Gold Stuck Between High Inflation and Strong Dollar

Commodities / Gold and Silver 2021 Dec 13, 2021 - 03:04 PM GMTBy: Arkadiusz_Sieron

Inflation supports gold, the expected Fed’s reaction to price pressure – not. Since gold ended November with a small gain, what will December bring?

Inflation supports gold, the expected Fed’s reaction to price pressure – not. Since gold ended November with a small gain, what will December bring?

I have good and bad news. The good is that the price of gold rose 2% in November. The bad –is that the price of gold rose 2% in November. It depends on the perspective we adopt. Given all the hawkish signals sent by the Fed and all the talk about tapering of quantitative easing and the upcoming tightening cycle, even a small increase is an admirable achievement.

However, if we focus on the fact that US consumer inflation rose in October to its highest level in 30 years, and that real interest rates have stayed deeply in negative territory, gold’s inability to move and stay above $1,800 looks discouraging.

We can also look at it differently. The good news would be that gold jumped to $1,865 in mid-November. The bad news, on the other hand, would be that this rally was short-lived with gold prices returning to their trading range of $1,750-$1,800 in the second half of the month, as the chart below shows.

Now, according to the newest WGC’s Gold Market Commentary, gold’s performance in November resulted from the fact that higher inflation expectations were offset by a stronger dollar and rising bond yields that followed Powell’s nomination for the Fed Chair for the second term.

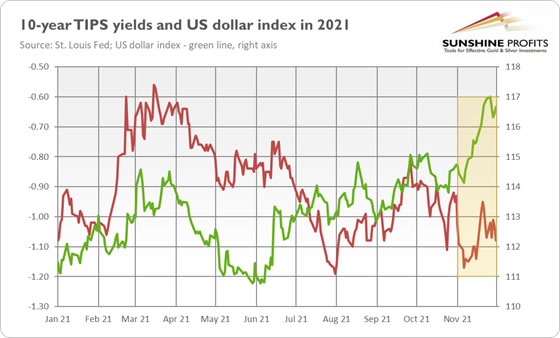

Indeed, as you can see in the chart below, the greenback strengthened significantly in November, and real interest rates rallied for a while. Given the scale of the upward move in the dollar, and that it was combined with a surge in yields, gold’s performance last month indicates strength rather than weakness. As the WGC notes, “dollar strength was a headwind in November, acting as a drag on gold’s performance, but not enough to outweigh inflation concerns.”

Implications for Gold

Great, but what’s next for the gold market in December and 2022? Well, that’s a good question. The WGC points out that “gold remains heavily influenced by investors’ continued focus on the path of inflation (…) and the Fed’s and other central banks’ potential reaction to it.” I agree. Inflation worries increase demand for gold as an inflation hedge, supporting gold, but they also create expectations for a more hawkish Fed, hitting the yellow metal.

It seems that the upcoming days will be crucial for gold. Tomorrow (December 10, 2021), we will get to know CPI data for November. And on Wednesday (December 15, 2021), the FOMC will release its statement on monetary policy and updated dot plot. My bet is that inflation will stay elevated or that it could actually intensify further. In any case, the persistence of high inflation could trigger some worries and boost the safe-haven demand for gold.

However, I’m afraid that gold bulls’ joy would be – to use a trendy word – transitory. The December FOMC meeting will probably be hawkish and will send gold prices down. Given the persistence of inflation, the Fed is likely to turn more hawkish and accelerate the pace of tapering.

Of course, if the Fed surprises us on a dovish side, gold should shine. What’s more, the hawkish tone is widely expected, so it might be the case that all the nasty implications are already priced in. We might see a “sell the rumor, buy the fact” scenario, but I’m not so sure about it. The few last dot-plots surprised the markets on a hawkish side, pushing gold prices down. I’m afraid that this is what will happen again. Next week, the Fed could open the door to earlier rate hikes than previously projected. Hence, bond yields could surge again, making gold move in the opposite direction. You’ve been warned!

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.