Is Gold Price Heading to $2,275 - 2,280?

Commodities / Gold & Silver 2024 May 28, 2024 - 04:24 AM GMTBy: The_Gold_Report

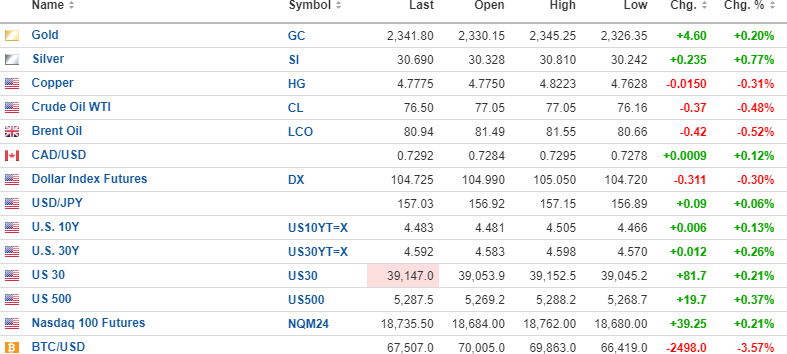

USD index has given back recent gains this morning with bond yields continuing to rise.

Gold (+.2%) and silver (+.77%) are rebounding very slightly but there has occurred some s/t technical damage, especially for gold. Copper (- .2%) and oil (-.08%) are lower, while stock index futures are modestly higher across the board.

Yesterday was one of those classic days where the powers that be decided that Jerome Powell was correct in his last press conference when he said, "I don't see any "stag," and I don't see any "inflation."

Accordingly, they took gold, silver, and copper lower with a vengeance as well as stocks after the Nvidia (NVDA:NASDAQ) earnings seemed to suck all of the bullish air out of the room.

I added to Pan American Silver Corp. (PAAS:TSX; PAAS:NASDAQ) yesterday with the June $20 calls at $1.60, so my new average is $1.775. PAAS is called $0.30 higher.

Silver must hold the $30 level lest I be forced to jettison the entire silver position, which is comprised of only the shares and calls in PAAS. If silver cannot hold that critical and much-publicized breakout level at $30, I see $28 and then $26 in a hurry.

I continue to add to American Eagle Gold Corp. (AE:TSXV)as I learned that drilling commences on the mighty NAK discovery on Monday. While it will take a few months to get results, I expect some speculative buying to propel AE north of $1.00 quickly and prior to results.

I will be working on the weekly missive for most of the day, but I leave you with two charts: gold and silver.

Gold looks like it is heading to $2,275-2,280, having broken the uptrend line with yesterday's crash.

Silver, however, is still in an uptrend and while it is coming down off an overbought condition, if it can hold $30, it might be a perfect entry level.

However, I will not add until it gets safely back above $31 and stays there for a few days.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure: 1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Aftermath Silver Ltd., Great Bear Resources, Western Uranium, Stakeholder Gold, Getchell Gold. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp. and Western Uranium & Vanadium Corp. My firm no longer does consulting work for Stakeholder Gold.. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Great Bear Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium and Vanadium and Aftermath. Please click here for more information. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports (including members of their household) own securities of Getchell Gold, Western Uranium and Stakeholder Gold and Aftermath, companies mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.