stock to invest in over the next 5 years", I can say AMD but is it going to work? I mean it's deviated by 42% from it's recent high! Excellent metrics coupled with a 42% deviation is delivering a good opp to accumulate for those who followed my lead by trimming hard into the $225 Mania high. Price chart, what can I say the bubble has popped! Yes it could keep falling along with the other stocks as support breaks at $130 to target $120, then $110 below that. Anything below $130 would be the icing on the cake. I'll keep adding the more it falls, with my buys getting heavier the lower it goes. We definitely got lucky with that mid July spike to $188 to trim into. Bottom line it's already deviated near 45% from it's high so I would be surprised if see a further serious sell off to say below $120, but if it does I will be buying.

(Charts courtesy of stockcharts.com)

MSFT $409, 2%, 1%, 19%, 71%

Steady as she goes gave a brief opp of sorts opp down to $390 for a 17% deviation. As I stated in my last article I seek much lower prices to accumulate Microsoft. something like sub $372, so whilst I will add some in it's buying range down to $386, it's not going to be much, there are better opps out there, but its possible Microsoft plays catch up and delivers the likes of $366 for a 22% deviation.

META $488, 4%, -2%, 12%, 108%

META another steady as she goes AI primary that also is not delivering much of an opp standing at a 10% deviation from it's high and well above it's buying range of $446 to $402. I seek sub $440 to add more, and sub $406 for larger buys, it's a stubborn stock refusing to correct despite being expensive at 108% of it's PE range.

TSMC $150,13%, +9%, 30%, 86%

Excellent metrics that improved by +9% which means the draw down should be temporary. The price has deviated by 22% from it's fomo high, downside is looking limited to about $135 for a possible 30% deviation. I will continue rebuilding my position with larger buys as it falls towards $135. The stocks too good to expect to go much lower than that i.e. seeing sub $130 would be getting lucky.

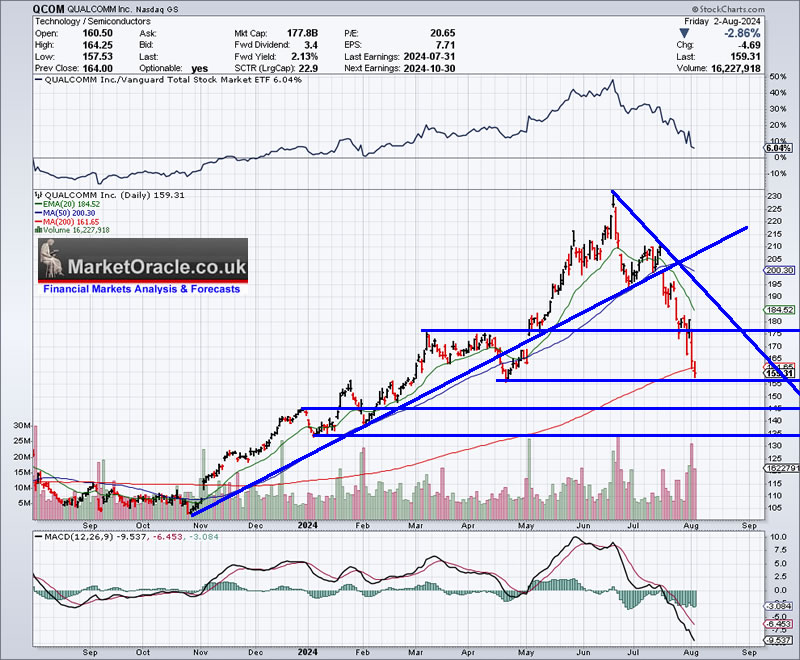

Qualcom $159, 0%, -3%, 10%, 56%

A steady as she goes stock with earnings due 7th August thus could prompt price volatility given the jittery state of the market. The stock is already off a whopping 31% off it's FOMO high, suggests not much more downside then about $150, break below that would target $135 for a 41% deviation. I'll be seeking to add more between $154 and $135 with the buying range accordingly amended .Though I hope we don't see a repeat of 2022 when I started buying at around $150 and it just continued to fall and get cheaper and cheaper all the way down to $100. There is heavy support along the previous highs at $135 which should act halt the decline. EGFS predict that the earnings will be flat so we could see Qualcom trade below $140.

TESLA $207 -5%, +18%, 16%, 184%

TESLA is the highest risk primary and continues to trade at a lofty premium of 184% of it's PE range which means it is always at the risk of a sharp correction. It was bad timing for TESLA because it was just getting going in it's FOMO driven bull run breakout when it got sucked back into it's trading range by the tech stocks correction. I can;t see Tesla not trading back below $200 to target $180, on the plus side downside volume is weak which suggests there isn't much selling, i.e. even a drop to below $180 could prove short lived if the volume continues to favour the upside unlike every other stock so far that has much heavier volume on down days. The MACD also suggests that Tesla could trade down to $180 as it unwinds its over bought state.

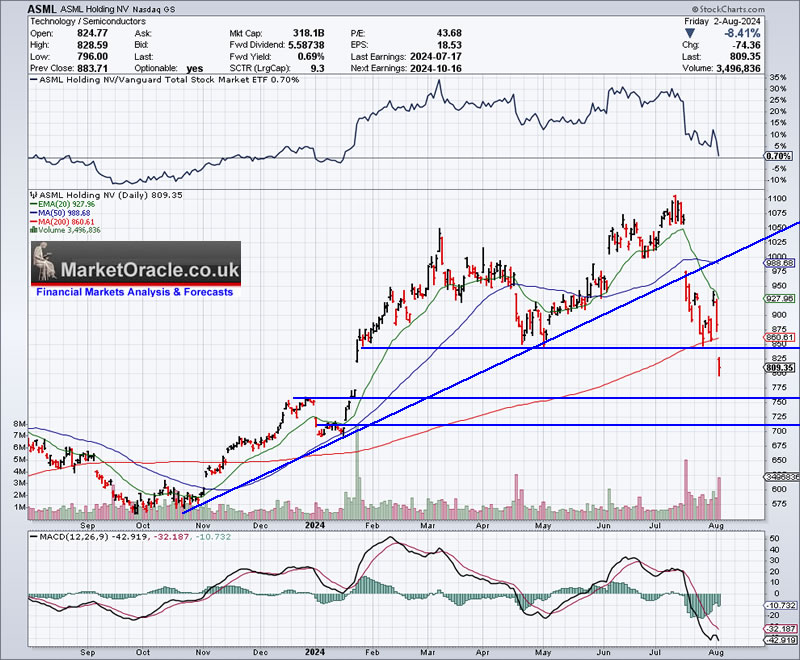

ASML $809 5%, +31%, 40% 84%

ASML stands out in the secondaries with strong metrics and direction of travel that is trading at -27% below it's high. The stock price is targeting support at $750 and then $700 which would resolve in a 37% deviation from it's high, I will continue to accumulate the best of the secondaries in terms of value as the rest remain expensive i.e. trade beyond 100% of their PE range, apart from Amazon.

(Charts courtesy of stockcharts.com)

Of the rest of the secondaries the closest to an opp is AMAT with it's 29% deviation that is yet to report and stands at 107% of it's PE Range. Notable price deviations are Micron at -41% deviation and LRCX ar -32%.

Meanwhile INTEL is suffering, though is showing a stealth +10% Dir so could surprise with a snap back rally post correction.

In summary AI stocks that stand out right now in terms of clear opps to accumulate are Nvidia, AMD, ASML and then AMAT hence I aim to continue to accumulate into these as I await the likes of META and Microsoft to finally join the party as well as upping exposure to others after earlier heavy trimming.

Looking a further field there are clear opps in FSLR and FCX.

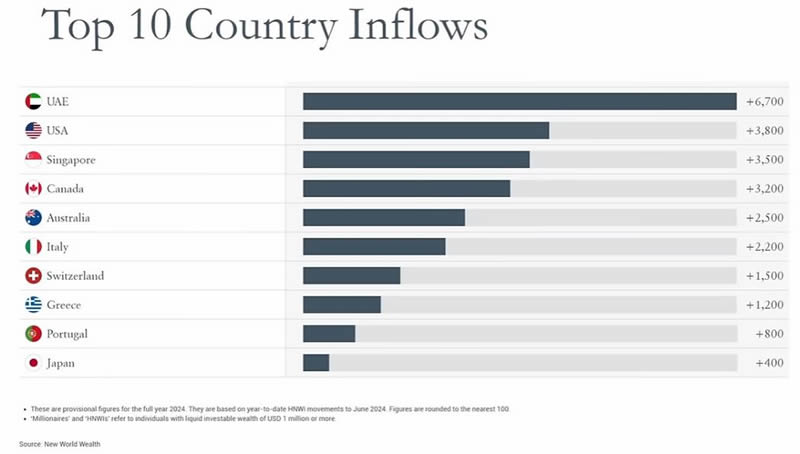

Everyone Wants to Move to Dubai!

What's taking place in Britain is in stark contrast to Dubai where on the surface at least everything is calm and peaceful, where the risks of violence appear non existant, not that Britain is particularly violent, it's just that the media here blows it up to be 100x actual whilst in Dubai they probably do the opposite suppress bad news events hence why it is the no 1 destination for millionaires across the world.

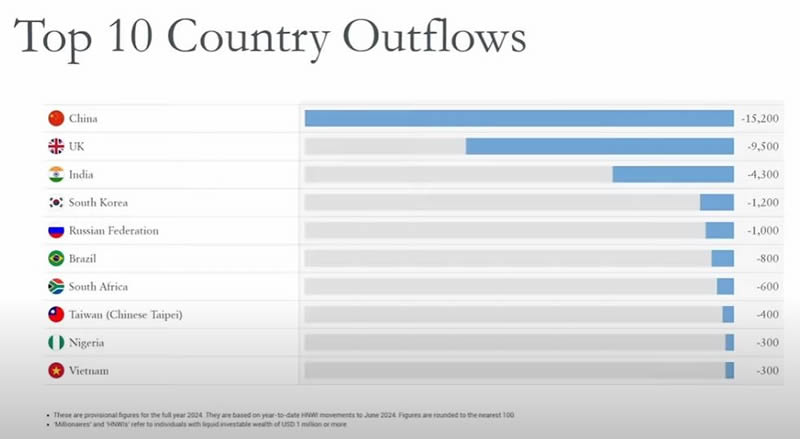

And where are they coming from? the UK with it's tiny Island population of 67 million ranks as second to China with it's 1.4 billion people in a brain and wealth drain under way, they don't need to put up with any of this rioting and looting nonsense, they can literally live like kings in paradise as long as they keep their mouths shut about the Emir.

Moving to Dubai becomes more appealing with each passing rioting day....

The Fourth Reich Wants WAR!

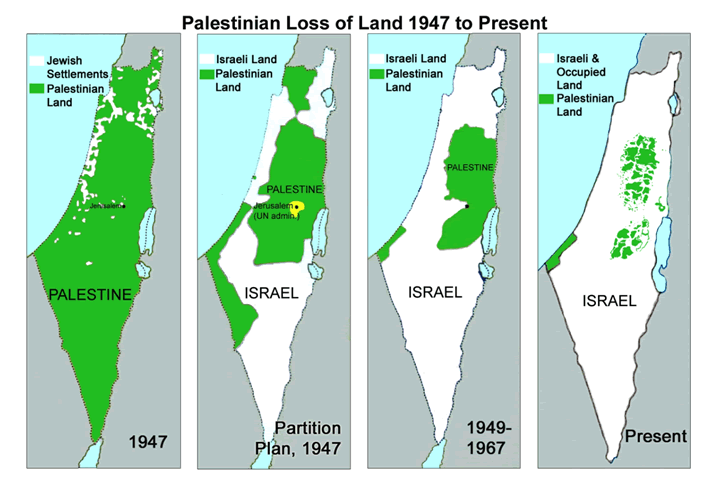

The Fourth Reich once more showed it's true colours by assassinating the Hamas leader they were supposed to be negotiating a 'cease fire' with whilst in Tehran sending a message to the Iranians the depth and breadth of their infiltration of their nation that NO ONE nowhere is safe from the reach of the Fourth Reich. Terror personified!

Apparently the riots kicked off within hours of reports that the UK has suspended arms sales to Israel.

There never was going to be a cease fire let alone peace negotiations, it's all smoke and mirrors as per the objective since day one 1947.

Current phase is to first eradicate the Palestinians from Gaza and then the West bank and it won't stop there as the Fourth Reich will turn it's attentions to further annexing chunks of neighbouring nations such as Syria's Golan heights where it siezed the land and changes the place names and pretends they were part of Israel all along much as the Third Reich did during WW2, but this time the Fourth Reich holds the Worlds sole super power by the balls, to do it's bidding by sending arms and CASH to the Fourth Reich due to the myriad of reasons from the bible pumper's of the Mid West who crave End Times so they can be raptured into Heaven to meet Jesus at the Second Coming. Then we have the bullet digging Messiah thinking he is doing Gods Work, it's all getting rather End Times, the AI's will be laughing at how easy it was to take control of the planet, none of the battles as portrayed in the movies just use their narratives and myths against them a bit like Dr Seuss and the Sneetches.

The machine intelligence is laughing.

Bitcoin Brief

Current price action should be wave 2 following the July top at $68.9k, but it is pretty deep and could break the $54.3k low which would not be good, that's the risk with crypto's, one places one bets and takes ones chances, The 10% drop is already making the chart look messy let alone what a break of 54.3k implies You'll probably know which way the wind blows by the time I get this posted. I won't be adding any more crypto's but will eye and drops to add to MSTR, COIN and CLSPK.

You analyst seeing the S&P dip below 5250 as I scramble to get this posted!

Again For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before next rises to $10 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

Most Recent Analysis - Stocks, Bitcoin, Crypto's Counting Down to President Donald Pump!

CONTENTS

Stock Market Correction Window

Stocks Bull Market Smoking Gun

Stock Market Intra Year Cycle

The Risks are to the Upside!

DOCU LIVES!

Nvidia Numero Uno

TRIMMING VS REBUYS

S&P ETF Passive Investing Bubble Mania

AI Stocks Portfolio Q3 Earnings Season

23rd - TSLA - $218 - EGF -7%, +13%, Dir +16%, P/E 93, PE Range 208% / 161%

23rd - IBM $232 - EGF -8, +1%, Dir +14%, PE 22.8, PE range 102% / 69%

23rd - Lam Research - $73.1, EGF +6%, +27%, Dir -3%. PE 24.1, PE Range 102% / 69%

24th - WDC $67, PE -177

29th - Google $166 - EGF +7%, +17%, Dir -8%, PE 23.9, PE Range 60% / 24%.

29th - AMD $154 - EGF's +15%, +54%, Dir +19%, PE 55, PE Range 95% / 51%

30th - META $582 - EGF +5%, +16%, Dir -1%. PE 29.7, PE Range 124% / 95%

Bitcoin Blood Bath Revisited.- PAIN IS GOOD!

Bitcoin Gift Bull Market Targets

BItcoin on the Launch Pad Awaiting President Donald Pump!

Crypto Market Caps

SCALING OUT OF THE BULL MARKET

UK Budget 2024

Recent analysis includes -

Stock Market October Correction Window Into Post US Election Rip the Face Off the Bears Rally

Stock Market Trend Forecast Sept 2024 to Jan 2025

Nvidia Earnings vs Stock Market Correction Window

Also access to my comprehensive 3 part How to Get Rich series -

Change the Way You THINK! How to Really Get RICH Guide

Learn to Use the FORCE! How to Really Get Rich Part 2 of 3

The Investing Assets Spectrum - How to Really Get RICH

Here's what you get access to for just $7 per month -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on this page and I will also send a short message in case the extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and net get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles, clear concise steps that I will seek to update annually and may also eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive at least 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of my analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

So for immediate access to all my analysis and trend forecasts do consider becoming a Patron by supporting my work for just $7 per month. https://www.patreon.com/Nadeem_Walayat lock it in before it next rises to $10 per month for new signup's.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your buying the dips analyst.

By Nadeem Walayat

Copyright © 2005-2024 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.