AI Tech Stocks Portfolio Buying Levels and Limit Orders for Buying the Panic!

Companies / AI Feb 02, 2022 - 08:28 PM GMTBy: Nadeem_Walayat

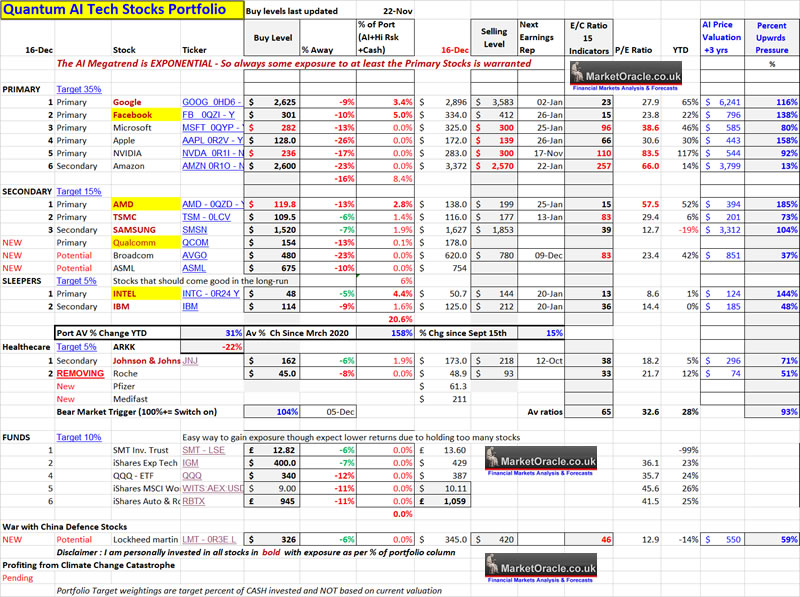

A reminder that my plan is to capitalise on a valuation reset in the over valued tech giants as they are one by one marked lower by at least 20% from their bull highs as we recently enjoyed with Facebook down to $300, with Nvidia and AMD already along their path towards triggering buying opportunities and the likes of Microsoft and Apple to soon follow suit.

Big image - Big Image - https://www.marketoracle.co.uk/images/2021/Dec/NW-Quantum-AI-Stocks-Portfolio-Big.jpg

Here's a quick look at the primary AI stocks.

GOOGLE $ 2896

Google is consolidating its advance to $3000, I can't see it breaking out higher any time soon, so downside is more likely than not thus targeting $2700 and then it's buying level of $2612.

FACEBOOK $334

bottomed on the day we bought ! UP 7% on that week! Facebook is STILL cheap for what it represents i.e. just as Google is primarily for SEARCH, Facebook is primary for METAVERSE. Does not matter what all of the small caps or startups are doing right now for Facebook can literally throw tens of billions of dollars so that it will OWNs a large chunk of the metaverse! So I am glad it is now my largest holding and should FC2.0 deliver more buying opps then I will buy more!

Technically Facebook is STILL in a downtrend, so it should at least retest the low, where if its going to bottom it has to halt any decline at around $312. However revisiting $300 once more is still possible.

APPLE $172

Apple was on FIRE as recently as yesterday following its breakout to new all time highs and briefly attaining the magic $3 trillion dollar market corp milestone. Also Apple AR and VR is on it's way! The stock should correct down to $150.

AMAZON $3,372

Italy fines Amazon $1.3 billion for abuse of power.The stock has basically gone nowhere for 18 months as earnings play catchup, stuck in a trading range. What could trigger a break out higher? News of a stock split maybe. Amazon IS a primary AI stock so I aim to gain limited exposure with an initial fractional share limit order at $3212 which should be achievable, next level below is $3000, though still I remain reluctant to buy any significant exposure higher than about $2,600.

NVIDIA $283

GPU demand madness see's Nvidia re launch a 3 YEAR OLD GPU! RTX 2060, with some extra video memory in exchange for which one is expected to pay a HIGHER price than the original launch price of 3 years ago! A reminder that Nvidia can literally print money, literally release old tech as new and sell it for a higher price! Why? Because TSMC 7nm production is running flat out, so production is shifting to old 14nm fab's.

ARM deal appears to be off, Nvidia's reaction so far has been pretty mild which shows underlying strength. The stock has just started to break below it's $290 to $330 trading range as per my expectations for the stock to fill the gap down to $230 where my buying level remains at $236, and I will seek to accumulate at least some exposure in the range of $240 to $220.

MICROSOFT $325

Just snapped up another $20 billion corp Nuance. Hiked its prices for Office products by 20%. Microsoft is experiencing volatile price action following it's recent high of $350. My expectations are for the stock to trade down to $300, I aim to gain limited exposure in the range $320 to $300 with my main buys pending achieving the buying level of $282.

AMD $138 - THE NEXT AI STOCK FOR A BIG DISCOUNT SALE?

First INTEL then FACEBOOK, it looks like AMD and Nvidia are next to start crumbling towards their deeply discounted buying levels. AMD is showing strong signs of gravitating towards at least $119.8. Where I will consider accumulating for the long-run at between $124 to $101.8 by likely increasing my exposure by at least 1/3rd.

INTEL $50.7

Intel's announcement to sell Mobile Eye saw the price spike to $55 before giving back all of the gains. Intel is clearly raising cash for it's capex programme. INTEL is due to join the GPU battle against Nvidia and AMD with their ARC GPU's and given the demand Intel should do well, none of which is reflected in the price! Intel remains a long-term bargain! There is going to come a day when it is PE will be trading at least in the mid 20's. I don't have any plans to add to my Intel position.

Limit Orders

I often get asked in the comments where have I placed my limit orders for x, y z stocks, so I compiled a list of most of my limit orders as of 14th December that excludes small minor orders on the likes of etorro and shorts (which are too short-term). Though note I do tend to adjust the limit orders from time to time i.e. current 9988 order is $109.6 against $111.6 on the 14th of Dec.

Y on the table denotes that I can buy the US stock on the London stock exchange and thus avoid fx fees as we cannot hold dollars in ISA and many SIPP providers such as AJ Bell. And the lower the limit order the larger will be the buy order. Yes, I even want to gain a sliver of exposure to Amazon via fractional shares at $3212.

One of the benefits of holding a lot of cash on account is that one can deploy a lot of limit orders against that cash.

Best Stock Investing Platforms

In response to patron requests here are what I consider 2 good 'investing platforms' for the primary reason that both allow tiny position sizes, including fractional shares and do not charge a trading commission instead make their profits off the buying and selling spread.

ETORRO

NO fees, no commission for regular stock investing, platform is US dollar based so when someone from the UK deposits funds they get converted to a dollar balance, unless one deposits dollars directly via the likes of paypal. The platform is fairly straightforward to get to grips with and offers limit orders right off the bat.

The coverage of stocks is good, for instance one can invest in other than US stocks i.e. UK and Hong Kong listings.

The only negative as far as I am concerned is that there is no ISA, or other tax free wrapper, so my exposure to Etorro is limited for tax reasons.

Follow this link to get started.

FREE TRADE

This is the best for me and likely most UK investors for the primary reason that it is basically ETORRO within an ISA tax free wrapper.

As is the case with ETORRO, no commission when trading, fractional shares, and no minimum buy.

However, there is an 0.45% fx fee when buying US stocks of which is a lot lower than most other UK brokers such as ii.co.uk and AJ Bell.

Note that for the ISA one needs to PAY a monthly fee of £3 or £10 for ISA plus LIMIT orders. However, this £10 fee can be wholly offset by depositing at least £4k as Free trade pays 3% interest on balances upto £4k thus the £10 monthly fee is fully returned as interest. Also the interest is paid on the total cash balance regardless of whether funds are committed to limit orders or not.

Free Trade also give a free share worth between £3 and £200 when signing up and depositing your first £1.

HOW to Get the FREE SHARE FROM FREETRADE

To get the FREE SHARE then you must sign up using my referral link , then we both get 1 free share worth upto £200! However you must follow the link as just downloading the app from the app store won't work, you wont get a free share that way it has to be by way of referral.

Steps to Get a free Share

1. Click this link that takes you to he Free Trade Free Share web page

2. Follow instructions to download the Free Trade App

3. Deposit at least £1.

4. Get your free share worth between £3 and £200 within 7 to 10 days.

I use both of these platforms. Etorro for trading in and out of small positions, as that is what it encourages one to do. And FREE TRADE for accumulating positions for the long-run.

Also note that UK FSCS investor protection is upto £85k so I would not go over that limit with Free Trade.

This article is an excerpt from my recent extensive analysis updates the current status of my High Risk Bio and Tech Stocks portfolio.

High Risk Bio and Tech Stocks Portfolio Q4 2021 Update

Contents:

Exponential AI Mega-trend

INVESTING PRIORITY

Why Most Investors LOST Money by Investing in ARK FUNDS

ETF BUBBLE Primed to EXPLODE!

INVEST AND FORGET

BREWING FINANCIAL CRISIS 2.0 - RECESSION 2022

FED TAPER CON TRICK

CP LIE - INFLATION vs DEFLATION

UK Inflation Fraud - Real Inflation is 15%+

The 2% Inflation SCAM, Millions of Workers take the Red Pill

Why Inflation is Soaring

Flip Side High Inflation Winners

Warren Buffetts $130 billion Master Plan

STOCK MARKET CRASH INDICATOR

The Quantum Entangled Stock Market

Unloved Biotech Sector

High Risk Stocks Portfolio

COINBASE $247, Risk 1, P/E 19, +0%

TAKEDA $13.7 - Risk 1, PE 10, -19%

Western Digital $56.7, Risk 2, PE 13, -2%

ABBV $132, Risk 2, PE Ratio 11, 4% Dividend, +24%

CORSAIR $21.7 - Risk 3, PE 11, -26%

Neurocrine Bioscience (NBIX) $84, PE 18, Risk 3

ALI BLAH BLAH BABA (9988) $120, PE 17.2, Risk 3

TENCENT TCEHY (0700) $57, PE 19, Risk 4, -9%

RBLX $95. Risk 6, +7%

CRISPR $74, PE 15.3, RIsk 6, -39%

AVIR P/E 30.5 , Risk 9, -71%

APM $1.88, -37%

ACCUMULATING

AI Stocks Portfolio

Limit Orders

Best Stock Investing Platforms

CRYPTO BRIEF

OMICRON a Fuss About NOTHING

The whole of which was first been made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And access to my most recent compressive analysis on how to capillase on the ongoing stock market panic -

AI Stocks Multi Buying Levels to Capitalise on the Stock Market Panic of 2022

THE VALUATION RESET

INVESTORS SEDUCED BY STOCK CHARTS COMPLETELY MISS THE THE BIG PICTURE!

QUANTUM COMPUTERS

AI Tech Stocks 2022 Correction

Stock Market Trend Forecast Current State

Dow Max Draw Down 2022

ACCUMULATE DEVIATIONS FROM THE HIGHS IN GOOD STOCKS!

NEW STOCKS

The Fishes that Have So Far Gotten Away

AI Tech Stocks Funds Revision

QUANTUM AI STOCKS MULTI BUYING LEVELS

NEW Investors

NETFLIX - You Cannot Say You Weren't Warned!

ARKK MATHS

Why Putin Wants the WHOLE of Ukraine - World War 3 Untended Consequences

Pandemic Rear View Mirror - Next Potential Catastrophe?

Also Access to my recent compressive analysis on how to successfully invest in stocks during 2022 and beyond.

HOW TO SUCCESSFULLY INVEST IN STOCKS During 2022 and Beyond

CONTENTS:

1. UNDERSTAND WHAT INVESTING IS

2. INVEST IN GOOD COMPANIES

3. UNDERSTAND THAT WHICH ONE IS INVESTING IN

4. STOCK PRICES

5. EARNINGS CATCHUP TRADING RANGE TREND PATTERN

6. EMOTIONAL INVESTING

7. MONITORING AND LIMITING EXPOSURE IS MOST IMPORTANT

8. BUY AND SELL on the Basis of VALUATIONS

9. INVESTORS BIGGEST MISTAKE

10. BEST TIME TO BUY STOCKS

11. WORST TIME TO BUY STOCKS

12. BUY VOLATILITY

13. INVESTING TIME

14. FUND MANAGERS

15. OPTIONS

16 . INFLATION

17. INVEST AND FOREGET

AI Tech Stocks Draw down and End of Year 2022 Price Targets

CATHY WOOD ARK GARBAGE

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per. https://www.patreon.com/Nadeem_Walayat.

My analysis schedule includes:

- Stock Market Trend forecast 2022 - Currently underway

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada and China - 65% done

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your metaverse invested analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.