S&P500, Gold, Silver and Crypto's Trend Forecasts 2023

Stock-Markets / Financial Markets 2023 Feb 08, 2023 - 10:14 PM GMTBy: Nadeem_Walayat

In terms of my stock market trend forecast the Dow by now would be trading at approx 32,500 vs actual last close of 33,203 for a +0.9% deviation, imagine if someone told you where the Dow will be in 3 months time and by that time the Dow is within 1% of the forecast price, so the forecast is proving to be an accurate road map against which to measure relative strength or weakness.

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023

Thus 2023 should see a bumpy ride starting with Q1 weakness that will encourage many to expect NEW BEAR MARKET LOWS! Which I expect to resolve in a rally to new bull market highs ahead of another significant correction later in the year before the Santa rally of 2023 delivering a bull run into the end of the year. My base case is for the Dow to target a year end of 34,500, though given the way the Dow has performed to date I would not be surprised if the Dow ends the year above 35k.

Transposing my Dow trend forecast onto the S&P chart suggests that following Q1 weakness for the S&P to target a break above of 4300 to target an assault on 4650 that will likely contain bullish exuberance, and result in a Q3-Q4 correction to resolve in a year end rally to target 4400, which would represent a rally of 14.5% on the last close of 3845 and 26.5% off the October low. Against which expect bearish rhetoric to prevail for the whole of 2023 as dire economic data will be taken as a cue to expect a break of the October low by most..

My objective will be to hold on to the bulk of the many falling knives I bought during 2022, that last one being TESLA which hit a new of $121 Friday, next support being $111, whilst $120 had been my target for this stock for the duration of this bear market, Unfortunately given the hype built around this stock it has been a battle for retail investors to avoid getting sucked into the Tesla black hole which is what I coined it to be well over a year ago, hence shorted it for most of 2022, only starting to accumulate into over the past few months which STILL proved to be too early for this black hole!

Has Tesla consumed ARRK? At the time of my above warning ARKK was trading at $113, current price is $30! Imagine all those poor souls who sought safety by investing with the 'professionals'. SCAM ARISTS more like it! As I rant from time to time the only thing fund managers are interested in is collecting their management fees (ARKK 2%) thus everything that spews out of the orifice they call a mouth is a SALES PITCH to entice more victims to enter into their funds. That is what you get when watching CNBC, 24/7 adverts to invest in turd funds such as ARKK.

The only thing I would add is that wherever Tesla finally hits bottom be it at $121, $111 or $100, I would expect the Tesla stock price to DOUBLE off that low during 2023, so at this point in time I am not too bothered by the draw down because we will only know exactly where this stock hits bottom with the benefit of hindsight and one cannot invest with the benefit of hindsight. Though since I began accumulating Tesla I have been warning all those who have been buying TESLA to be prepared to see the stock trade below $130.

This article S&P500, Gold, Silver and Crypto's Trend Forecasts 2023 was was first made available to patrons who support my work.

So to gain immediate access to all of my ahead of the curve analysis as my extensive analysis of the stock market illustrates (Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1), that continues on in the comments section of each posted article, all for just 4 bucks per month which is nothing, if you can't afford 4 bucks for month then what you doing reading this article., if someone did what I am doing then I would gladly pay 4 bucks for it! Signup for 1 month and you will see what I do cannot be beaten by those who charge as much as $100 per month! I am too cheap! As I aim to keep my analysis accessible to all, those willing to learn because where investing is concerned the sooner one gets going the better as portfolios compound over time, 4 dollars is nothing for what one gets access which will soon rise to 5 dollars per month for new patrons so at least give it a try, read the comments, see the depth of my analysis and you won't be sorry because i do do my best by my patrons, go the extra mile which you will soon see, then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat. Lock it in now as $4 per month as this is soon set to rise to $5 per month, your very last chance!

Also access to recent analysis including -

- Stock Market Completes Phase Transition, US Real Estate Stocks - Housing Market Part1

- Stock Market Rally Slams into Q4 Earnings Season

- Stock Market Gasping to Reach 4000 Ahead of Earnings Season, Dow New All Time High 2023?

- S&P500, Gold, Silver and Crypto's Trend Forecasts 2023

- Santa Battles Grinch to Deliver Stock Market Last Gasp Rally into the New Year

- Santa Sledge on the Launch Pad for Stock Market Post CPI To the Moon Rally

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023 - Part 2

STEALTH INFLATION

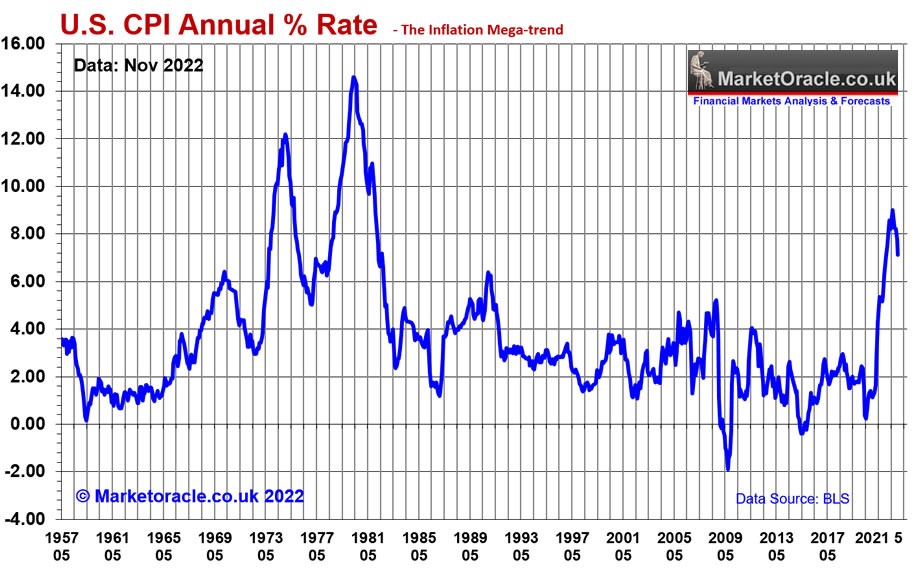

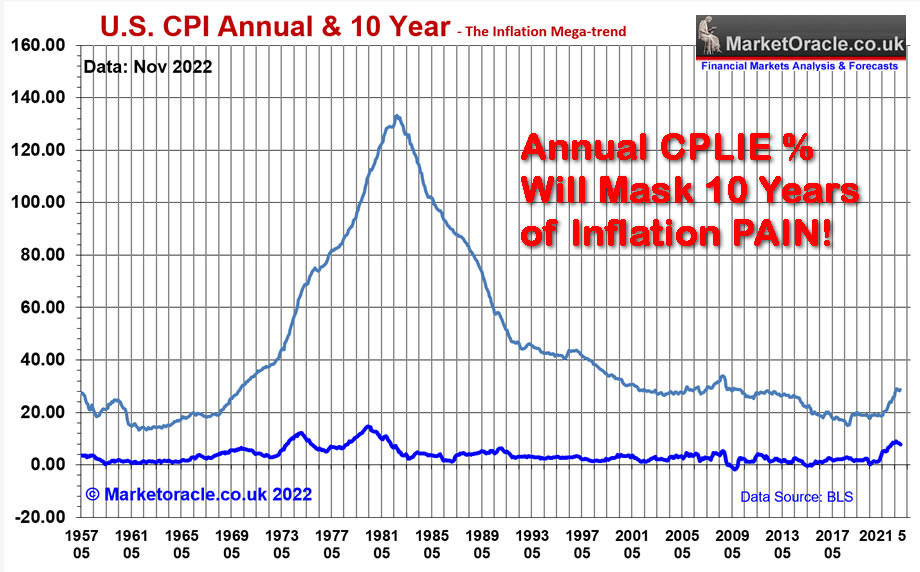

Gold and especially Silver are coming alive, the sleepers finally waking up to the INFLATION that they have been waiting for a decade to materialise. Where most are focused on the smoke and mirrors annual rate of CPLIE that the clueless mainstream media will latch onto to indicate that the Fed is winning and inflation is being defeated as the annual rate of CPI falls as the economy weakness..

However, most will remain completely blind to the actual inflation trend underway that I expect will deliver waves of COMPOUNDING inflation over the course of this decade where the current spike high of 9% CPLIE was merely the first wave! So yes the headline rate of annual inflation WILL SUBSIDE to wards 3% during 2023. However, CPLIE will MASK the actual INFLATION PAIN that most will experience as will be illustrated by the relentless climb in the 10 year inflation rate, which will climb higher and higher fed by the next CPI wave to above 9% peaking once more some time during 2025. and with it will the PAIN most experience as their earnings are unable to keep pace with prices in the shops which will so much civil unrest, rioting, looting and burning commercial districts especially during the hot summer months..

And it is this STEALTH INFLATION which will increasingly make itself manifest in assets that cannot be easily printed such as housing, certain stocks and GOLD AND SILVER!

The consensus narrative is that rising interest rates are bad for Gold and Silver so one would expect the opposite to happen during 2023, i.e. rising rates coupled with cooling inflation should act to dampen the prospects for Gold and Silver, however the trend going into the end of 2022 has been one for the emergence of a stealth bull market in both precious metals, especially silver.

SILVER CRACKUP BOOM!

My last look at the prospects for SIlver of early May 2022 warned to expect the inflationary crack up boom to eventually make it's way to the precious metals complex - The CRACK UP BOOM! Implications for Stocks, Housing. and Commodities, Silver Potential

Silver is at the opportune level of $22 for long-term accumulation that first targets the top of the range at $28 and then on a breakout higher to ultimately target the previous all time high of $50.

As I often voice Silver exhibits a messy trend, infuriating at times, as was the case during the summer months when instead of climbing higher along with rampant Inflation it actually fell to below the last lost of $21, falling to support at $18 eventually bottoming at $17.4. Definitely not an easy market to trade! Nevertheless subsequent price action has seen Silver put in a series of higher highs and lows, with the price since early November not allowing those sat on the sidelines waiting for a dip to buy to get onboard as each correction has proven to be milder than the one before.

The stage finally appears set for Silver to make a run for resistance between $28 and $30 which I am sure will again resolve in a messy trend, however the price action that follows will set the scene for a breakout higher to target at least $35 during 2023.

Gold Price Trend 2023

And similar trend for the Gold price, also attempting to break out higher off the October - November base that is likely to Gold target a trend to between $2000 and $2100 during 2023 vs the last close of $1804.

Looking at the longer-term chart then I am not seeing as much upside potential in Gold as Silver has, i.e. at best Gold appears to be targeting a trend to $2500 over the next couple of years.

Crypto's, with Most Potential Upside

Firstly, one does not invest in coruptos, one gambles on coruptos that one day a greater fool will come along to pay more than what one paid because as far as I can tell crypto's do not have any intrinsic value. Still the one thing that could lift some is limited supply and low inflation rates, especially those that tend to undergo halving's in miner rewards such as Bitcoin, though most coruptos (99%) are SCAM COINS! As many have found out during the corrupt0 blood bath of 2022 when several so called pegged to the US dollar stable coins disappeared in a puff of smoke with the rest teetering on the brink, so a case of having ones eyes wide open. Again Crypto's are SCAM CENTRAL! Especially during the bull mania phase as the scam artist celebs all try to cash in at the expense of their followers, the likes of the Kim Kardashian who settled out of the court with the SEC for pumping EthereumMax scam coin, and mega youtubers such as Logan Paul with his scam Zoo token game that disappeared in a puff of smoke taking millions of dollars of his fans money with it, though the scammers ended up stabbing each other in the back to such an extent that most of the scammers also lost money, rug pull on the rug pullers as the Dev did a runner with $6 million leaving Logan Paul and his inner circle down collectively about $1 million. Anyway crypto's are a case of having ones EYES WIDE OPEN, if ones eyelids are droopy then steer clear!

Whilst the crypto markets are at a time of extreme FEAR with centralised exchanges blowing up left, right and centre, disappearing with client funds and crypto holdings. Miners throwing in the towel, cutting their losses under the burden of exploding costs, One only needs to trundle along to youtube to see how many have lost all, abounded their mining dreams to literally be back to limited mining from their parents garage desperately clinging on to their crypto dreams by mining with a mere handful of machines as this once wannabe crypto multi millionaire who lost $200k on crypto mining illustrates, is back to working at his local gas station, of how the crypto mining bust is playing out as costs soar whilst mining revenues collapse.

https://youtu.be/RJB5-Q5aJRg?t=332

Sp crypto markets are in EXTREME distress which is the time one tends to pick up the greatest opportunities though crypto's will always be a gamble given that they have no intrinsic value, unlike gold and silver which DO have intrinsic value! I.e. an ounce of Gold will always be an ounce of Gold compared to crypto's that are just 1's and 0's on a blockchain, and don't get me started on NFT's, thankfully I have always considered NFT's to be an even bigger SCAM than what most crypto tokens are and so steered clear of the NFT opportunities to LOSE MONEY!

My existing trend forecast for the Bitcoin price as of 28th November is target a trend to $100k during 2024. So every time I look at the bitcoin price I do the mental math of dividing 100k by current price $17k = 5.9.

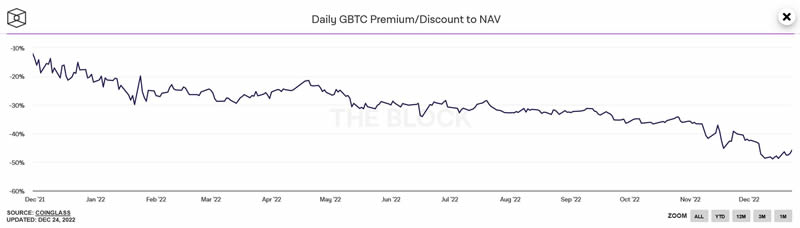

Usually the best times to accumulate into a 'market' is when it is at it's most distressed state when DOOM and GLOOM and FEAR REIGN supreme, one such market that fits the bill right now is the crypto casino! The evidence of which I have covered in recent articles such as the huge 46% discount to NAV in the Grayscale Bitcoin Trust that currently trades at $8.33 vs the Bitcoin price of $16,800. The problem with GBTC is that if it never coverts to an ETF then it is basically worthless and thus the NAV will continue to worsen as the management collect their annual 2% fee paid in bitcoins held by the trust! So investors are buying the promise of conversion to BTC someday in the future whilst Grayscale management siphon off their 2% annual management fee in Bitcoin! what a SCAM!

So which of the major crypto's could have the most potential upside during the next mania when all those who would not touch crypto's with a barge pole today will once more be piling in for a piece of the action?

The answer probably lies in what performed the best during the previous mania. Of course the starting point matters, so I am not taking the start as when the crypto's were last dead, say when the pandemic first hit, but rather when the crypto's had already entered into a bull run and starting to perk the interests of many including myself during December 2020, as shortly afterwards I started mining as soon as my RTX 3080 GPU's were delivered.

The crypto that stands out as having the most potential upside during a mania gold rush is ADA which had a huge 2000% bull run.

Next is Ravencoin, though this bull market died very early. at +1550%, which fooled many including myself that it would follow the bitcoin bull trend to new highs, which it never did! So ravencoin would be one crypto to exit EARLY! The beauty of rear view mirrors!

POKADOT comes next, +1000%.The price trend was pretty close to that of Bitcoin, so offered leverage to BTC.

ETHERUM - No2 to Bitcoin, Trend closely matched Bitcoin for +830%.

Bitcoin +295%, the safest of the lot, if one can consider any crypto as safe. However this relatively safety carries a cost in terms of lower potential return.

LInk and XLM saw earlier first peaks as Bitcoin with subsequent peaks coming nowhere near to that of Bitcoins November 2021 peak. this fooled many including myself in assuming there would be a rotation out of Bitcoin into the alt coins which NEVER HAPPENED.

And lastly one of my favourite crypto's Litecoin proved to be a damp squib in terms of returns, early peak of +438%, secondary peak of +278%, the only reason I liked this crypto is because the price was very volatile i,.e. limit orders on NiceHash could be triggered at deep discounts to where the price was trading such as LTC $170, gets triggered entry at $120 etc.

So if one is seeking to gamble on crypto's , and yes it is gambling rather than investing, the the two safest to accumulate into are probably Bitcoin and Ethereum. Then Pokadot for some leverage to the next mania. Next ADA for a X10 to X20 gamble.

Whilst crypto's to be wary of are Link, LTC, XLM and yes Ravencoin, though which may deliver an early X10 spike.

So I will mainly be placing my bets on Bitcoin, Ethereum, and to a lesser extent Pokadot.

I may also add a little more to ADA Whilst scrapping plans to add to Ravencoin, XLM, Litecoin, and aim to exit my Ravencoin early.

Another crypto that's perking my interest not on this list is Solana which has collapsed as a direct consequences of Sam Bankman-Fraud due to forced selling of holdings,with the price falling from a high of $260 down to $11 today..

So may main fantasy plan is to profit from BTC, Ethereum and Pokadot during the next mania. where my best guess is the main bull run will be in the aftermath of the next BTC halving during early 2024 as halving's put upwards pressure on BTC, which then perks the interest of the investing crowd that soon flow into the Alt Coins. Anyway we shall see a couple of years from now if what I accumulate today pays off several fold or not. Patrons can keep track of my crypto holdings right at the bottom of the AI stocks portfolio table which currently totals 1.07% value where I am looking to double this to just over 2%, which compares to near 6% holding in Google alone, so pinprick exposure.

The bottom line is that crypto markets have been crushed like a bug in the rug to an extent that most would not touch them with a barge pole, whilst I do not know where they will bottom,i.e. Bitcoin could bottom anywhere between $13k to $9k, we just don't know what the next crypto exchange blow up forced selling will deliver in terms of price drops, nevertheless I am accumulating now for potential payoffs a couple of years down the road with my expectation to see the likes of Bitcoin to at least X5 from current levels by which time everyone will be FOMO-ing into the peak.

A CHIA Trip Down Memory Lane.

During early 2021 of the myriad of emerging crypto out there one which perked my interest in early May 2021 was CHIA coin, where one farmed CHIA plots on ones hard drives at the rate of 100gb per plot, which given that I had plenty of spare hard drive storage space at the time in form of a couple of 28tb western digital external drives, so I gave it a good 7 day run at farming CHIA coins which was just enough time for me to figure out that this would turn out to be another crypto scam designed to only profit the insiders and thus I warned in a series of articles and videos to stop farming CHIIA, t's a SCAM! And not to be duped by the then artificially engineered high price of $1000+ per coin! as my following video from May 2021 illustrates.

So what happened to the CHIA price since? We'll the dump is what happened, the insiders offloaded their pre-farmed CHIA coins onto the plotters who collectively had committed many millions in excess storage hardware on the dreams of earning $1000+ CHIA coins. Another similar scam is Helium where gullible fools paid between $200 to $1000 for useless helium mining boxes.

The moral of the story is that during the next crypto mania many such new coins will emerge virtually all (99%) of which will turn out to be SCAM COINS! So even though one is gambling on crypto's, one should not make the mistake of deviating from that which has already stood the test of time of this bear market. There will be NO NEW opportunities in NEW COINS only SCAMS!

What do I use to buy Crypto?

Etorro - 1% fee but safer than the other platforms, so I am using etorro for NEW buys.

Binance - Low fees but it could go BUST! So I keep most of my crypto that I bought via binance off exchange in Trust Wallet which is a mobile software wallet.The risk is one loses ones phone or it gets hacked. Here's a tip configure your phone so that it turns OFF WIFI as soon as one leaves ones home, there is a setting on android phones to do this. Next step use a 2nd phone dedicated just to crypto's and the step after that is to use a hardware wallet.

Nicehash - Holdings via GPU mining in the background, currently using a couple of desktops for very limited background mining, i.e.just to warm up the office after midnight when the kwh rate drops to 1/3rd the day rate. Near two years ago this was a no brainier, get PAID to heat your home by having a computer GPU mining in every room like radiators during the winter! And that crazy state of affairs lasted a lot longer than I thought it would right into early 2022, with the nail in the coffin for GPU crypto mining being Putin's war on Ukraine.

Coinbase - limited due to high fees, I used to transfer from Nicehash to Coinbase because the transfers were fee free. However I will add some to Coinbase to spread the risk.

Again this article S&P500, Gold, Silver and Crypto's Trend Forecasts 2023 was was first made available to patrons who support my work.So to gain immediate access to all of my ahead of the curve analysis as my extensive analysis of the stock market illustrates (Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1), that continues on in the comments section of each posted article, all for just 4 bucks per month which is nothing, if you can't afford 4 bucks for month then what you doing reading this article., if someone did what I am doing then I would gladly pay 4 bucks for it! Signup for 1 month and you will see what I do cannot be beaten by those who charge as much as $100 per month! I am too cheap! As I aim to keep my analysis accessible to all, those willing to learn because where investing is concerned the sooner one gets going the better as portfolios compound over time, 4 dollars is nothing for what one gets access which will soon rise to 5 dollars per month for new patrons so at least give it a try, read the comments, see the depth of my analysis and you won't be sorry because i do do my best by my patrons, go the extra mile which you will soon see, then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat. Lock it in now as $4 per month as this is soon set to rise to $5 per month, your very last chance!

Also access to recent analysis including -

- Stock Market Completes Phase Transition, US Real Estate Stocks - Housing Market Part1

- Stock Market Rally Slams into Q4 Earnings Season

- Stock Market Gasping to Reach 4000 Ahead of Earnings Season, Dow New All Time High 2023?

- S&P500, Gold, Silver and Crypto's Trend Forecasts 2023

- Santa Battles Grinch to Deliver Stock Market Last Gasp Rally into the New Year

- Santa Sledge on the Launch Pad for Stock Market Post CPI To the Moon Rally

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023 - Part 2

Apart form regular AI Tech stocks and stock market updates, my schedule includes:

- US House Prices Trend Forecast - 50%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your trim the FOMO rally analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.