SoftBank: A Possible Stock Market Omen for What's Ahead

Companies / Stock Markets 2024 Jan 19, 2024 - 05:09 AM GMTBy: EWI

Here's what happened to the once most valuable U.S. startup

SoftBank, the multinational holding company which is heavily involved in the technology sector, has had a tough go of it.

Its stock price has been in a steady decline for the past few years and one has to wonder if this is a preview of what may be ahead for many other firms, especially those in the technology sector.

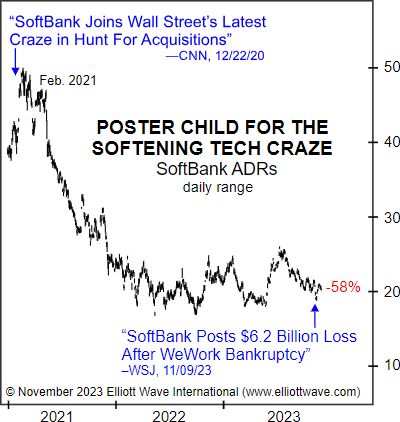

The December Global Market Perspective, a monthly Elliott Wave International publication which covers 50-plus global financial markets, showed this chart and said:

SoftBank's stock price followed the tech sector higher until February 2021, then reversed and underwent a three-year nosedive of nearly 60%. For investors, the regret phase is now coming on fast. Last month, the Financial Times published an image showing the lifetime performance of 25 SoftBank-funded stocks, including former market darlings like Alibaba, Uber, DoorDash and Fitbit. Just three of the 25 companies showed a positive return since their IPOs, and 12 of them were down more than 50%.

And here's a headline from Nov. 9 (AP):

Japan's SoftBank hit with $6.2B quarterly loss as WeWork, other tech investments go sour

Notably, SoftBank's WeWork -- once the most valuable U.S. startup -- filed for Chapter 11 bankruptcy protection in early November.

The Financial Times called WeWork "one of the worst venture capital investments in history."

By contrast, the FANG+ index approximately doubled in value in 2023. However, the group performance of the well-known big cap tech names early in 2024 has been a different story (Markets Insider, Jan. 4):

It's been a bleak start to 2024 for the Magnificent 7 tech stocks after crushing the market last year

And, as you may be aware, those Magnificent 7 stocks have mainly been holding up the entire market.

In other words, if those big cap tech names crater, the main indexes are likely going to crater too.

At this juncture, you may want to keep a close eye on the stock market's Elliott wave pattern.

If you'd like to learn about Elliott wave analysis, the definitive text on the subject is Frost & Prechter's Elliott Wave Principle: Key to Market Behavior. Here's a quote from this Wall Street classic:

Without Elliott, there appear to be an infinite number of possibilities for market action. What the Wave Principle provides is a means of first limiting the possibilities and then ordering the relative probabilities of possible future market paths. Elliott's highly specific rules reduce the number of valid alternatives to a minimum.

Club EWI members can access the online version of the book for free!

In case you're unfamiliar with Club EWI, it's the world's largest Elliott wave educational community (about 500,000 worldwide members and growing rapidly). Club EWI is free to join and allows members complimentary access to a wealth of Elliott wave resources on financial markets, investing and trading.

You can have the book on your computer screen in just moments by following this link: Elliott Wave Principle: Key to Market Behavior -- free and instant access.

This article was syndicated by Elliott Wave International and was originally published under the headline SoftBank: A Possible Omen for What's Ahead. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.