Stock Market Betting on Hawkish Fed

Stock-Markets / Stock Market 2021 Nov 24, 2021 - 04:31 PM GMTBy: Monica_Kingsley

S&P 500 reversed from fresh ATHs as spiking yields sent tech packing. Value didn‘t soar, but held up considerably better – still, stock bulls are getting on the defensive. Markets have interpreted the Powell nomination as a hawkish choice. I‘ve written the prior Monday:

(…) the Fed is still printing a huge amount of money on a monthly basis, and it remains questionable how far in tapering plans execution they would actually get – I see the risks to the real economy coupled with persistently high inflation as rising since the 2Q 2022 (if not since Mar already, but most pronounced in 2H 2022.

Inflation hasn‘t moved to the Fed‘s sights, and yesterday‘s rection in yields and precious metals is a bit too harsh. While rates are on a rising path as I‘ve written yesterday, precious metals overreacted. True, the bullish argument for the dollar stepped to the fore as yields differential between the U.S. and the rest of the world got more positive, and at the same time, various yield spreads keep compressing. That‘s a reflection of less favorable incoming economic data. Just as much as Friday‘s reaction was about corona economic impact projections, yesterday‘s one was about monetary policy anticipation.

Inflation expectations though barely budged – the decline doesn‘t count as trend reversal. CPI isn‘t done rising, and the more forward looking incoming data (e.g. producer prices) would confirm there is more to come. All in all, it looks like precious metals (and to a smaller degree commodities), are giving Powell benefit of the doubt, which I view to be leading to disappointment over the coming months. Should Powell heed the markets‘ will, the real economy would weaken dramatically, forcing him to make a sharp dovish turn – and he would, faster than he flipped since getting challenged in Dec 2018.

We‘re experiencing an overreaction in real assets – as stated yesterday:

(…) the Fed would have to reverse course once the tapering effects start biting some more – not now, with still more than $100bn monthly addition. Cyclicals and commodities that had massively appreciated vs. year ago (oil doubled), are feeling the pinch of fresh economic activity curbs speculation in spite of the polar shift of U.S. strength in energy of 2019 and before. Begging the OPEC+ to increase production might not do the trick, and with so much inflation already in (and still to come), the key investment theme is of real assets strength.

Precious metals have broken out, are no longer an underdog, and the inflation data will not decelerate for quite a few months still. And even as they would, it would come at a palpable cost to the real economy, and the resolute fresh stimulus action wouldn‘t be then far off. As I wrote in Apr 2020, it‘s about the continuous stimulus that‘s the go-to response anytime the horizon darkens, for whatever reason. Wash, rinse, repeat.

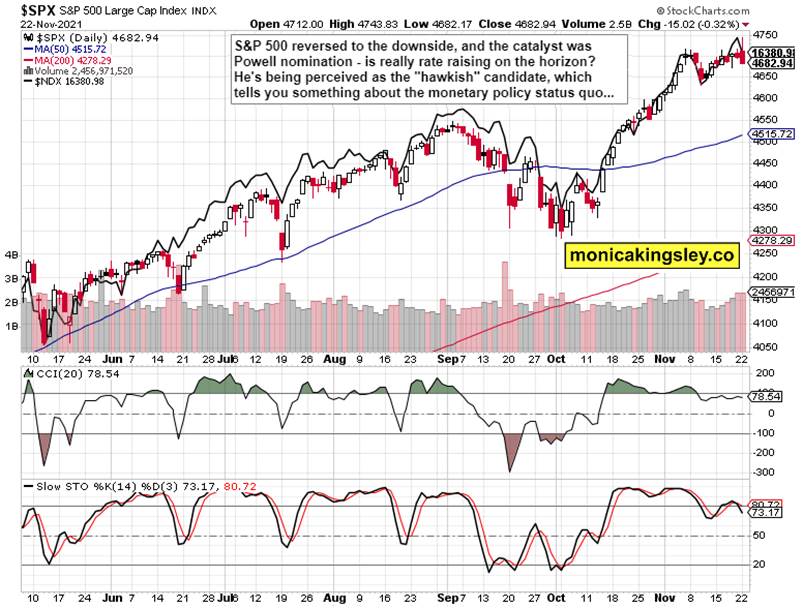

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 bulls lost the momentary upper hand, and value recovery isn‘t yet strong enough to carry it forward. A less heavy move in bonds – temporary yields stabilization – would be needed to calm down stock market nerves.

Credit Markets

Treasuries held up best, and that‘s characteristic of a very risk-off sentiment. The low volume in HYG isn‘t a promise of much strength soon returning.

Gold, Silver and Miners

Precious metals turned sharply lower, and haven‘t stabilized yet. Bond market pressures are keenly felt even though inflation expectations didn‘t follow with the same veracity. The next few days will be really telling.

Crude Oil

Crude oil bulls have made a good move, and more strength needs to follow. The fact that it would be happening when the dollar is strengthening, and many countries are tapping their strategic reserves, bodes well for black gold‘s recovery.

Copper

Copper springboard bulding goes on, and the CRB Index isn‘t tellingly yielding – the hawkish Fed bets better be taken with a (at least short-term) pinch of salt.

Bitcoin and Ethereum

Bitcoin and Ethereum are still going sideways, and today‘s resilience is a good omen – across the board for risk assets.

Summary

- S&P 500 bulls need tech to come alive again, and odds are it would with a reprieve in spiking yields. While bond markets are getting it right, yesterday‘s fear in corporate bonds was a bit too much – the Fed isn‘t yet in a position to choke off the real economy through slamming on the breaks. Markets are prematurely speculating on that outcome, which would be a question of second or third quarter next year. Treasuries have though clearly topped, and stocks do top with quite a few months‘ lag – we aren‘t there yet. Enjoy the commodities ride, and confidence gradually returning to precious metals.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.